FREE WHELAN: Sanctions will stick and so will Chinese lockdowns, if they stay positive

Pic: Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

There’s a few unsurprising things about the world and the market today and firstly it’s Tom Brady deciding he’s retiring from retirement and any Russian “we’ve made progress towards peace” chat.

Firstly, I always try to stay positive on things. Attack it from the best possible light then let your expectations die slowly.

Tom Brady Summary:

Very funny.

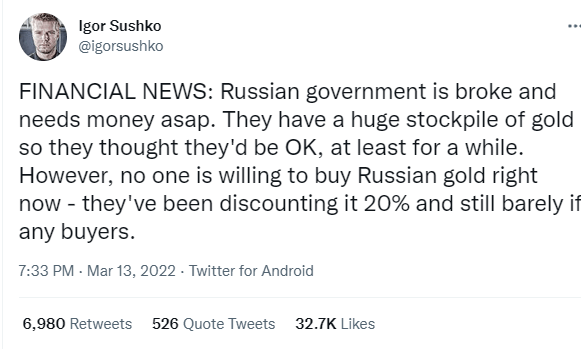

Okay now seriously have a look at the chances of peace to come out of the Ukraine war and relate that to Russia running out of actual money.

Remember a few weeks ago I said that Russia looked to be lining up for a thing in Ukraine maybe because their gold reserves were stacked and they were good to go?

This chat comes from the same guy who released those “letters” about Russian intelligence being dragged for bad intelligence on Ukraine.

Russia can’t sell their gold. They’re going broke. Maybe.

In this game you can’t always verify if something is real or not immediately but if you step back and think about things and run them through the “does this make sense” filter you can usually have a pretty good lash at whether something is plausible.

Russia is running out of money, of that there can be no doubt.

However, as I always do, play the tape to the end: Russia breaks for peace and some sort of deal gets sorted. Markets pop, commodities may take a bit of a tumble but that MAY be short lived because what happens next?

Is this a realistic scenario?

“Hey! Russia and Ukraine have decided that in exchange for the Crimea and some disputed regions Russia will completely withdraw and so sanctions will be rolled back this week and gas will flow freely into Europe and they’ll have a nice little celebration in Moscow for how they managed to secure peace in the region and Abramovich gets to own Chelsea again and everyone gets their boats back and Putin will be okay.”

Is there seriously any way that this gets resolved quickly? No.

Sanctions will stick. Nobody forgets this.

Commodities exposure

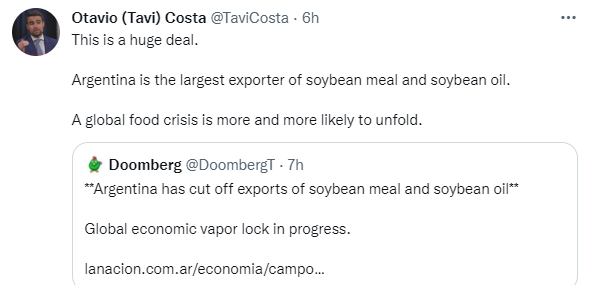

Commodities will probably still go up, particularly oil. I still stand by the view that food will be the talk of 2022. And now we’re three months in to 2022 and food is absolutely a big part of the talk then, yes, I think I’m on track.

If you want the commodities exposure then COMM is the way to go. Commodities packaged up in an ETF trading in London in GBP.

If you want equities access then FOOD by Betashares is also good. Actual equities in the food space. Because this is THE THING for 2022:

Countries will continue to secure what they have.

Also this..

Shenzhen! The lockdown is back!

Supply chains aren’t expected to get any easier now. And we were all expecting them to get a little better.

I still think China was getting set to ease their Covid restrictions but now I’m thinking that’s looking like it may be delayed for a bit.

And the Fed is meeting this week.

And they’ll raise rates.

Because inflation is running hot.

So does any of this seem like it’ll ease soon, based on your ability to play the tape to the end and run out the plausible scenario?

Quite frankly the biggest shock on my feed today was Tom Brady undoing his retirement.

Invest accordingly.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.