FREE WHELAN: Has the US economy hit the ‘Goldilocks zone’? No need to be bearish if so

Pic via Getty Images

In this Stockhead series, investment manager James Whelan, managing director of Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Hello one and all… it looks like we are continuing our way forward re markets.

I’ve had some things come across my desk regarding allocations and potential changes in the face of recent events, so I thoughts I’d write a little about that.

We have hit what some would call the “Goldilocks zone” in the US.

Inflation coming in a little weaker than expected and the consumer still strong. Company reporting still great and the world has changed a great deal from the concerns of a few weeks ago. And Goldman has dropped its recession risk from 25% to 20% as well. Good areas.

We discussed this on our podcast recorded on Friday (see end of this article for link).

But that’s why you don’t panic – like this guy…

Ten out of 11 S&P 500 sectors have shown year-on-year revenue growth for the second quarter of 2024.

Economy is great, companies are great, the presidential election cycle is doing its usual thing.

The backwards looking part of the latest BofA Fund Manager Survey is showing exactly what happened during the moves of the BOJ shock.

Long bonds into the cutting phase isn’t the worst idea, either.

The 60/40 is a sound place to be allocated for just these reasons.

Of note, too, in the FMS, “Soft Landing” expectations at 76% with “No Landing” back down to 8% and “Hard Landing” at 13%.

And that’s probably problematic because when everyone agrees… that’s when bad things happen.

Meanwhile, China

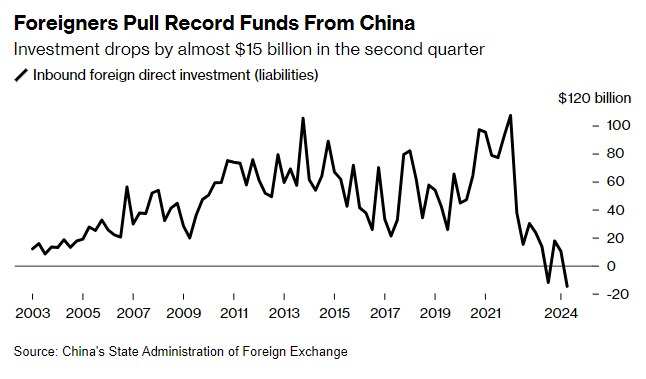

And China, it seems, is not amazing from an allocation point of view. These took over the headlines early last week and should not be ignored.

As most people know, I prefer India to China and allocate as such.

I see…

Leverage

In the absolute low of the carry trade unwind crisis I jokingly searched for the worst possible thing to load up on for a high/high return/lose your house conviction trade.

I discovered the 5x levered Magnificent 7 ETP, trading in London and Milan in a variety of currencies. If the Mag 7 goes up a per cent, you’re up 5, same on the downside.

Do not touch these with a barge pole. Leverage and panic is how money goes from retail to insto so often.

That being said…

“We see the LEVERAGED ETF space’s cumulative 5d rebalancing as the largest 1 week ‘BUY FLOW’ in the history of our data at +$34B of buying across these awful products in the past five sessions.”

– per (market analyst) Jesse Felder’s newsletter this week.

Do not touch these things. Please, people.

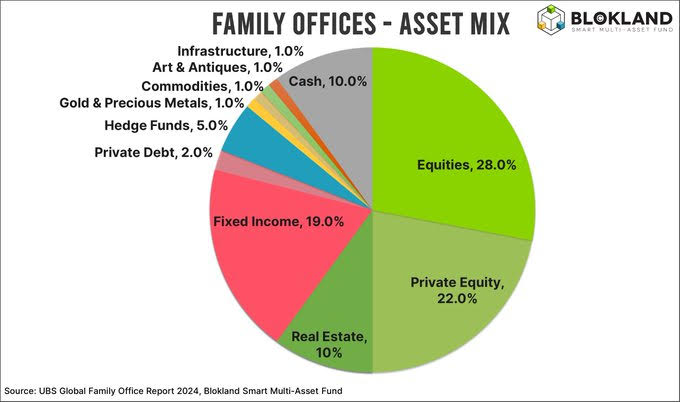

And the final word on allocations comes from the UBS Global Family Office Report, showing the current mix across assets for family offices.

That gold allocation is too low in my opinion and 19% for fixed income seems lower than it should be. Private Equity is a great way to have holdings that can be marked to valuations of anything you want that’s not the actual market, too – hence its appeal.

So that wraps up my little look at the allocation dust settling after the shock of the last few weeks.

Act accordingly.

Now for the fun stuff

Self driving cars don’t know what to do when there are no literal adults around and the dystopian future we all know is coming is painfully funny, and noisy.

Self Driving Waymo cars are stuck and are honking at each other during the night in San Francisco

The future is here … and it doesn’t let you sleep quietly. pic.twitter.com/IE3RgmImAc

— Lord Bebo (@MyLordBebo) August 14, 2024

All the best and stay safe,

James

Theory of Thing podcast > Listen here for all the market news you need.

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.