Guy on Rocks: A cheap entry into the one resource that might actually save our species

Pack your asbestos undies folks. Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Gold continued its previous week’s strength, hitting US$1,979/oz in response to the rumblings in the Middle East. It was up over 2.5%, before settling back at US$1,978 in early trading on Monday morning. Silver also showed some strength last week closing up over 3% to US$23.34/oz.

Not much movement in the PGM space with platinum finishing the week up US$16 to US$897/oz and palladium down 4% to finish at US$1,083/oz. The platinum:palladium ratio is currently at a five-year high of 0.83 compared to the median of 2.98 and the mean is 2.75.

US 10-year Treasuries closed at 4.93%, representing a 17-year high but in early trading on Monday, spiked up to 5.14%. Higher treasuries were therefore negative for most major exchanges, sending them down last week, including the DOW off 1.6% for the week to 33,127. Volatility continues to track up, closing at 21.4.

Congress is spending US$2 trillion more this year and Sprott pointed out last week that value destruction in US debt markets is currently five times greater than the 2008 Global Financial Crisis, with the elements of a systematic crisis now in place sufficient to undermine the validity of US sovereign debt.

While gold’s move was not surprising, it may face near term headwinds from strong Consumer Price Index numbers which rose 0.4% last month, following a 0.6% rise in August well above market expectations of a 0.3% increase.

Inflation also rose 3.7%, again slightly above consensus forecasts that were predicting a 3.6% increase. Core inflation over the last 12 months came in at 4.1%. The Federal Reserve again stated last week its longer-term target of bringing inflation down to 2%.

In a recent article, Sprott partner John Hathaway believes that the correction in precious metals is “near exhaustion” and expects gold to trade at new highs over the next 12 months. His rationale is that the Federal Reserve’s “higher for longer” stance is unsustainable and is likely to trigger credit deflation and a steep election-year recession.

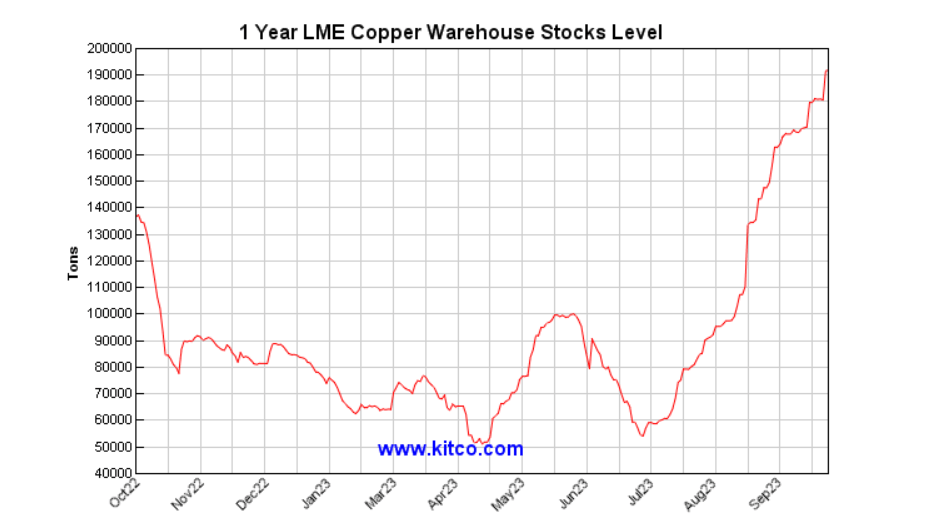

Copper was flat, up 1 cent on the week to close at US$3.58 and is hovering around 12-month lows with the four-month futures contract remaining in backwardation at 3% suggesting a negative near-term outlook despite the Chinese claiming 5% GDP for the third quarter. LME inventories remain at 24-month highs over around 190,000 tonnes, up 10,000 tonnes on the preceding week (figure 1).

The International Copper Study Group (ICSG) met in Lisbon a few weeks ago and believe 2024 will see a significant copper surplus with production projected to exceed usage by 467,000 metric tons, up from previous estimates of 297,000-metric tons at their April 2023 meeting. The group however considers the market will be in deficit this calendar year but again this figure has been revised down from 114,000 to 27,000 metric tons.

Oil had a strong week finishing up 1.5% to US$89.02/bbl (after reaching US$85/bbl earlier in the week) driven by geopolitical instability in the Middle East while the Biden administration imposed more sanctions on Russia.

Inventories were down 4.5MBOE for the week while US oil production was steady at 13.2MBOPD.

Exploration rigs were up two for the week but down around 30% year to date. The Department of Energy (DOE) in the US has remarkably stated its intention to increase oil inventories just as energy prices are rising.

In Europe, middle distillate inventories such as jet fuel and diesel remain at very low levels while natural gas prices have been surging now at US$17.50 MBTU compared to US$3.0MBTU in the US.

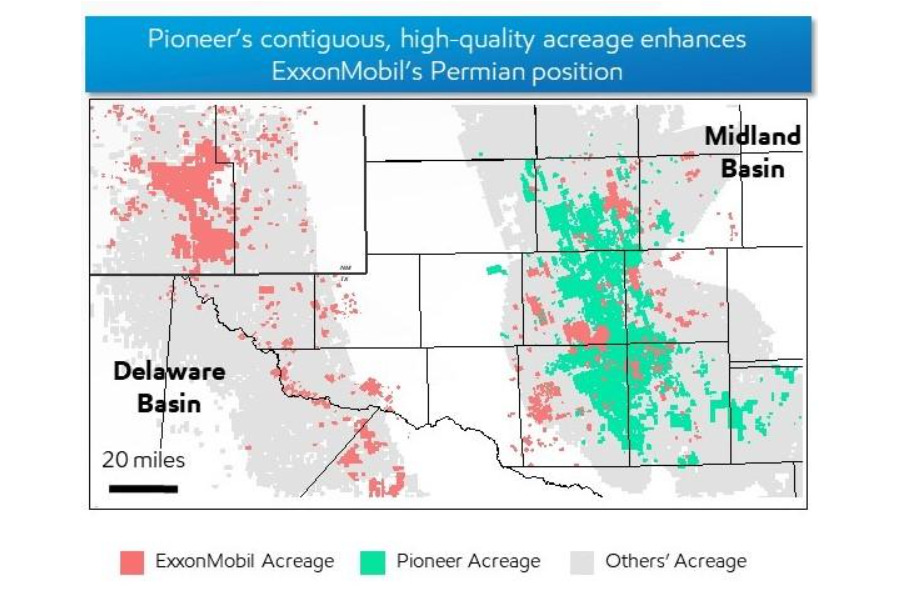

Despite the Biden administration’s war on fossil fuels, Exxon sees a longer-term future in the Permian basin (figure 2), a prolific shale oil producer, recently announcing a US$60 billion merger which will combine Pioneer’s more than 850,000 net acres in the Midland Basin with ExxonMobil’s 570,000 net acres in the Delaware and Midland Basins.

The deal will create the leading undeveloped US unconventional inventory position with total resources of 16 billion barrels of oil equivalent resources in the Permian basin alone. ExxonMobil considers the merger will deliver an opportunity for even greater US energy security.

Uranium closed at near pre-Fukushima highs of US$72.38/lb, up 4.5% for the week a high since February 2011. Uranium equities are struggling to keep up, with the Sprott Physical Uranium Trust still trading at 2.0% below net asset value.

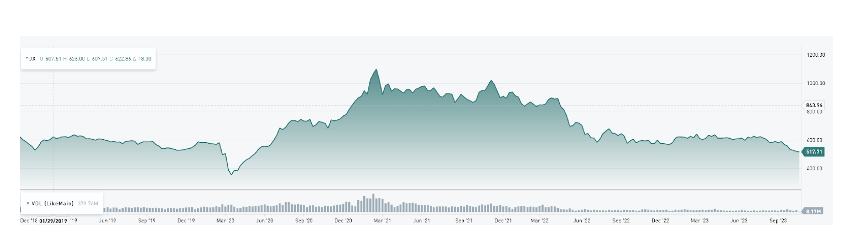

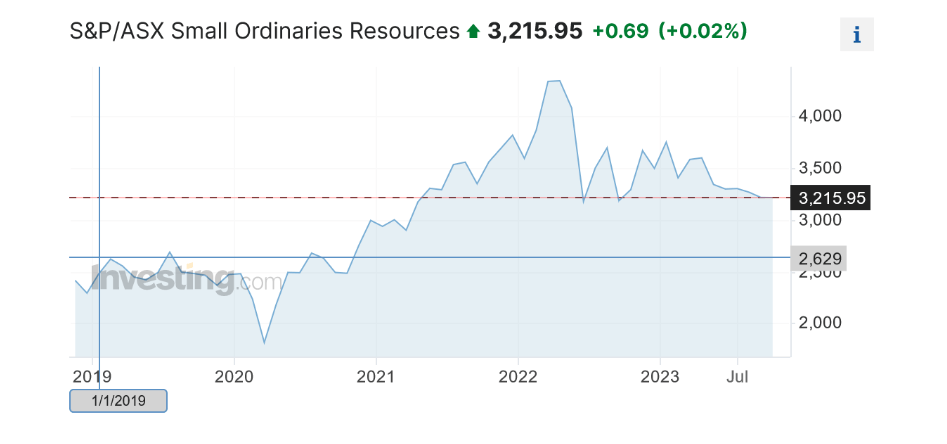

As the TSX-V exchange in Canada closed at 517 (figure 3) on very low volumes of less than 20 million shares per day, I couldn’t help noticing an article in the Globe & Mail (Toronto) highlighting the very challenging environment for junior miners in Canada. The paper believes that Australians are “eating their lunch”, buying up Canadian assets and listing them on the ASX.

Based on the current workflow here at RM Corporate Finance, together with a multitude of cross border transactions between Canada and Australia, I would have to agree. Unfortunately, the banks got control of many of the brokerage houses in Canada, showing a preference for mutual funds and investment grade product. The pool of brokers, retail and other investors has diminished to a level which suggests the TSX-V, once a powerhouse of junior mining, is now permanently broken.

As TSX-V listed Resource Mining’s CEO Chris Eager recently commented regarding the company’s intention to dual list on ASX:

“… we have found that investors in Australia have demonstrated a deep understanding of the rare earths market … we believe that the ASX has an active retail investor base that has a strong following in the small resources sector… we believe a listing on the ASX would greatly assist in building shareholder value through increased market exposure and trading liquidity.”

Well, it’s not all bad as I get to have lunch at one of my favourite restaurants, Hy’s, in Toronto and go skiing on a more regular basis. Maybe the more politically correct statement would be “optimising value for Canadian investors”. What could possibly go wrong?

News out next week includes Q3 GDP, durable goods, personal consumer expenditure.

New Ideas

A small but enthusiastic crowd attended RIU’s South-West Connect conference in Busselton last week. Similar to last year this had very much a battery metals theme dominated by lithium stories with a few gold, base and industrial mineral explorers thrown in.

One couldn’t help noticing the hammering a lot of share prices have taken over 2023 as money has flowed out of risk assets while US 10-year treasuries were hovering around 5%.

Aside from increasing the red wine and cigar intake over the week (this is proven method of calming the nerves in volatile markets) I took some time out to listen to the great mining entrepreneur Robert Friedland’s Northern Miner interview where among other things he believes that lithium has a limited shelf life given the rapidly changing battery technology, the concept of net zero is fantasy and that the consumption of fossil fuels is increasing as we build more EVs.

He also believes that we are on the verge of “destroying ourselves as a species” (not just by excessive wine consumption last week) in our pursuit of green energy. So, while he is talking his own book as chairman of one of the world’s largest copper miners, namely Ivanhoe Mines, he is a big fan of copper as it is the best conductor of electricity and is pivotal in the “electrification of everything”.

Speaking of copper, I caught up with Belararox Resources (ASX: BRX) managing director Arvind Misra at the South-West Connect conference and had a brief overview of their 32,000 hectare copper portfolio in the San Juan district of Northern Argentina.

Investors should also be comforted by the presence of former South African and Zimbabwean off spinner John Traicos on the management team. John played in the 1970 Australia-South Africa Test cricket series which the Aussies lost 4-0.

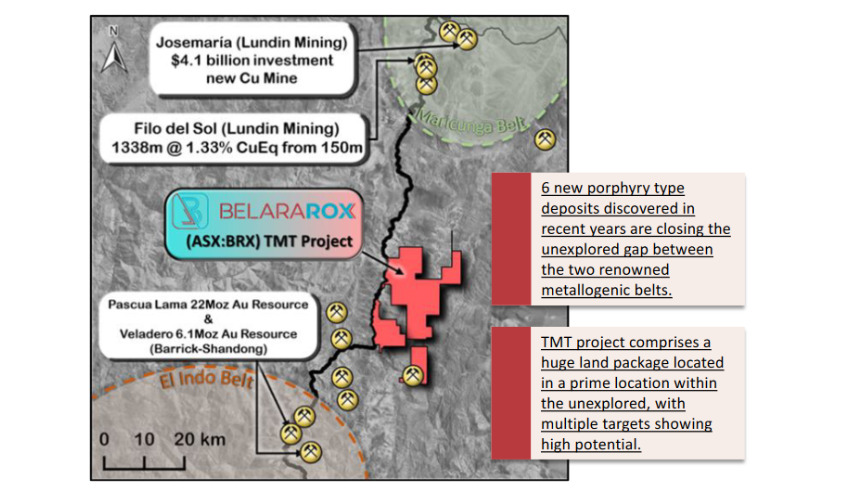

This region of Argentina is elephant country with Barrick-Shandong’s Pascua Lama at 22Moz gold to the south (Barrick – Shandong) and Lundin Mining’s Filo Del Sol with 1.3Bt @ 1.33% Cu equivalent from 150m depth (figure 6). Lundin has also committed around US$4 billion on the development of the Josemaria copper mine.

Figure 7 highlights numerous alteration-geochemcial-geophysical targets in the structural corridor running along the Chilean-Argentine border.

The highest ranked target, Toro, already has confirmed Zn-Pb-Cu mineralisation from previous drilling including 72m @ 1.% Zn from 56m downhole.

The company also has active base metal programs in NSW (Belara Project: JORC Resource of 5Mt @ 3.4% Zn) and a lithium project at Bullabulling in the eastern goldfields of Western Australia. The real leverage however is in the porphyry copper+/-zinc+/-gold targets at TMT where drilling will hopefully commence in January 2024 (figure 8).

Argentina is not without risk, however the presence of major mining houses exploring and building mines in the region does give the company an exit strategy if it hits something big. At a market capitalisation of just over $30 million with around $3 million in cash the stock isn’t cheap, however the prize is a big one so any success should see this tightly held company respond.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.