Guy on Rocks: A potential 300koz at 5g/t open pit resource? This high grade gold minnow could be due a re-rate

Pic: Via Getty

- Gold, silver prices flying; gold nearing record highs

- Uranium continued its strong run over the last six weeks, while uranium equities in Canada and Australia remain flat

- Near term outlook for battery metal cobalt looking bleak

- Stock of the Week: gold explorer Riedel Resources

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Indonesia and DRC ramp up cobalt production, price softens

Gold closed up US$7 per ounce to finish the week at US$1,989/oz and is now trading around US$2,017 per ounce.

Silver closed more or less flat at US$25.01lb while the platinum group metals gave back most of their gains from the previous week with platinum down almost 4.5% to US$1,074/oz and palladium down 7% to US$1,428/oz.

We are likely to see more volatility in gold as the US debt ceiling rears its ugly head after US Treasury Secretary Janet Yellen commented: “After reviewing recent federal tax receipts, our best estimate is that we will be unable to continue to satisfy all of the government’s obligations by early June, and potentially as early as June 1, if Congress does not raise or suspend the debt limit before that time.”

While it will surely be sorted, there is not a lot of time left to find a solution.

WTI traded around US$75/bbl closed down 1.5% to US$76.67/bbl.

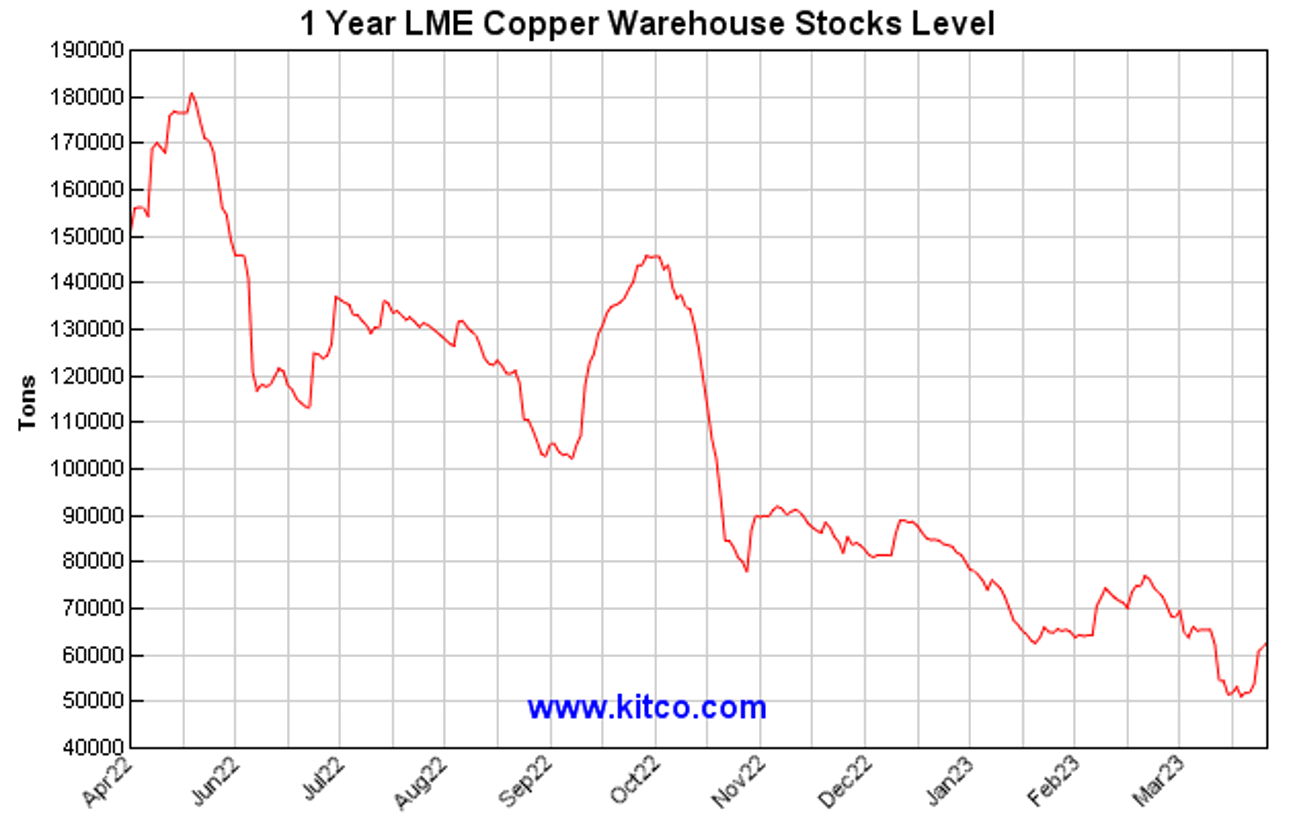

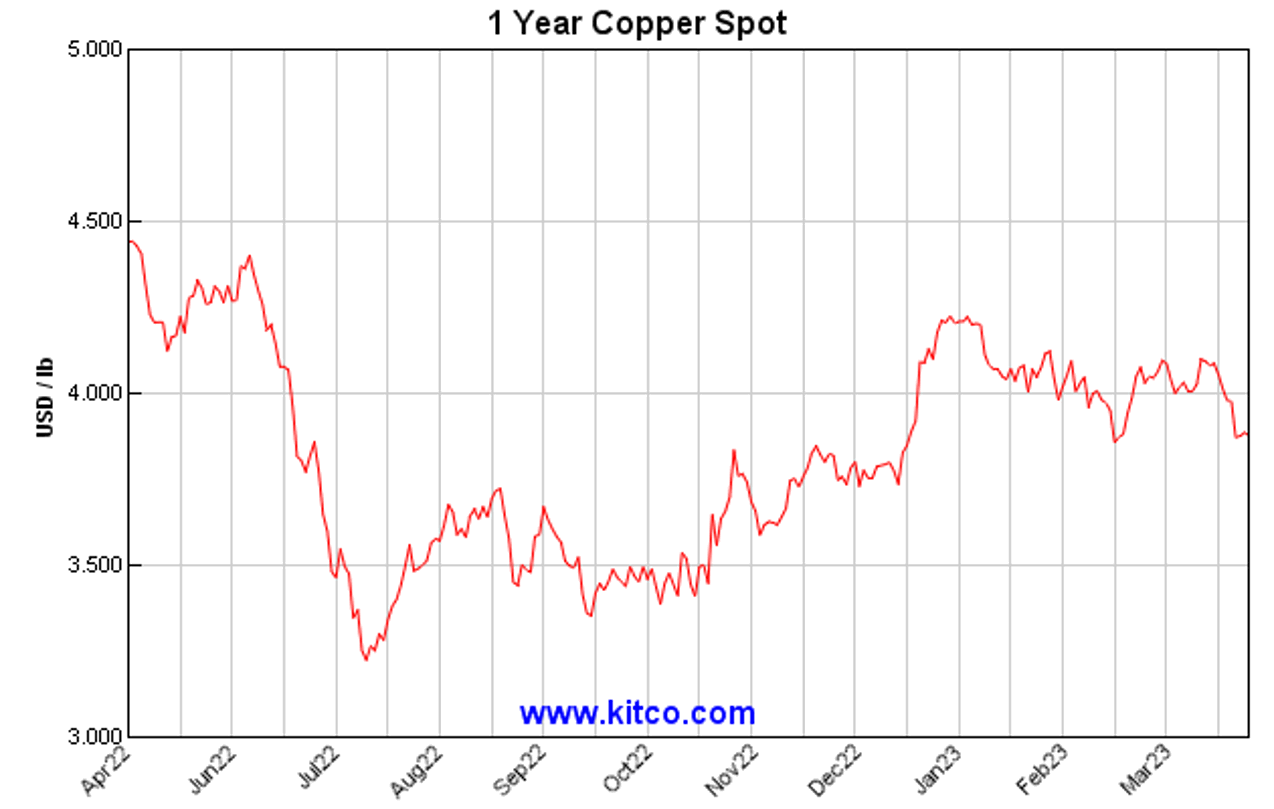

Despite historically low inventories (figure 1), copper (figure 2) is now sitting at six-week lows around US$3.88/lb with the three-month forward contract in slight contango on the back of softening demand and weak economic news from China and US.

Iron ore (figure 3) finished the week around US$107/tonne (62% fines) with losses amounting to 16% over April of this year.

While steel production has grown around 6% in March, mostly attributable to lower coal and steel prices, it appears that monetary stimulus has been relatively modest at around 9% compared to +2-% over the corresponding period in 2020.

Uranium continued its strong run over the last six weeks closing at 53.50c/lb while uranium equities in Canada and Australia remain flat.

The US dollar index was hovering around 101.5 most of the week before closing down 10bps to 101.63 about with volatility levels remaining low as the VIX closed at 16, well below 12-month averages/medians.

Over the weekend the Chinese PMI Manufacturing index dropped to 49.2 from 51.9 while the non-manufacturing index fell to 56.4 from 58.2. In the US however, consensus is that the Federal Reserve Bank will lift interest rates by 25bps later this week as employment costs rose by 1.2% for Q1, slightly above expectations of 1.1%. Recent economic headlines in the US have been dominated by the Federal Deposit Insurance Corp calling for bids from the major banks to bail out First Republic; JPMorgan finally came to the table and clinched the deal.

In Europe, German Q1 GDP figures for Q1 were flat compared to an anticipated rise of 0.2% while the revised Q4 figures showed a contraction of 0.5%. As with the US, the market is anticipating another 25bps lift in interest rates when the European Central Bank meets on Thursday.

It is good to see Stockhead’s favourite son Donald Trump back on the campaign trail and giving EVs a real plug.

From what I recall, he thinks they are good for around two hours which is not great news if you are stuck in the desert. At the same time the Biden administration’s war on fossil fuels continues and has recently set a policy to ensure that the US military will convert all vehicles to electric by 2030. Good thing this policy wasn’t implemented during the Gulf War as the road to Baghdad would have amounted to the world’s largest traffic jam…

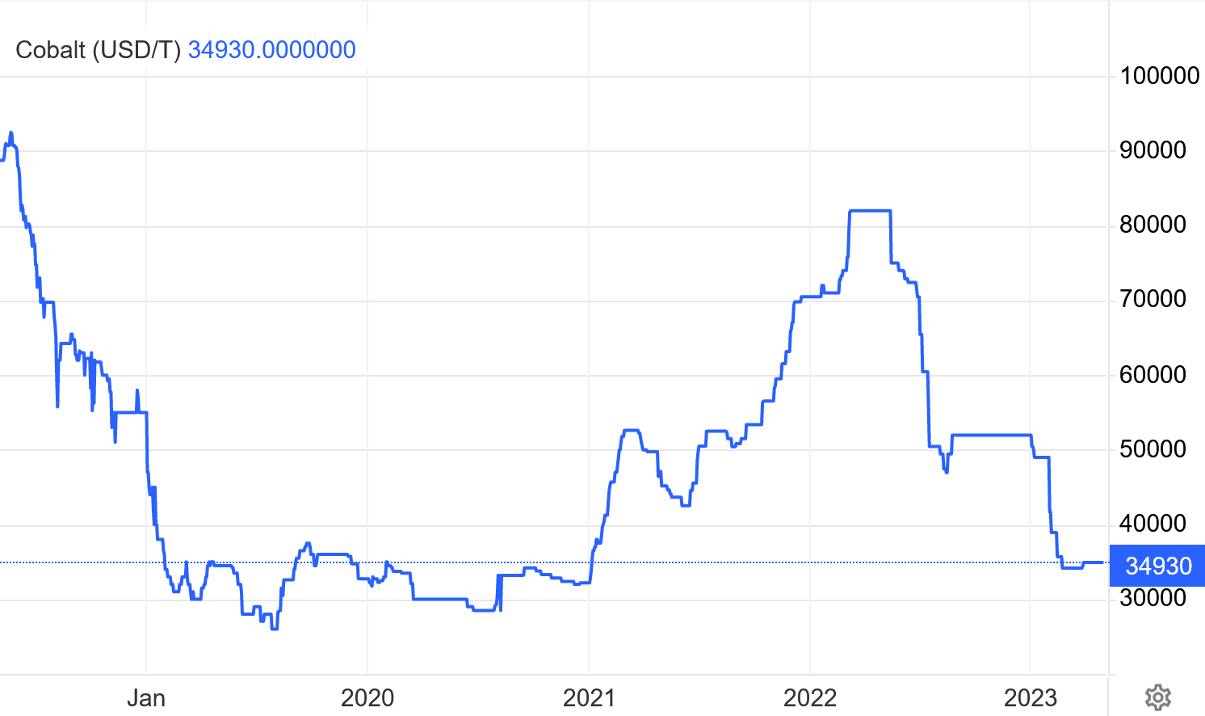

One commodity I haven’t mentioned for some time is cobalt (figure 4) which appears to have fallen out of favour.

After peaking over US$40/lb back in May 2018, the price has collapsed to around US$16/lb in response to weak demand. Hydroxide payables, according to UBS (April 2023) have also fallen from 90% to 55% even with supply disruptions from major producer China Moly (CMOC) that operates in the DRC.

The price moves have been a little surprising given 8% growth in world demand over 2022 following on from 19% in 2021.

While EV demand has been strong since 2021, the declining use of cobalt in batteries has seen demand soften. Add to that strong projected growth from the DRC and Indonesia, which are anticipated to add 70ktpa and 30ktpa respectively.

Indonesia is ramping up High Pressure Acid Leach (HPAL) production and has two projects starting up, namely Lygend at +8kt Co, and Huayue with +5kt and a further two projects to come online by 2025 namely Huayu at +11ktpa and Huafei with +11ktpa.

Finally, thanks to the fun police at the RBA for ruining the week of many highly leverage punters here in the West courtesy of a 25bps lift in cash rates to 3.85%.

Mind you, I did mention to the Stockhead faithful some time ago that more aggressive interest rate rises would be required given inflation is still running at an annualised rate of around 7%…

Stock of the Week: Riedel rides again

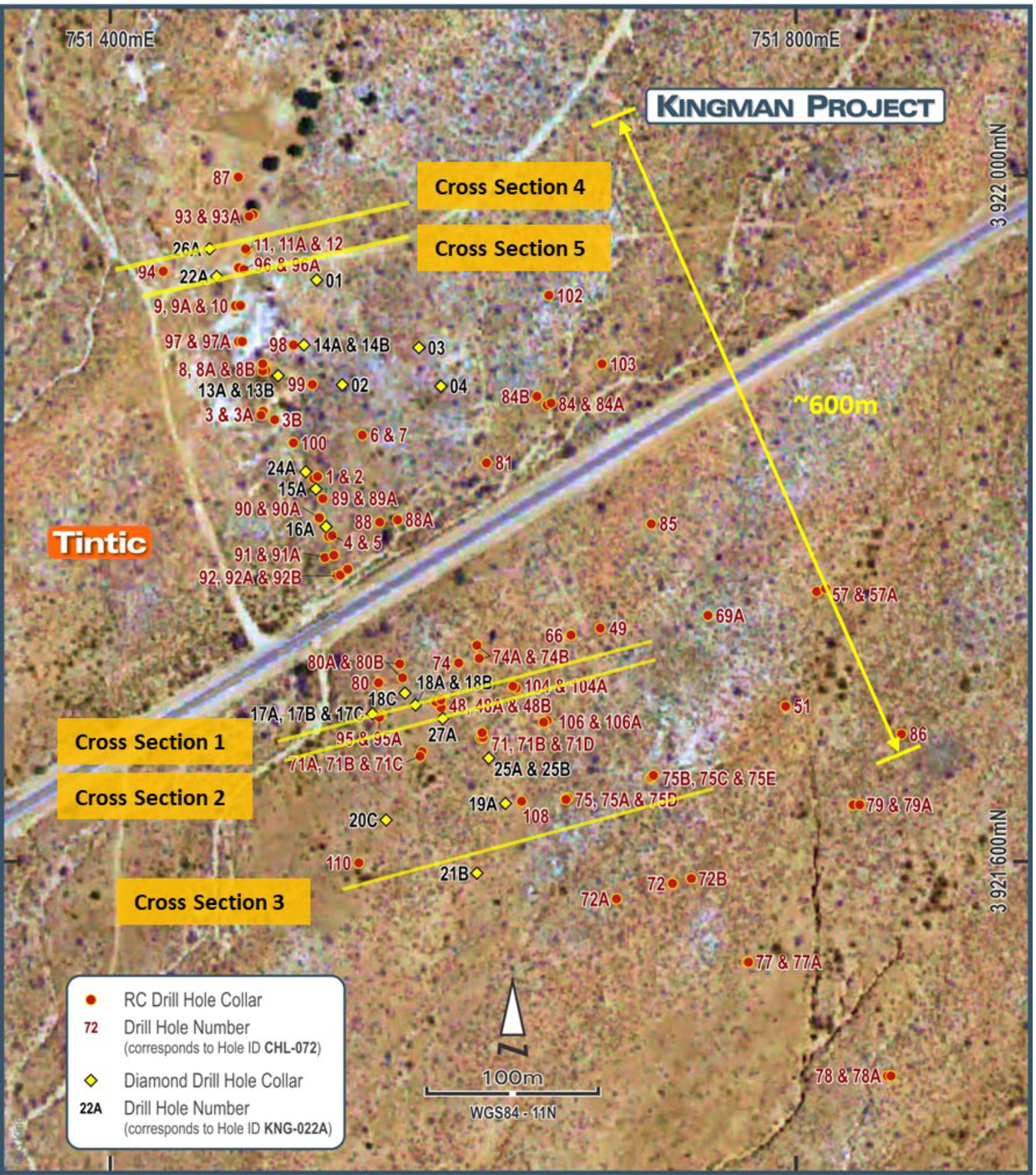

I first picked up Riedel Resources (ASX: RIE) (figure 5) back in April 2021 when it was just starting out at its Kingman Joint Venture in Arizona (figure 6).

The Kingman Project is situated around 90km from Las Vegas and 5km from a major highway. The company has recently appointed former Medallion Metals (ASX: MM8) exploration manager and geologist David Groombridge as CEO as the Kingman Project moves into a more advanced phase of exploration.

RIE has recently varied its farm-in terms and is now acquiring up to 90% of the project and is acquiring the additional 39% (previously 19%) via the expenditure of a further $5 million and a royalty capped at $3 million. While the stock price has been under pressure over the last year or so exploration has not disappointed with their March Quarterly report highlighting the near surface, high grade gold potential.

Better results from the Tintic prospect (figure 7) included the following;

- 0.37m @ 122.6g/t Au, 172g/t Ag and 3.7% Pb from 67.4m (2022-KNG-021B)

§ 0.24m @ 130g/t Au, 732g/t Ag and 28% Pb from 21.0m (2022-KNG-013B)

§ 0.82m @ 32.3g/t Au and 110g/t Ag from 24.3m (2022-KNG-026A)

§ 1.46m @ 23.1g/t Au, 120g/t Ag and 6.5% Pb from 12.8m (2022-KNG-018C)

§ 0.34m @ 14.9g/t Au, 535g/t Ag and 3.3% Pb from 22.71m (2022-KNG-018C)

§ 2.14m @ 11.22g/t Au and 48g/t Ag from 17.4m (2022-KNG-018B)

To date mineralisation at Tintic strikes for around 600m with ground magnetic suggesting this may extend for around 2km.

The company is currently bedding down a $2.5 million share placement at $0.005/share together with a $500K SPP on the same terms with the funds to be applied to testing new targets as well as infilling the existing mineralised envelope.

A maiden JORC Resource is due in late CY 2023, and I am hopeful of a near surface (less than 20-30m deep) resource over 300Koz of +5g/t gold which will make for a fairly easy open pit mining scenario with processing options within a 50km radius.

At an enterprise value of $6.6 million post the SPP and two tranche Placement, RIE represents a compelling value equation given the very high grade, near surface nature of the mineralisation with nearby treatment options. Production in the district dates back to the 1880s and Arizona is also an excellent mining jurisdiction.

The proximity to Las Vegas also has appeal to some, of the RIE shareholders who have done some of their best work there. I am talking about professional development activities, not some of the other nefarious activities some of the Stockhead faithful may have been contemplating…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.