Guy on Rocks: 28m at 34.81g/t? This 3.2Moz gold project just got a whole lot more interesting

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: Inflation genie still at large

We continued to see more volatility last week on the back of higher-than-expected inflation 6.4% (consensus 6.2%) and personal consumption expenditures which was up over US$18,000. The VIX-Index spiked to 21.7 and the US dollar surged a whopping 136 basis for the week to 105.3 with US 10-year treasuries up 13 basis points to 3.95% with two-year yields at 4.78%.

So, the 2– and 10-year treasuries continue to blow out and are now at an 83 basis point differential. Gold threatened to drop below US$1,800/ounce before closing at US$1,811 and recovering to US$1,836.8 at the time of writing.

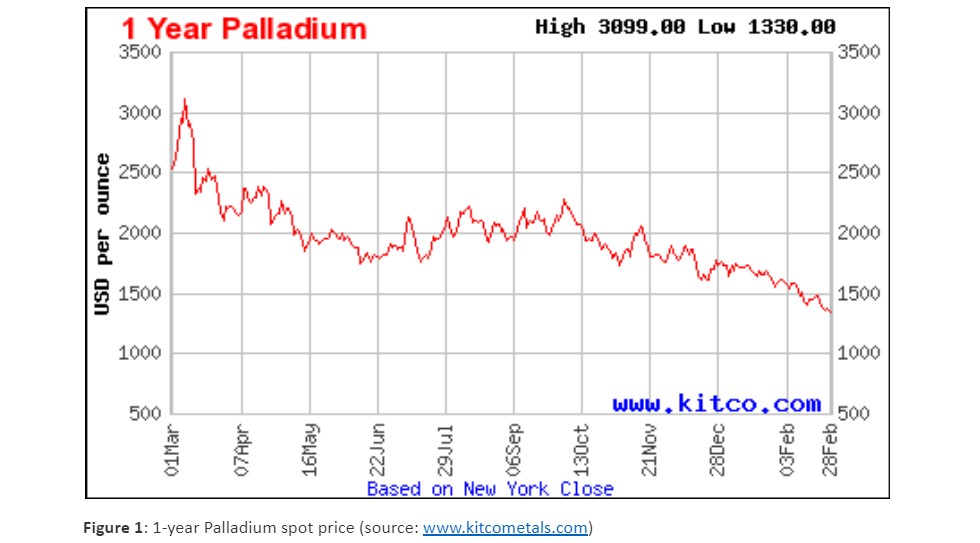

Platinum fell US$10 to $909/ounce, down 15% over CY 2023. Palladium (figure 1) continued its slide closing at US$1,340/ounce with losses for CY 2023 totalling 22%.

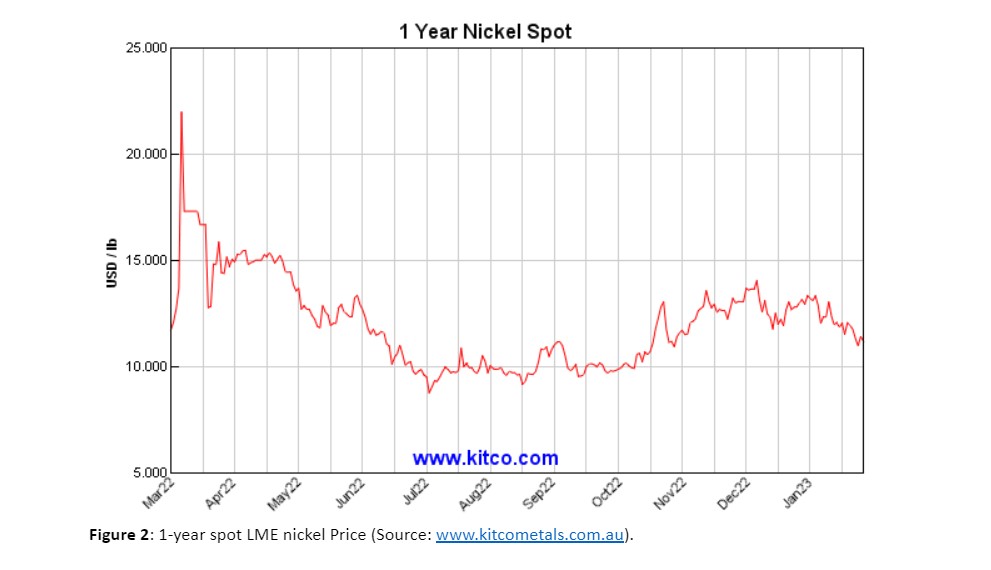

Base metals were also sold off last week with nickel closing at just over US$11/lb and the copper price dipping briefly below US$4.00/lb closing at US$3.98 with the front month forward contract at a 2 cent backwardation on fears of rate hikes and Chinese inventories building.

Uranium finished flat around US$51.58 however the big mover was natural gas which surged to US$2.79MMBTU. Not surprising at it come off a very low basis of US$2.5MMBTU on the back of a 20-year supply agreement between Ventures Holdings and China Gas Holdings (0384.HK), one of China’s largest independent distributors.

The Stockhead faithful will be pleased to know that I am in transit to Toronto on my way to the Prospectors and Developers Association of Canada (PDAC) from 6-8 March 2023 to see how our poor cousins in Canada are travelling.

The Toronto Ventures exchange has been languishing all year on low volumes and limped to a finish of 618 last week.

Anyway I am sure there are lots of good assets and cheap companies worth following up. There is a large contingent from Perth, all on their best behaviour, so that should add some spice to the week.

I’ll have to keep this brief as I am just getting ready for Casino Night at PDAC. Not sure what this involves but more than likely large amounts of alcohol and dusting a bit of money on the tables.

Given it is a broking/mining conference many would argue that it is all proceeds of crime anyway so nobody should be too concerned with blowing a bit of money.

New ideas: ‘A cracking intersection’

Check out the RXL/VMC announcement (2 March 2023). A cracking intersection at their Youanmi Joint Venture (RXL 70%; VMC 30%) situated around 480km northeast of Perth.

The first of a series of holes to test structural trends 250m to the south of the old Youanmi open pit have returned continuous bonanza grades in RC drilling with;

- RXRC458: 28m @ 34.81g/t Au from 204m, including;

- 18m @ 51.96g/t from 207m, including;

- 10m@ 79.55g/t from 211m, including;

- 3m @ 138.07g/t from 218m.

The JV is trying to get the Youanmi Mine off the ground and recently published a Scoping Study (19 October 2022) with some reasonable metrics given the constraints of forwarding looking statements these days. Not much is known about Midway but a high-grade open cut complementing the existing underground resources could transform Youanmi into a significantly more valuable asset with a much more interesting production profile if these grades persist.

Obviously we can’t get too excited until we see a bit of continuity (along strike and down dip) to indicate there is some size potential to these initial intersections which appear to be along a +1.5km long structure, so that is an excellent start.

It would certainly be good to see a few hundred thousand ounces of +2g/t gold open pittable dirt within the top 200-250 metres. Midway was an epic battle so hopefully this prospect will deliver something memorable…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.