FREE WHELAN: The Critical Edition

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Critical Budget…

Ahhhh Budget Week, always memorable as it comes around my birthday. (And another happy 43rd to me!)

Alas. I never get a birthday present from the Federal Treasurer.

Lots of goodies to throw around the place, but almost always given to people who aren’t me.

However, keen Treasury beans do occasionally note a few dollars sent to a few interesting places and the one I’m seeing is the boost for critical minerals mapping.

Critical Minerals

$566m to find and map the locations of critical minerals, make them freely available to industry and use that to build on the target of net zero (critical minerals being integral to the production of renewable energy).

“There is no nation on earth better placed than Australia to achieve our goal of moving toward a clean energy future.” So said the Prime Minister Anthony Albanese in a Wednesday presser last week.

“This investment highlights my Government’s commitment to building a secure and sustainable future for all Australians. By investing significantly in geoscience, we can boost our progress towards net zero,” Albo added.

The funding will be channelled into delivering essential data, maps and tools for the resource industry in order to aid in the identification of new mineral deposits and energy sources.

As we are connected to companies in the space and continue to support the sector, we will watch intently.

Critical Podcast

Another sharp podcast recorded by Heath Moss and myself on Friday. But mainly Heath.

We run through the market as it is and as it will be. Specifically the weaker US jobs numbers creating a solid floor under the market. Inflation data moves upwards for a few data points and then downwards again, taking the market along inversely as it does.

We remain bullish.

Critical US market valuations update

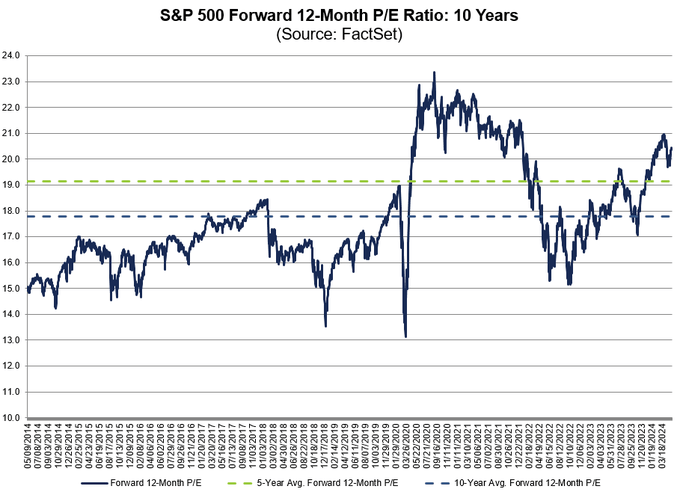

The forward 12-month P/E ratio for the S&P 500 is 20.4. Above the five-year average and the 10-year average.

RBA vs Treasury

Locally, Treasury feels that “inflation is solved, get involved” which have inflation forecasts back to a more appropriate level and is getting everyone excited about the chance of a pre-election rate cut.

I hope he’s right, but as we know hope is not a strategy.

I hope they’re wrong in Germany

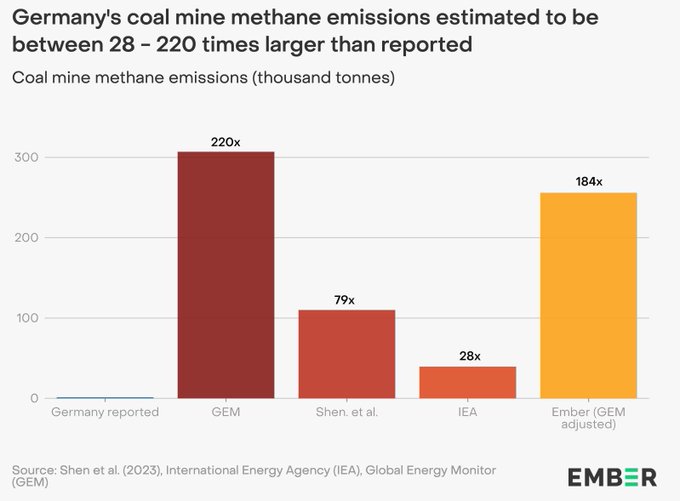

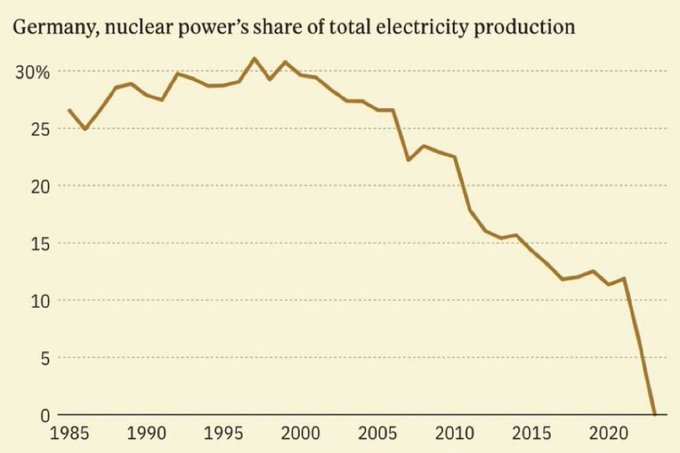

What does appear to be a strategy is the German Greens who are fighting climate change by closing the nuclear power plants and then massively underreporting the methane emissions of the still-running coal mines.

So.

25% of Germany’s power comes from coal now.

This simply cannot go on.

0 Days to Expiry is not an option

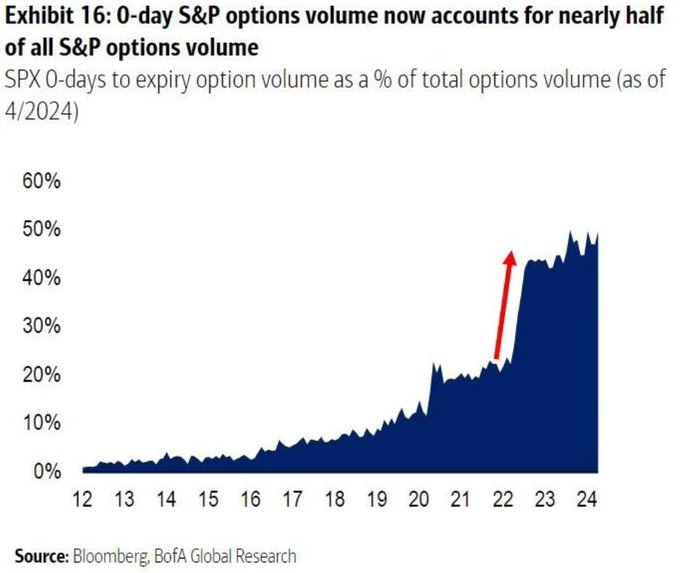

I’ve mentioned 0 Days to Expiry options before, and they’re getting outta hand.

This theoretically makes the VIX less relevant due to the move of anyone trading options away from the things that make up the VIX.

Finally

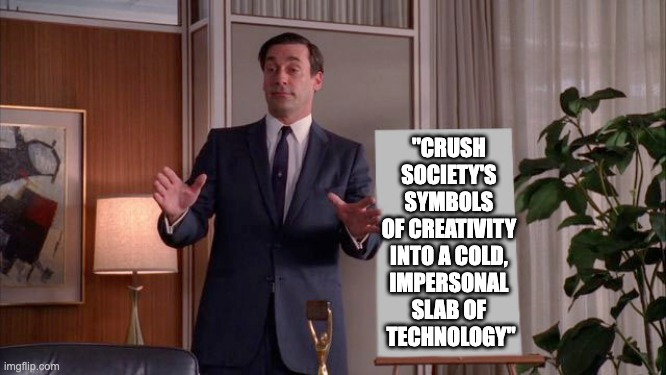

Also, Apple launched the new iPad Pro.

Yay.

But the way in which they did it really reminds you of what sort of dystopian reality we’re building for ourselves.

Watch the ad posted by Tim Cook then make up your own mind:

https://x.com/tim_cook/status/1787864325258162239

If you had the thought that “wow it looks like Apple is taking pleasure in crushing the world’s creative tools into a lifeless black object” then congrats, you have a soul.

Humans are amazing.

Critical, we must never forget that.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.