Free Whelan: The USA, China, Meta, Macau and HalloWieners – all trick and no treat?

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between.

Good Morning Universe,

Firstly…

It’s time again to look upon the USA with amazement at how they manage to stay a superpower with these sorts of daily antics.

Not unironically, however, this week there are others challenging for the title of top spot in the world leader stakes.

All eyes are on China at the moment as we break down the intricacies of Xi’s address to the CCP five-yearly Congress.

Of note is Xi calling for policies to address the collapse in births, the number of which has fallen to its lowest level since 1950.

The party boss also mentioned how challenging the next few years of economic growth will be and has called for promotion of the “spirit of frugality across the entire society.” This second one doesn’t bode well for luxury and casino stocks. The first one doesn’t bode well for anything (for now at least).

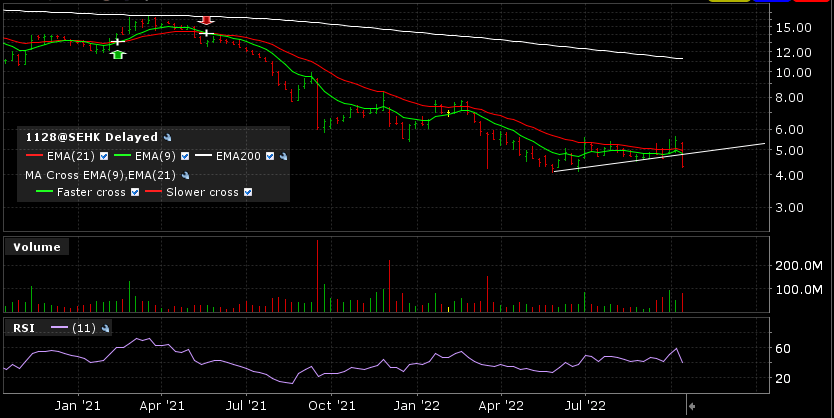

Macau Casinos – Get Shorty?

Choosing a Macau name at random and we see a clear sell here.

Wynn Macau is the name and I’m happy to predict more downside ahead, regardless of China’s economic recovery – which I’m backing.

The Chinese recovery could be televised.

It will include property and steel.

It will not include Chinese crowds hitting the tables in a show of united frugality.

Fool’s China

Along with the seven straight months of foreign outflows from China’s capital markets, we’re nearing a point where the turnaround is enticing at reasonable value.

However, across the board there is so much justified bearish energy that getting in the way of it now would seem like a fool’s errand.

There is significant movement in the options market pointing to more downside ahead.

Last week, retail traders bought $19.9 billion worth of puts to open. They bought only $6.5 billion in calls to open. This is the first time in history that puts were 3x calls.

Remember good news is still bad news. Don’t argue.

Bear’s fool

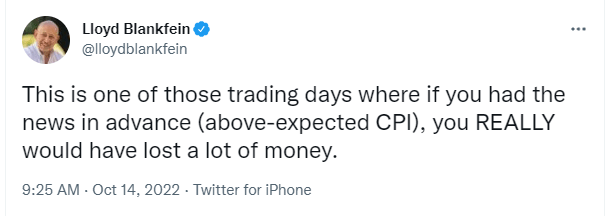

The inflation data beat expectations on Thursday night in the US and after dropping initially (as expected) there was a massive rally. I did a little drum banging on the business channels, Instagram and my podcast that bullish intraday swings like that only happen in bear markets.

Friday’s selloff showed this to be the case for now.

Make no mistake, there’s a whole market of investors getting caught out.

Here’s a lovely take from former head of Goldman Sachs that sums up the end of last week perfectly.

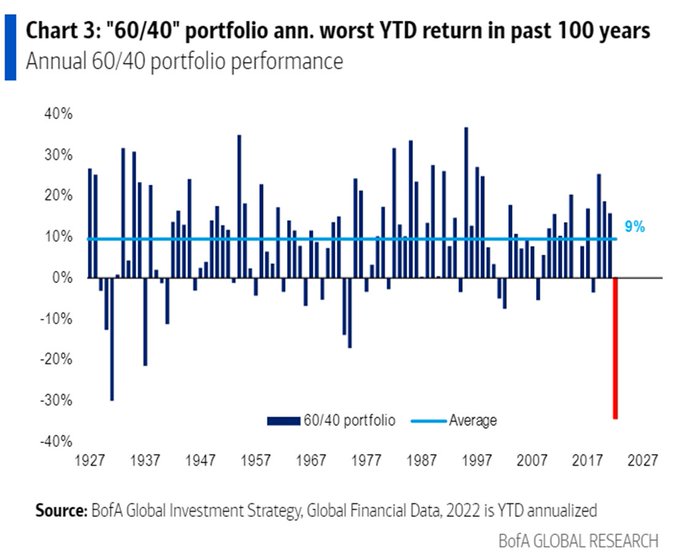

Even better news out of Bank of America Global Research: YTD annualised return for the 60/40 portfolio is the worst in 100 years.

A 60/40 portfolio has been the gold standard of easy investing since Year 0 so this stat really says something.

But it’s not all bad news…

Because the worse a 60/40 portfolio goes this year the better it looks to be a fresh investor in one next year.

There will be a point at which easy money can be put to work in the bond market and I continue to encourage small allocations to bonds into the last quarter of the year.

Fuel’s goal

The energy crisis has continued to put a rocket (on a timer) under the uranium market.

Here’s a really good thread on amazing things happening in the U market at the moment.

Big week for nuclear energy!

1) Greta Thunberg reverses course & for 1st time supports nuclear: "a mistake to close down plants to focus on coal"

2) Canadian uranium company Cameco purchases Westinghouse (nuclear reactor co) in vote of confidence in nuclear industry

👇

— Julia DeWahl (@juliadewahl) October 14, 2022

Reactors are being built and maintained. There continues to be movement at the station.

Happy to add and or open positions very tentatively, because regardless of how great uranium looks, the market is still hazardous.

I go into it with Cadence Capital’s Karl Siegling on the podcast. There’s lots more in there too about where he sees rates going and the predictions will stun even the most cynical.

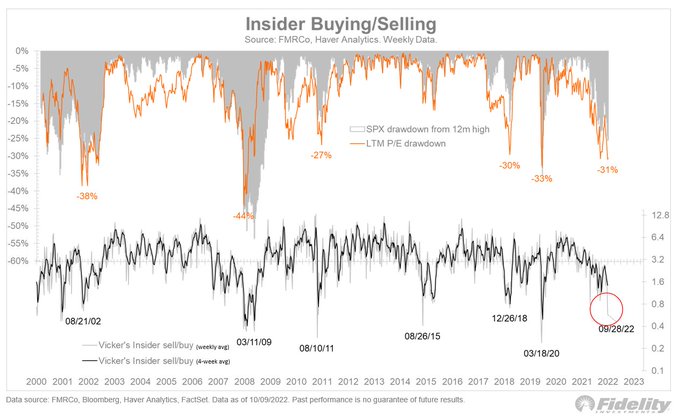

But at least Corporate Insiders are buying apparently in the US, which, whiled they’re usually early, bodes well for light at the end of the tunnel.

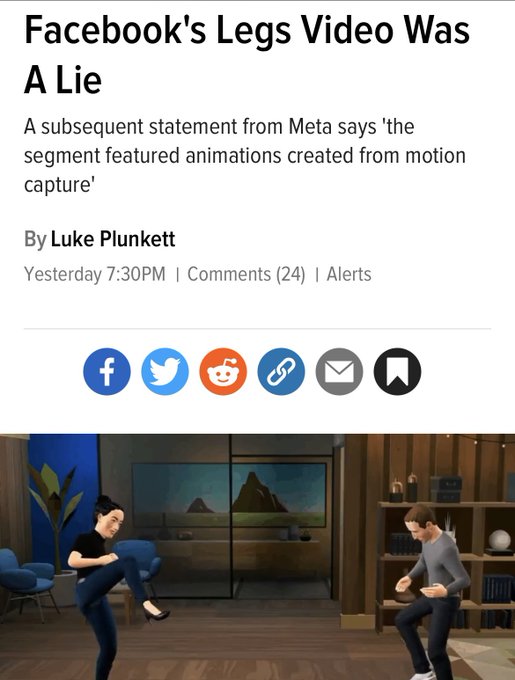

I continue to remain bearish on Meta. As in, I want to feed a large bear the arms and legs of key Meta decision makers.

I see no reason as to why that stock should do well.

And speaking of limbs, it seems they’re still struggling with making legs in the metaverse.

One job, Mark. One job.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.