FREE WHELAN: It’s a recession. The indicators are true. And I checked Crows Nest Vinnies.

Depiction of Saint-Vincent de Paul in Trinity church. Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good afternoon… or good morning,

…largely depending on how quickly Christian can edit this in France and send to Reuben who gets a look in Denmark, W.A. before Peter hosts a 3 way zoom from Launceston beginning with the words, Where’s Whelan been this week?

I have the answers.

And. Pls note:

Am hosting a Global Outlook in a few weeks. Book a spot now and catch all of my views in a little more detail.

In more serious news, my thesis on the Aussie recession we’re currently experiencing was well received. As well as it could be received considering it’s an awful reality most of us must now face.

Beware the anecdotal evidence but I popped into Vinnies on Sunday looking for a tea strainer (mine has been left in a different location) and I’ll tell you that for a Sunday late morning Vinnies at Crows Nest was packed.

Keep in mind I have nothing to compare that to and only rarely do I duck into Vinnies and even then it’s to get old beer glasses or discarded trophies for us to play for in golf comps with the guys. (Clothes should be left alone for the most part, especially suits and shoes which should be left for those people down on their luck or trying to get back into society who may need them for a job interview.)

The anecdotal evidence I just offered above is a prime example of confirmation bias, one of the key psychological tricks to which investors often fall.

Once you have an idea in your head all you can see is things that agree with it. Note that just because I put a string of evidence together it does not mean it’s correct. As pointed out on the podcast on Friday by Heath Moss.

Listen here to hear the other side of the story…

Because if you pay attention, you’ll see some conflicting evidence from the same place.

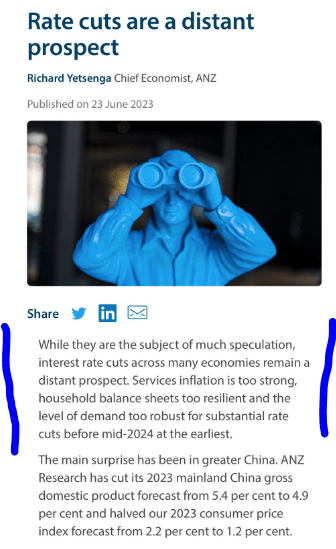

Here’s an example from the Head of Economics at ANZ taking about rate cuts being a long way away because household balance sheets are too resilient etc.

This is the same bank that put out the note highlighting declining year on year credit card spending across dining, groceries, travel and shopping.

So I’ll leave you that to stew over.

Card spending on certain things is way down but apparently household balance sheets are resilient.

Maybe card spending is down because your credit cards are maxxed out and you need to raid the resilient household piggy bank to buy food?

But I jest…hopefully.

Either way there’s two key takeaways: stay well clear of consumer discretionary because even if household budgets are resilient then people are making the active choice to cut certain things out of their lives. The other message is that none of this matters since Dr P. Lowe will not be the RBA Governor for long so his last chance at a legacy is to absolutely be the one to put rates so high he, and only he, will be the one credited with finally getting inflation under control.

His future (Ed: eye-wateringly bland) speaking events and board seats depend on it.

Indonesia

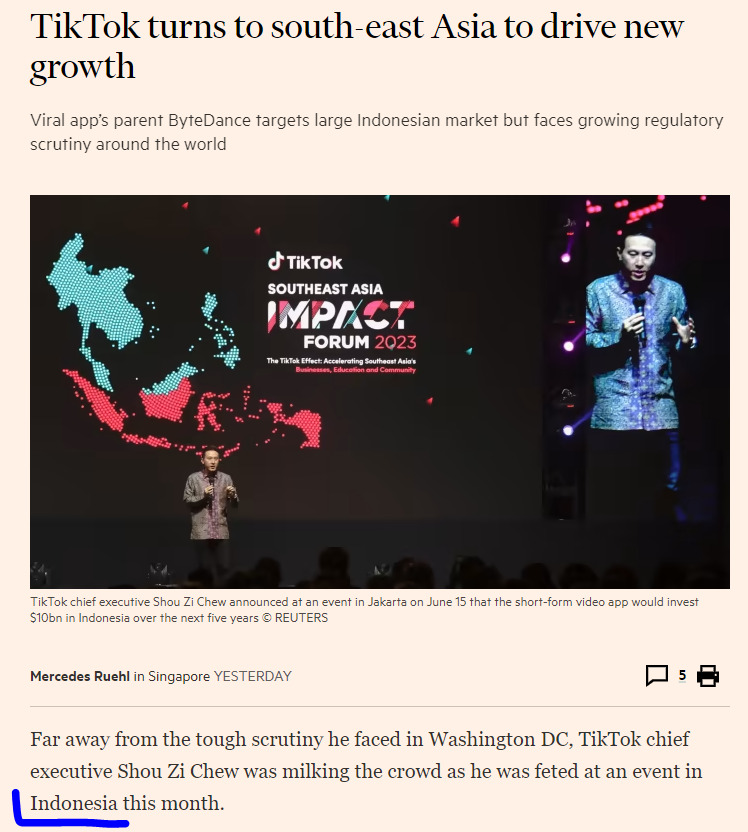

Funny thing that happened last week and related to the confirmation bias mentioned above. When I hear something mentioned a few times I tend to prick my ears up because it means there’s a trend forming somewhere. So when I see this about TikTok targeting amazing new things in Indonesia:

Compare that to these comments from Morgan Stanley’s podcast two weeks ago. Partial transcript below:

“And so you’ll see a cyclical boost to Asia, coming out of China. Layer on top of this our structurally bullish views on economies like India and Indonesia, where there’s a medium term, really positive note, you have all of these coming together, and it sets the stage for Asia really to be an engine of economic growth.”

And…

““India has been also implementing structural reforms over the last five years … that’s driving private investments higher,” Ahya said.

He predicted that India’s growth will come in at 6.5% in 2023, superseding International Monetary Fund’s forecast of 5.9% by 2023.

Indonesia’s implementation of orthodox macro policies has also reduced the Southeast Asian nation’s inflation structurally, the economist said, attributing it to the government’s commitment to keep fiscal deficit under 3%. That has led to Indonesia’s public debt to GDP ratio being one of the lowest in the emerging market space at under 40%, he said.”

You’ve got Morgan Stanley mentioning Indonesia alongside India as an Emerging market’s potential powerhouse and you’ve also got TikTok, the most popular app in the history of anything with all the marketing and media they have access to, deciding Indonesia is the place to get aggressive.

There’s something there.

Noting that economies aren’t markets, the Indonesian market does trade on 12x P/E ratio and 1.9x Price to Book. The best way to access is via the iShares ETF EIDO.

Just on a watchlist for now but still an emerging market to keep alongside India, of which I am still favourable.

To finish off here are some worrying charts…

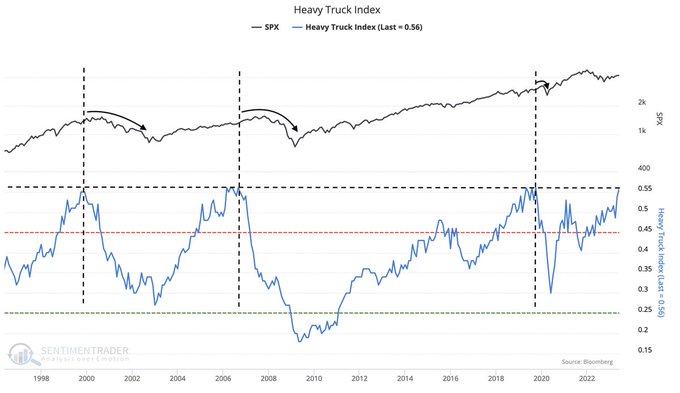

The Heavy Truck Index is approaching toppy levels which does happen to coincide with equities selloffs.

This last one is interesting and gives some real fuel to my argument in favour of the 60/40 portfolio this year.

One of the basic rules of investing is if there’s two assets with the same returns then choose the one with less risk. And if there’s two assets with the same risk then take the one with the higher return.

In short you don’t need to hold as much risk to gain yield in the US. These are serious things to consider.

Not able to be covered here today but I am bullish the USD. In short the Fed will keep doing its job and growth currencies like ours will struggle as the reality of sluggish global growth takes hold. Staying invested means a switch to unhedged ETFs to benefit from any currency upside.

-

Long USD – switch to unhedged

-

Stay long bonds

-

Long India

-

Long quality

-

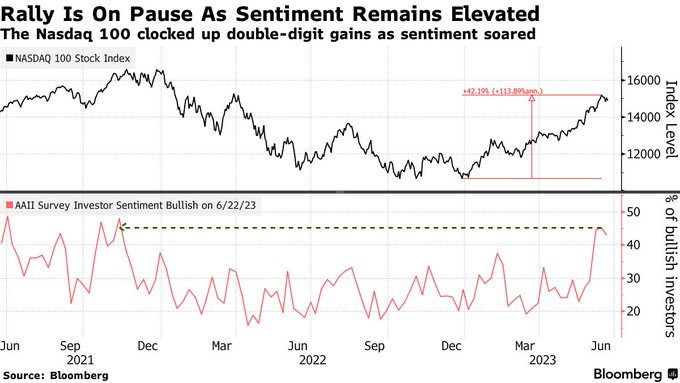

Underweight big tech

-

Very hesitant the Aussie market for now

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.