FREE WHELAN: Orcasionally… I see an opportunity and I do this to it

Picture: Getty Images

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Aaaaaand it’s Jackson Hole week. << Insert endless circular discussion about whether the Fed goes 50 or 75 next month here >>

That’s the love-in symposium where the Fed talks about their big plans. It will be written about extensively.

Does it matter? Yes.

Will I talk about it? No.

So…

It’s a great time to take a step back and look at the map from 30,000 feet. Anyone who knows what I actually do knows that I’m not the minute by minute trader of pips. I take bigger picture views and hold for long term, trying to capture longer term trends. Occasionally I see an opportunity and I take it, like the overweight in Nvidia which was cut back to a smaller long term holding last week.

Nice profit and happy to hold for the long term now, which probably means it takes a backwards step before the rally towards the end of the year.

Don’t forget August and September in mid-term years are usually weaker with the end of the year being historically bullish.

In the process of focussing more on the big picture, over the weekend I listened to a really good podcast (that wasn’t my own) called Macro Hive Conversations

There’s plenty there to go through which I recommend you get across as Cameron Crise is a great macro commentator for Bloomberg. He gets us across numerous parts of the market but interestingly he notes something known around the market for a while now.

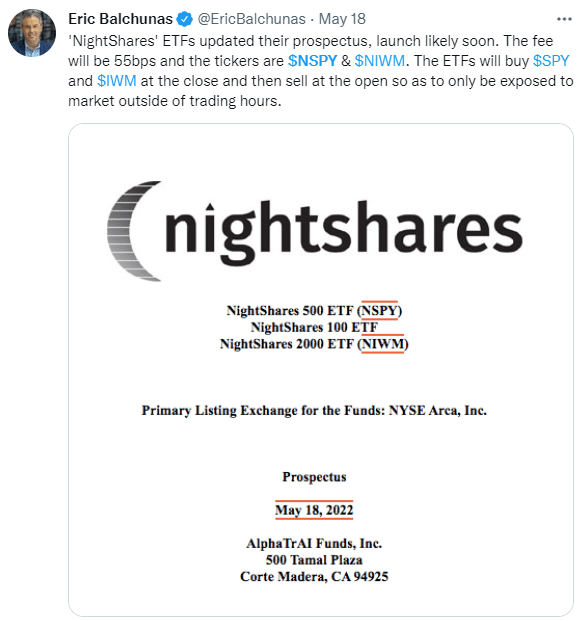

The US market is now so efficient at pricing events that the moves only happen overnight now. Intra-day the market doesn’t really move after the initial gap up or down.

Funnily enough this reminded me of something I talked about on telly a few months ago about an ETF being applied for that only bought on the close and sold at open the next day. It was launched at the end of June and I’ll keep an eye on it.

It’s run by Nightshares and they buy futures on the close and sell at open the next day. Risk-adjusted returns outperform holding the market during the day. Interesting that it’s popped back up on my radar again.

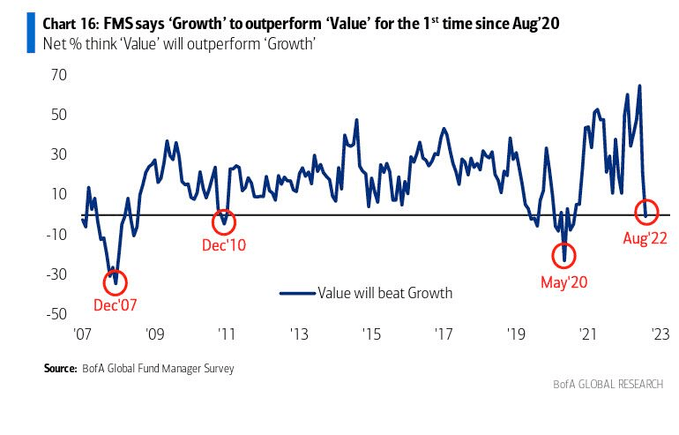

The BoFA Fund Manager Survey dropped last week and it was a bit of a doozy. “Sentiment is still bearish but not apocalyptically so.”

Cash levels dropped a little indicating renewed confidence in the market but it’s still historically high.

Interestingly for the first time since August 2020 the survey showed that there is a net percentage of fund managers who think growth will outperform value. That’s interesting for the Value ETF we hold and may be just the thing we need to move us to the sidelines in that area.

Overweight/underweight is telling. Cash is still heavy and defensives/inflation plays with the market still hating on Europe (and with good cause)

Happy to continue to thin out holdings and look to allocate further down the track.

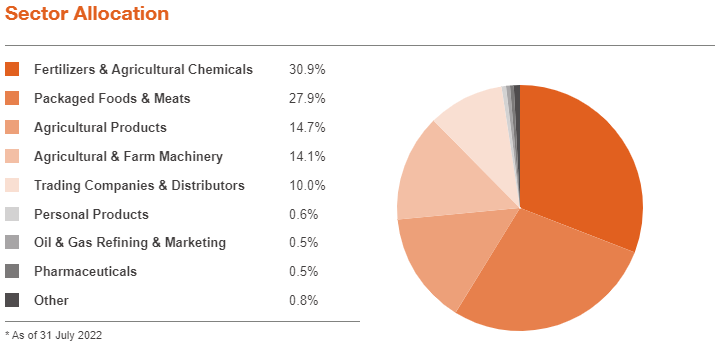

Key area of reinvestment has to be FOOD. My love for this ETF is well known and as we move into the third year of La Nina the northern hemisphere will require more to do the same with less. Same story as before. This ETF is great because it has all of the things required to make this happen:

A few weeks ago I wrote about a dam in Vegas that is at record lows. Now the drought is so bad in Europe that the Danube is exposing wrecked German boats from WW2.

So whilst the feel this week will be to lighten risk, the need to regain our holding in agriculture is still required.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.