FREE WHELAN: Oil at US$150. First, the good news…

PPK Group has announced a breakthrough in BNTT technology. Picture Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Firstly, it’s time to say farewell to the VFS Group. I can’t thank VFS enough for their assistance in all things and I hope that the work I’ve done here has been beneficial to both current and future clients, and the industry as a whole.

As much as I was keen to stay on, I’ve been made an offer to head up BPC Asset Management that I simply cannot refuse, it’s an opportunity to build a wealth management team and that’s always been part of the dream.

Rest assured there will be no interruption to the advice or service as we move ahead.

Now to moving ahead…

The latest edition of the podcast starred StoneX’s David Scutt and was brilliant as always.

We touch on general market alignments regarding rate expectation and how much attention should be paid to the Middle East. Long story short: a lot.

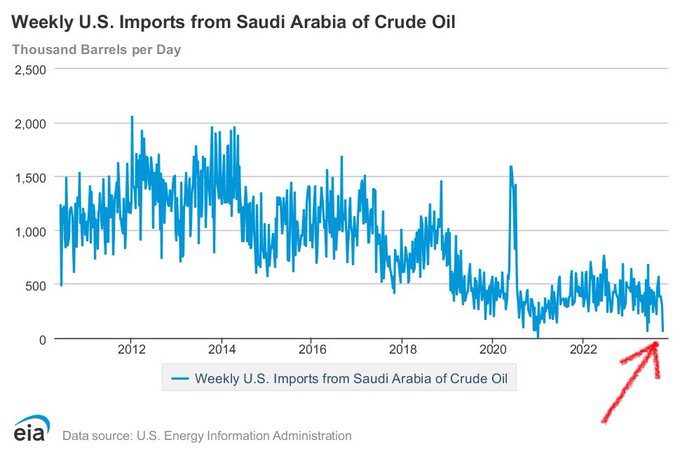

There’s Saudi movements of crude oil to the States, the third lowest weekly level in over 20 years. Note this drop comes as Saudi Arabia is cutting production.

Courtesy @JavierBlas

Then there’s the Aircraft Carrier. Sorry…Aircraft Carriers.

There’s two now there/on the way depending on when you read this.

The USS Gerald Ford just arrived and the USS Dwight D. Eisenhower is on the way.

Anyone who knows the expression Civis Romanus sum and (with enough cynicism) also thinks about Biden’s awful approval rating heading into an election year can see the grim path ahead.

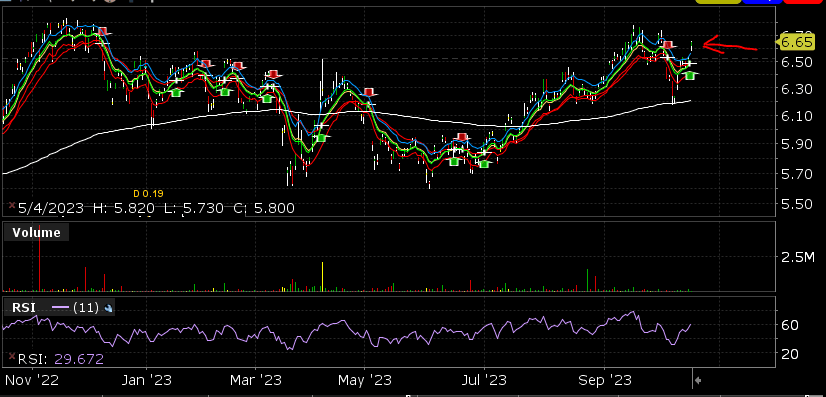

Separating from the obvious tragedy unfolding we added to the FUEL ETF last week and are currently happy to hold.

There has been legitimate speculation of the potential for oil to get to US$150 on a proper escalation.

What that means: The good news is it will mean no more rate hikes.

The bad news (aside from the obvious) is that the world then gets tipped a little closer, and probably into, the recession every man and his dog predicted last year.

Japan

Last week I was lucky enough to attend the latest Blackrock Investment Institute quarterly market update and along with the usual on yield expectations there was one question from one of the small room of managers there about Japan expectations.

What followed was the most blindingly bullish case made for Japan I’ve ever heard from the chief investment strategist of APAC, Ben Powell.

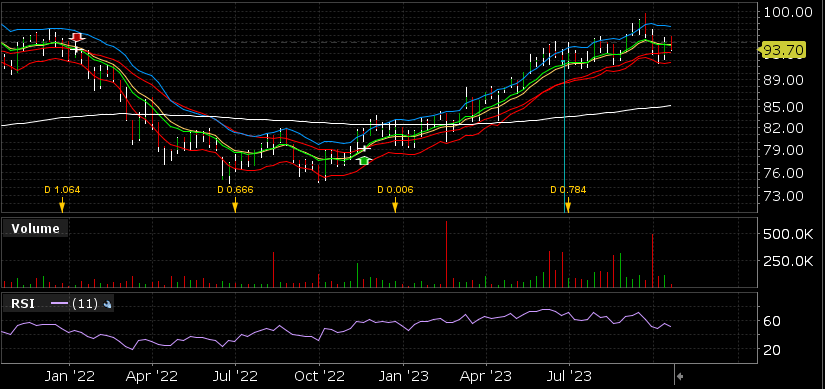

In my own words the Japanese potentially or inevitably abandon Yield Curve Control at the next BOJ meeting (which happens to fall on Halloween) and that really lets the cat amongst the pigeons. Inflation is already decidedly higher for longer (not high, just higher) and eventually the amassed savings of Japan, about US$7tn equivalent, has to depart savings accounts and head somewhere.

The local market is the best place, apparently. And better yet due to interest rate differentials this is a rare opportunity to be long Yen as well.

The best access to this play is (credit to the idea generator here) from Blackrock themselves on their idea and it’s IJP.ASX. It effectively just buys a Japanese ETF listed in the US on an unhedged basis so your USD view needs to be strong.

What I’m really chasing is something that’s direct into Japan or a Japanese listed ETF which would work fine for backing this view.

This is worth a search if you want to find it.

IJP.ASX Courtesy Interactive Brokers.

Finally…

Ozempic (the everything drug helping weight loss across the world) continues to shine. The company that makes it (Novo Nordisk) has a larger market cap than the GDP of its home country Denmark but more importantly it’s changing the eating habits of the world.

Why have consumer staples underperformed the regular market?

Aside from the obvious being that there’s some massive growth stocks at the top of the index that are distinctly NOT in the staples area but also that the eating habits of Americans are changing.

Why?

Because of Ozempic.

Also, these low cost food companies don’t have much room on margin. They have to be cheaper because that’s their thing. When the price of all their inputs goes up they pretty much have to eat the difference. Pun intended.

Consumer staples aren’t the defensive they once thought they were.

Finally, Finally

There’s a glitch in the amazing return to work orders of companies all over the world when this guy will, for a fee, use your swipe card to go log in for you so you can stay at home and get some work donw in your trackies.

A thanks to all who have assisted this far.

The VFS Group Team is like no other I’ve known and these guys are more like my brothers and sisters than workmates.

I depart with a heavy heart but with anticipation and confidence for what’s ahead.

All the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.