Guy on Rocks: Iron ore – back in black

Angus Young of AC/DC performs onstage during day 1 of the 2015 Coachella Valley Music And Arts Festival in 2015. Photo by Karl Walter/Getty Images for Coachella

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Reports of iron ore’s demise may have been premature with improving economic data coming out of China.

GDP growth in October 2021 came in at a better-than-expected YoY bottom of 3.3% (or 4.9% 2Y CAGR) in 4Q21 and rebounding to 5.5% in 2022 according to Morgan Stanley (China and the Miners, November 2021).

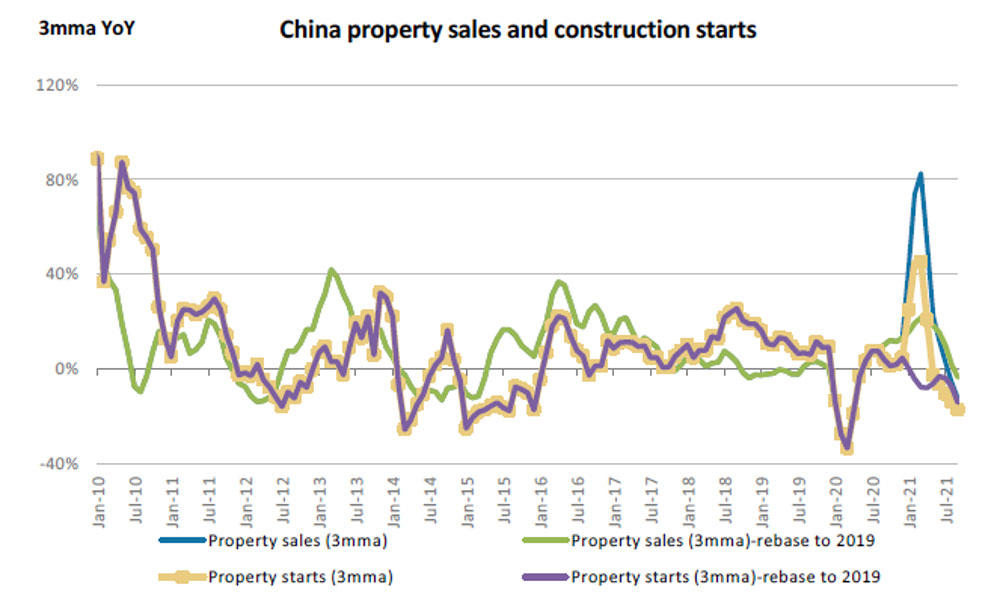

The property market is also looking a little healthier after a sharp contraction in property sales and construction starts over CY 2021 (figure 1).

Property and infrastructure demand rose 3.5% YoY in October (+3.1% September), however PMI contracted to 49.2, from 49.6 in September 2021. The PMI however rose to 50.1 last month for the first time in three months reinforcing the more positive manufacturing outlook.

The Chinese government’s response to the soft property market is a loosening of property policy to bolster demand.

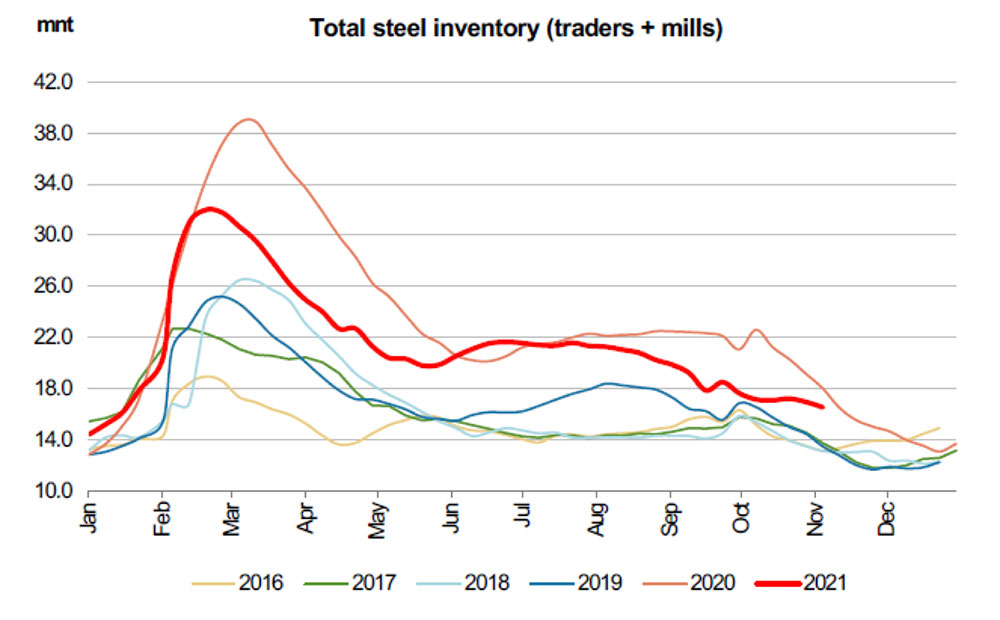

It appears the government is also about to ease production cuts, with My Steel suggesting that Chinese steel mills are restocking ahead of a restart sometime this month after running down steel inventories (figure 2).

This is also likely to coincide with an increase in pig iron production which is projected to rise by around 37,000 tonnes per day.

The Dalian iron ore price jumped over 6% on Tuesday to just over US$103/tonne.

The January contract was also around 2.5% higher at US$95.75, still in backwardation but higher, nonetheless.

The supply side also remains tight with Vale forecasting production in the range of 315-320 million tonnes this year which is on the lower end of their guidance of 315-335 million tonnes.

The other variable to watch out for, of course, are disruptions to shipping as Australia enters the wet season over November to March.

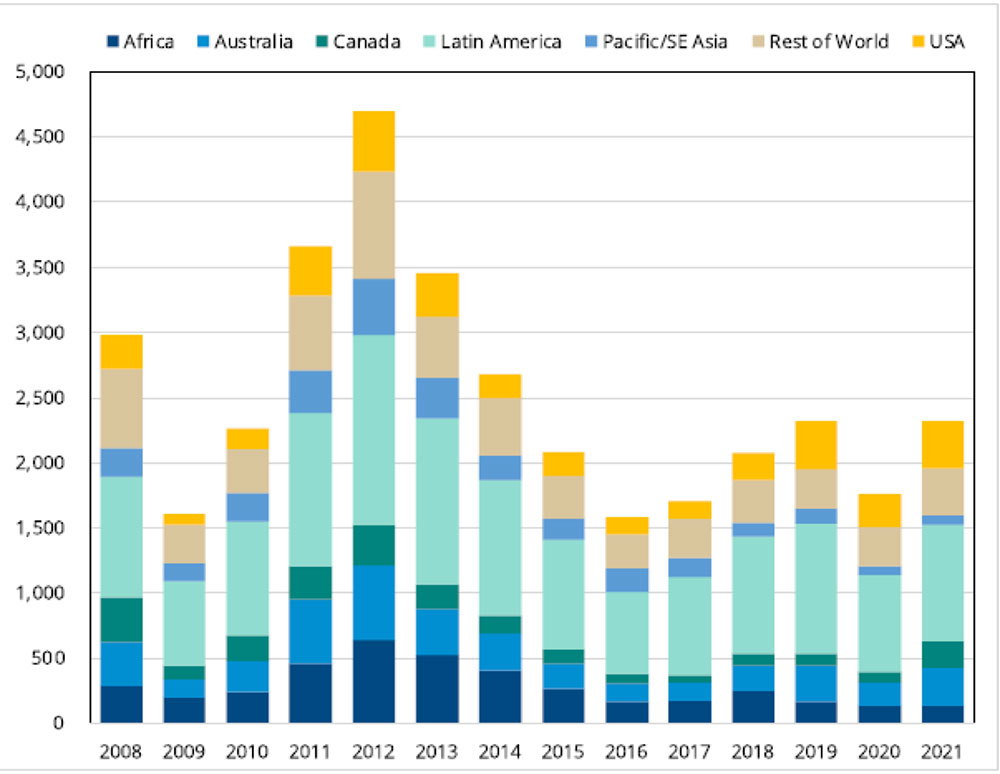

RFC Ambrian published an updated report on copper as a follow up to their ‘Copper M&A – The Cupboard is Nearly Bare’, that was published in November 2018.

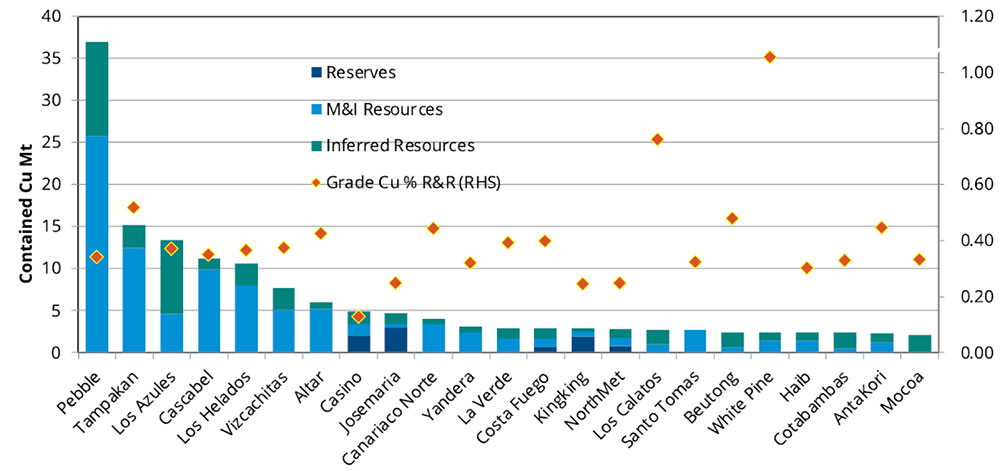

Well not surprisingly, figure 4 confirms what we know about declining exploration over the last 9-10 years with the majority of the world’s largest copper projects located in regions subject to civil and political unrest (figure 5).

Put this together with the EV demand and you have set the scene for a bull market that could run for 5-10 years or more.

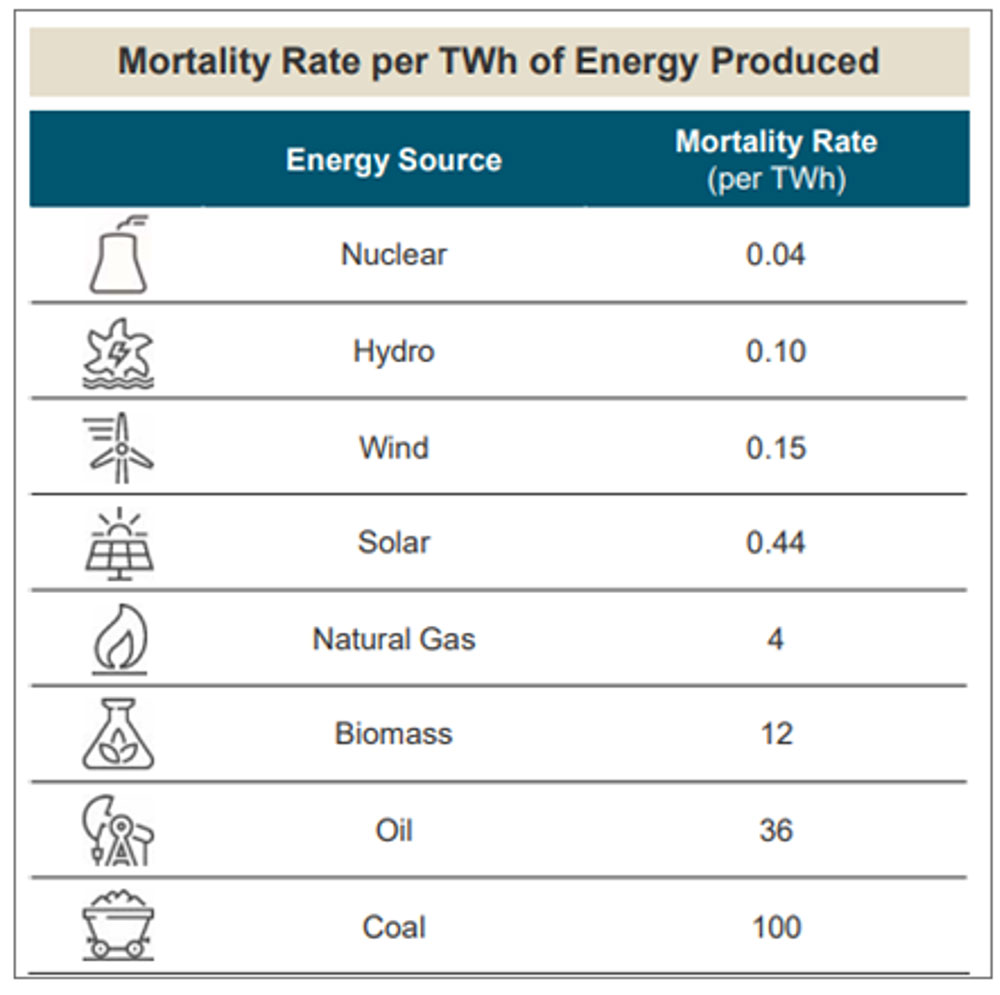

Some interesting information from Sprott regarding uranium safety (surely they are not talking their own book?).

It is interesting that everyone wants to talk about the handful of people that have been fried from nuclear accidents, but it appears hydro, wind and solar have claimed many more victims on a per terawatt hour (TWh) basis! (figure 6).

It appears Biomass has claimed a very high number of people also.

Burning wood and biomass creates a PM2.5 air pollution, including volatile organic compounds (VOCs), and nitrogen oxides (NOx).

All of this air pollution damages health, from airway inflammation to free radical damage to cancer and numerous health problems. They are also known to aggravate and can cause asthma and emphysema.

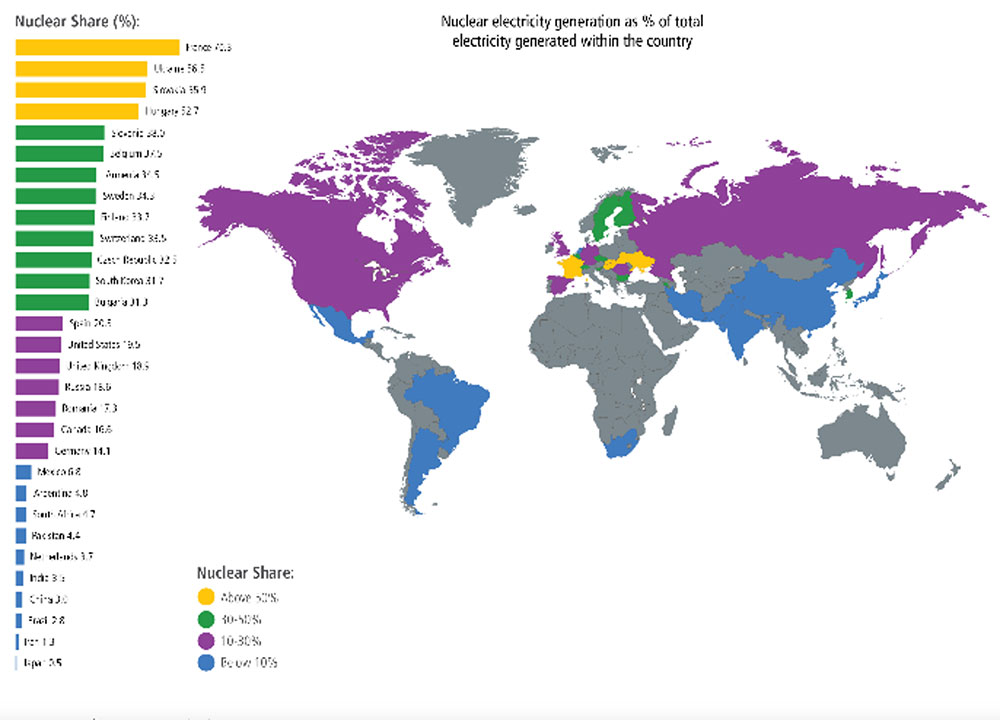

The following map (figure 7) shows the current reliance on nuclear power. I would think the yellow footprint will spread.

So, what are the biggest pollutants out there now?

Electric vehicles that consume more carbon than petrol cars in their construction and plug into coal-fired power for their energy.

That is if you believe that carbon is the primary contributor to global warming of course. Cooling during the Middle Carboniferous reduced average global temperatures to about 12C (54F) however atmospheric carbon levels were similar to today. So maybe the whole carbon debate is also crap?

So, if the Stockhead faithful think the world has gone mad pumping money into relatively inefficient power sources such as wind and solar while chasing a possibly flawed carbon argument as the primary driver to global warming, you are probably correct.

The real crime is turning our backs on nuclear, the cleanest, greenest, and safest source of available base load power in the medium to longer term.

Company News

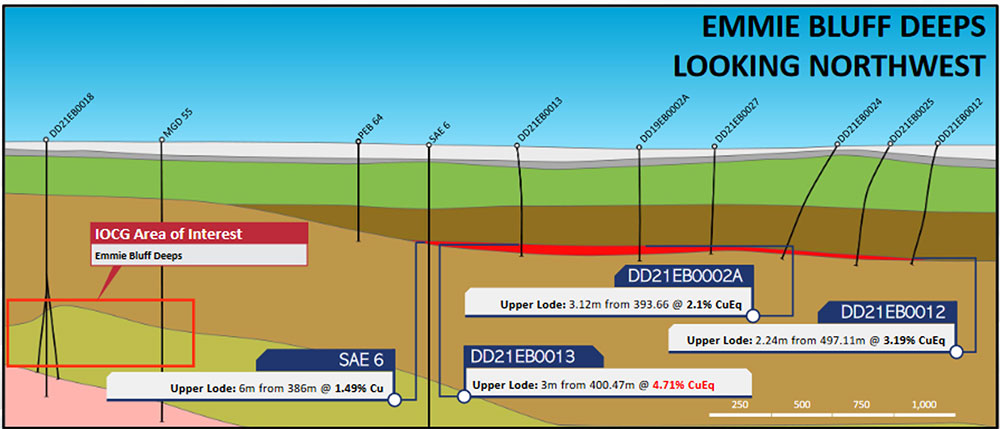

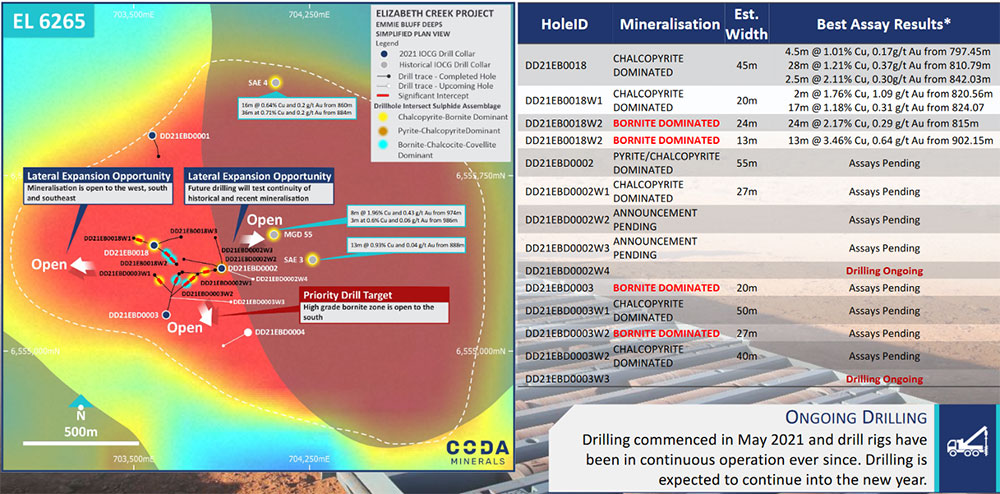

Coda Minerals Ltd (ASX:COD) has seen a 21% spike in its share price possibly following the release by Shaw and Partners research report which put a price target of $2.30/Share based on their projected copper resources at their Elizabeth Creek Copper Project (100km south of BHP’s Olympic Dam). That includes the Emmie Bluff deposit (figure 9) which Shaw’s believe should come in around 800kt CuEq (100% basis) at ~1.6% CuEq or 50Mt @ 1.6% CuEq.

It’s a little deep at around 400m below the surface but if the grades come in as Shaw’s anticipate this will be one of the first Zambian style copper projects of any size found in the Adelaidean formation, a sequence of rocks that sits above the Hiltaba suite (lower Proterozoic felsic intrusives) that host the giant Olympic Dam deposit.

I believe Emmie Bluff looks a little more promising than the IOCG targets at Elizabeth Creek which are +800m deep and a bit lower grade.

On the other hand, there are some decent widths (up to 28m downhole) with plenty of assays outstanding together with visible bornite.

In other words, they are drilling in the “boiling” zone at similar ore forming temperatures, pressures, salinities etc to Olympic Dam so they are well and truly still in the game to find something large and relatively high-grade, or at least comparable grade to Olympic Dam.

More recently, the company had some encouraging results at its Cameron River project (earning 80% an interest) located in the Mt Isa province of North QLD.

A total of 696 samples were collected, 31 returning anomalous copper and 16 returning anomalous gold values. Better results included 12.6% Cu, 2.72g/t Au and 4.3g/t Ag. I don’t generally get too excited about rock chip results but will be reviewing the results of the planned 50-hole RC program in due course.

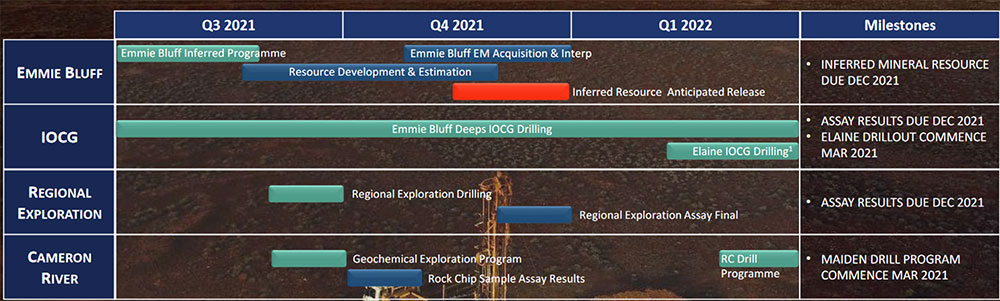

I thought the company was a little expensive when it was trading at $1.72 (+$170 million market capitalisation) but at 83 cents and an enterprise value of just over $65 million it is coming into buying territory with a good a good pipeline of news flow to follow (figure 11).

You have to admire companies drilling holes to the centre of the earth and with plenty of new targets to follow up (such as Elaine – IOCGU target) the company looks set for an exciting and volatile 2022.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.