Guy on Rocks: Gold valuations ‘compelling’ as Morgan Stanley predicts US$2,300/oz bull case

Pic: Via Getty

- Rising operating costs are suppressing gold miner valuations, for now

- But “we are at the beginning of something [bull market], not the end”, says Tavi Costa

- Morgan Stanley also bullish on gold with a US$2300/oz price target

- Stock of Week: Culpeo Minerals

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Gold and the climate change lie

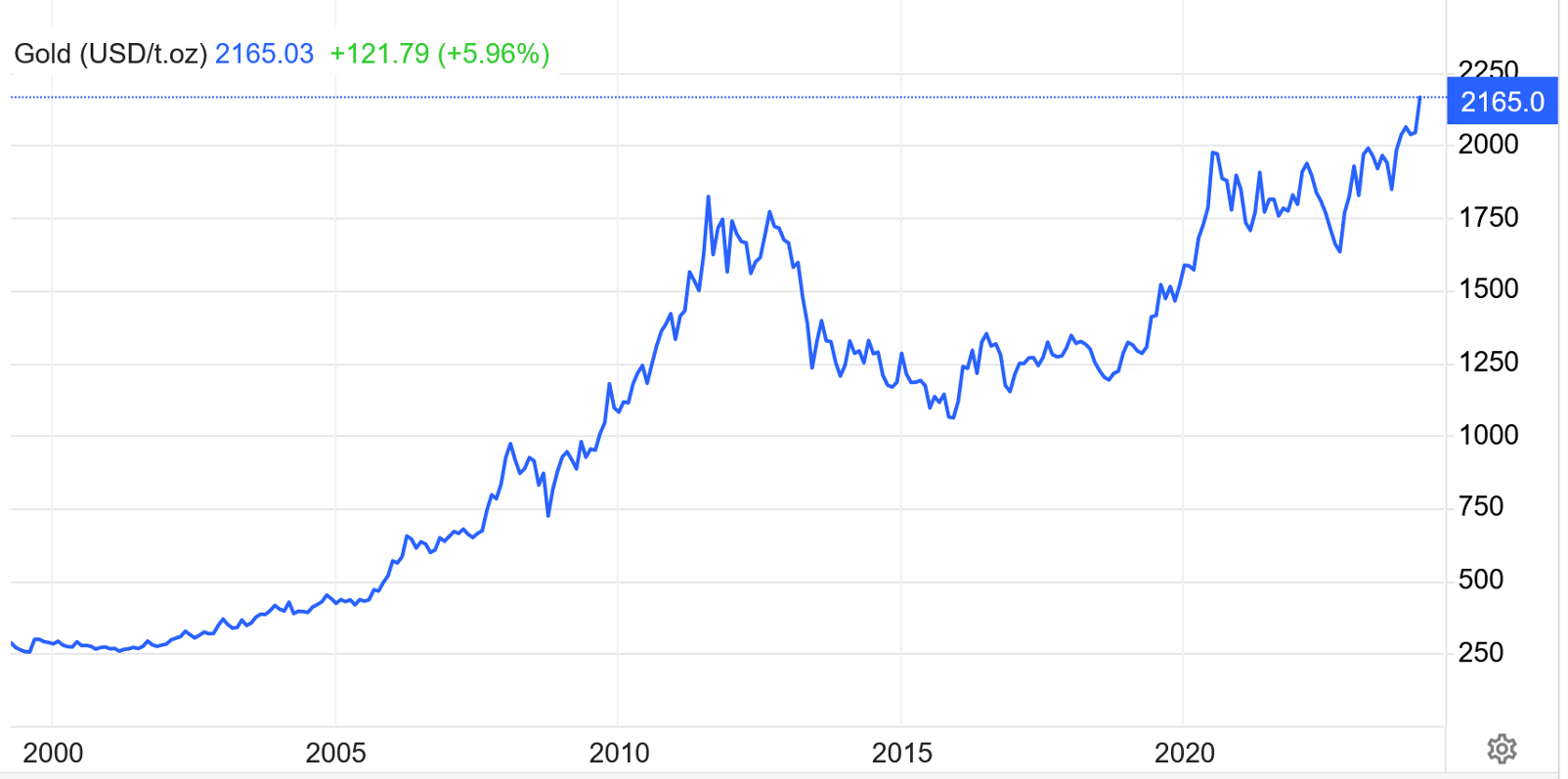

A surging USD saw gold pare earlier gains in the week after trading above US$2,200/ounce, finishing up US$8 after the Federal Reserve Meeting last Wednesday to finish the week at US$2,164/ounce.

Gold was trading slightly higher at US$2,172 mid-week. The DXY had a strong week up over 100 basis points to close at 104.43 with US Ten Year treasuries off around 100 basis point to close at 4.20%. Volatility index (VIX) remains low at 13.

While gold prices have been bouncing off all-time highs, gold equities have not been faring so well with Kitco Mining correspondent Paul Harris pointing out that rising operating costs have seen the VanEck Gold Miners ETC down 3% to $29.60/share.

As I recall back in 2022, over two consecutive years quarters, operating costs from Australian listed gold miners were up on average 30-35% and have remained sticky ever since.

Tavi Costa, from Crescat Capital, however believes current market valuations are not dissimilar to those we saw during the global financial crisis in 2008.

He believes, referring to the broader commodities market, that “we’re at the beginning of something, not at the end… Valuations are as compelling as they were during the global financial crisis.” This is based on his believe in gold’s dual role as both an industrial and investment asset.

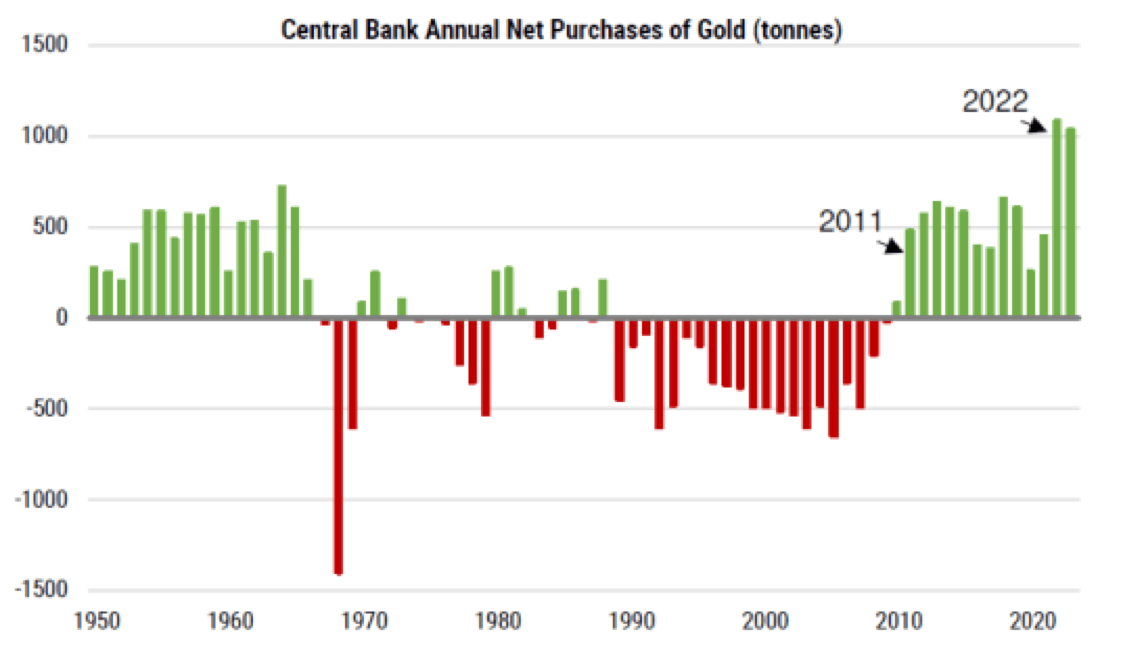

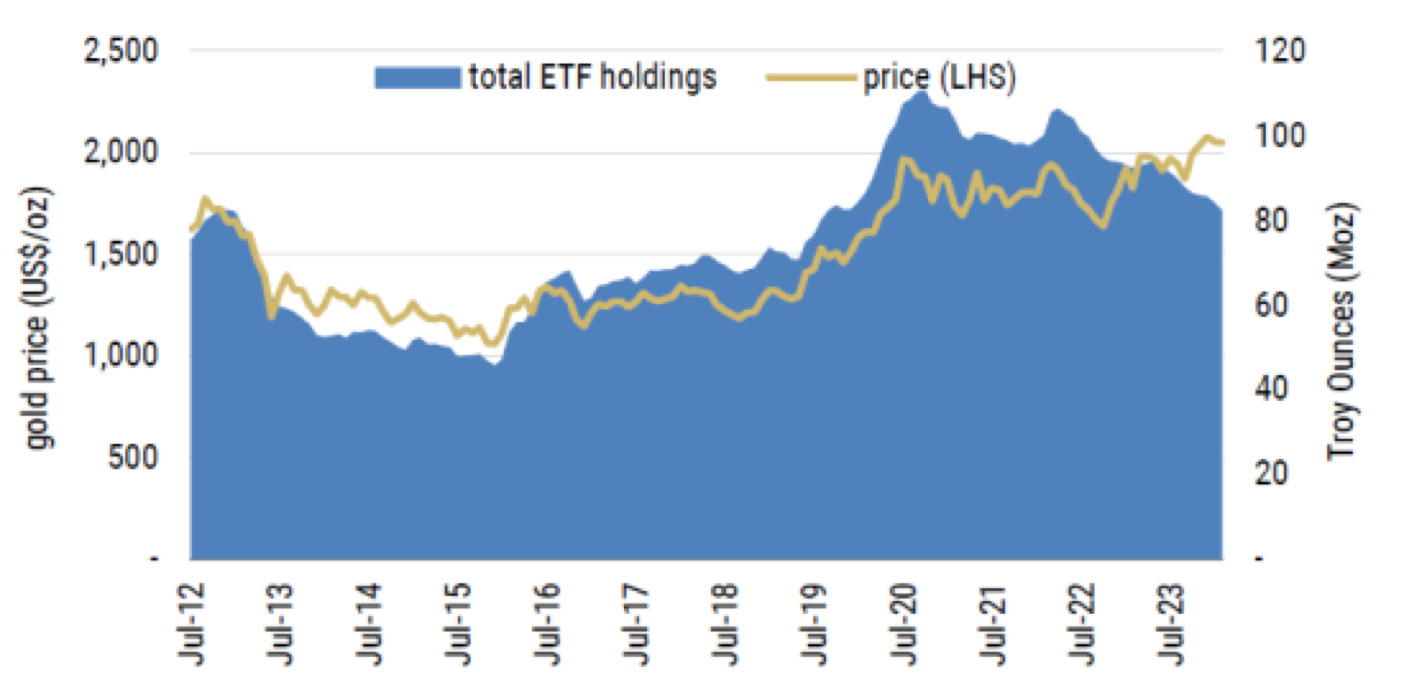

Morgan Stanley are also bullish on gold citing strong physical (including jewellery) demand helped along by strong central bank buying (figure 2) which have more than offset ETF outflows (figure 3).

In fact, Central Banks hold around 36,000 tonnes compared to ETFs with only 2,321 tonnes of gold.

Another key driver according to Morgan Stanley are real yields that continue to fall with the bank forecasting 10y treasuries at 1.55% by Q4, or around another 50bp decline.

So, what is their bull case? US$2,300/ounce.

Other precious metals also lost ground last week with silver down 2% to US$24.62 and platinum losing US$37/ounce to close at US$895/ounce.

Palladium (figure 4) was down US$94 to close at US$895/ounce. While many investment banks are projecting a rapid decline in palladium’s use in catalytic converters as demand for EVs (which are palladium free), I think the uptake will be far slower.

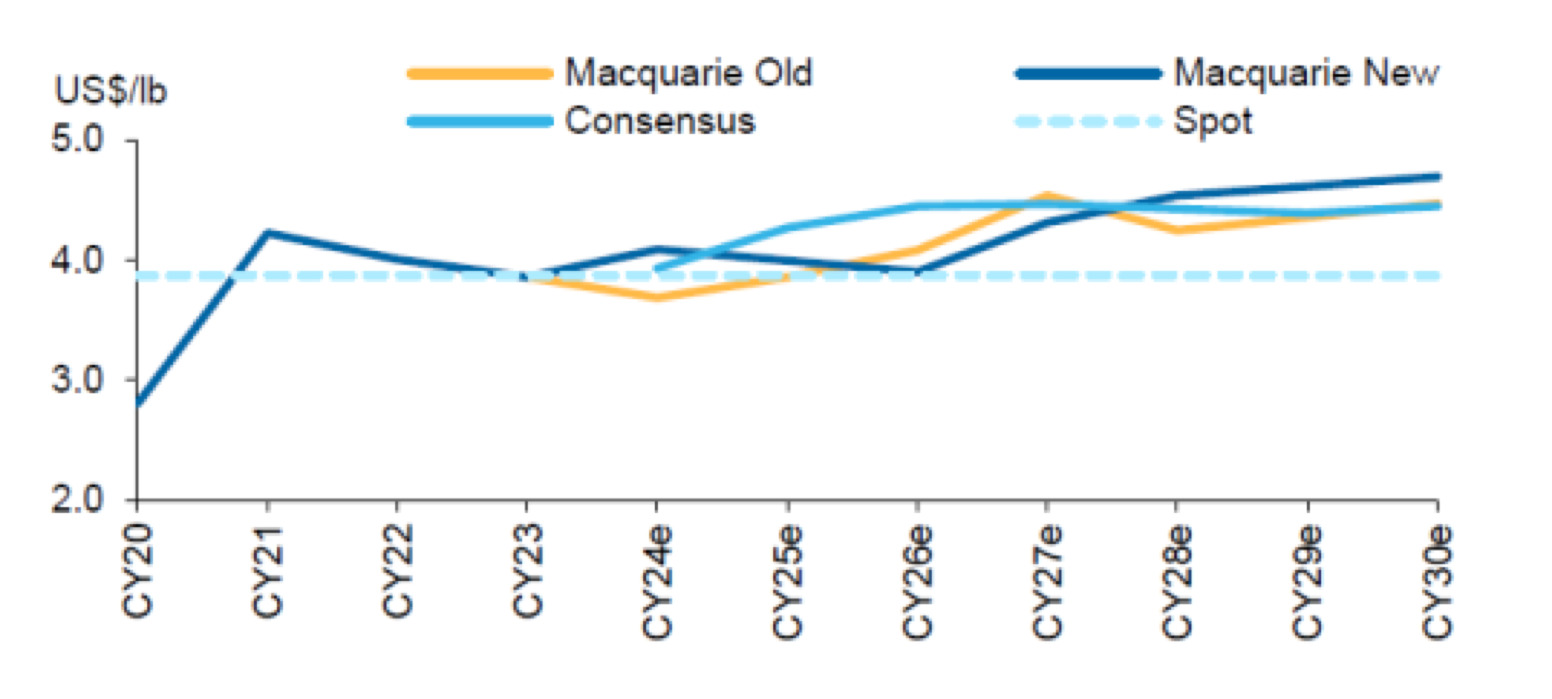

Copper dropped back 16c to close at US$3.96/lb in the face of a stronger dollar with cash to 3-m still in a 4 cent contango.

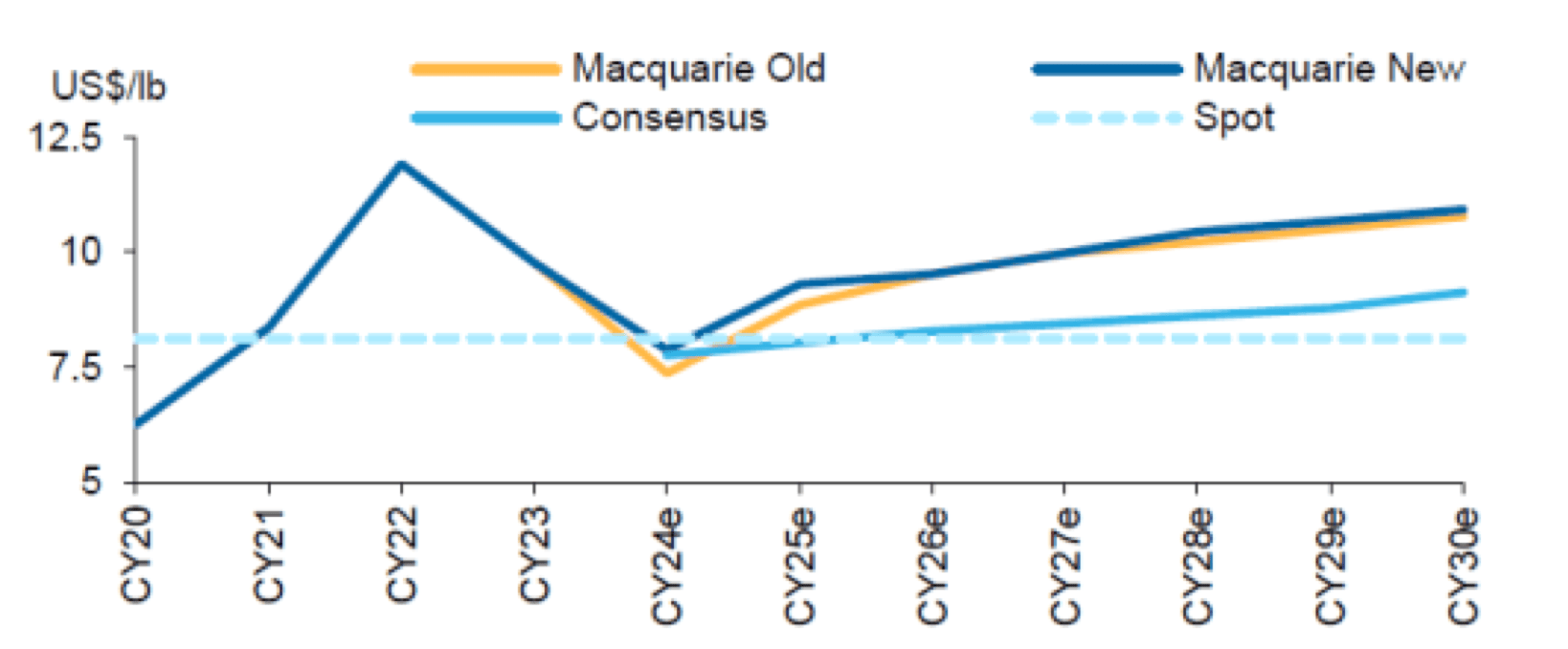

Macquarie (Macquarie Research, 14 March 2024) believe supply shortages and a robust demand should push copper higher citing the medium term (2026/2027) supply outlook with a large number of projects likely to be deferred.

The bank is projecting the red metals to average around US$4.09/lb over the remainder of CY2024, moving to US$3.81/lb longer term.

Interestingly Macquarie is bullish on nickel pushing their longer-term price projections to US$20,000/tonne a whopping 20% above consensus forecasts (figure 6).

In energy markets, oil was flat closing at US$80.80/BBL, drilling rigs are down 5, US production was down 13.1mBOPD with talk of shale oil peak.

Inventories down around 2MBOPD imports down 6.3 down 800,000 BOPD, refineries increased 300,000 BOPD gasoline up 8 cents and inventories remain at the bottom of their range.

Finally uranium bounced, adding US$5.50 to close at US$89.50/lb.

Good to see the Bolt report podcast (21 March 2024) earlier last week getting stuck into the national energy and climate change debate. Called a “cult” by Barnaby Joyce, who points out that you don’t shut one energy source down unless you have a cheaper one.

In certain states Joyce goes to point out that it is immoral to mine and export uranium but it’s OK to maybe bury the waste back in Oz?

As for global warming, even the former co-founder of Greenpeace Patrick Moore says there is no climate emergency and that the climate change debate is being driven by false narratives.

Check this website out with plenty of credible science papers that might have you asking questions on climate change: https://notrickszone.com

Finally mull over this little chestnut:

“From modern instrumental carbon isotopic data of the last 40 years, no signs of human (fossil fuel) CO2 emissions can be discerned.”

Net Isotopic Signature of Atmospheric CO2 Sources and Sinks: No Change since the Little Ice Age, Koutsoyiannis, 2024

And how is the renewable energy transition going?

According to Colin Packham, in an article in Friday’s The Australian (22/3/2024) entitled “Renewable Targets Lost in Transition” (may as well be “Lost in Space”) the largest gas pipeline operator APA Group said that time frames “likely to need further extensions to reflect significant challenges faced by project proponents,” and that “Renewable energy projects face complicated and lengthy approvals processes that projects must go through before construction can even begin”.

So the answer is swimmingly, by the look of it.

Well, if you believe the populist climate change debate you would have swallowed the weapons of mass destruction saga.

Actually, this did turn out to be true. The Labor government had the good sense to dispatch Kevin Rudd to Washington who, according to my friend Donald Trump, is now doing his finest work…

Stock of the Week: High impact copper explorer

Finding good copper plays on any exchange has been a challenge over the last couple of years despite the supply constraints and growing demand.

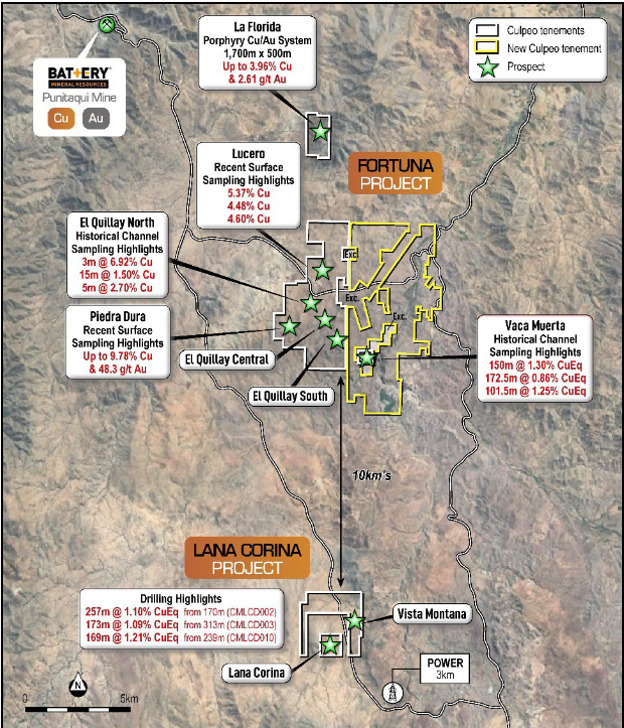

Culpeo Minerals (ASX:CPO) have been swinging a big bat in elephant country at their Chilean La Corina and Fortuna Projects (figure 8).

So far drilling has delivered some eye-watering intersections at the copper-molybdenum rich La Corina project with 257m @ 1.10% CuEq in CMLCD002 from 170m and 173m @ 1.09% CuEq in CMLCD003 from 313m.

Porphyry copper exploration has been pretty dead for the last 12 years, grinding to halt in 2012, with not a great deal of junior activity since.

The board is well catered for with Max Tuesley having plenty of porphyry copper experience in the Philippines over the last 20 years.

He has even endured some more spicy jurisdictions in the Zamboanga region of Mindanao where the odd Westerner is known to go missing.

So, if anyone is looking to send the mother-in-law on a “one way” trip, the island of Jolo in the Sulu Archipelago could fulfil that need. Just quoting Smart Traveller here.

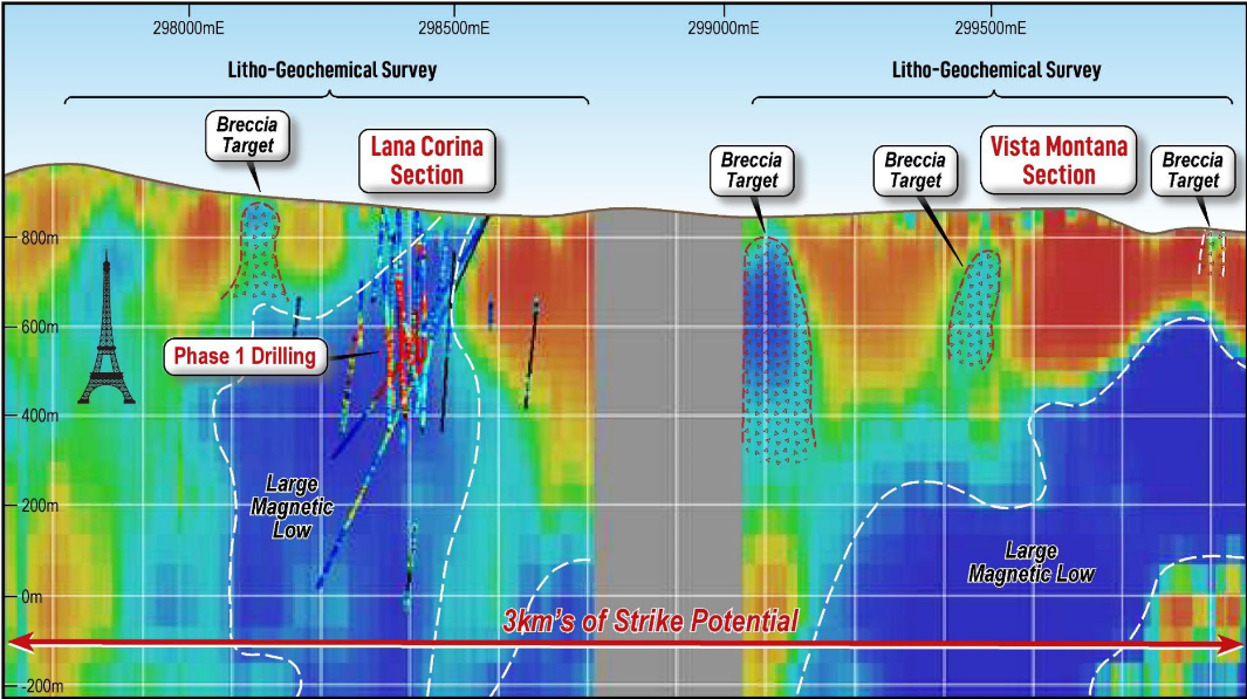

So, Fortuna looks like a Cu-Au rich system while Lana Corina is presenting multiple opportunities for high-grade Cu-Mo along a 3km strike (figure 10) with a number of magnetic lows that are potentially mineralised breccia targets.

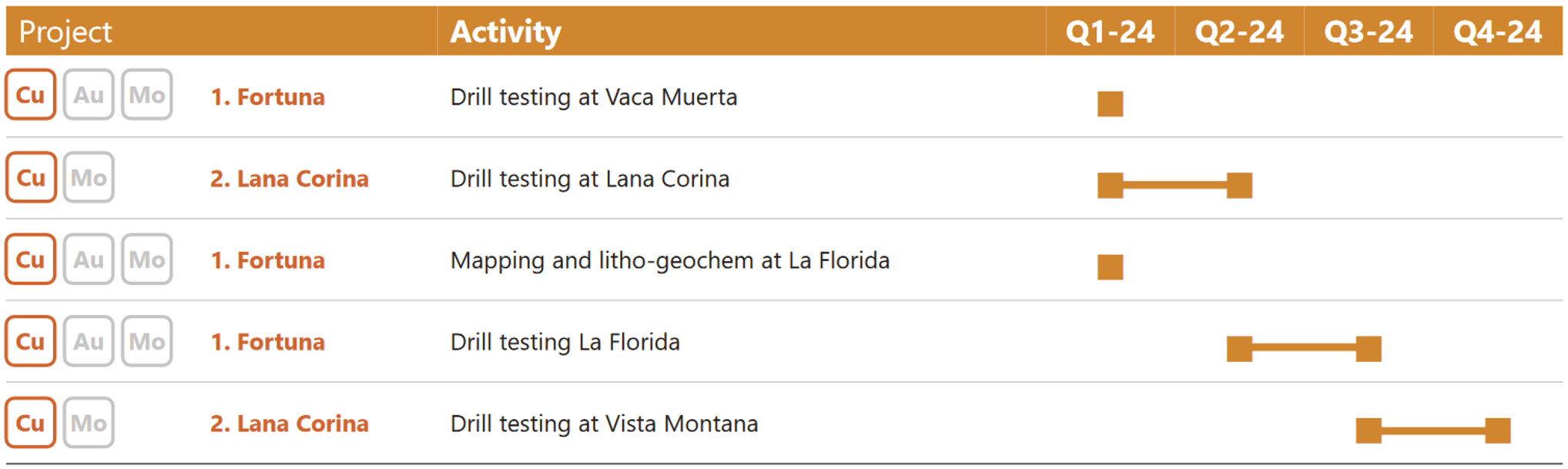

The company has a busy exploration schedule this year (figure 11) with my primary interest in the deeper drilling at Lana Corina as well as testing the Breccia pipes along strike (figure 10).

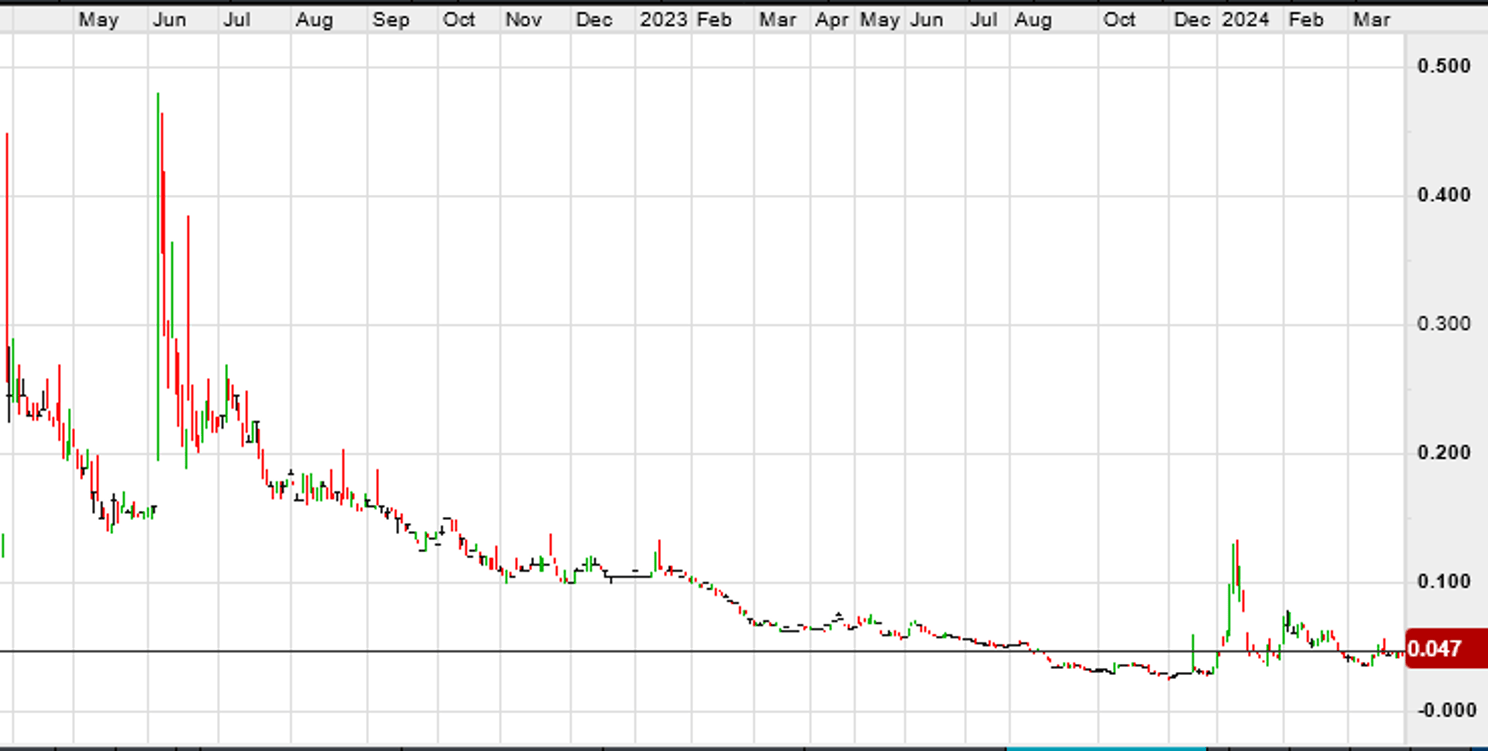

For a company that has an exploration target (my estimate) of +100Mt @ >0.80% CuEq the market capitalisation of under $8.0m with around $2.7m in cash is hard to rationalise.

Definitely one to put on the radar if you like highly leveraged base metal plays.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.