FREE WHELAN: Just remember YOU are not too big to fail

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Fresh month, fresh quarter, similar outlook.

I’m asking you to please be reminded that it was only a quarter ago that we were debating what type of recession the largest economy in the world was set to see. And suddenly it all went away.

Then, as if out of the blue, it all came back again. Yes, it took a fairly substantial banking crisis that is still not resolved but whatever it takes to get the mind focussed I guess.

And the mind should be focussed because there is still plenty to be aware of, keeping in mind that most of the impending disaster articles are merely there for clicks and shock or merely because they don’t know the whole story.

I also reiterate the overarching philosophy of the Fed and Jay Powell moving forward that “it is easier for me to fix things we break in raising rates than it is to maintain this cycle of nothing rates.”

Higher for longer is the theme of the year.

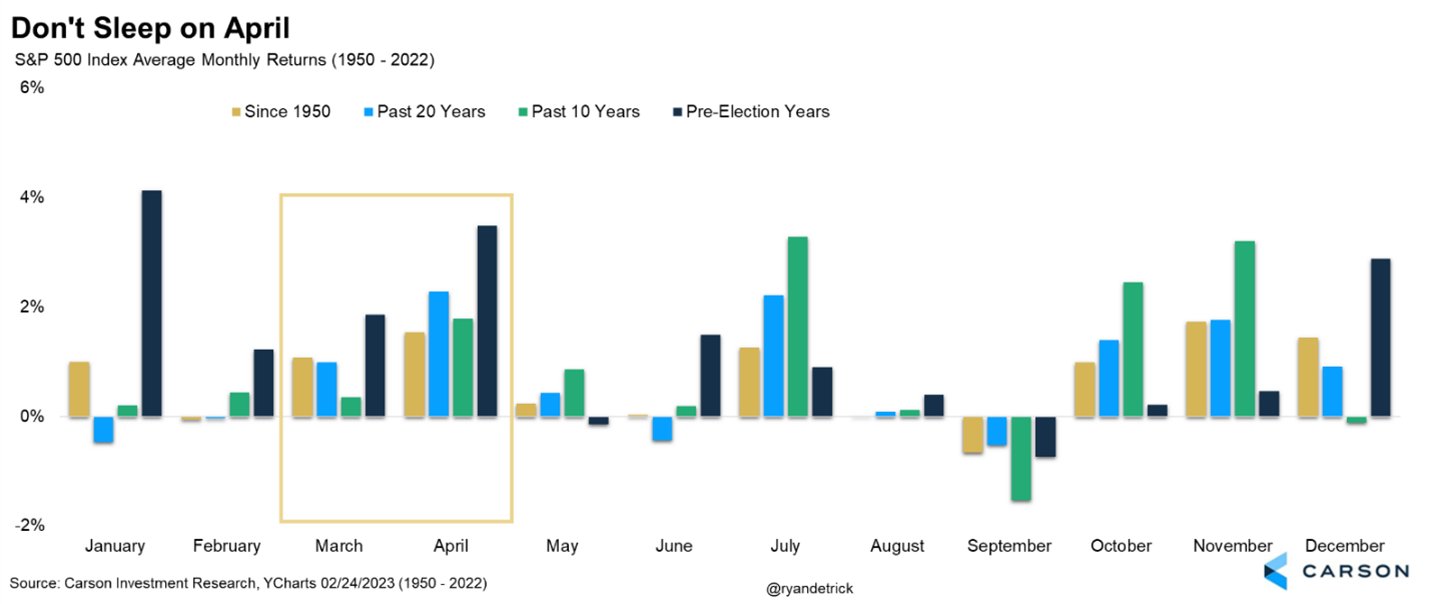

First the good news and again historical stats can go really wrong really easily but with nothing else in the way they usually hold up okay. As usual Ryan Detrick from Carson is the man to follow here:

Since 1950 April is the second best month for US stocks. Better if you take the last 20 years. It runs well (17/18 positive months) in pre-election years.

Now the bad news.

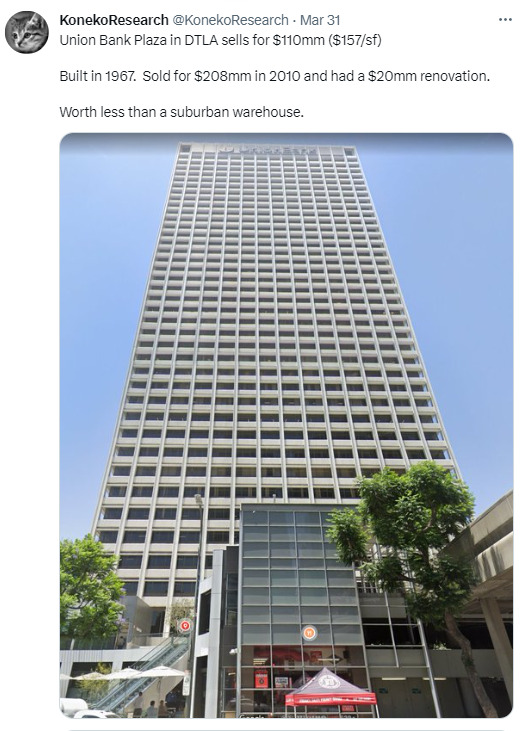

I was talking about commercial property last week and I still will because it’s still a thing. Particularly office space. I was asked on Ausbiz on Friday if the regional banking situation in the US was directly to blame for the potential collapse in commercial property, especially office space. I answered “even before all this was it really a thing you wanted to be invested in to begin with?”

The office is now just a mandatory nice to have. Drawing a parallel to Covid I guess it’s a bit like another glass of wine. You still need one post-Covid, just not as much of it.

I’ve said for years now the general managers of the world will look out at their domains and see that whilst technically they had their workforce working a few days a week again, there is no way they need all that space.

It’s also covered in the latest episode of The BIP Show with Buyers Buyers’ Pete Wargent.

I think office is cactus. Can’t get any simpler.

70-80% of funding for commercial real estate inthe US is done by the regionals. The regionals are still receiving outflows.

Remember, though. NOTHING IS ALLOWED TO FAIL ANYMORE. That’s where all the doom callers are falling short.

However…

S&P reports that global corporate defaults are currently happening at the fastest pace since the Global Financial Crisis.

— The Spectator Index (@spectatorindex) April 1, 2023

It’s all a little quiet if you ask me.

But then again you could be like McDonald’s who brought people back to the office only to send them home again so they can get their layoff notices virtually…

Being forced back into the office only to be forced back out again so that you can get sacked via Zoom is peak hybrid 2023.

70% of McDonalds’ 150,000 workforce is outside the US. Worth noting.

The “Saudi Put”

It’s also the week of Easter. People are planning trips.

Speaking of trips, OPEC+ has announced voluntary cuts of 5% of its daily output. Oil has rocketed. There is a natural floor under WTI at that $70-$80 level which I heard dubbed the “Saudi Put” earlier today.

The USA’s Strategic Petroleum Reserve is fast becoming a real issue.

Keep in mind it’s meant to be a STRATEGIC reserve for things like wartime contingency but it’s been treated as a chance to ease pressures for the US consumer. Even though the whole point of the Fed’s rate rises has been to make life for the US consumer harder. They had a chance to refill it and told the Saudis they would. But didn’t.

Energy was a screaming buy this last fortnight gone and I was happy to add to FUEL last week.

There is no more clear indication that OPEC+ controls the price of oil more than ever than the price action on Monday morning.

Theoretically though OPEC are doing the Fed’s work by sending oil prices up a few months before the US heads into its driving season. (A phenomenon that still puzzles me in it’s size.)

Strategic April

Strategy for the month of April will be to take the rally as it comes and shave off equities profits. Any decline in bonds is still a buying opportunity.

We simply do that in a lead-up to May when rhyme-based investing (Sell in May & Go Away) becomes a very real thing. Overweight bonds and cash then and re-enter at lows.

Simple.

Whilst I still think it’s a choppy road to the end of the year (the real estate collapse hasn’t been felt through the market yet and we haven’t priced in a Fed response to it yet.)

US Commercial property is absolutely too big to fail.

We still need to go through that motion first.

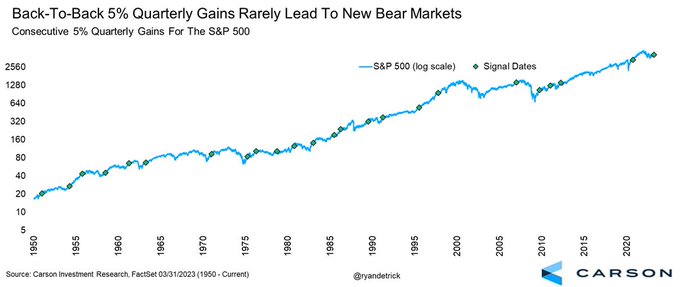

If the US market is up over 5% on two consecutive quarters then on average it’s up 13.5% a year later.

But then that’s the past. We’re dealing with the future here.

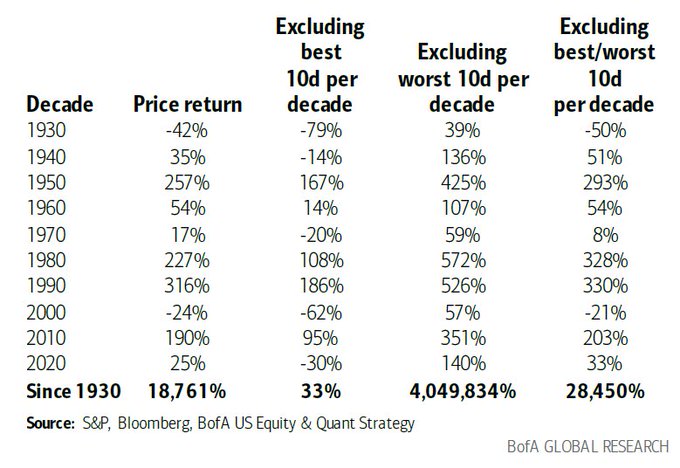

I will leave you with this (below) which was posted by the BofA Quant.

Visualise what happens if you’re not in the market for the good and bad days.

If you exclude the best 10 days your returns are dramatically reduced.

All the best, stay focussed and safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.