FREE WHELAN: Nickel’s minor pickle and a hand for the Cu believers

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good afternoon and a happy week ahead.

The rain so unexpected by the BOM this year has passed and, say it quietly, but maybe the golf courses will allow carts to go around again. Blessed day.

Along with this is an opened, closed and successfully raised $3 million for Impact Minerals (ASX:IPT) to now proceed into the next stage of their life of producing High Purity Alumina.

Not that this is a spruiky newsletter (officially) but it’s amazing the see what a determined group of people can do.

This team I’ve joined are capable of anything, and whilst I act and talk like Ted Lasso, it’s nice when everyone believes the same way I do.

Thank you all.

We mentioned this on the Friday Theory of Thing podcast as well as a lot of things about copper which I’ll go into here, along with some things on the Fund Manager Survey.

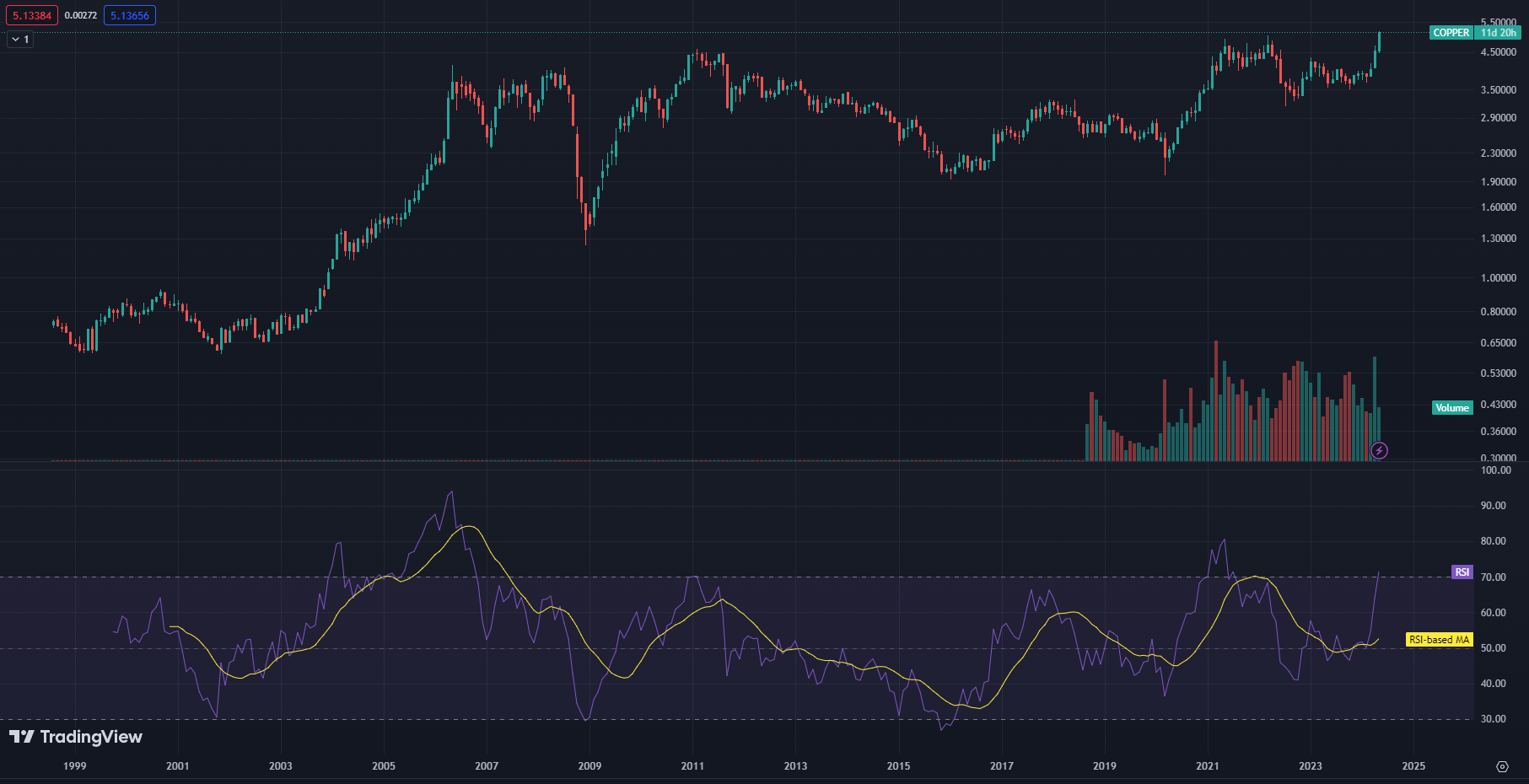

Regarding copper, we’ve seen an all-time high. Can you believe it?

Chart for those that can’t believe it.

This chart is a monthly chart back to the late ’90s when everything wasn’t so awful.

It was around February this year when I started to get very excited about copper, urging positions to be taken in any way possible.

Copper ETFs I have loved

The usual ETFs I prefer are COPA on the LSE and WIRE here in Australia (thanks Global X) and if you’re chasing a small cap then we’re close enough to Alma Metals (ASX:ALM) to say it’s well levered to the price of copper to be doing better then it is.

Keep an eye on it.

Re: copper, eh have a listen to the podcast by the Odd Lots crew at Bloomberg. They interview on the of the best in the commodities space, Jeff Currie of the Carlyle Group, and it’s a great summary of the road ahead.

Oh, and I can’t keep repeating myself on this…

Ok. Apparently I can. I’ve been at it for a while now.

Nickel in a pickle

Whilst on commodities there’s a bit of trouble in New Caledonia at the moment as they struggle for independence. The nickel market is apparently oversupplied and so if you were long the critical metal then maybe it’s a good time to take the foot off the gas.

Western Mines Group (ASX:WMG) has a “globally significant” holding of nickel and it looks to be, as the couch commentators would say, poised to break out in one direction or another. That’s a coward’s way of saying…

I don’t really know.

I hope for a speedy resolution in New Cal, a place I will never visit again since I went in 2018 with the wife and discovered it’s completely overrun by snakes trying to get in your hotel room.

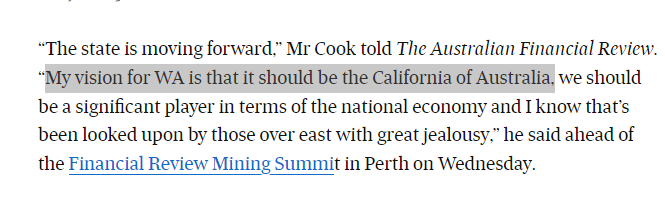

Next metal is magnetite, with the WA government doing their best to talk it up.

We agree and see no reason to disagree any time in the future. This from the AFR today.

Also this, displaying something I’ve always found off about West Australians.

As for the US the market keeps growing, see below. It does look like it could be time for a breather though, even if only on the very short term.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.