FREE WHELAN: The favourite lost – again. Markets head up. Shell goes green. Weirdly, utterly predictable

Picture: Getty Images

In this Stockhead series, James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends across domestic and global markets. From macro musings to the metaverse and everything in between.

Good morning,

And so, just like that, we move into the first full week of November and once the race is over apparently everyone is excused from making any decisions until late January. An insane tradition in the market which I choose to battle every year.

That being said, some time to refine some of the changes to our Wealth Management offering that I’m overseeing would be handy. Watch this space and if you want to know more please drop me a note.

Who won? Congratulations to Without A Fight.

Who lost? Mortgage holders after the RBA hiked by 25 points and we saw the bets go from pineapples to house bricks at 2.30pm. (That’s $50s to $20s for the non slang oriented of you)

Speaking of bricks, I’m pulling up a little slow today after shifting all the excess pavers from the back of my house to the front on Saturday. You have to love the efficiency of social media as I posted a “they’re here, come and claim them” post on the local Facebook page and within the hour someone had claimed them.

The economy is still tight.

Without being asked he presented us with some home-made marmalade! Great to see there are still some people in this world doing good.

Speaking of doing good

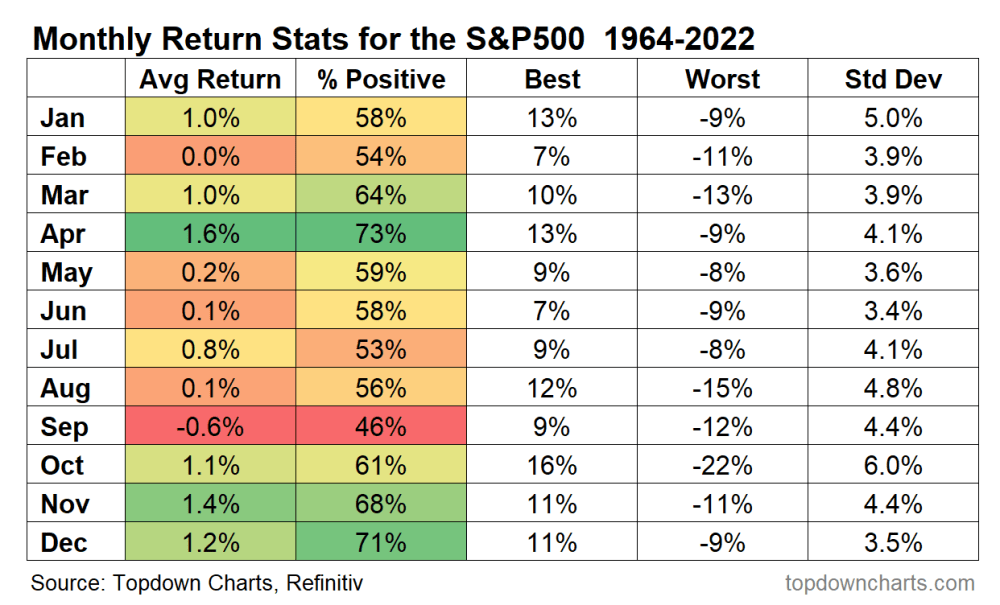

We now move into the part of the year when somehow despite the mass switch-off, the market almost always heads upwards. The average return for the next two months is 2.6%.

Last week was no exception with the S&P 500 heading up almost 6%. Any regular readers will know I mentioned that markets will move like the tides for a while.

- Strong data

- Yields higher

- Market wobbles

- Lower forecasts

- Average data

- Yields lower

- Market rallies

Pick a good horse and stay on the carousel. (Pun intended.) Happy to stay long into year end.

Last week

I spent three days in and out of the IMARC mining conference and had a chance to meet some amazing companies and people in the mining space. My previous role didn’t allow me much time to really get the sleeves up and dig into small cap stories and I can’t lie, I found it great to get back to it.

What was interesting was the turnout of various governments and particularly the focus on defence industries.

With a big focus on renewables I created a little watchlist of names that should do well. If there’s any interest please let me know.

BOJ

The BOJ didn’t completely throw the baby out with the YCC bath water; instead, slightly lifting the cap on their upper yield. So there was no yield explosion as there could have been.

Of note though was their realignment of inflation forecasts, putting them higher than before for longer. THAT does play into the thesis of money having nowhere else to go but the Japanese market.

Stay the course.

Gas it

Finally I’m interested in an article in the FT about Shell shifting its focus re renewables, moving to a leaner, more selective investment strategy. They’re cutting 200 jobs in the space and reviewing another 130 and seniors are leaving already because of the shift.

I have to agree with Shell here, that for a while we all lost our heads a little and threw money at any project.

Now money isn’t free, so being selective is paramount for the humble retail investor as much as for the largest company on the FTSE.

Words like this give me a great feeling too. Hydrogen is underrated.

Knowing a company like Shell that is consolidating its decisions is still leaning heavily into this fills me with confidence.

Stay safe and all the best,

James.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.