Guy Le Page: Could a high-grade, 3Moz Cote d’Ivoire project be the ultimate gold hedge for this 9c explorer?

Picture: Getty Images

‘Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions: I’ve got yellow fever

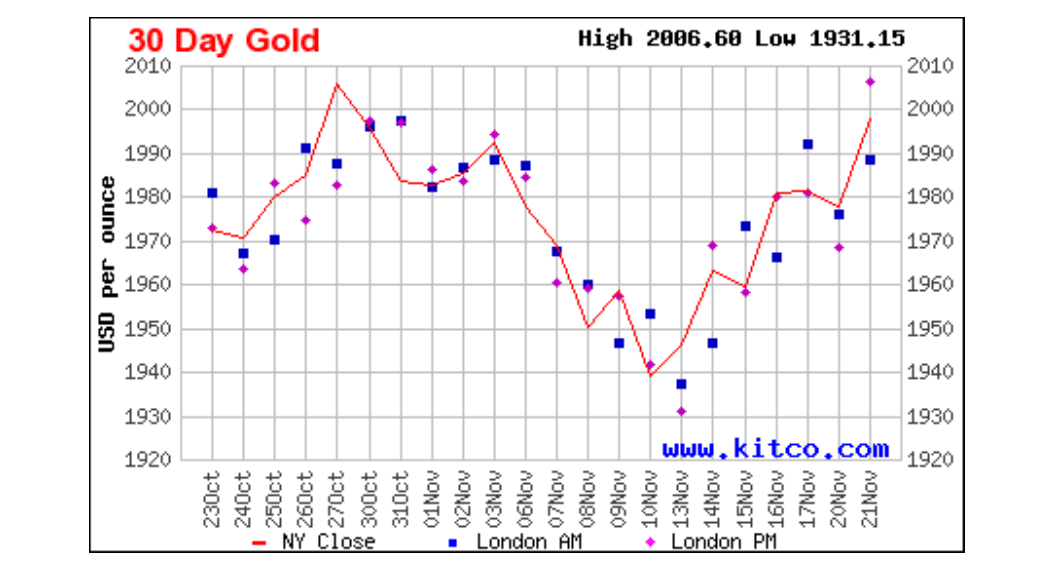

Gold (figure 1) was up 2.3% on the week on the back of a failing USD and falling US inflation figures to close at US$1,980 and has further strengthened on Wednesday trading to US$1,995/oz.

Inflation in the US appears to be subsiding slowing to 3.2% in October compared to 3.7% in both August and September.

Energy costs, a big driver of inflation, were down 4.5% with gasoline prices off 5.3%.

The DXY was down 40 basis points to 103.90 drifting further to 103.28 by Tuesday mid-day. US 10-year treasuries were 17 basis points weaker at 4.44%, touching 4.4% on Tuesday with the 2–10-year inversion remaining at around 40 basis points.

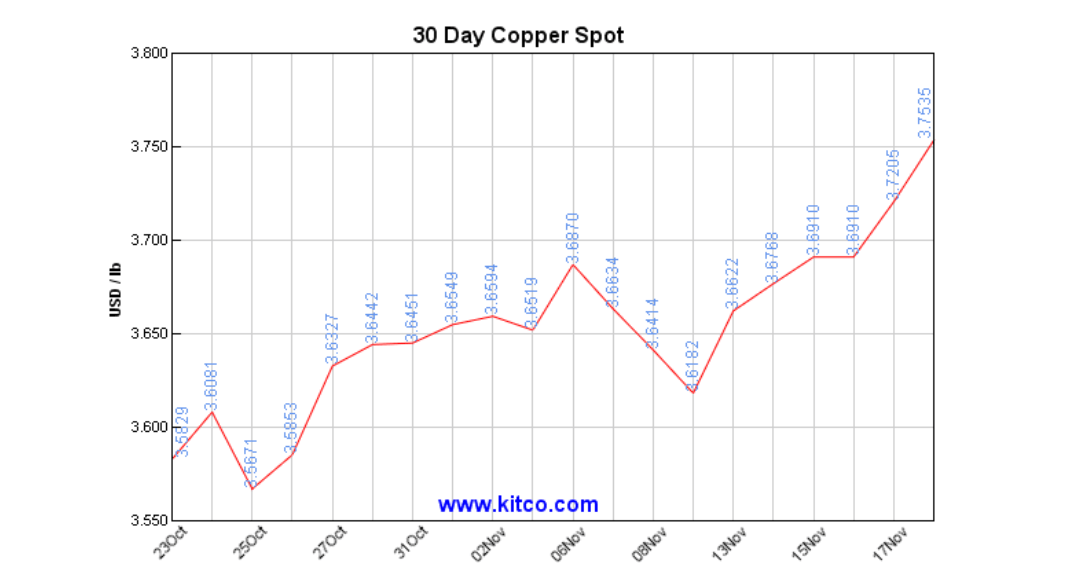

Silver also gained just under 7% to US$23.70 last week, as did platinum which was up almost 7% to US$898/oz and palladium bounced 10% to US$1,042/oz after last week’s 14% fall. Industrial metals performed better with copper up 3% for the week to close at US$3.63/lb with the three-month forward contract remaining in a 1 cent contango.

By mid-week, copper strengthen further to US$3.75/lb (figure 2) on the back of China’s improving economic outlook and money starting to flow back into risk assets.

In copper news First Quantum Minerals (TSX:FM) announced (20/11/2023) that it was ramping down copper production at its Cobre Panama mine to one remaining ore processing train and by now would have run out of supplies for the on-site power plant.

Blockades remain in place in the form of small boats at the Punta Rincón port which continue to prevent the delivery of supplies. A temporary halt to production looks likely in the coming weeks.

The short-term outlook for copper according to Shangahi Wooray Metals Group Inc (20/11/2023) looks soft with the global copper market facing a surplus into CY 2024, however they consider shipments of copper ore from overseas mines will be sufficient to satisfy Chinese smelter demand, in spite of the ongoing expansion of Chinese processing capacity.

Demand was likely to pick up in late CY 2023 as the effects of the Chinese stimulus and a depletion of ore reserves filter through.

In nickel news Vale Canada and Sumitomo Metal have executed an initial agreement to sell a 14% stake in Indonesia nickel miner to PT Mineral Industri Indonesia (MIND ID), a state-owned mining company (17 November 2023). Foreign investors are required to divest 51% of their stakes to local buyers after certain periods of operation with MIND ID moving from 20-34% after the transaction.

Iron ore has been remarkably resilient over recent months trading over US$131/dmt (62% fines).

… which is not surprising given that capacity utilisation among the 87 Chinese electric-arc-furnace (EAF) steelmakers according to Mysteel’s increased for the sixth straight week over the period November 10-16, rising by 4.88% on week to reach 59.21% – a new high since late April as more mills nationwide ramped up production.

Oil was sold off heavily to around US$77/BBL down 2% on the week with rumours of OPEC increasing production by around 1m BOPD.

By mid-week however Brent Crude had recovered to just over US$83/BBL. The falling oil price came despite the fact that year-on-year demand for oil is increasing. Oil rigs in the US were up two this week with production remaining static at 13.2m BOPD.

Oil imports remained flat 6.4MBOPD as were refineries at 15.3m BOPD.

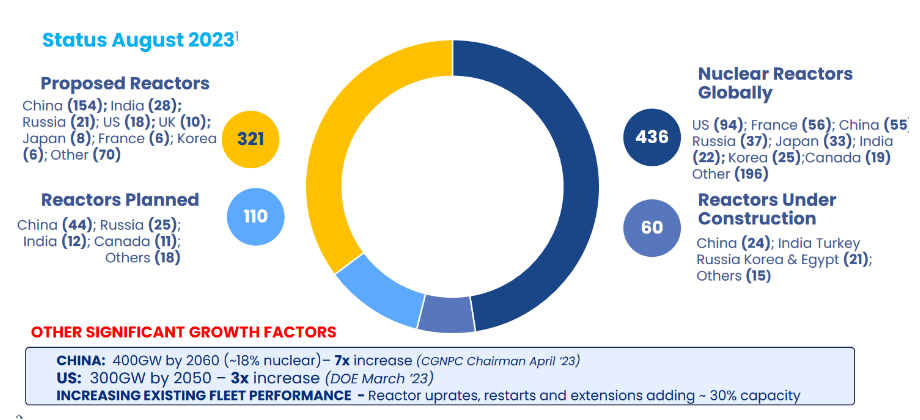

Uranium hit a multi-year high closing at US$78.50 for a 7.5% gain late last week before breaking through US$80/lb this week. Prevailing spot prices represent a high since the mid-2007 crash where it peaked at US$135/lb.

Just a reminder from Mr Uranium (John Borshoff) MD/CEO of Deep Yellow (ASX: DYL) from the RIU Conference (Vertical Events) at The Westin today on his case for uranium:

Nuclear is a 24/7 clean energy source:

• Lowest carbon footprint (UNECE1 analysis Sept 2021)

• Lowest material requirement

• Lowest land usage component

• Lowest cost per unit energy (IEA 2 analysis 2020)

• Best safety record of all technologies

• Meets ESG demands

This thematic according to Borshoff is backed up by pivoting government policies and strong global reactor growth (figure 4).

And where is the uranium price going? Over US$100/lb in my view or maybe US$150/lb according to Toro Energy chairman Richard Homsany?

With the level of contracting now over 160mlbs of uranium according to Siobhan Lancaster from 92e Energy (ASX:92e) the stage is set for a glowing 2024…

With gold and uranium running I have well and truly got yellow fever…

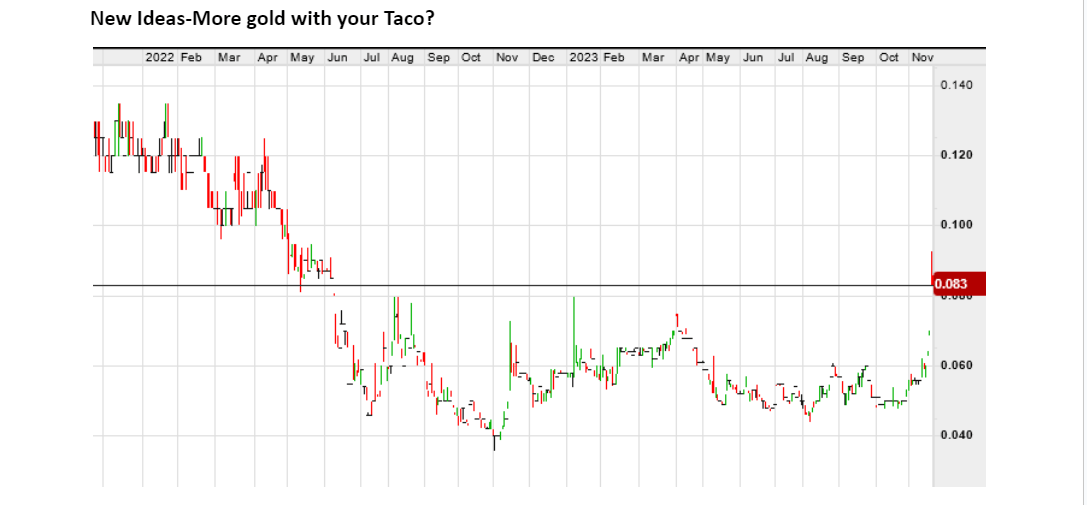

New Ideas – More gold with your Taco?

The Stockhead faithful will well remember gold explorer Turaco Resources (ASX:TCG), the West African gold explorer that had, like many of its peers, experienced some heavy weather as political instability in neighbouring countries (Burkina Faso, Mali and Niger) together with a sell-down in risk assets saw some widespread price destruction.

To add to its woes, managing director Justin Tremain had traded in his gold pass at Next Generation gym for a platinum membership to the home fridge.

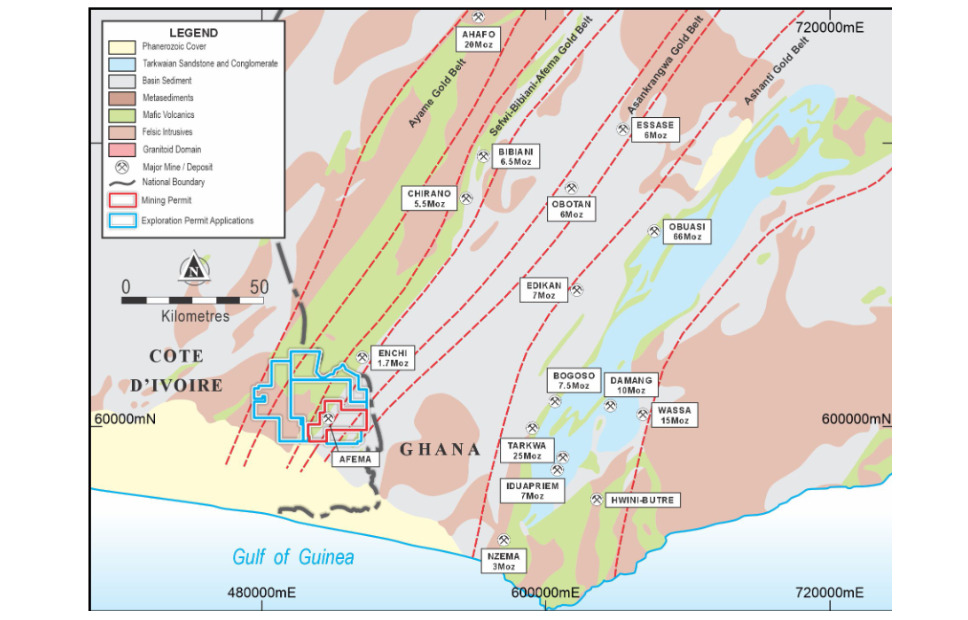

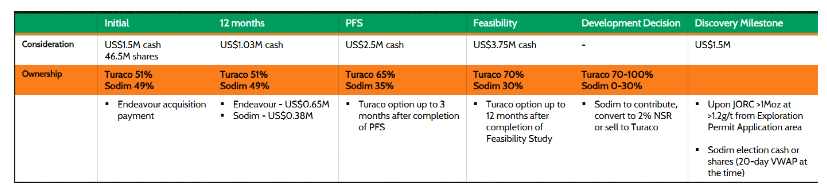

Not to worry, TCG has pulled off what I believe is a company-making deal in the form of the Afema acquisition in Cote d’Ivoire, one of the few bastions of stability in West Africa, for around $20m (inclusive of all milestone payments) for a 70-100% interest (figure 7).

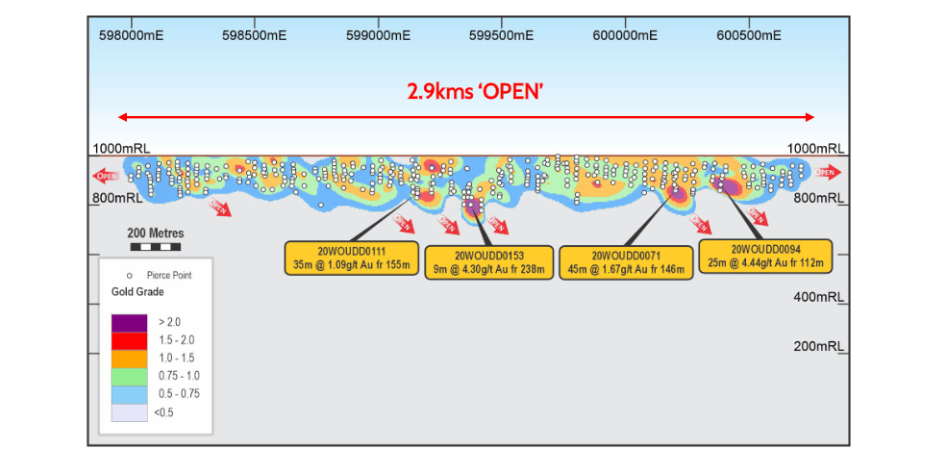

There is a lot to absorb here but the short summary is that the project has potential for 2-3Moz over the medium term and includes high-grade prospects such as Wolou Wolou (figure 8) which is a 3km long broad zone of gold mineralisation that could represent a near surface low strip open pit opportunity.

Preliminary bottle roll tests returned 95% recovery in the oxide and 89% in fresh rock.

While the company is likely to be needing to raise money in the near term, at an enterprise value of around $40 million post settlement of the Afema acquisition, TCG has the potential to replicate the success of Cote d’Ivoire gold producer Tietto Minerals (ASX:TIE) which is currently the subject of a takeover bid by Hong Kong based Zhaojin Capital and is capped over $650 million.

I would recommend indulging with senior management in some cookies and ice cream (why not, we are coming into the festive season) and reading the most recent TCG presentation over the Christmas break, one of the better acquisitions in the resource space in recent times with relatively modest front-end payments.

The stock has moved up 30% since the announcement on 21/11/2023, however I feel there is more to come as investors return to leveraged gold plays after almost two years of a bear market…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.