Free Whelan’: You want an inflation hedge? I know a doctor you should go and see

Pic: Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

It’s been another long day (or week) out there.

We’re all coming off the back of an ANZAC Day, which for me isn’t so much about consumption as it is about duration.

Up at 5.30am for the dawn service at Orange, through to a 5pm finish at my local in Sydney for a few games of 2-up and a glass raised for the Diggers.

This year, my phone was buzzing away the whole time, telling me how badly the Aussie dollar (then Euro markets) were getting smashed because apparently even more of China is going into lockdown.

Commodities are getting slammed, and apparently our dollar is only good for one thing — and that’s commodities.

Ok, so…

Inflation has peaked, maybe.

But whether it has or it hasn’t, the real focus is on the following:

1. The Fed is (apparently) going to raise rates by 1,000bps, tomorrow*;

2. China is (apparently) locking its people in restaurants and homes, in a brutal extension of its Covid Zero policy.

(*for the more literally-mind readers, that was a joke — the 1,000bps part, and the tomorrow part).

Funnily enough, these two things are connected.

With energy coming off as China forces an easing of demand, you’ll see less stress on gas prices. Lower gas (petrol) prices means lower headline inflation.

However, if China eases back on its Covid Zero policy, you’ll see a rebound in energy prices and the same pressure on the Fed to sort it out.

Right now, a double-shot 50bp rate hike by the Fed in May is very much on the cards.

Some analysts are flagging more double-shots in June, July and September.

For mine, I believe that’s all possible if the entire scoreboard stays the same.

If the Russia/Ukraine conflict settles down then energy comes off, which should offset the burden Americans have because their mortgage rates are going up.

Also, consider this; if the US gets pushed into a potential (or actual) recession, then the Fed will absolutely stop their hiking cycle.

Hopefully that times in with the Russia Ukraine conflict easing, and China coming back out of lockdown.

There’s still hope for 2022.

Commodities amid the chaos

Here’s a quote of a Twitter account I found which sums up the chaos nicely:

“One way to explain what’s going on is, the biggest economy in the world has started its fastest monetary tightening cycle in +20 years while the second & third largest economies in the world are both either explicitly (China) or implicitly (YCC in Japan) easing monetary policy….”

Source – @jturek18

But back to commodities.

A few years back I was asked to provide my best commodities picks for the year.

Along with a whole article (on Stockhead) by seasoned veterans on their best picks in various spaces (with NPVs and ore grades) there was me; James Whelan, VFS Securities.

My comparatively simple take (at the time)? “Buy Copper”.

And if you look at copper now you can see that was an amazing call (if not for wanting on the detail).

However, if you look at the copper chart this week then it’s not looking amazing.

But if you think of all the things that have been the cause to our woes recently, you get something like this…

ESG funds drove underspending in energy production, while an overemphasis on making the switch to “climate friendly” alternatives made everyone believe we were ready for the switch to wind turbines and EVs waaaaay ahead of time.

Russia finally built a second gas pipe and needed it online through Germany to Europe ASAP.

With an over-eager focus on ESG, Europe was understocked on its energy needs.

Russia then tried to force Europe’s hand with an undersupply of gas heading into the northern Winter.

So, food prices continue to go up.

Gas is needed for fertiliser, which is needed because one key output of fertiliser production is carbon dioxide, which is used as the main method for slaughter.

No gas, no Christmas Turkey.

At the same time, Ukraine was seen as an easy target because Europe had no energy alternative and was ultra-dependent on Russia.

Supply chains have continued to be fractured and energy prices are blowing a hole in inflationary expectations.

The rest we are seeing play out now.

The hedge

You want an inflation hedge? You want something that will get more spend as food and energy — two of the main contributors for inflation — continue to rally?

You also want something that will be in high demand to stop the dependence on oil and gas and will form part of the EV revolution?

You guessed it — Dr Copper.

I’ve said a few times over the years that an EV needs 3x as much copper as an internal combustion vehicle.

I was corrected on my podcast by Robert Rennie, Head of Financial Market Strategy at Westpac, who said I wasn’t taking into account charging stations and everything connected.

“Probably more like 5x, Jimmy.”

Everything that will be needed to try control food and energy inflation? Plus a key ingredient in just about every facet of modern life (including electric vehicles)?

It all requires copper.

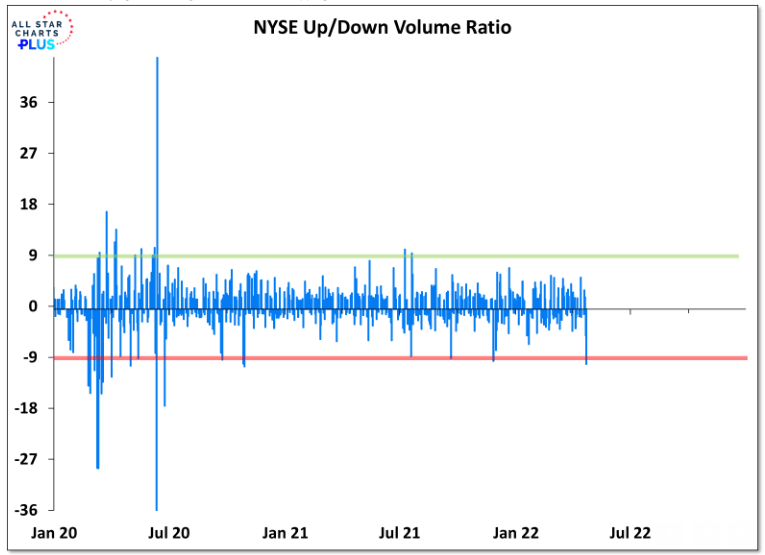

Sure as hell beats trying to second guess this market dropping stats like this:

This was Friday, April 22. 10x more volume downside than upside.

It happens a bit, but with everything that’s happening at the moment there’s better places to put your money than a general index that’s dependent on the Fed trying not to lose its nerve this year.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.