Guy on Rocks: Good news continues for commodities

Experts

Experts

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Good news all round for metals with iron ore averaging US$170/tonne for CY 2021 with shipments by Australian producers down 15% week on week.

RIO’s was off 20% to 5.4mt, BHP down 15% to 4.9mt and FMG’s 5% to 3.3mt.

The only notable increase was Vale with an increase of 25% over the same period to 5.2mt.

Yet again we are seeing spot prices well above projections by the banks, as Macquarie forecasts v actuals demonstrates.

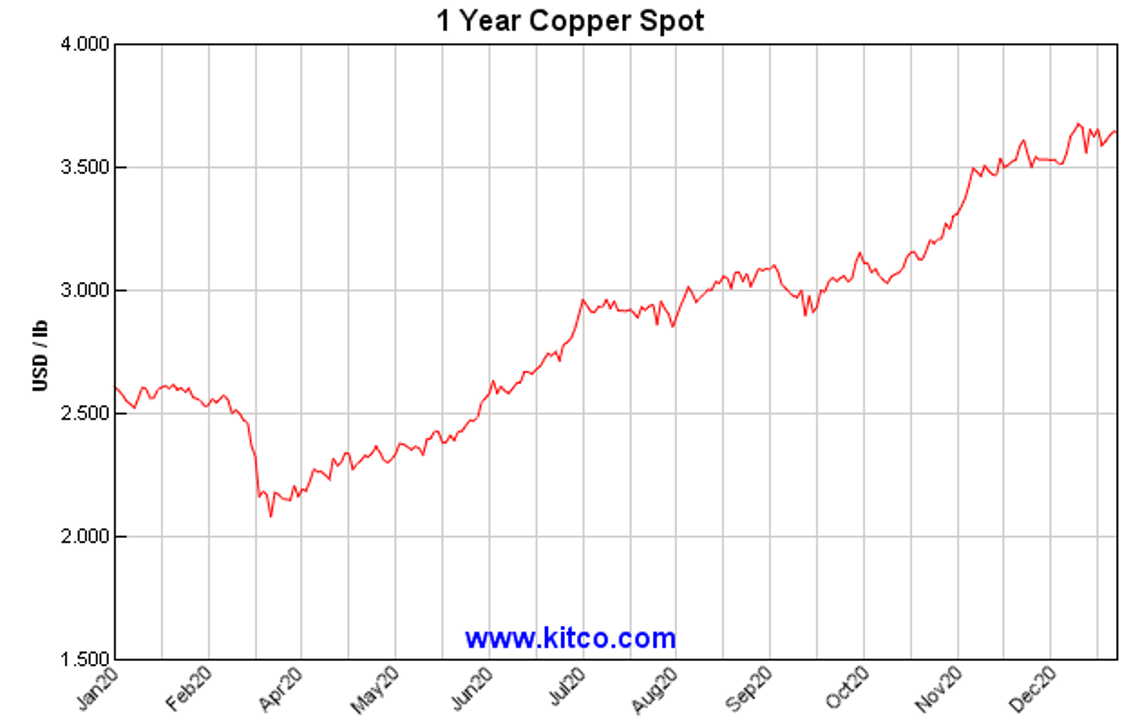

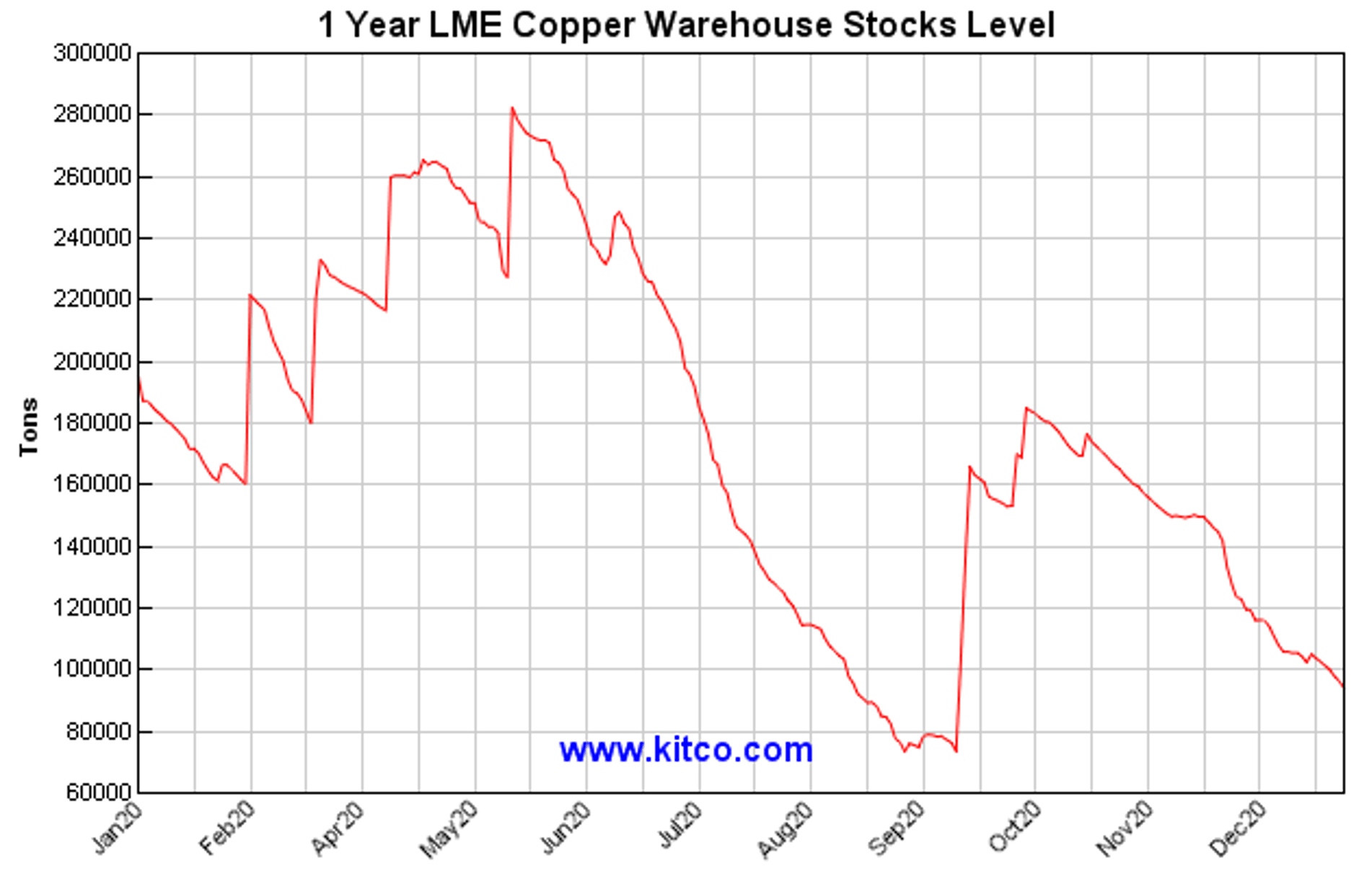

As foreshadowed last year, copper is looking for a strong year with inventories currently at a three- week low with projections (Morgan Stanley, 2021) ranging from US$3.60/lb to US$4.32 over 2Q20 with a bull case US$4.32/lb.

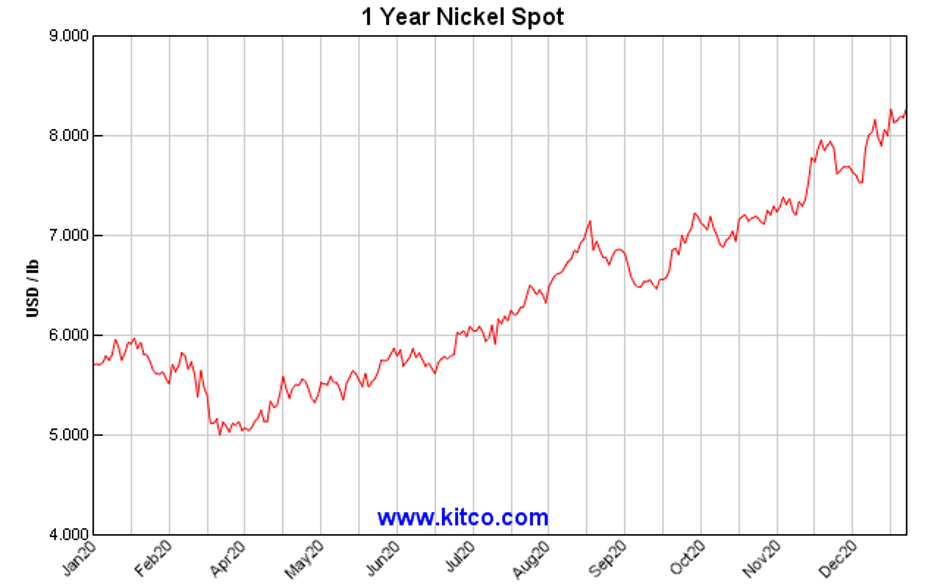

While iron ore continues to dominate news, nickel spot prices continue to edge up recently passing US$8.00/lb.

Given the strong outlook for stainless steel, battery grade nickel and delays in HPAL commissioning this is not surprising.

The only dampener medium term is likely to be an increase in Indonesian Nickel Pig Iron (NPI) production.

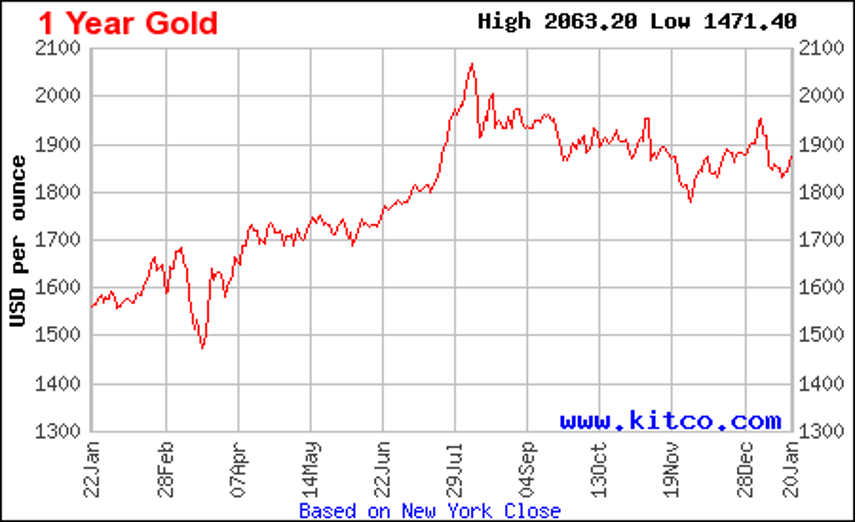

Gold has struggled somewhat in the last few months to crack US$2,000 in the face of rising US10 year yields.

While inflationary pressures and an aggressive roll out may be, on the face of it negative for gold, I believe political instability may take over as a key medium driver.

Along with De Grey Mining Ltd (ASX: DEG) (5 cents to a peak of $1.58 in CY 2020), Chalice Mining Ltd (ASX: CHN) was one the stand-out performer last year discovering a potentially world class Ni-Cu-PGE resource at Julimar (70km north of Perth) reaching touching an all-time high of $4.72 (market capitalisation $1.6 billion with $120 million in cash) at the time of writing on the back of a 21.5 cents to $4.25 move in CY 2020.

Recent strength is attributed (ASX Announcement 4/1/2021) to the imminent magnetic/soil geochemical survey to the north of the Gonneville PGE-Ni-Cu-Co-Au discovery.

The company is also set to continue its aggressive 6-rig resource definition drill program at Julimar.

Blackstone Minerals Ltd (ASX: BSX) announced (ASX Announcement 22 January 2021) that it had signed a non-binding letter of interest (“LOI”) with Trafigura Pte Ltd (“Trafigura”) that will potentially allow for Trafigura to supply certain quantities of nickel and cobalt to Blackstone as part of the company’s downstream processing strategy for the lithium -ion battery industry at the Ta Khoa Nickel Project in Vietnam.

Blackstone’s recently completed a Scoping Study (ASX announcement 14 October 2020) that contemplated a downstream refinery processing up to 200ktpa of concentrate sourced from mining operations at the Company’s Ta Khoa Project.

In other news Mako Gold Ltd (ASX: MKG) was recently granted the Quangolodougou permit in Côte d’Ivoire covering 111km2 of ground near Barrick’s 4.9Moz Tongon Gold Mine that forms part of the 100% owned Korhogo Nord Permit with exploration due to commence shortly.

The company is also planning to commence a 1,500 metre RC program at its Napié Project.

Los Cerros Limited (ASX: LCL) have followed up on some previous impressive results at the Tesorito South porphyry target, (part of the 100% owned Quinchia Project, Colombia), with TS-DH14 returning an impressive porphyry gold intercept (within a package of andesites, diorites and breccias) of 320m @ 1.5g/t Au starting from 2 metres down hole.

This also included:

Gold mineralisation remains open to the west and at depth below 300m.

The company considers these some of the better porphyry intercepts in the Mid-Cauca gold belt which is known to host multi-million-ounce gold and gold-copper deposits.

Two diamond drill rigs are in operation on the Tesorito South porphyry with a third diamond rig drilling at the Chuscal gold target, located 2km south of Tesorito.

At a diluted market capitalisation (incorporating in the money options and some performance rights) of just over $100 million, definitely one to watch out for noting that there are around 120 million options and performance rights that are in the money and likely to put downward pressure on the price in the short term.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada and the United States.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.