FREE WHELAN: It’s going to get hot in here, so please prepare to pass me the FOOD ETF

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Quick reminder. I’m hosting a webinar on February 15th with some great guests, including Stockhead(s), talking about the year ahead and how to navigate it. Should be a great evening so please RSVP via this link and I’ll see you there.

Firstly, and I don’t want to cause any unnecessary panic, but there’s a radioactive capsule lost and authorities are still looking for it. There’s concern it can cause serious harm to anyone nearby.

The fact it’s been lost (by Rio Tinto) on a 1400km stretch of road between the Pilbara and Perth is obviously important too. The panic that ensues when the government has the chance to tell people things are OKAY! while donning the white hazmat suits and pulling out their detectors is incredible.

Reminds me of the extraordinary panic of early 2020 COVID and the ongoing concern around the move to nuclear energy.

The things we have had around us and use day to day are always fine. We grew up with them so they’re okay. Imagine someone just coming up with the idea of running through the city at lunchtime as if it hadn’t ever been thought of before.

“…so you’re doing the most respiratory intensive thing you can? Right next to operating vehicles spewing out an unknown amount of carbon monoxide? Driven by the sort of drivers who occasionally need to use their phones while driving?”

“That’s correct.”

“And you’re doing this for your health?”

“Absolutely!”

I’m reminded of potatoes as well…

There’s a theory that says that if potatoes had never been around and just appeared one day you’d be hard pressed to get approval to grow them privately.

There’s no way a government agency would trust that individuals would not eat raw, green potatoes, thus exposing themselves to the toxic solanine contained. Because obviously that’s what people would do. Some Facebook post urging people to fight the power and eat raw potatoes to counteract the effects of the fluoride in the water and the Department of Agriculture would have a valid case. A plague on both your houses.

The same rule applies to nuclear energy.

We’ve not had it here so for many of us our knowledge extends as far as late ’90s episodes of the Simpsons. We just don’t have the lifestyle of safely understanding the costs of nuclear, so we tend to panic. And if Western Australia showed us anything during COVID it’s that they really know how to have a panic.

Fortunately, we have potatoes and know how to eat them.

*Interestingly in WA it was illegal to carry more than 50kg of potatoes in your vehicle in without being from the Potato Board. You could be stopped, searched and issued a fine by the WA Potato People (?) for carrying too many potatoes in the trunk of your ’87 Honda Prelude and there wouldn’t be a thing you could do about it.

(Ed: That’s right – but it’s not the potato people/board… but members of the Potato Marketing Authority – PMA – who are allowed to stop your car and search for them if they suspect you might have more than 50kg of potatoes on you.)

From LeBrun Lawyers: Not only is it illegal, Potato Inspectors have the right to demand the name and address of anyone in possession of what appears to be more than 50kgs of potatoes, and can seize them as evidence. The fine is $2,000 for your first offence, or $5,000 for your second offence. The crime has existed since 1946, but it’s unclear why it first came about, but was likely to do with protecting the state’s commercial activities.

This wasn’t a “ye olde yards are the length of the king’s arm to his nose” law either – it was only repealed in May 2021.

Western Australia, please never change.

There’s an ETF launched recently by Global X which is named ATOM and covers Uranium.

Add it to your watchlist.

Tight ’till Fed Time

Can you tell I’m killing time until the most important FOMC meeting in history this week?

Thursday morning we’ll know if the Fed are hinting at a pivot with a 25-point hike or not hinting at a pivot with a 50-point hike or various combinations of that. Either way, trying to get ahead of this market has been a mug’s game month after month whilst noting that January has already had an out of the box rally to start.

Beware. Cautiously optimistic but… beware. We’re about to see the last of the blows dealt between the Fed and the bond market.

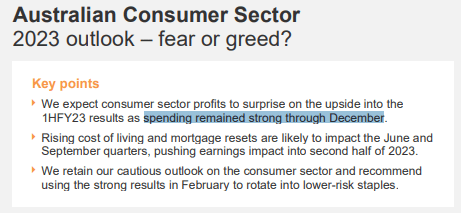

As mentioned above, our ability to deal with change is getting harder and harder. Our ability to deal with not only higher costs of living but more and more prohibitive interest rates also appears to be very slowly acclimatising as well. Mac Bank research thinks profits in the local names will surprise to the upside but that will be it. In short, Christmas 2022 was our last hoorah for a bit.

Belts get tightened from here on in.

On that I agree entirely.

The last few years have been tough for all of us and the end of last year was the last chance to share a glimmer of happiness before mortgage rates really start eating into bank accounts. I wouldn’t care to be a holder of any local consumer discretionary stocks for a while, and agree with Mac Bank that selling into upside surprises would be prudent.

Bonds: maintain the rage

A great note in the Bloomberg daily email by guest of the BIP Show, Garfield Reynolds, talking about the surplus of $1 trillion held by US corporate defined benefit plans.

As they load into bonds to lock in their requirements for the years to come it will, temporarily, artificially inflate bond prices and bring yields down for a while. Any pop in prices should be used to sell into to accumulate later (because I’m still happy to own bonds at good prices) but there’s a level of expertise in seeing bond flows which is not accessible by the regular observer.

I’ll follow this up in a later note with what to look out for.

USTB Global X US Treasury Bond ETF (Currency Hedged) is the easiest way to gain exposure to the US bond market if you think the Fed is going to blink and there’s a weight of money heading in that direction.

It’s going to get hot. Be warned.

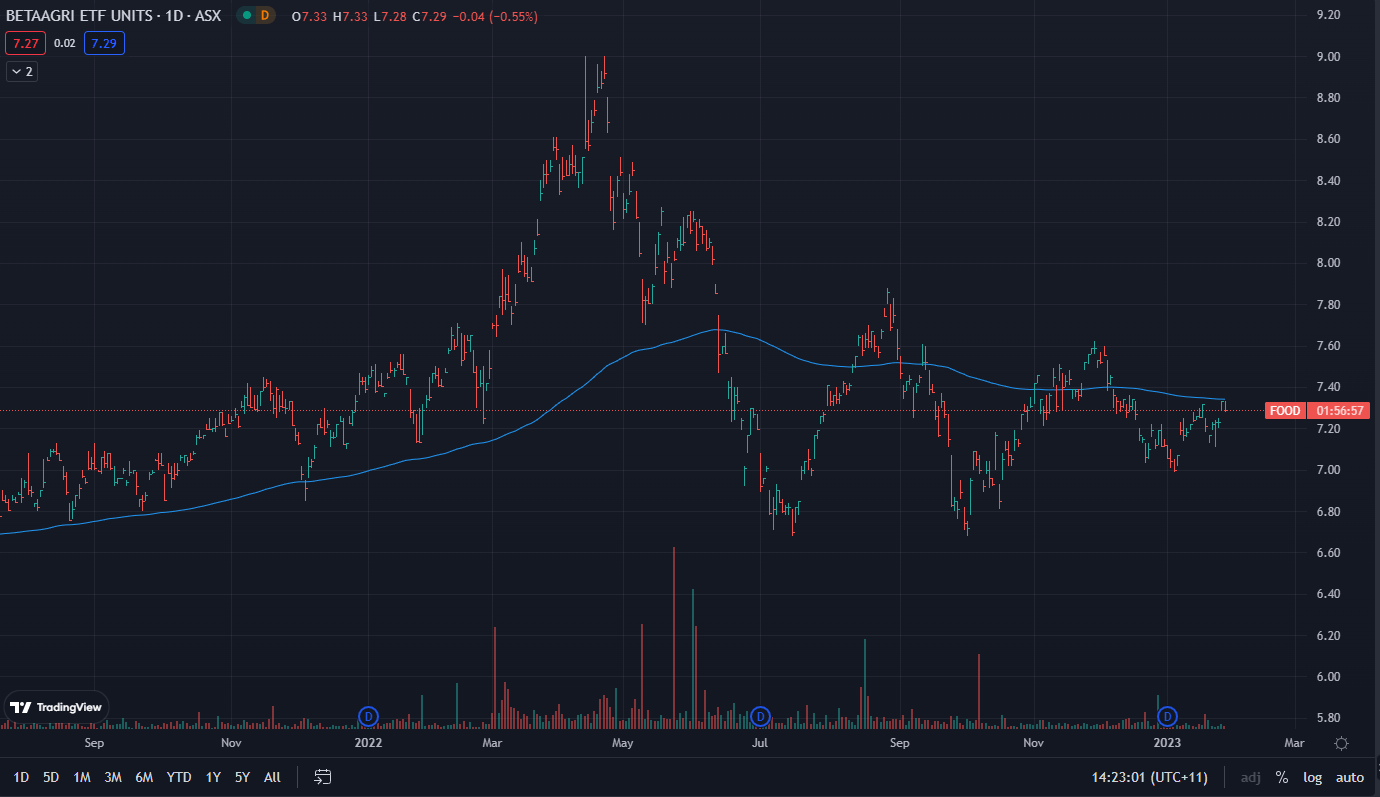

Finally, speaking of food and now going through my notes from my time at the farm I am now convinced we are heading into a significant dry period.

We’ve had a few seasons of La Nina which brought the rain and now we’re heading into the type of hot spell we tell our kids about. Food inventories are low but fertiliser prices have dropped and are dropping.

We sold it a while ago and were happy for the profits by there’s a point at which the FOOD ETF comes back on my radar.

Not yet though…

Anyone who has paid attention to my chatter about the weather in the past knows that in early 2020 I shouted loudly about how much rain we’d get and how little the US would get. I used it as the basis for the long food trade which did so well during COVID.

If there’s a flare-up in Ukraine, the grain deal goes sour there, fertiliser prices rise again in a cold winter next year, our crops don’t produce as much and rainfall hinders production in other parts of the world then you may just find yourself hoping you had planted 49.9kg of some of our old friends now.

We’re sitting tight on positions pending Fed chatter this week.

Remember, until they say or do pivot, they have not commenced. Anything else is speculation.

All the best and stay safe,

James

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.