FREE WHELAN: What happens when an entire country tightens its belt?

Picture: Getty Images

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Good Morning,

A note that I’m hosting a webinar on February 15th with some great guests, including Stockhead, talking about the year ahead and how to navigate it. Should be a great evening so please RSVP via this link and I’ll see you there. We’ll cover copper miners, gold, trading strategies and global themes for 2023. It’ll be great.

Now…

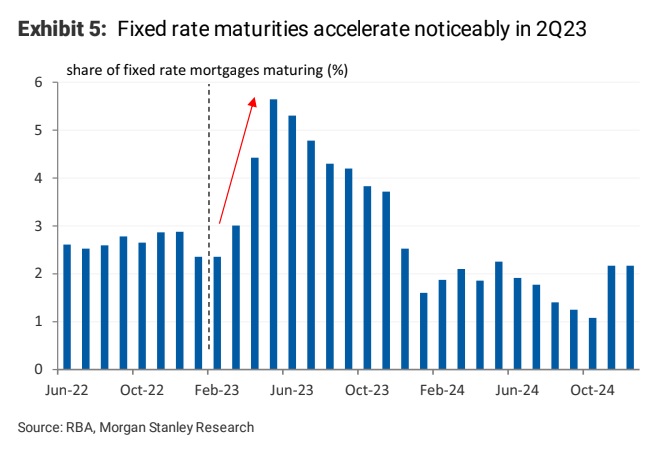

It looks like the turn is upon us! My good friend and occasional guest on the podcast Jonathan Pain put some stern words in front of subscribers on Saturday of which some heed should be taken. Notably we saw this chart mentioned by him and others this week.

It’s happening and it’s happening sort of soonish. The fixed rate cliff/peak/whatever in Australia really hits hard in the coming months. There’s a lot of conviction calls on property going around which I take with grains of salt but the absolute gut call from my corner is that consumer discretionary gets hit really hard.

People always pay the mortgage. They don’t pay for clothes and dinners out and a bigger TV when that mortgage number is massive.

But here’s the problem with inflation still going up: the people who keep buying things (probably) aren’t affected by 25bps of rate rises here and there. They’re still travelling as much as possible before they’re not able to. Inflation keeps rising and the RBA has to keep hammering away at us all as a group.

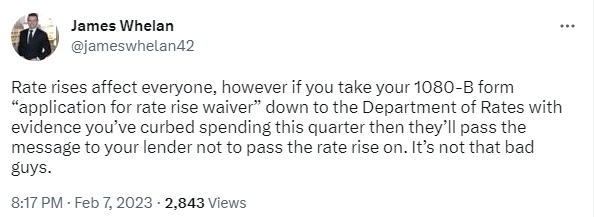

This led me to tweet something entirely satirical but which received many genuine responses because it seems like the next natural step in our organised society reliant on government intervention every step of the way.

There’s no such thing as a 1080-B; I just made it up. However, so many people thought that it was perfectly reasonable that if you’re not actively contributing to the inflation problem then you shouldn’t have to bear the burden of the solution.

Not going to lie, I’m inclined to agree. It’s not fair. And fairness is a big deal for me. But let us not get confused by what the goal is of the RBA and that is very much to kneecap the economy just enough to get inflation down. That’s not a laughing matter.

Also, a reminder, that we’re all contributing to the inflation problem just by living our lives. That’s really serious.

What’s also not a laughing matter is the governor of the RBA, after sitting silent for weeks on the Aussie economy and rates direction, drops the expected 25 point hike with a delayed message about carrying on more hikes in the months ahead right out of the blue. AS IF THERE’S A SHORTAGE OF MICROPHONES AT THE RESERVE BANK.

Then on Friday breaking bread at a lunch hosted by Barrenjoey with numerous industry types, and yields start moving on loose chat around the table…

But enough of this. David Scutt (Ausbiz) and I cover this on the podcast recorded on Friday. It’s timely and we go over a fair amount of ground.

In short I think there’s only one clear trade and that’s being as far away from consumer discretionary as possible.

There’s no direct way to trade that though so for most people it’s just a matter of being on the sidelines while the carnage happens.

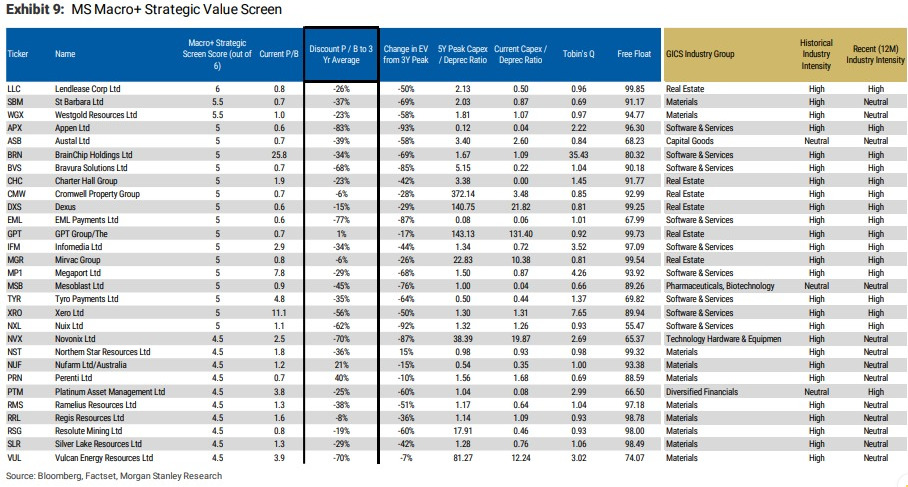

Takeover targets going cheap

Last week, out of the blue, Newcrest received a $24bn takeover offer from Newmont Mining. Morgan Stanley put out some classy research showing what’s next up on the block using metrics such as price to book value, timing of the capex cycle, ownership structures etc.

The list is interesting with some names that look really cheap anyway. Food for thought on takeovers…

Margins are the reason for the season

According to Factset, 60% of S&P 500 has reported, 70% beating EPS (vs 74% median).

Aggregate beat is just +0.6% (vs +8.6% 5yr avg), lowest since 2008. Revenues are +4%, but EPS is -5% due to 100bps of margin compression.

Year on Year, Ex-energy EPS was off 9%.

Huge question if we’re at the bottom of earnings or not. Personally I lean to the “not” camp.

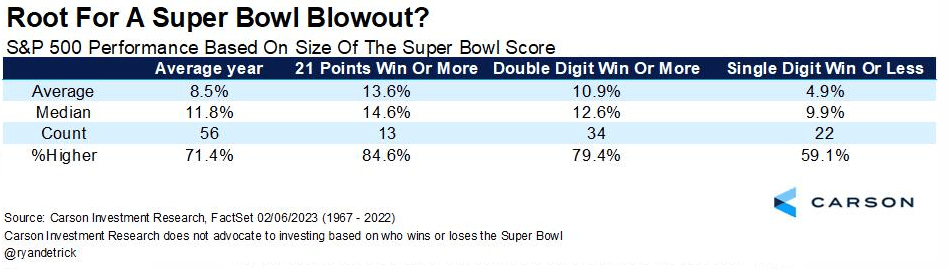

All thrills, no spills

With the Super Bowl happening we need to be aware of what happens if there’s a blowout vs if there’s a tight finish. All good fun, yes, but interesting that there’s enough data to actually think about it. If it’s a blowout then we’re off to the races!

(ICYMI – we’re not off to the races.)

Stay safe and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.