Guy on Rocks: Ground control to ‘Major Tin’

3rd July 1973: David Bowie performs his final concert as Ziggy Stardust in London. Pic: Getty

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week.

Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

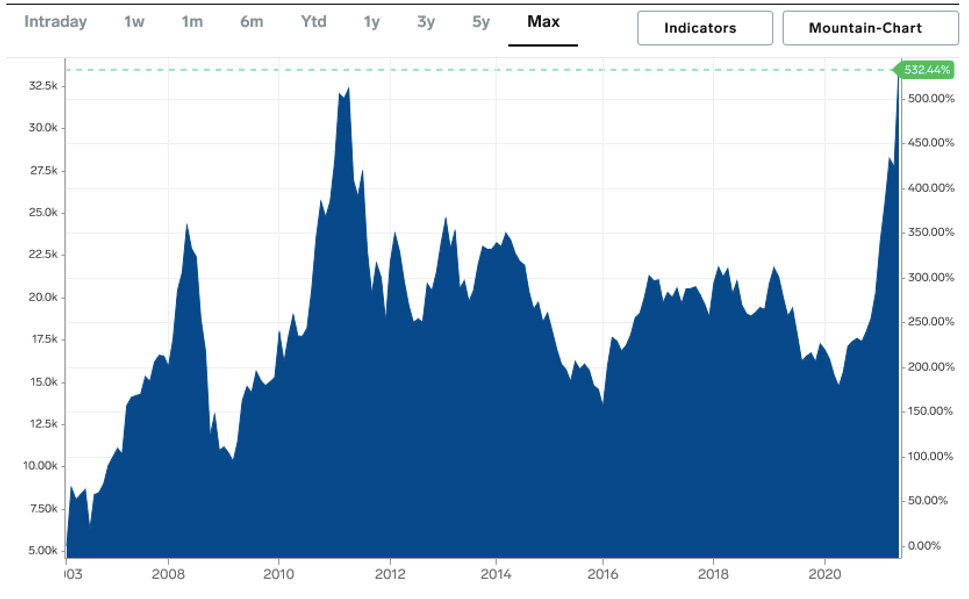

Tin (figure 1) is the latest metal reaching for the heavens, driven by a combination of virus hit supply, delays in deliveries, and a roaring electronics industry in China.

Goes to show every dog has his day! Interestingly, soon after the Shanghai Futures Exchange introduced the new tin contract in 2015, almost 500,000 tonnes traded over just two days – more than a year’s worth of global production. You will no doubt here more about this tearaway metal very soon.

I have previously mentioned security of supply, with China being an aggressive stockpiler of metals (currently mandated to buy up to $US8.5bn in gold) with Russia’s industry ministry announcing last week it recently held discussions with metals producers about the state-owned entity Rosrezerv buying their products for the state stockpile. Stockpile levels are a Russian state secret (no surprises there!)

It was a volatile week for currencies and precious metals. Gold was down $US11/oz, closing at $US1892, silver dipped $US0.52 to $US27.65 and palladium closed at $US2740, up $US20 for the week.

No doubt the market will be looking with interest at US inflation figures (the elephant in the room for 2021) due out Wednesday, with consensus figures of 4.8 per cent (excluding energy and food) probably a bullish sign for gold.

Non-farm payrolls were also off slightly last week, showing that less than 62 per cent of Americans were fully employed with 7 million fewer jobs compared to February 2020, when America’s favourite son, Donald Trump, was in the chair.

Copper closed at $US4.50 a pound, down 2.5 per cent for the week even with an unwinding of speculative long positions (currently at a 10-month low, declining 1.2 million tonnes since December 2020) and the likelihood that tax hikes in Chile are unlikely to proceed.

Broken supply channels, a lack of financing in 2014, low inventories and a strong contango for copper futures have probably been contributing to elevated prices this year. Citi believes that a tightness in the refined copper market will become evident in calendar spreads and refined stock draws before the fourth quarter of 2021.

An unusual aspect of copper’s 32 per cent rise this year is the coincidental 40 per cent decline in net CME and LME speculative positioning.

This divergence has only been seen four times before in almost 30 years of data and is perhaps the second largest ever behind 2005-06. This level of positioning unwind has only been surpassed once in the last 30 years by the initial COVID-19 sell-off, however similar scale unwinds took place in 2013, 2015, and 2017.

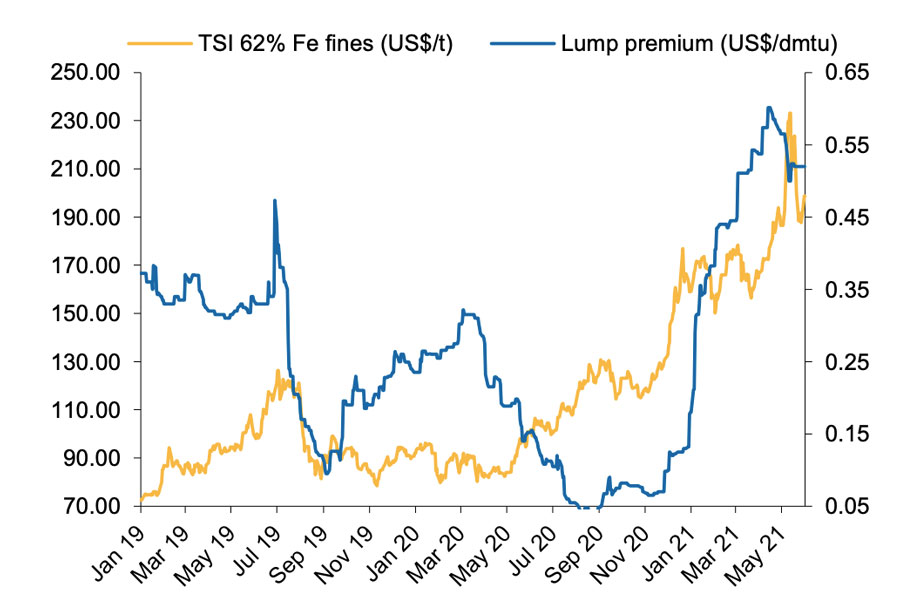

Elsewhere, iron ore is holding firm above $US200/tonne, closing at $US207/tonne (62 per cent fines), with rumours that steel mills in Tangshan city, the largest steel producing region in China, will soon be allowed to lift production ahead of schedule with an easing of output curbs.

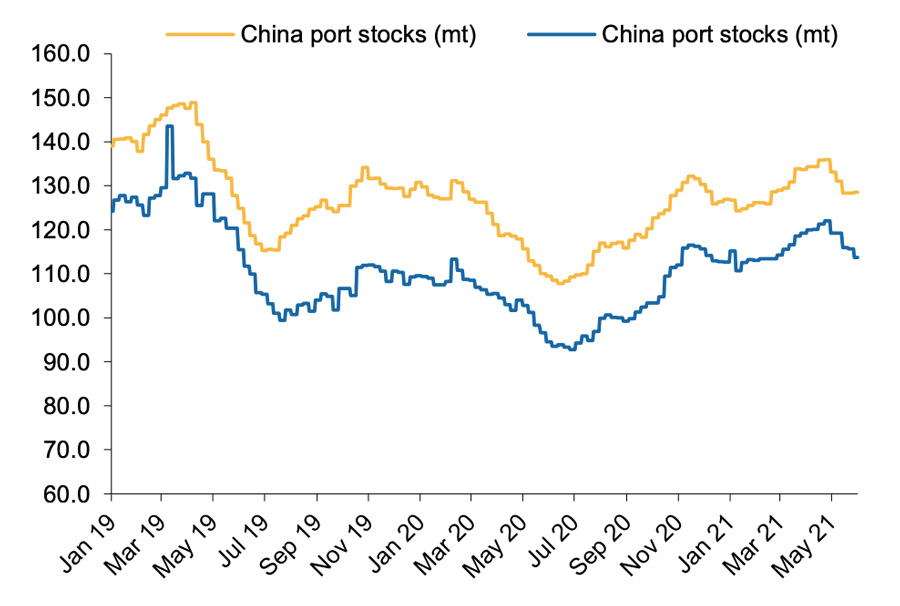

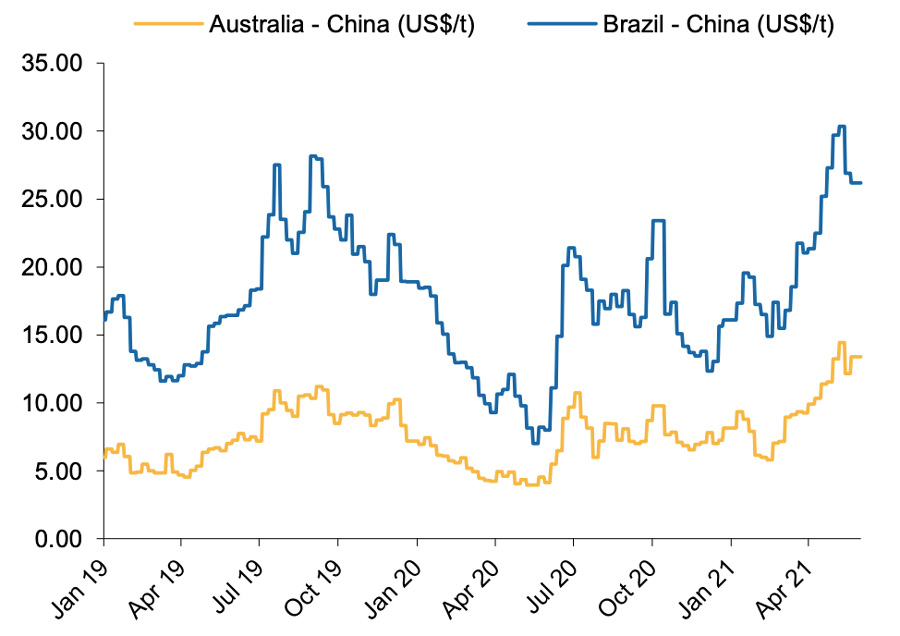

Premiums for high-grade lump have increased to $US0.52 per dry metric tonne unit (dmtu) (figure 3).

(Source: Macquarie Global Iron Ore Miners, 2nd June 2021)

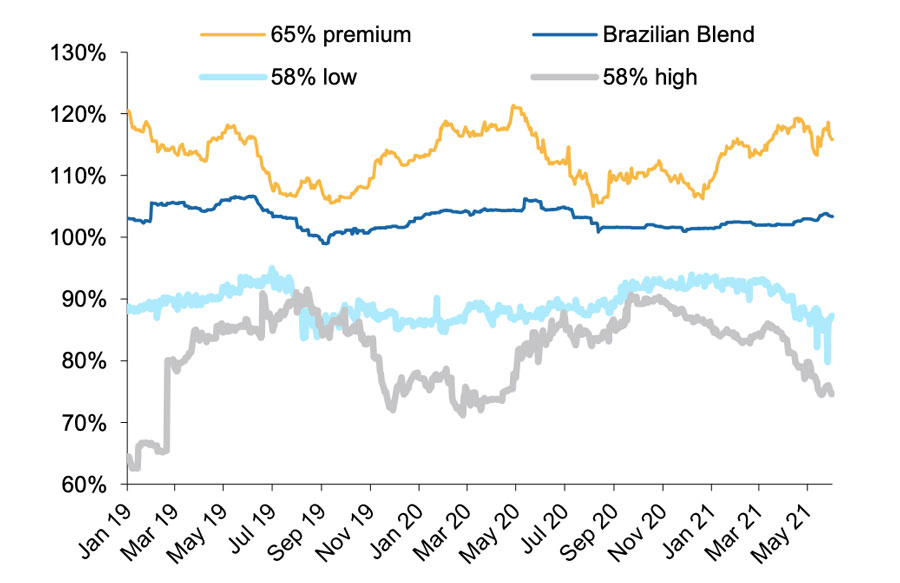

High-grade prices have also increased (figure 4) with port stocks declining (figure 5) and, not surprisingly, freight rates increasing (figure 6).

(Source: Macquarie Global Iron Ore Miners, 2nd June 2021)

(Source: Macquarie Global Iron Ore Miners, 2nd June 2021)

(Source: Macquarie Global Iron Ore Miners, 2nd June 2021)

Movers and shakers

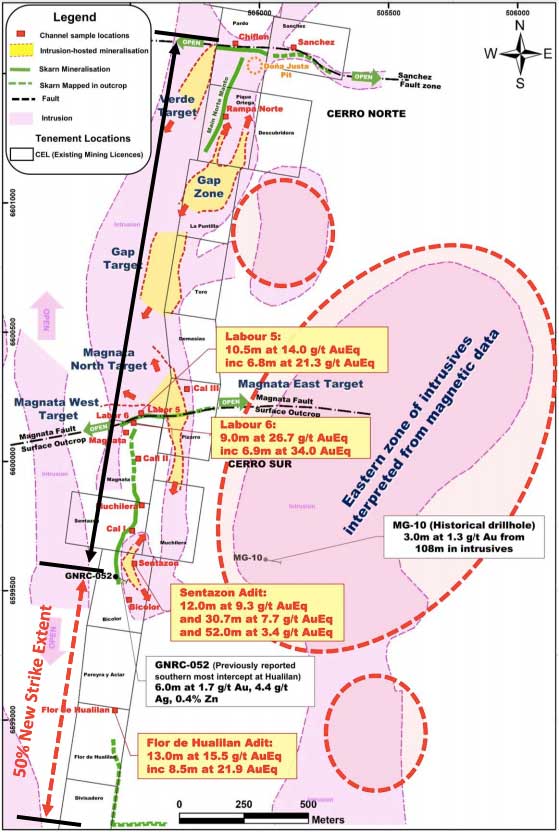

Another impressive round of results from Challenger Resources (ASX:CEL), with a new zone of high-grade mineralisation identified from the recent round of drilling extending the strike extent of Hualilan (figure 8) by 1km to 3.1km.

(Source: CEL ASX Announcement, 3rd June 2021)

Mineralisation was identified 550m south of the previous southernmost drill intercepts at Hualilan, with better results from underground sampling results including:

- 13m at 15.5 grams per tonne (g/t) gold equivalent,

- 5m at 21.9g/t gold equivalent, and

- 2m at 5.1g/t gold equivalent.

The completion of the adit sampling program south of the Magnata fault, according to CEL, looks like establishing a continuous zone of high-grade mineralisation from Magnata to Sentazon.

The stock has come off a little since my last mention in May, however I think the case for a 4-million-oz JORC Resource of gold (CEL interest 75 per cent) supporting a 4-5 million-tonne-per-annum operation is achievable within the next 24 months, and with it a significantly higher share price.

For those looking for a hedge in volatile markets and think gold is a good place to be, you can put CEL, and Tribune Resources (ASX:TBR) on your shopping list.

Hot stocks to watch

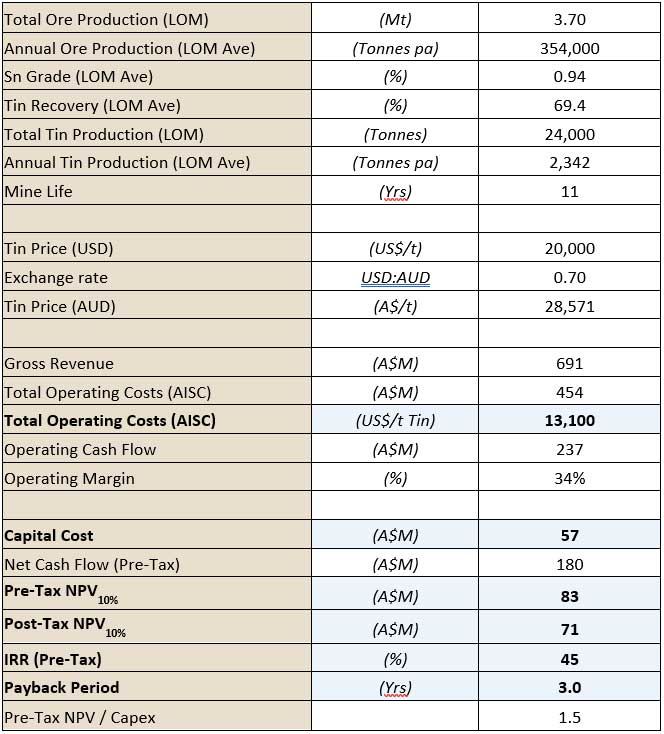

Now that tin has gone into a low earth orbit, it’s timely to roll out Stellar Resources (ASX:SRZ) (figure 9) which holds a 100 per cent interest in the Heemskirk tin project (figure 10), situated on the west coast of Tasmania.

The project contains a JORC resource of 6.6 million tonnes at 1.1 per cent tin, making it one of the highest-grade undeveloped tin resources in Australia and the second highest in the world.

A mining study is well underway, incorporating data from the Severn, Queen Hill and St Dizier deposits, with excellent metallurgical recoveries so far of around 69 per cent producing a 49 per cent concentrate.

The processing plant is proposed to be located northwest of Queen Hill to minimise impact on the Zeehan and Trial Harbour road.

With a relatively modest CAPEX of under $60m and all-in sustaining costs of around $123/tonne, the 2019 scoping study (table 1) showed a very respectable net present value (NPV) of $71m with an internal rate of return of 45 per cent.

I’m looking forward to the revised study with tin having doubled since 2019. The NPV is likely to come in around $150m given current spot prices in the order of $US30,000/tonne. At an enterprise value of around $18m there is plenty left in the tank for the SRZ share price.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.