FREE WHELAN: Oil, NVDA, Gold, Copper and 3,878 CyberTrucks

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Afternoon all,

Looks like we are well on our way through a fairly orderly correction. So much for “the second half of April is traditionally more bullish than the first” but let’s drill it down to see what’s really going on…

Last week in the US we saw the Nasdaq get a bit of a touch-up to the tune of 5.5% and the S&P 500 at just over 3%. Ouch.

However, the Dow was flat. Seriously.

Copper was also up almost 6% for the week.

Don’t start me on gold or oil.

Going down to sectors showed that 8/10 sectors outperformed the 500. (Thx Sonus Varghese of Carson Research Group for that.)

Much of what we’ve seen has been tech giving some back.

NVDA went crazy for how long? And now we’re seeing a healthy correction because inflation continues to inflation… also some other things in the Middle East.

But… mainly the bond yields because of the inflation.

Re NVDA drop, I believe the investment team over at the TikToks have the answer…

Note… this is actually from March 2022. The internet investing crowd are far more savvy now. Right?

Like these guys who sell everything to invest in TSLA while living in their Tesla. That last line really is something.

Friday’s podcast was another piece of excellence and I would love to see us finally recognised for some kind of podcast award. While we wait for that though I had one of the biggest hitters of the Big Bash, Chris Lynn, talking about his company Playbook Coach. Just an amazing way to improve at any sport and handy for me as I take on a kicking challenge with one of my Barclay Pearce colleagues.

Link Here, great market report too from Heath.

Gold

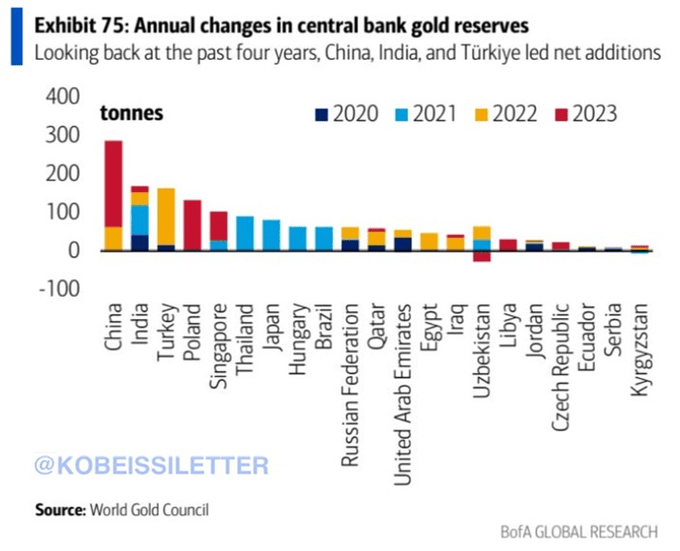

Heath mentions gold, which I said last week wasn’t making much sense in the face of rising yields and must have something else going on (obviously with price moves like that)

As with many things right now, it’s China.

I’ll make it easier…

And even easier…

I have no reason to think that China changes course here on this or on their stockpiling of copper either. Not only are Central Banks big buyers but the Chinese retail market have found a place to store wealth in the face of banking and real estate instability.

Cybertruck

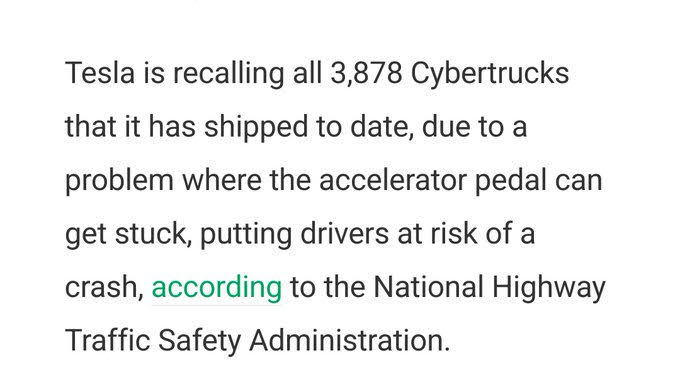

Finally Tesla, who I clearly loathe because battery cars are awful and everyone should go to hydrogen, had to recall their stupid Cybertruck. The accelerator pedal was sliding forward and getting caught under part of the underside of the dash and sticking there.

Because it’s a recall, we finally get a look at the numbers for how many of the things they sold.

For reference this is only 878 more than DMC sold of the DeLorean.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.