FREE WHELAN: Goldman Sachs’ Five Laws for Copper and Gold Insanity

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good afternoon and welcome to June following an amazing May.

We are also now just over a month away from our Australian Investment Summit in London, working with the LSE showcasing some great companies to the UK market.

Big shoutout to the “Sell in May” crowd for successfully getting it wrong again.

This is why rhyme-based investing is stupid. The US market just had the best May in the last 10 years.

What usually happens then?

Usually (doing all the work) markets are up if May is strong. Funnily enough you can say that about most months, because the market is usually up.

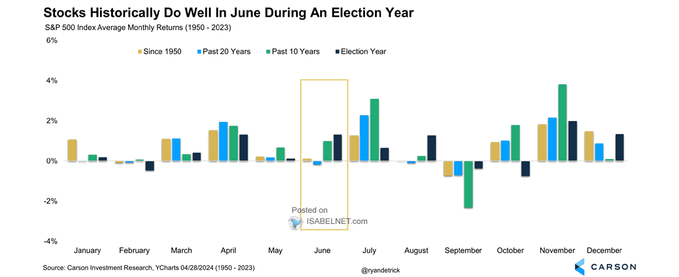

In an election year June is usually up more than usual.

Usually. (See below…)

Exhibit Arggh

Also.

This is why you don’t be short into month end when the tails are up.

Critical Minerals

I spent the tail end of last week at the Australian Critical Minerals Conference, seeing some great speakers and making some new contacts.

I came away with some interesting titbits that have been cooking away in my little brain. I cover these in the Friday Podcast.

The first came from the CEO of the WA Chamber of Minerals & Energy, Rebecca Tomkinson, regarding the logistics behind building the WA government’s wind generation policy. I’ll try as best as I can to relay it easily.

There is 350 gigawatts of power generation proposed by WA through wind, including their hydrogen policy.

Each gigawatt of power needs 170 wind turbines to generate.

Each turbine requires 12 escorted truck movements (big truck, cars in front, power lines need to be shifted etc).

That means to meet the target there needs to be 306,000 escorted truck movements.

Leaving aside anything we already know about how much copper, steel and everything else we need to build the turbines, dwell on the sheer volume of diesel required to shift them into place.

The other interesting note was about neodymium, used in most EVs.

90% of NdPr (used in EVs – magnets etc) is produced by China.

Most of their concentrate to make it is sourced from Myanmar. Unless your EV is Japanese (they source theirs from somewhere else) you’re almost certainly assisting some very ordinary things in that part of the world.

Speaking of China

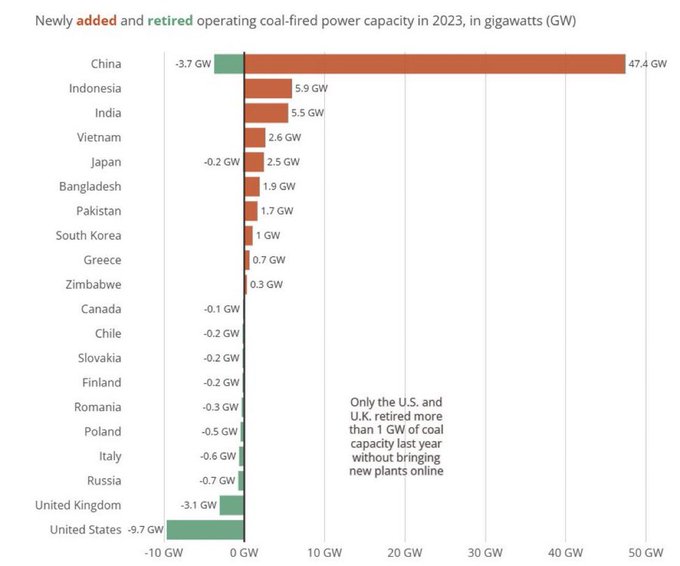

China, adding to renewables… which would be great if you’re into that kind of thing.

But then also… not.

They’re still adding to coal.

We need more power and it can’t be wind.

That’s assuming we’re going to move in the same direction as the rest of the world re data. Remember last week I spoke of the demand for data centres being way underestimated.

Larry Fink, BlackRock CEO at the WEF in Riadh a month ago dropping truth.

“The world is going to be short power, short power. And to power these data companies you cannot have just this intermittent power like wind and solar. You need dispatchable power because you can’t turn off and on these data centres.”

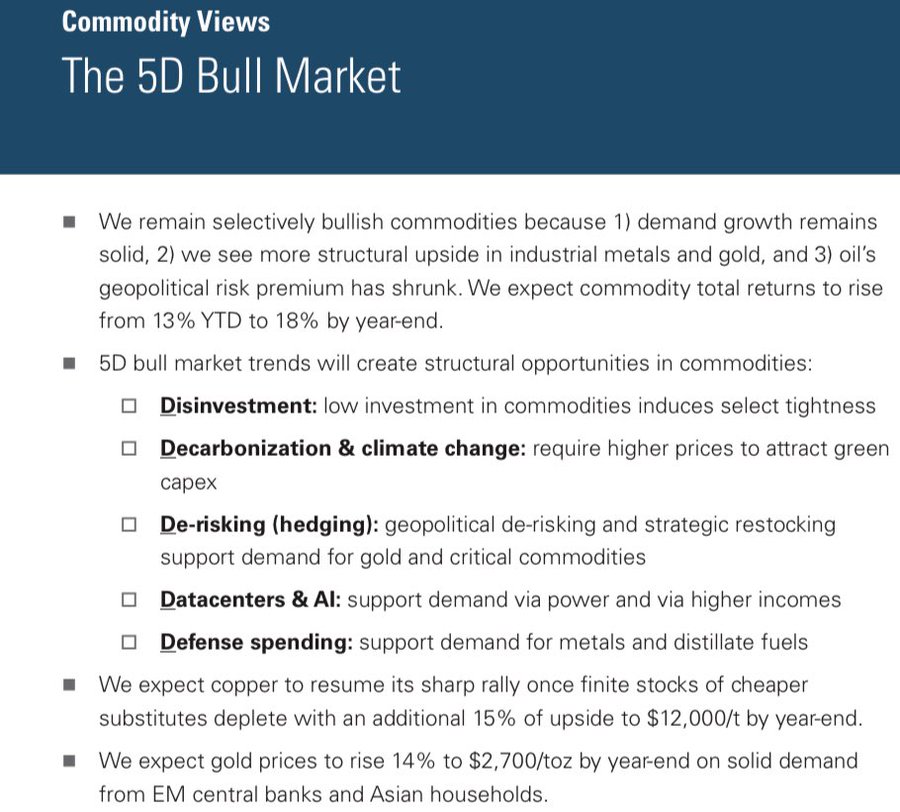

Copper, quick reminder of the Goldman Sachs “5 Ds” and why copper is gonna copper.

Data Centres are on the list.

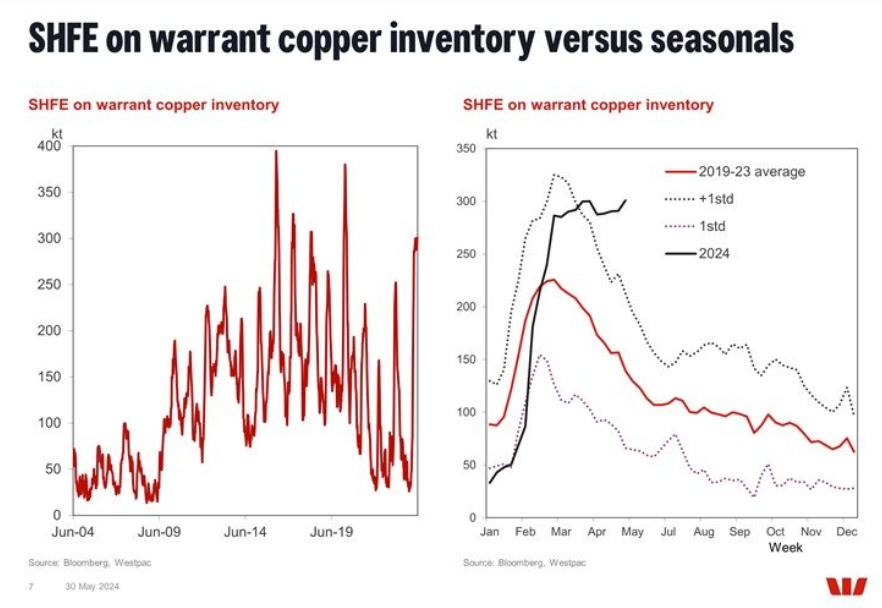

But don’t charge in when inventories are high. How high? Over a standard deviation above average high.

This was posted by head of Commodity Strategy at Westpac Rob Rennie last week:

All the best and stay safe,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.