FREE WHELAN: How green the grass is, according to Australia’s new Prophet Margins

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good morning and I’m keen to announce that we are so back.

By that I mean that my weekly note is so back after a hiatus over the long break.

And, whilst I am always logged in and contactable, it’s good to do that from somewhere with fresh green king prawns off the back of the fishing boat and beef in the evening.

Speaking of which, here is the annual shot of one of our newest members to the farm.

Bullish (ha)

But there’s another reason I post this and it’s to show you (proudly) how green and thick the grass is in East Gippsland. Driving back and forth to Sydney you notice that the situation is the same everywhere.

Which is great.

What’s not great is talking to the farmers down there (as is my job to do) because you hear that same frustration at the number of financial decisions that were made in 2023 based on the forecasts and predictions by our Bureau of Meteorology.

Remember the prediction was for El Nino to kick in and for the drought to start fairly soon. (I’m paraphrasing. I apologise.)

Decisions were made and they have been early.

I’d like to see an inquiry made into the decision that was made to see if it was 100% made based on the data. If so, that’s worth further investigation.

If not… well you see where I’m going here.

Either way people are a little upset that the source they rely on was so wrong at such a vital time.

How vital?

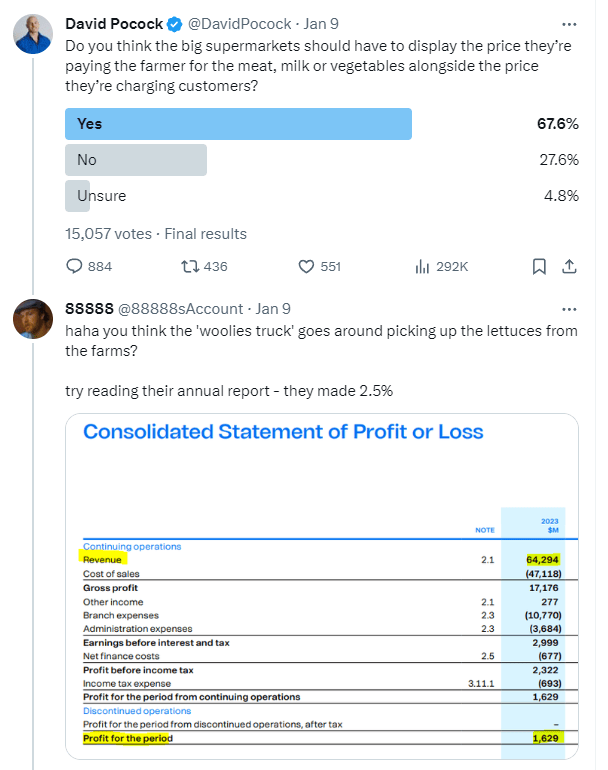

Australia is caught in some bizarre war against the supermarket giants regarding the price of food.

There’s financial commentators and politicians out there saying Woolies is making too much from food and that’s impacting what we pay in store. In fact Woolworths’ (ASX:WOW) margin on food is about 2.5%.

Interactions like this kept me company in early January.

Lotta folks became experts on food logistics and profit margins. Which is a change from geopolitical experts and before that, infectious disease experts.

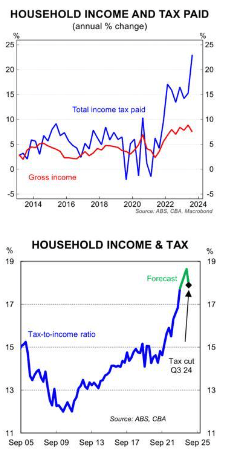

This chart doesn’t lie. In fact, it’s scary and comes from the office of the always excellent CBA Head of Aussie Economics Gareth Aird.

Food costs as they are… that blue line… I think there’s more rate cuts this year than priced in.

EM Call

In our daily note last week I put in the case for China equities with an ETF to match it. CETF by Van Eck to be exact. I think the flows are there. Not to go over it again but the risk/reward for China exposure was too good to ignore.

Here’s a link to our report (with my part at the bottom) explaining it. I still think it’s worth a look.

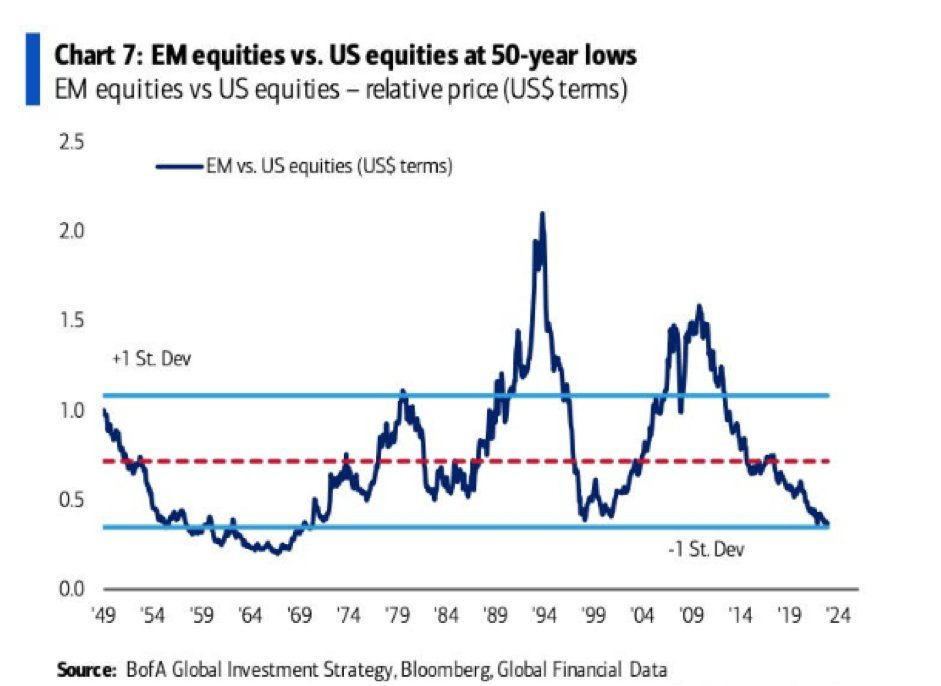

Speaking more broadly on EM and late last week two charts sing straight out of my psalm book.

Cheap and strong flows? Yes please.

And:

Don’t fight the flows.

Finally, this happened…

Bitcoin was finally approved to be in an ETF so everyone thought this was going to up the flows into the original coin.

It’s really just been an already priced in transfer from an expensive structure (Greyscale) to cheaper new ones.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.