FREE WHELAN: The tightening in the economy to come will be about as much fun as flying sharks

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

A few things to look at this week.

Firstly, the strange pattern we still find ourselves in where inflation is up on escalated fuel prices, so global growth appears slowing which would ease inflation which should take the pressure off oil demand which should help stimulate global growth which should increase inflation while raising oil demand and the circle doesn’t break.

Also there was almost twice as many people getting a job in the States than economists were expecting. 528/- vs 258/- expected. Wages were also up.

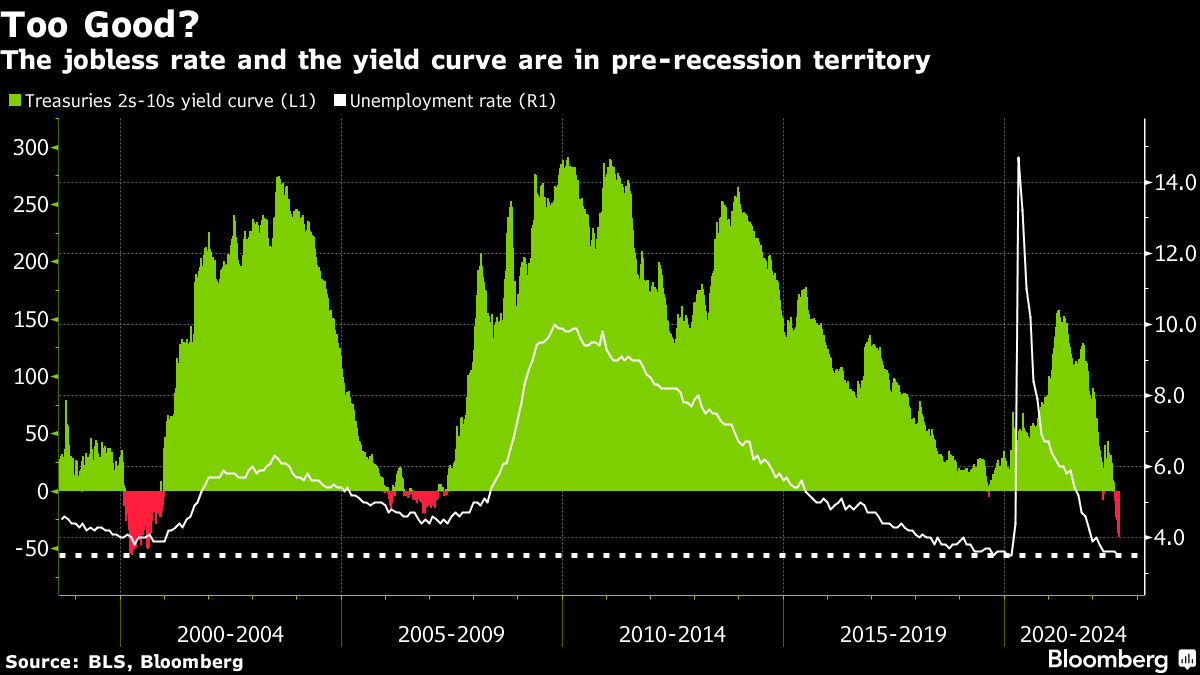

Unemployment stays low. Wages were actually revised up. Yield curve inversion points more so towards a recession than it has done in the recent past. And whilst technically the US is in a recession it’s not in a recession until it’s called one.

Basically not much has changed in a week except bonds were sold off (obligatory “that means yields are up” addition) as the Fed are seen as being far from done.

Someone on Twitter did mention “what if these jobs numbers are people having to get a second job?” and it made my head hurt trying not to think about it.

However here is the chart that sums it all up nicely.

When the 2 year – 10 year yield curve inverts (red troughs) that’s when the recession starts (we all know that already) and you see the unemployment rate rise. It gets uglier.

Apparently it gets uglier quicker:

Locally we’re in for some real strife.

The thesis is sound. A massive amount of fixed rate mortgages roll off towards the end of the year and people are now staring down the barrel of a variable cliff. It’s been spoken of a bit but it’s becoming closer on the horizon every day. I spoke of it last week. I’ll probably speak of it next week as well.

Head of Aussie Economics at CBA Gareth Aird is, for mine, the best across this of anyone.

Here’s the quote from the CBA economics report on the 5th August.

“…there is a significant dichotomy in the domestic economic data at present and this will continue over coming months. Backward looking labour market data will remain robust, wages growth will accelerate and inflation will remain elevated. But forward looking data has deteriorated and further weakness is expected (this includes consumer sentiment, home prices, housing lending and building approvals).”

But overall the way I see this working out is that we will see an almost immediate retraction of non-essential spending, basically overnight.

Your monthly repayment suddenly goes from 3% to 6% and it’s not a matter of “let’s make Friday night pizza night and we’ll go and get it and bring it home as a family instead of delivery”. It’s “I bought the cheapest pizzas I could from Woollies and they’re heating in the microwave”. And it happens in no time flat.

Any numbers you’ve seen are a massive underbid on how much tightening of the home economy is yet to take place.

Then add in the baristas and delivery people and bar staff who have nothing to do, hours cut back… and you get an idea of where it’s headed.

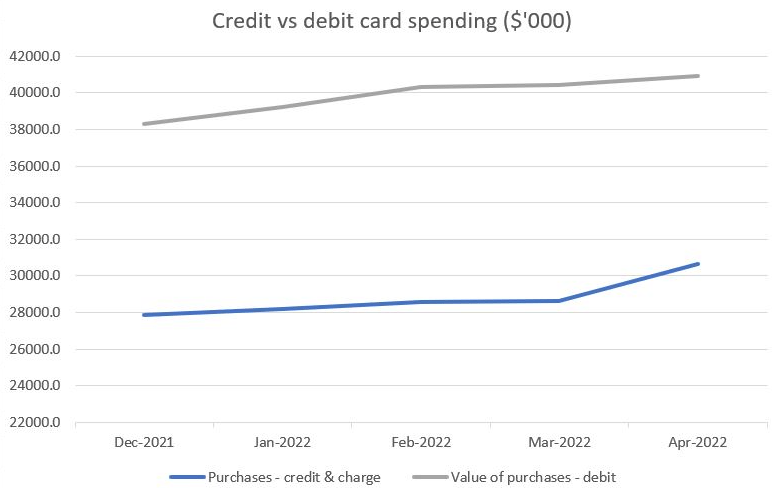

Card spending will rally. Pay day advances will almost certainly get a jump as well. Compared to what we’re expecting now, it’ll be like sharks learned to fly.

This was sent by a friend of mine out of the RBA data.

What happens if a weight of people get FOMO on rates and fix in asap and it’s at a fairly high rate on the expectation rates are going to climb higher. The RBA would be left with no choice but to drop rates sooner. Aggressively.

So all of these things happen quicker than expected. It’ll be a hell of a toboggan ride.

It was council clean up in my neighbourhood on the weekend and I usually take that as an opportunity to scavenge spare golf balls in thrown out golf bags. Because of where we live something I’ve always noticed is a constant supply of big, newish TVs and BBQs. People see a newer type of tech (4K or 5K or whatever) and feel the need for an upgrade. This time around I found zero TVs out and about and if there were they must have already been claimed by people around the place. One BBQ as well.

So the council day pulse check on the local economy suggests a pretty sad state of affairs.

The thing is if you look around everything is still booming.

So it’s all still ahead of us.

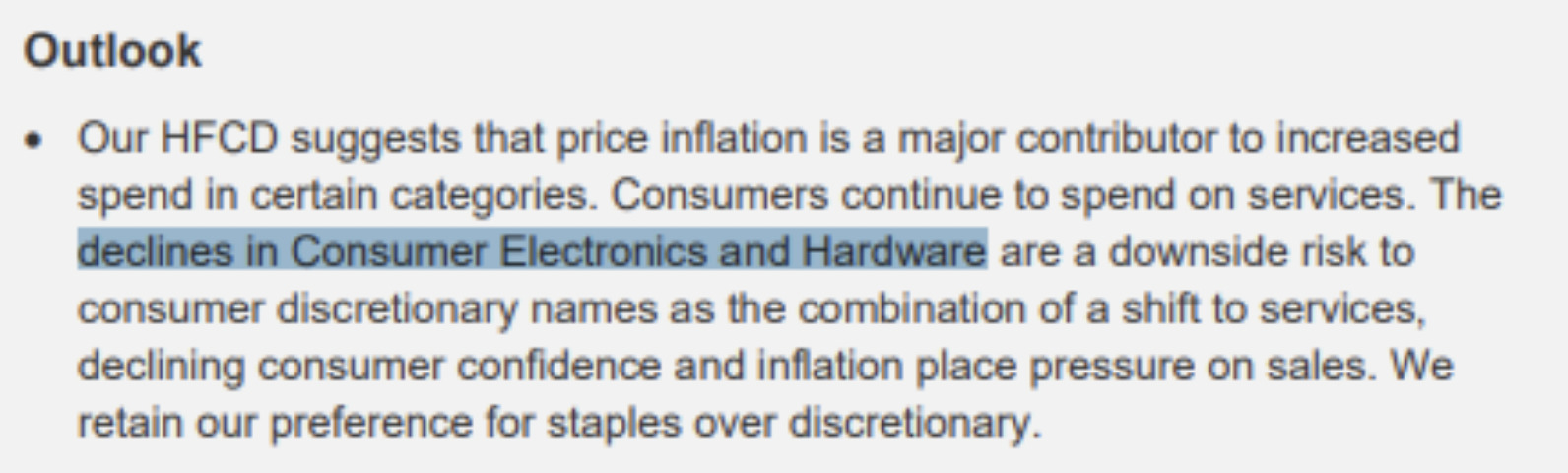

Mac Bank runs its High Frequency Customer Data and the latest cut from their 5th August report hardware spend down for July whilst spending at restaurants and cafes was still strong. Above pre-Covid levels but a fair chunk of that is price inflation. Off-premise alcohol is in line with pre-Covid also and Consumer Electronics is off.

Harvey Norman looks like the best “anti-Covid” short. Easier still that it actually has a functioning options market in which to buy puts.

Maybe an airline as well. Rex?

UBS from 22 June:

Watch this space.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.