FREE WHELAN: Oh snap, it’s time to sit down and have the ‘only buy quality tech’ chat

Via Stephen Hoerold/Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets.

From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Freshly returned from my holiday with all the energy of a newborn kitten. Sleep patterns all jammed up and a sore head full of crazy ideas.

Can’t recommend Gundagai enough for a visit, by the way.

Lovely little town, full of history.

Travelling with the eldest daughter really gives one the chance for some great one on one time and funnily enough a little chance to let her in on some of the engines of the industry. She wants Snapchat and I won’t let her have it for as much because it’s a toxic app that corrupts young minds but also because it’s an awful company.

Listening to one of my podcasts between Thredbo and Cooma it was mentioned Snapchat were going to start some sort of subscription premium service.

Me: “That’ll tank!”

Daughter: “I know 5 people who will immediately sign up for that… and for the LAST time please watch the road”

Me: “What. Ever!”

There’s no real point to this tale – other than filial piety cannot be bought and neither should Snapchat… but it does provide a good example of always bouncing an investment idea off another set of ears, regardless of their selective hearing.

It also raises another question: Would you let your daughter use a product run by a company you couldn’t stand?

Meta, I’m looking at you.

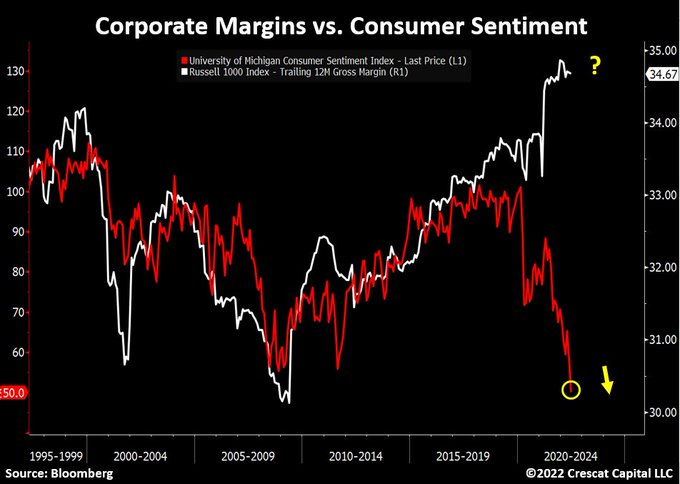

Speaking of Meta we’re about to head into 2Q US earnings season. This is when the margin compression will really take over and outlooks will be grim. If there’s going to be another savage leg lower it’ll be because of this. It’s already well known and documented but should be the last piece in the “are we going to have a recession or not?” puzzle.

This is a chart that seems like a bit of a stretch (much of the stuff from @TaviCosta needs a shot of salt to take it in) but it does show that, all things being equal just how far confidence (red line) has drifted from margins (white line). Them margins about to come down harder than something that needs to come down hard.

My brain is too tired to come up with a witty metaphor. Try something about NFTs or something, I don’t know.

Speaking of crypto… I got your new screen setup right here.

We will be going through some real pain here.

Unverified stat from Gold Telegraph that 12.7% of buyers who financed their car in June are paying over $1000 a month in repayments. That’s a country that may see a depression on further tightening. Act accordingly.

Remember what we’re going to do for this earnings season. Look at awful earnings reports and if the stock is trading at a surprisingly robust price then you should look to allocate a little. If you must.

Quality tech is going to find a place in every portfolio this year.

Emphasis on the first word though – quality – if the company has this sort of thing going on than I don’t want to know about it:

— cold (@coldhealing) June 28, 2022

Honestly. Some of this big tech is basically adult daycare.

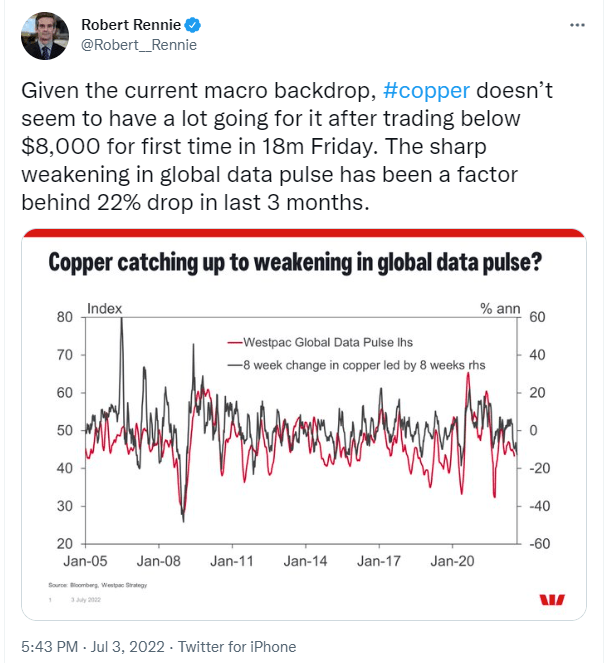

Speaking of dip buying… copper is reacting exactly as copper used to react when global growth outlooks are trending down.

Good friend of The Whelan and an all round great guy Rob Rennie (WBC commodity strat) posted this simple note showing why copper isn’t amazing right now.

See you in a week, stay safe and all the best,

James.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.