FREE WHELAN: It’s almost Turkey Time

Picture: Getty Images

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Good afternoon,

A week until Thanksgiving and I believe things are on track. Tables and chairs are booked for delivery. Who is bringing what side has been arranged and a few cases of Bud are on the way.

I still don’t have a turkey. And I need a big one.

But I’m sure that will work itself out over the week as all things do.

Something else working itself out is the FTX calamity, which is now regarded as maybe the biggest fraud in history, funded by some of the smartest names in finance.

And Tampa Bay QB Tom Brady.

Turkey Time

The new CEO filling in to investigate just what happened was scathing about Sam Bankman-Fried’s management. “Never in my career have I seen such a complete failure of corporate controls and such a complete absence of trustworthy financial information.”

The chickens are coming home to roost and highlights why I was banging the table about owning quality last year. Rising rates are the great leveller. You can’t hide when the bill comes. Example picked at random here is Bird, who allegedly deals in e-scooters, a thing I don’t really think is a thing.

Watch as more literal frauds get found out over the coming months. Something happens in the new year’s break when people take leave, someone fills in for them and realises certain parts of the spreadsheet don’t quite add up. When everything is going fine it usually doesn’t matter but things are definitely not fine at the moment.

Oil coming off 10% just in the last week was a pretty big sign that we do face a slowing economy up ahead. It doesn’t (rarely ever) mean dump equities. It just means you need to own the right things.

Speaking of oil, our exit on the FUEL trade was timely but I would like to see energy exposure added back in or increased eventually.

2023

As turkey season approaches we see ourselves moving into the time of year when strategies for next year are predicted. In relation to the above there’s a really good podcast run by Morgan Stanley called Thoughts on the Market. They recently ran through their 2023 outlook and it’s very much in line with my thinking.

Here’s a link to it with the transcript so you can skim the notes instead of listening to the whole thing. Andrew Sheets is the chief cross asset strategist for Morgan Stanley so has a great way of tying a lot of ideas into specific themes.

One of the key themes was adding to the bond portfolio with an allocation to high grade credit:

“So we think of high grade bonds as a perfect example of an asset class that cares quite a bit about interest rate uncertainty while being a lot less vulnerable to the risk that the economy slows.”

Along with credit they also mention…

“Something that links all of those themes is that both US defensive, equities, banks and energy in Europe, and tech and semis and Asia, they’re all quite high yielding sectors.”

Specific ways to access these ideas would be CRED, the Betashares corporate debt ETF and F100, an ETF holding the FTSE Index, again the Betashares and allowing you to access some great European names listed on the FTSE.

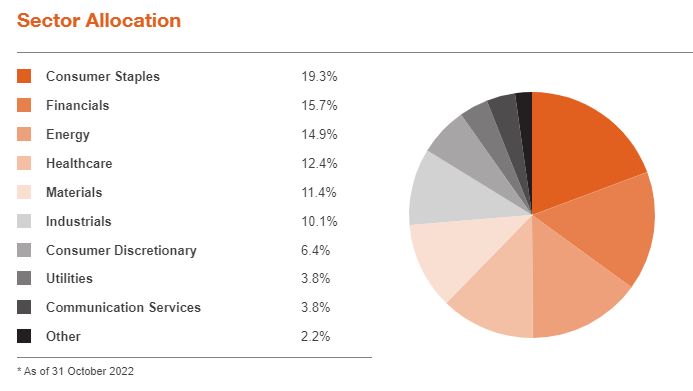

It has a great mix of financials and energy.

We already own F100 so I’ll be looking to add to it on dips. CRED is one we used to own and it may find its way back into portfolios soon as we look to complete the goal of creating 60/40 portfolios for 2023.

I still believe a simple portfolio of local and international bonds and quality equities will outperform what should be a choppy 2023.

Invest accordingly.

Stay safer and all the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.