FREE WHELAN: ‘The time has come’

Not Jerome Powell, yesterday. Pic via Getty Images

In this Stockhead series, investment manager James Whelan, managing director of Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Top of the morning to you and a happy post Jackson Hole Monday, for all who celebrate.

“The time has come” the Walrus said… to talk of other things.

And I’m just glad Jackson Hole is behind us so we can all obsess over, checks notes, NVDA earnings… ugh.

We actually talk of other things in our latest cut of the Theory of Thing podcast, recorded on Friday (see link at bottom of article).

I thought it prudent to look into the past so that we may best navigate the future, which runs contrary to my usual motto of “don’t bother looking backwards, you’re not going in that direction”.

However, I’ve been on a roadshow the last week and the crystal ball is a little blurry, so better we get back to basics.

Firstly this, and a lesson about buying the dip…

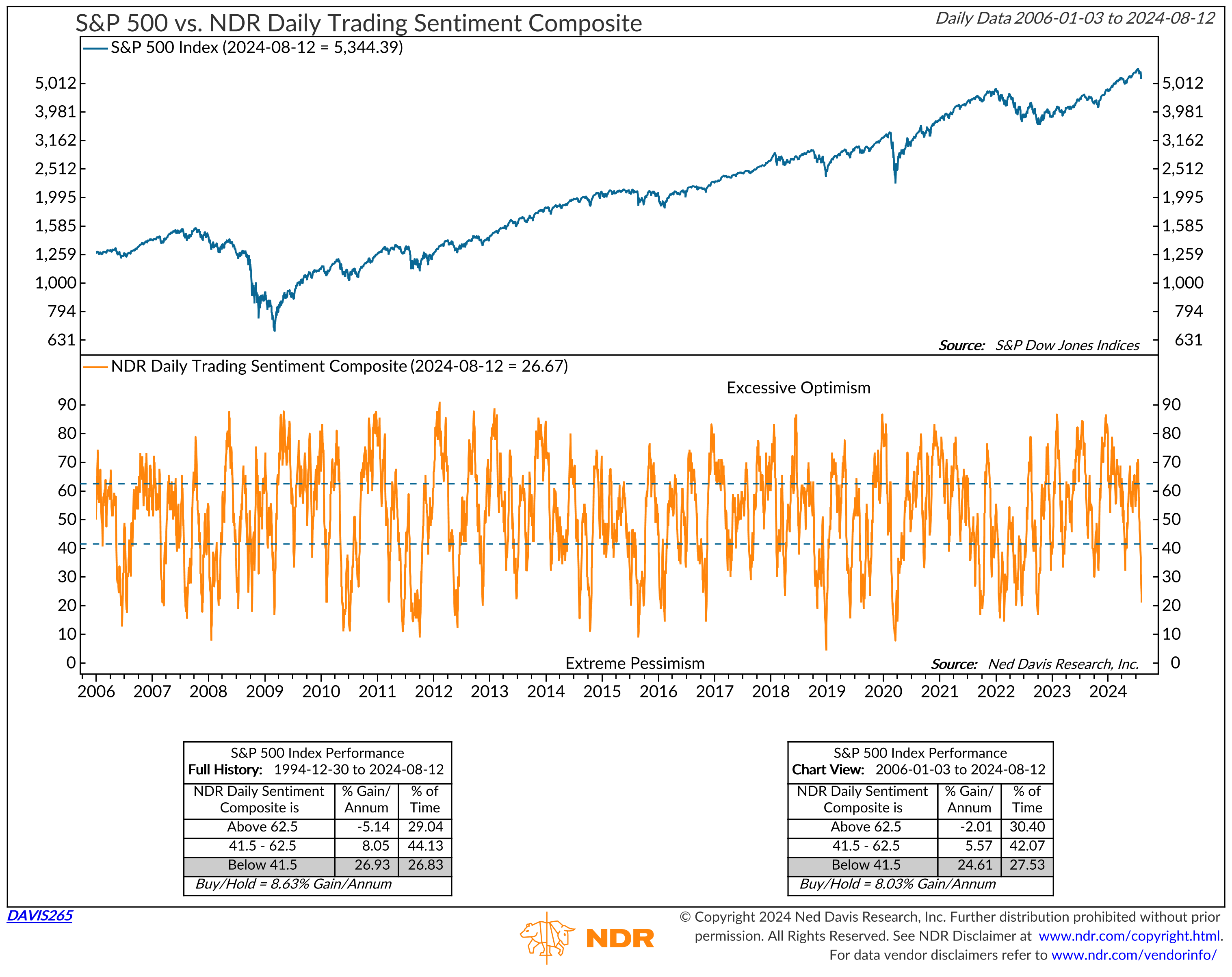

From August 14 – “NDR Trading Sentiment Composite is at its lowest level since late-2022. When short-term sentiment is this washed out, stocks usually rip.” Willie Delwiche, CMT, CFA

This was when everyone was absolutely losing their heads at the perfect storm of recessionary signals in the US and the BOJ shenanigans caused the great unwind of carry.

Narrator: dip buyers were well rewarded.

Now, on with the absolute show

US Federal Reserve chief Jerome Powell spoke at Jackson Hole on Friday, and the only way it could have been more market friendly is if they’d literally released doves as he was speaking.

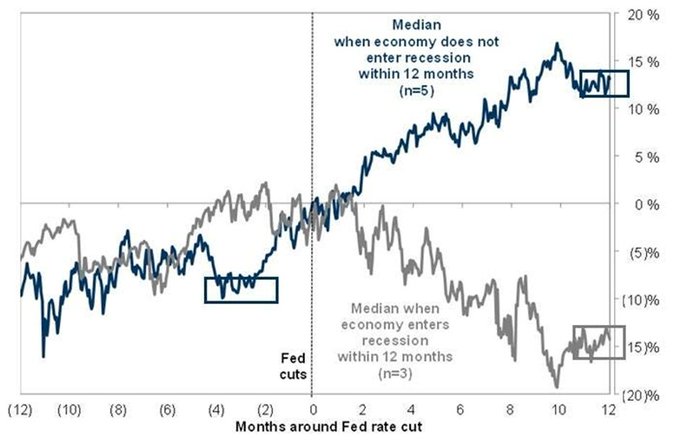

But what happens in rate-cut times?

Beware a lot of folks who are drawing comparisons to past cut cycles, saying that rate cuts usually signal a market selloff. What they’re missing is that there was usually a recession attached.

Note this, from early August as well…

Source: @Mayhem4Markets

It really does look like the Fed has a handle on it without sending the US into recession. For now.

Got any ideas that aren’t just ‘buy gold’?

Let’s spin this back a bit – again, looking to the past to see where we’re meant to be going.

Before the BOJ stuff, there was a fairly hefty rotation into small caps out of the Mag 7. In actuality, this was a small departure from the Mag 7 which megaphoned the allocation into smalls.

Because the economy was fine and rates were set to come off, small caps were set to get a run.

Then we were distracted by the above.

Tell me why, relatively speaking, this can’t be the case going into the last quarter of the year?

The Van Eck small caps ETF looks like it could be a good slot again.

Cannabis is back and it’s a new style

Aside from that, I spent last week on the road with Wellnex Life (ASX:WNX).

Brokers and clients are amazed at a stock with this story trading where it is.

On Thursday we spent the day at a cannabis facility in Wonthaggi, owned and operated by Onelife Botanicals. It really was a best-in-class facility, being the only place in the Southern Hemisphere making cannabis gel caps.

Chemist Warehouse wants a bigger piece of the cannabis pie, hence the reason it’s gone into a JV with Onelife and Wellnex in the space. Chemist Warehouse dispense ~30% of the national prescription market but only ~1% of the medicinal cannabis prescription market. That’s a gap it’ll be keen to make up. Watch this space.

And aside from that, it’s good being back at HQ.

Stay safe and all the best,

James

Theory of Thing podcast > Listen here for all the market news you need.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.