Guy on Rocks: Dusting off an advanced tin-tungsten project as prices go into Low Earth Orbit

Pic: Getty

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: I’m excited

I was wondering what the late great sports commentator Daryl Eastlake would have thought about markets for base and precious metals. “I’m excited” and “wonderful” comes to mind at full volume.

Precious metals were up last week in a “risk off” environment.

Platinum closed at US$1,067/oz up almost 4% and Palladium finished at US$2,293/oz up 1.1% for the week.

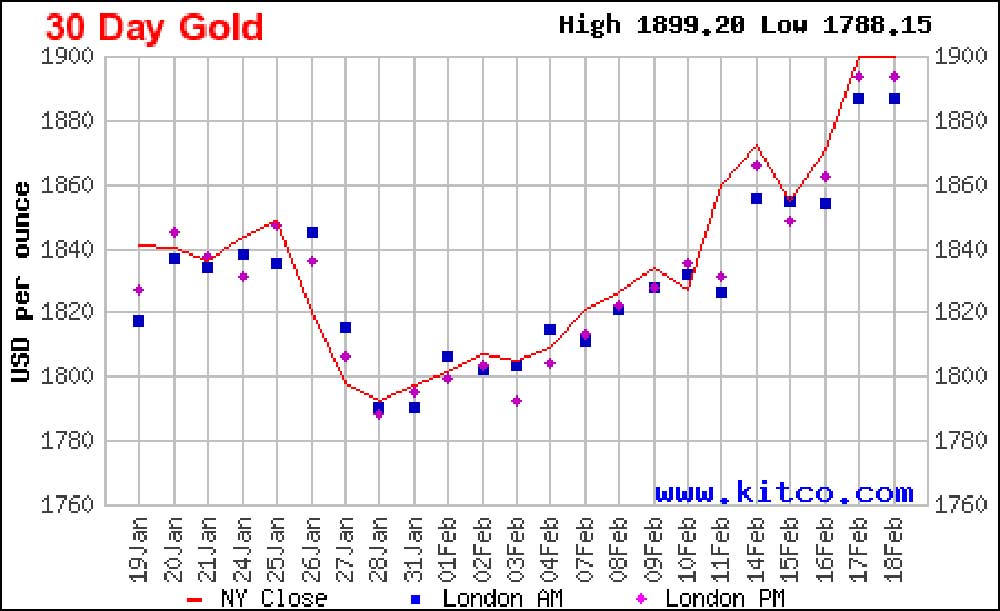

Gold put on an impressive 3% last week touching an eight-week high of just under US$1,900/ounce on the back of geopolitical tensions on the Russia/Ukraine border.

But we don’t need those pop guns to go off to see the yellow metal go higher, as Bank of America’s chief investment strategist, Michael Hartnett, points out that “recession risks are rising, with “rates shock morphing into recession shock.”

On the base metal front, prices are moving higher across the board with inventories of Cu, Ni, Pb, Zn, Sn and Al at very low levels.

The Chilean politicians are still debating taxes on copper mining which could rise, assuming spot prices of US$4.50/lb, by a whopping 20%.

They must have been a bad batch of that Peruvian favourite pisco sour (kick on it like a mule last time I knocked some back) as potentially devastating policies put copper production at risk in Chile and Peru.

While not having an immediate impact on mines such as Los Pelambres (ANTO) and Escondida (BHP/RIO), which have stability agreements in place till late 2023, the higher tax rates would kick in from 2024.

There is some way to go before the revised taxes become legislated, but it will certainly put the brakes on exploration in Chile in the short term.

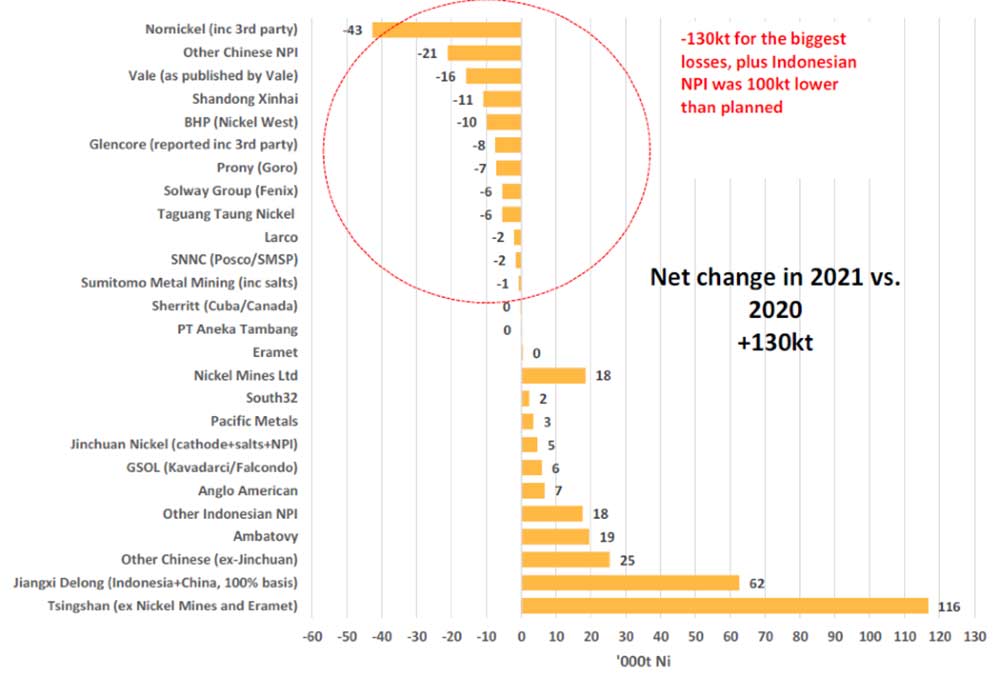

Macquarie have quantified what I have been talking about for some time, that is the large gulf between forecast and actual nickel supply with 2021 being one of the biggest “misses” between projected and actual production.

This was due to widespread losses among the major Western producers, in addition to a drop in nickel pig iron production from China. Overall supply increased 5.3% YoY mostly attributable to a 39% YoY rise in Indonesian nickel pig iron production.

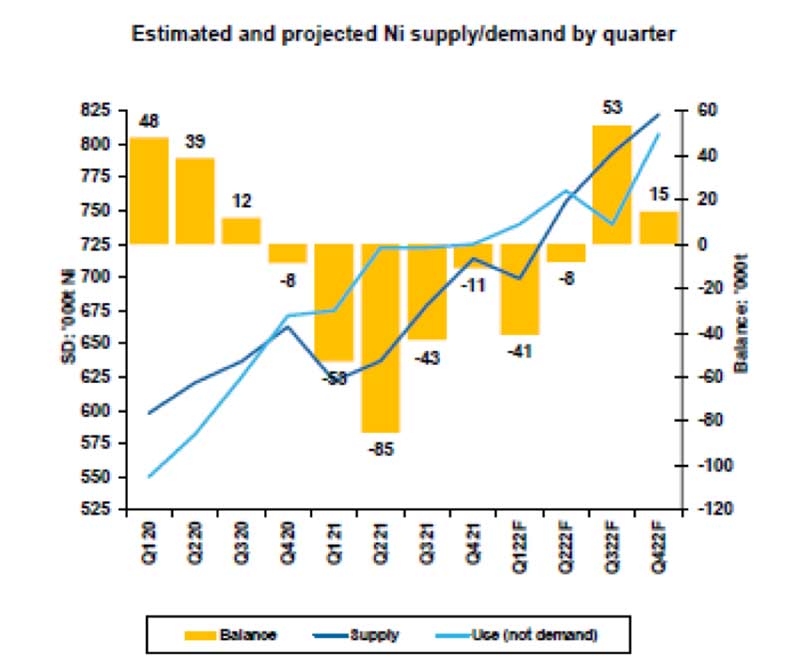

Macquarie are projecting supply growth (figure 3) of around 16% YoY, or 419kt representing the largest ever one-year growth in nickel supply which will still likely see a deficit in the 1H 2022.

Watch out for sanctions on Russian nickel if the Russians decide to roll across the border. Mind you as long as the troops remain where they are, Putin can flex a lot of muscle without taking too many risks.

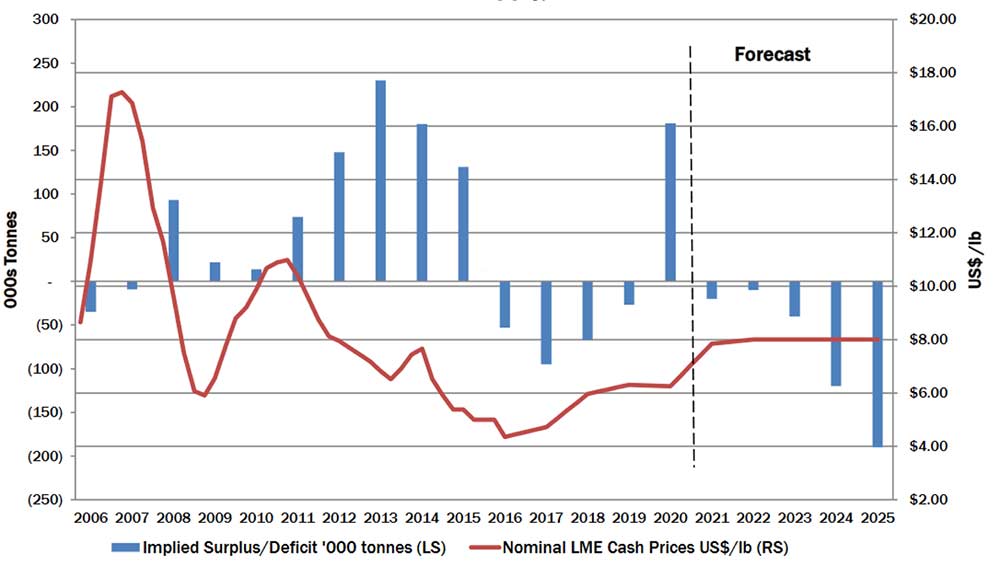

Longer term, BMO/Canaccord are projecting a 200,000-tonne deficit in nickel by 2025.

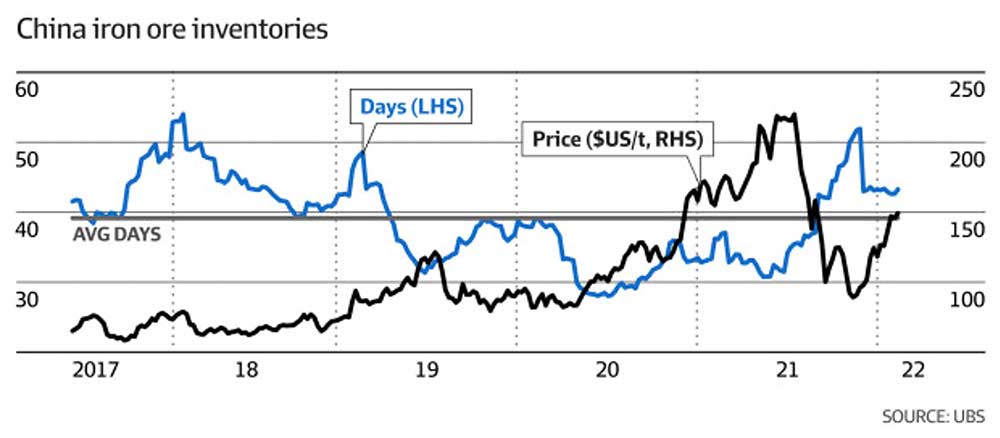

Finally iron ore pulled back from its recent highs around US$150/tonne (62% fines) following China’s National Development and Reform Commission (NDRC) and State Administration of Market Regulation (SAMR) insisting that some iron ore traders release excess inventory and reduce stockpiles following a joint investigation on the port of Qingdao.

Previous attempts by the Chinese government have had little impact on medium to longer term iron ore prices (figure 5) however steel margins provide better guidance with margins in the range of US$90 to US$120 for hot rolled coil steel at their lowest levels since late November 2021.

Interestingly, Morgan Stanley are projecting prices to rebound to US$175/tonne over Q2 2022 on the back of strong Chinese steel production which they see as growing by 20% (compared to 4Q 2021 in Q2 2022).

Company News

The RIU Explorers conference (run by Vertical Events) was well patronised this year by the usual suspects from West Perth and St Georges Terrace with an impressive line-up of high achievers over the last 12 months including De Grey Mining (ASX:DEG) winning the Craig Oliver award.

The award is presented to the best “all round” company that has excelled in exploration, mining, corporate, market results, environmental and community over the past 12 months.

Of course, it helps if you find something, so I guess the 6.8Moz JORC Resource at Hemi should get you on the short list.

There is a lot to like about the project and DEG is a worthy winner.

One of the things I later found out about Craig (figure 6) (also a former director of DEG) is that he insisted on travelling economy class to Africa when he was working with former ASX listed iron ore developer Sundance Resources (ASX:SDL) 12 or so years ago before the entire board’s untimely death in a plane crash in the Congo.

The hostess was so impressed with his modesty that she insisted on serving him Business Class food. I have also adopted this Spartan approach to travel however requests for Business Class food have, so far, fallen on deaf ears.

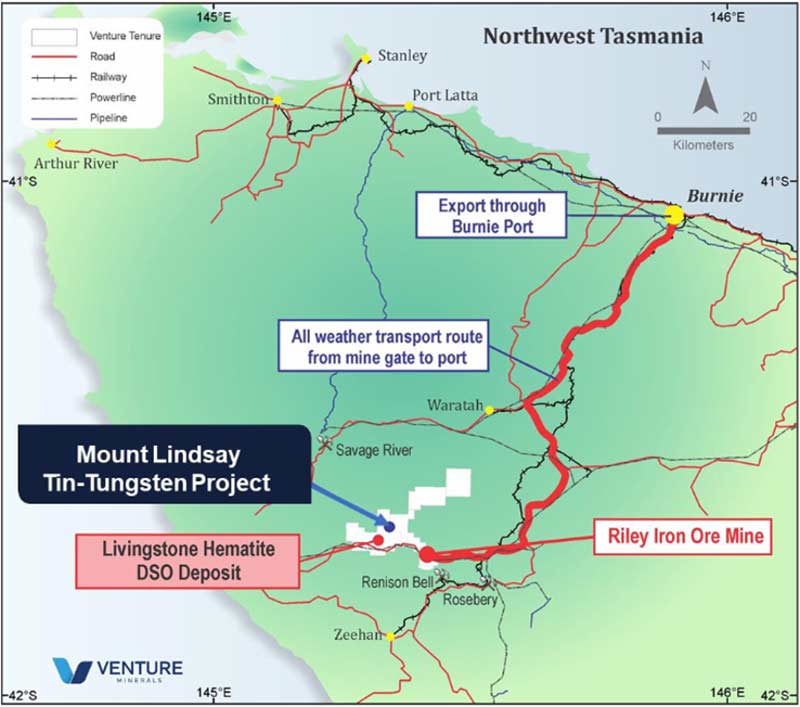

I managed to reconnect with Andrew Radonjic (who looks much better wearing a mask, as do many of the other attendees) the managing director of Venture Minerals (ASX:VMS).

The Stockhead faithful would remember my note on the commissioning of the Riley iron ore project in Tasmania back in August 2020 after which the company had a great run from 3-4 cents hitting a high of around 16 cents in the middle of last year.

The rapid retreat of the iron ore price to just under US$90/tonne in late 2021 brought the small-scale iron production to an abrupt halt.

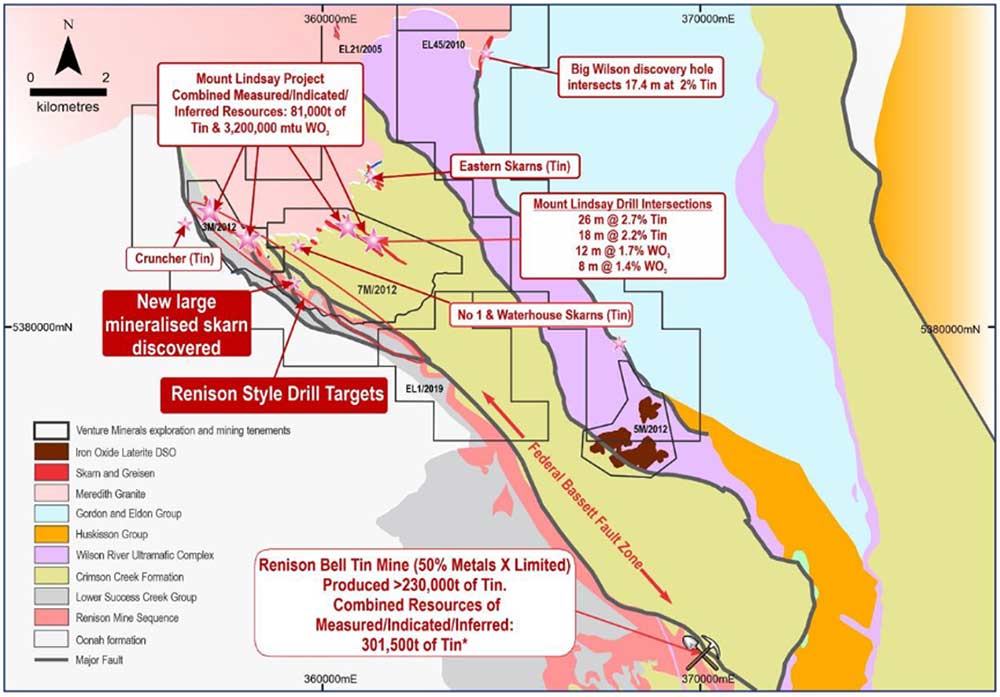

Not to worry — the company is in the process of dusting off the Mt Lindsay Tin-Tungsten project situated in north-western Tasmania (figure 8) with the commencement of a Feasibility Study based on a JORC Resource comprising 45Mt @ 0.40% Sn equiv (80,000 tonnes of Sn, 3.2Mt of WO2 based on a 0.2% cut-off grade for Sn and 0.1% for WO2).

Recent exploration at the project has recently discovered two new mineralised skarns with potential for tin-tungsten mineralisation (figure 9).

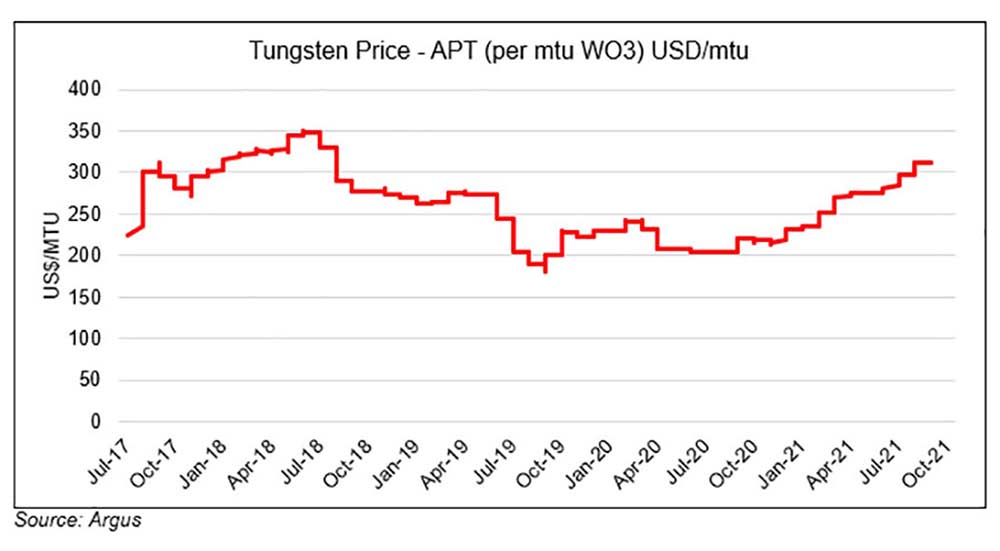

It certainly helps that both tin and tungsten have both gone into a low earth orbit (figure 10 and 11).

Tin is critical for energy storage while tungsten is used in steel hardening, armaments, semi-conductors, and electronics among other uses.

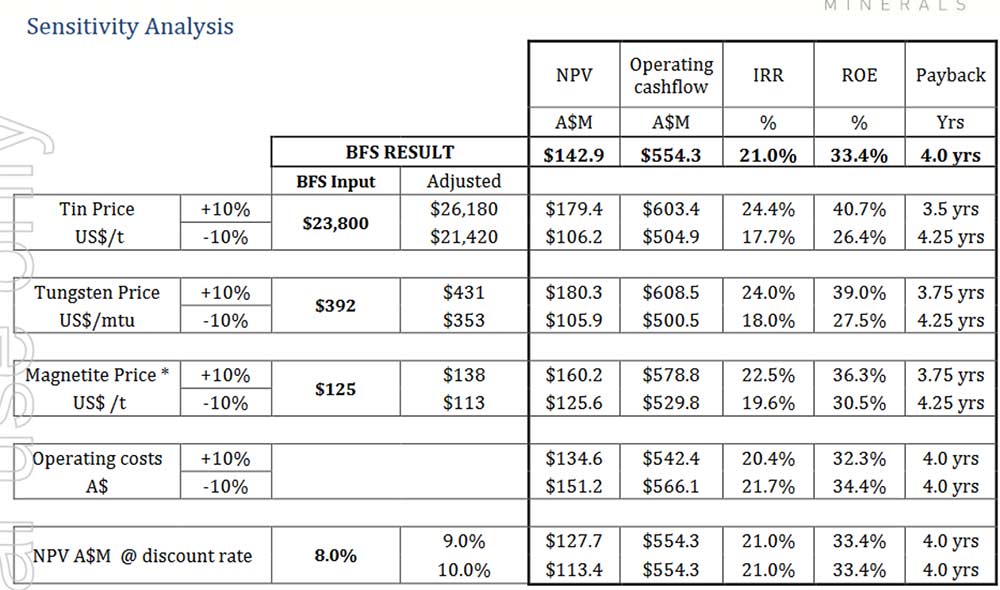

Have a look at the 2012 Feasibility Study financial metrics (figure 12) based on US$28,000 Sn and US$392 MTU for tungsten and assuming an exchange rate of US$/A$ of 0.90 for a CAPEX of just under A$200 million.

While capital and operating costs have risen significantly, I think the Feasibility figures due out in Q4 2022 could be quite attractive and at an EV of only $60 million we could see the VMS share price re-test recent highs of 16 cents in the short term.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.