Guy on Rocks: How do I like my nickel? Profitable!

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold breaks through US$2,000 as USD plummets

Gold was up USD$22/ounce to USD$2,035/ounce on a weak US dollar and silver is trading around US$22.46/ounce, little changed over the last week. Platinum was down US$20/ounce to US$887/ounce while palladium (figure 1) is trading at US$938/ounce, after touching five-year lows of US$863/ounce earlier this month as a surplus of 300,000 ounces looms this year.

Copper strengthened on the back of a weak USD and hopes for an increase in Chinese demand to close at US$3.82/lb, up 8 cents, and remaining in strong contango.

Energy was down across the board with WTI closing at US$76.55/BBL, down 2.1% for the week. In the US exploration rigs were up six with production flat at 13.3MBBLS and imports were 6.7MBOE up 170,000 BOPD on the week.

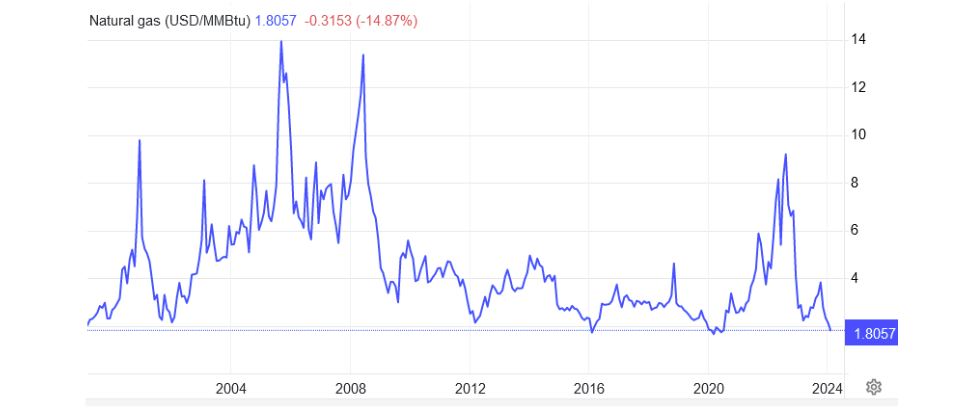

Gasoline prices were up 7c and averaged 3.27 gallon. Biden has added 500 new sanctions on Russia and relaxed sanctions on Venezuela. Mickey Fulp in his weekly commentary believes that Uncle Joe is likely to increase Venezuela oil imports after being suitably blended with Russian oil. Natural gas (figure 2) in the US is currently selling for US$1.6 MBTU, which is close to a 30-year low.

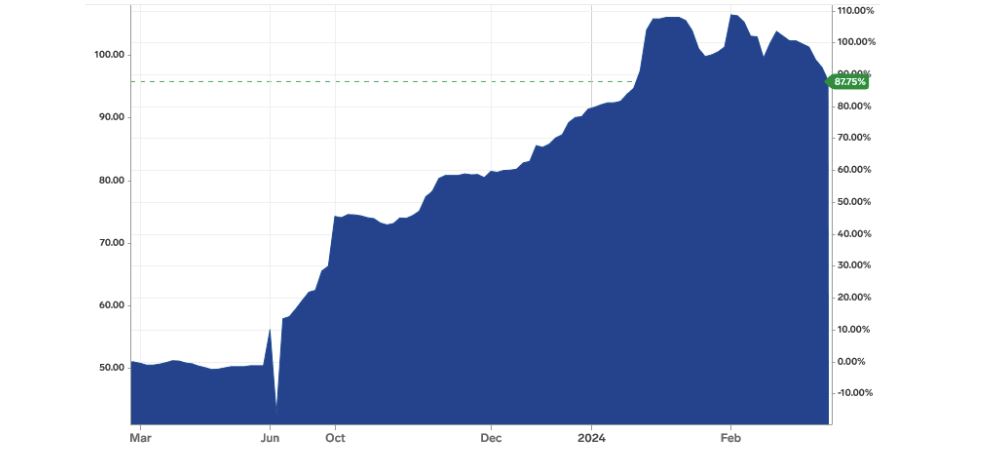

Uranium prices (figure 3) traded below US$100/lb for the first time in three weeks to trade around US$95/lb, still up over 50% year on year. That’s after reaching highs of just over US$106/lb earlier this year.

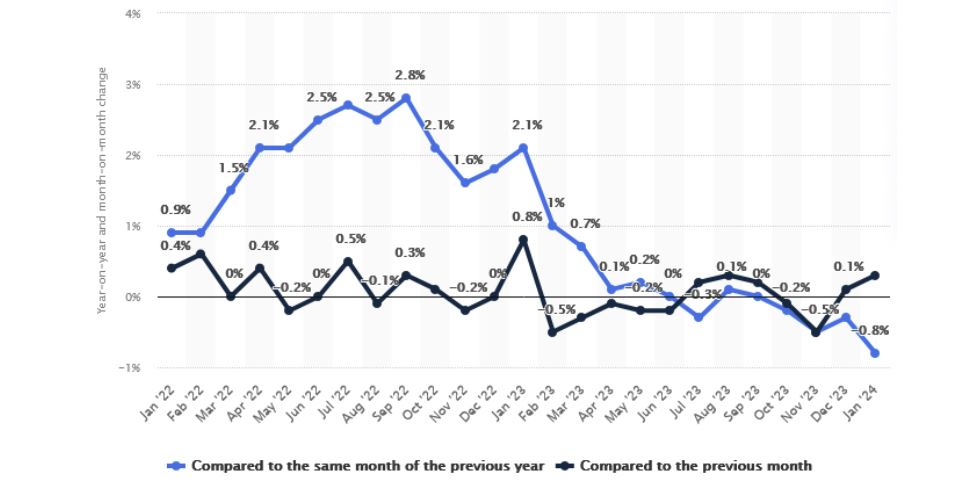

While there is a lot of focus on the US economy, here in Oz we need to stay focussed on China which appears to be caught in a deflationary vortex not unlike what we have seen in Japan since the early 1990s. It appears the soft real estate market, a hangover from loose monetary policy, combined with an ageing population and falling consumer confidence are all contributing factors.

After 10 consecutive months of flat or accelerating deflation (figure 4) real rates have seen modest rises due to very limited rate cuts so far. More specifically it appears the PBOC’s policy actions are in conflict with trying to maintain a strong Yuan and a desire to maintain falling net interest margins for the banks.

Uncle Elon is lending support to the nickel market and has helped pay for a report outlining a case for tax break for Australian nickel and lithium miners in a scheme not dissimilar to those available in the US. As reported by the Brad Thompson (AFR, 27/2/2024), this might be in response to a serve from Dr Andrew Forrest who had a swing at Uncle Elon at the National Press Club on Monday for using “dirty nickel” from Indonesia in his Tesla batteries.

Last September, Tesla chairman Robyn Denholm indicated that Australia was at risk of losing market share to the US, Europe, and Asian trading partners unless tax breaks were introduced for battery-grade lithium processing.

BHP last week reported it was losing around $50 million per month from its Nickel West operations in WA with no visibility on when this cash drain will cease. The flow-on effects could be significant with the Lynas Refinery in Kalgoorlie dependent on acid supplies from the Nickel West operations.

Mineral Resources, Pilbara Minerals, Liontown and IGO along with Tesla, Wyloo, and various rare earths and vanadium companies, are behind the report on tax breaks that was recently commissioned by the Association of Mining and Exploration Companies.

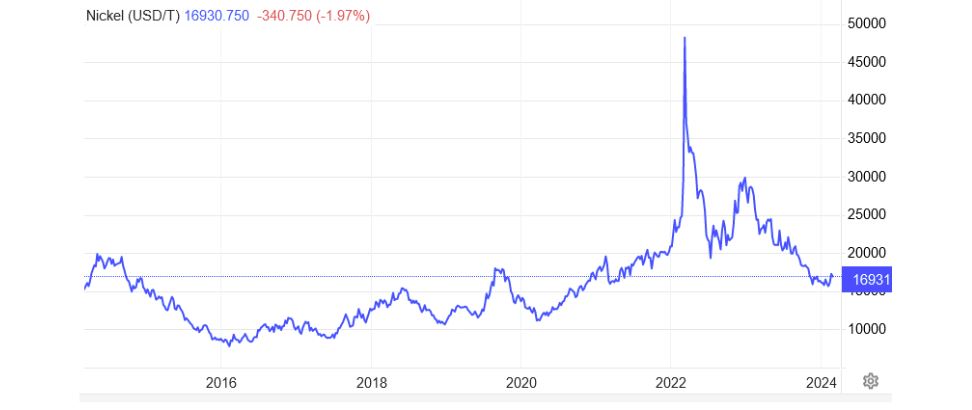

S&P Market Intelligence believe that the nickel market surplus of 300,000 tonnes forecast for this year is likely to continue into 2025 and at current levels is starting to impact on the profitability of Indonesia producers of nickel pig iron and matte.

With nickel prices (figure 5) starting to bite the lowest cost quartile producers, perhaps we have reached the bottom of the cycle for nickel?

I have received some criticism from the great unwashed, who are for the most part not signed up to Stockhead, about dumping on climate change policies while at the same time highlighting battery metals stocks under New Ideas. There is a very logical explanation for this.

On the matter of climate change dumping, The Cigar Social Climate Change Committee (CSCCSC) subsidises my cigars on the basis I continue to toe the party line. With regard to recommending battery metal stocks, I believe the governments of the world will push forward with their current decarbonisation policies (and other self-destructive policies) no matter what the science tells them.

All makes perfect sense.

New Ideas

I brought nickel laterite miner Nickel Industries (ASX: NIC) (figure 6) to the attention of the Stockhead faithful in the middle of 2023 as one to keep an eye on. Since that time the stock price has tracked the nickel price down from around US$20,000/tonne to lows just over US$15,500/tonne earlier this year.

With the Australian nickel sector in disarray, there are reports emerging that the lower cost/higher volume nickel laterite producers are also starting to feel the pain.

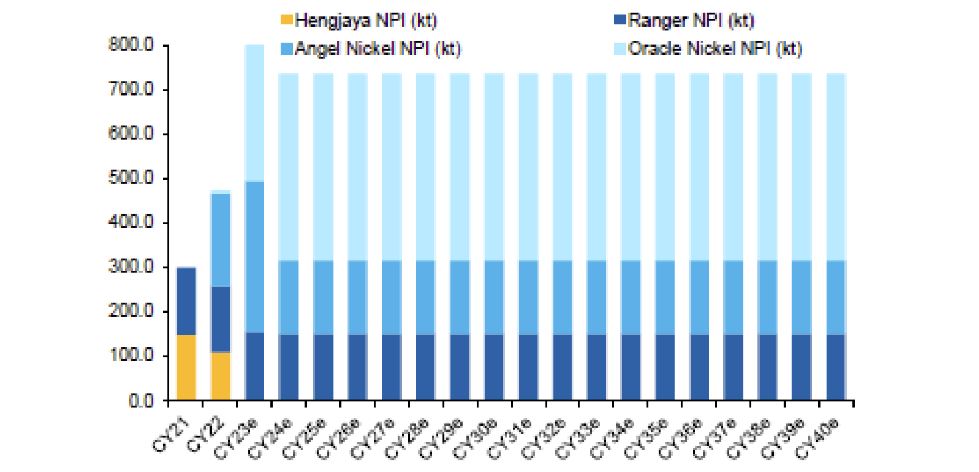

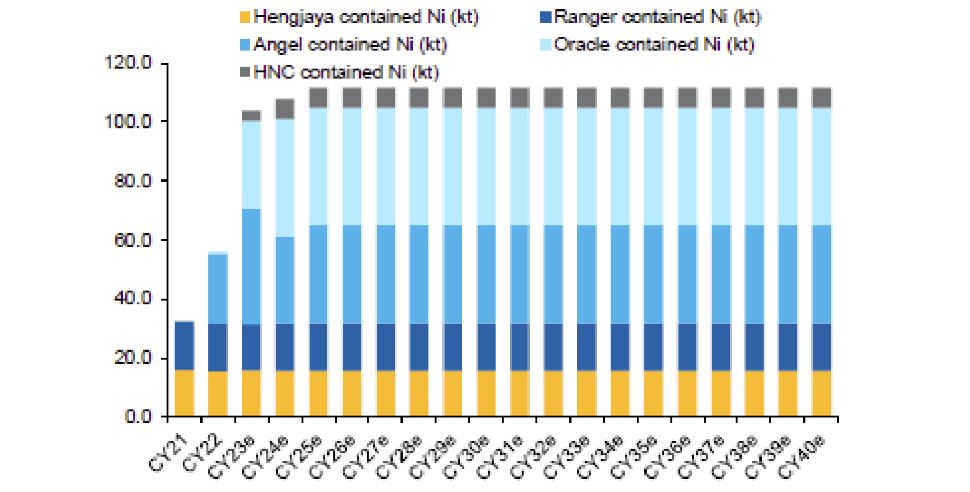

NIC operates five mines in Indonesia and despite a tough second half, delivered a strong quarterly result with NPI production, according to Macquarie Research (30/1/2024), up 15% on their previous estimates at 232,176 tonnes (figure 7) as well as nickel metal production of 34,450/tonne (figure 8) up 2% on the bank’s previous estimates.

Underlying EBITDA was also solid at US$85.1m, 41% stronger than their previous estimates of US$60.10 million. The bank has a 12-month target of $1.10/share which I think is reasonable.

Whether there are any headwinds from the perception (and reality) of poor environmental practices remains to be seen however the current prevailing prices provide no incentive for new development. So, as you show off your shiny EV to your neighbours, there is no point in feeling guilty about the environmental damage in Asia, it is too far away to be of any concern.

One thing for sure is that they should benefit from any recovery in nickel prices which have recently bounced off two-year lows of US$15,526/tonne and are now trading just above US$17,000/tonne.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.