FREE WHELAN: If you believe in the AI thing long term then this is the ETF for you

Via Getty

In this Stockhead series, investment manager James Whelan, managing director of Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

It was a wonderful podcast recorded on Friday last week with lots to take into this week. Earnings – really ramping up with more of the Mag 7 telling us the scores and commodities looking a little sketchy.

You’ll find the link to that podcast at the end of this article, by the way.

But a funny old week it was. Seemed like lots going on but not much going on. But beware geopolitical events, too, with the Olympics now in full swing. The Opening Ceremony organisers must have been hoping for anything at all to take the attention away from whatever most of that was. I had my parents down for the weekend and spent an evening on the couch watching the first events with mum.

Watching Olympics is great because every four years you get to tut-tut at the absolute best athletes in the world while drinking wine in your house clothes.

Mum is reading this so knows that I was keeping an eye on the clock to see how long it would take for the Couch Commentator to chip in.

About 1 minute 45 seconds into the dressage part of the equestrian and she picked up a sluggish transition from canter.

That’s not a bad time.

My wife arrived home, poured a glass and sat down while we had the men’s gymnastics on. Took her about 18 seconds to comment that a gymnast had underdone his launch off the vault.

Just phenomenal areas from my couch. But we love the Games and will have the TV locked on for the full two weeks. Having grown up with just one channel, which would spend the first week on swimming heats, I love that we can find some more obscure sports (in which to obviously become instant experts).

Now on with the show…

It was a well-timed article last week on stretched market valuations with the S&P 500 taking a bit of a hit.

We look to the Nasdaq 100 Index to find our entry points and if you go back to 2017 there are some key points to keep an eye on.

So… borderline corrections for the big end of the Nasdaq while small caps still remains relatively robust. Some reasoning for why this rotation for bigs to smalls is so impactful appeared in a Goldman Sachs “Is the Big Tech Trade Over?” podcast I was listening to in the gym over the weekend:

“Just to give you a sense of the size, because of the huge market cap concentration, if just 1% of assets comes out of the S&P 500 and flows into, for example, the Russell 2000 small cap index, that 1% of S&P 500 market cap would represent more than 15% of Russell 2000 market cap.”

They go on with something about dip buying, too:

“If you look historically, an investor who just closed their eyes and bought the S&P 500 when it dipped 5% would be higher three months later, about 80% of the time.”

Both quotes attributable to Ben Snider, senior strategist on the US Portfolio Strategy Team at GS.

Earnings

We have monstrous weeks ahead for earnings as AMD, MSFT, META, ARM, AMZN, APPL and a host of other tech names.

A great expression came out of the Commsec morning report – when it comes to these big names and their Artificial Intelligence gains the “tell me” phase is over and the “show me” phase is upon us.

So true.

Big question marks continue to appear over where the benefits of all this expenditure on AI is going to be found.

It’s hyperbole, but this summarises where we are in the adoption cycle.

You’ll see the lack of new trade ideas in this piece because I’m recommending the same as last week.

Continue to hide in small caps until the coast is clear then push back in to the big end once you’re sure it’s safe. A lot of that is gut check country, so stay tuned for more updates.

Anyone who has been reading my nonsense for long enough knows how much I loathe intra-day analysis on company reporting because I’m a long-term guy.

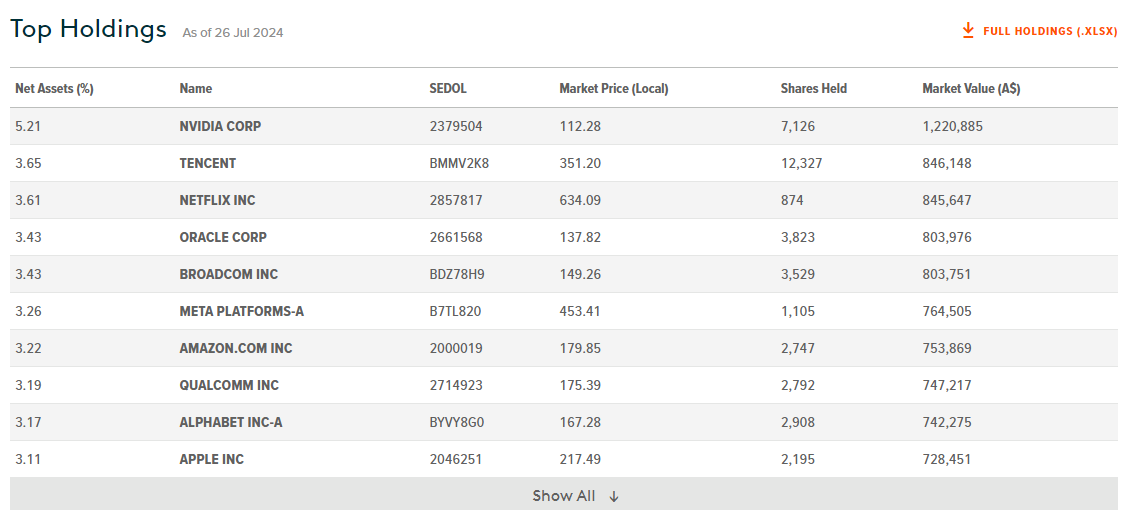

If you believe in the AI “thing” long term then the ETF for you is Global X’s AI ETF.

Stock code is GXAI and it invests in the companies most likely to benefit from the AI boom. I personally would like to see this a little more tailored to the smaller end that will benefit the most but it is what it is.

Speaking of long-term issues…

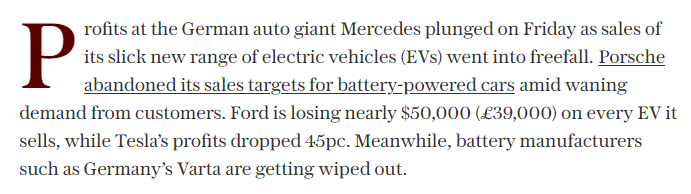

The façade of EV is starting to crack.

This is a paywalled article by the Telegraph in the UK but here is the first paragraph:

My gosh.

Here is the link, but essentially the years of taxpayer subsidies to prop up a whole forced industry is starting to come undone in Europe.

China will own the market and Europe can’t compete.

Some things to end on while we ride out earnings – wait for the geopolitical escalation in some part of the world, call out minor errors in elite athletes while we’re in our track pants on the couch, and I’m in the mood for saying “enough is enough” on the waste of space and money being misdirected in the EV goose chase.

This is, according to the US Office of Nuclear Energy, 20 years of spent nuclear fuel from the former Maine Yankee nuclear plant. That’s it.

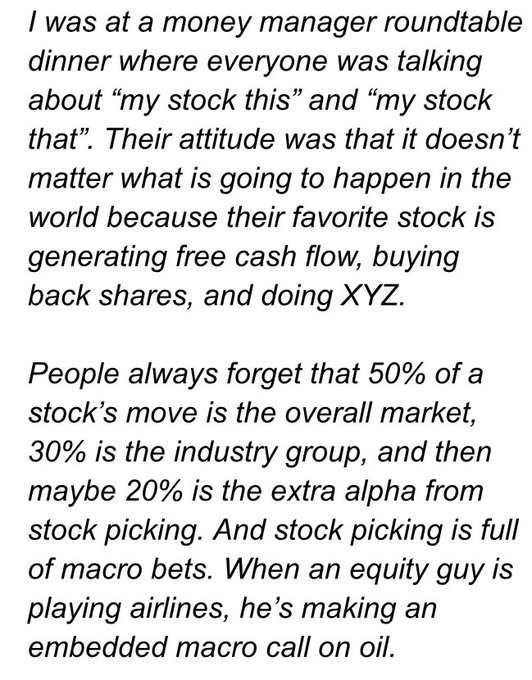

And finally, one great tip on why your stock is going up – by one of the all time greats…

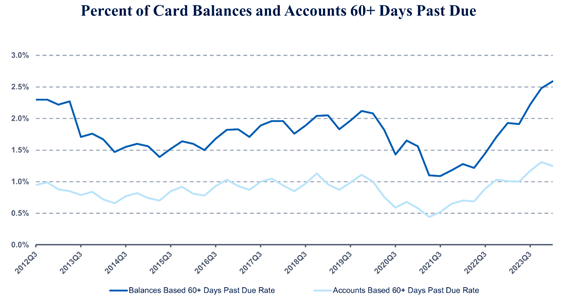

Finally, finally – the US is now 100% going to cut rates in September and here’s a chart telling you that there’s more strain in the consumer than many would have you think.

This goes back to 2012 so it’s not a nothing chart.

Stay safe and all the best and go Aussie!

James

Theory of Thing podcast > Listen here for all the market news you need.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.