FREE WHELAN: Fifty Shades of White, why rate rises don’t work and why this Indian ETF does

Via Getty

Mid-September already and we maintain the rage on not being too exuberant on markets when they rally and not being too bearish when they don’t. The image of the snake eating its own tail has appeared before me a few times this month (Ouroboros is the name of the symbol) and I think it’s relevant.

The good and bad outweigh each other. Growth and disintegration etc…

You get the idea. Heath and I have a very good go at summing it up on the poddy.

Symposium and MMT

On Wednesday I attended a seminar (it was actually a symposium) on defensive assets. Some great speakers were lined up and it’s a chance to get off the screens and hear some great big picture points of view.

The speaker of the last presentation of the day is always hard. Everyone’s tired, most of the ideas have been repeated and the energy can be a little glum.

The speaker on this occasion was Professor William Mitchell, Economics at Uni of Newcastle.

He’s the co-father of Modern Monetary Theory.

Remember when that was all the rage during the pandemic?

Then suddenly everyone’s rent, groceries, air conditioning and groceries went through the roof because of all the money printing that took place to keep us at home.

Reap what you sow.

Anyway… the classically stereotypical Professor (stumbled on stage, almost dropped handwritten notes in a little book he was reading from, trouble removing his mask etc) did actually spill a little truth.

One was that the RBA and our Government should have just let it be with regards to inflation and whether or not it can be muffled with rate hikes.

The reasoning was simple:

“I could have told you it wouldn’t work. In fact, I did.

“Imagine the property owner having their rate increased? How are they going to afford it?

“By increasing the rents on the places they own. Then the tenants at the places they own have to pass that on and inflation actually gets WORSE because of rate hikes, instead of better.”

– Professor William Mitchell

Doesn’t get any simpler than that.

If anyone wants to hear his answer for what he would have the RBA model look like please send me a note.

Thanks to Inside Network for the invite to attend. I had a great time and many canapes.

CPI Week

In the States we have US CPI which will again be a great way to tell if the world’s largest economy is going okay enough to not be in a recession but not so OK that prohibitive rates are still needing to be raised.

Getting down to 2% is going to be a task though.

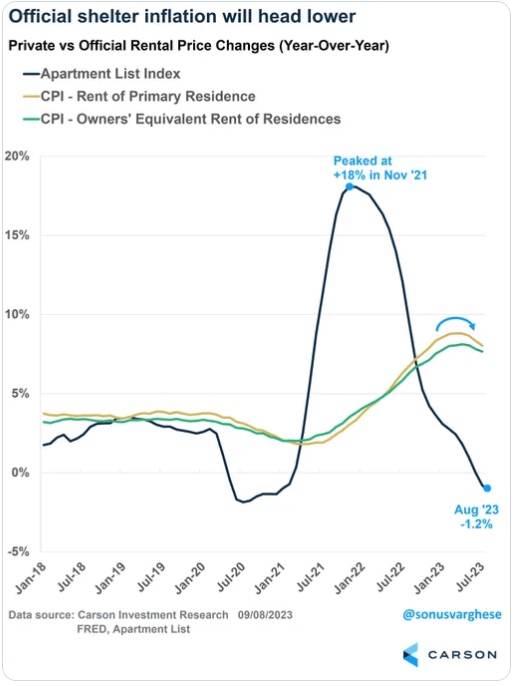

As before I think the numbers should be OK – taking out food and fuel from said numbers. Rent continues to drop and that’s a big part of it.

“Rent prices down 1.2% YoY, after a peak of 18% in Nov ’21. This has been a clue that rents and owners’ rent equivalent would be weaker later this year. Shelter is 40% of core CPI, another clue the Fed is likely done hiking.”

India

India hosted the G20 just this weekend and they did it well. Another little signpost for my amazing prediction of India being the best investment you can make this year if you want to sidestep the soft landing fan dance that is Central Banks setting monetary policy.

This chart of the Indian ETF by Global X is truly a thing of beauty.

More on Food

It looks like the world is ready to declare El Nino officially open, if not already done.

Google “El Nino” and you get the four main personality types at the moment.

- The Oz is talking about farmers

- The ABC always have to make it about climate change

- The Atlantic cares about what happens to America

- And Marie Claire recommends breezy layers with lots of pastels to match the weather. (I look good in light blue so I’m already set there, thanks MC)

- Rice continues to be in shortage as more countries lock exports down

- And olive oil is getting crazy out there

This is bad news for people like me who love a shot of the stuff when they’re cooking pasta, as well.

Courtesy Dmarge, which also ran an article about Spanish olive oil getting half-inched and why it’s so expensive. (In short: drought and inflation or a blend of each. Article here)

Food inflation and actual oil heading back to $100. Things are not OK in the real world.

There’s a reason we are positioned as we are and it’s because of the above.

Finally…

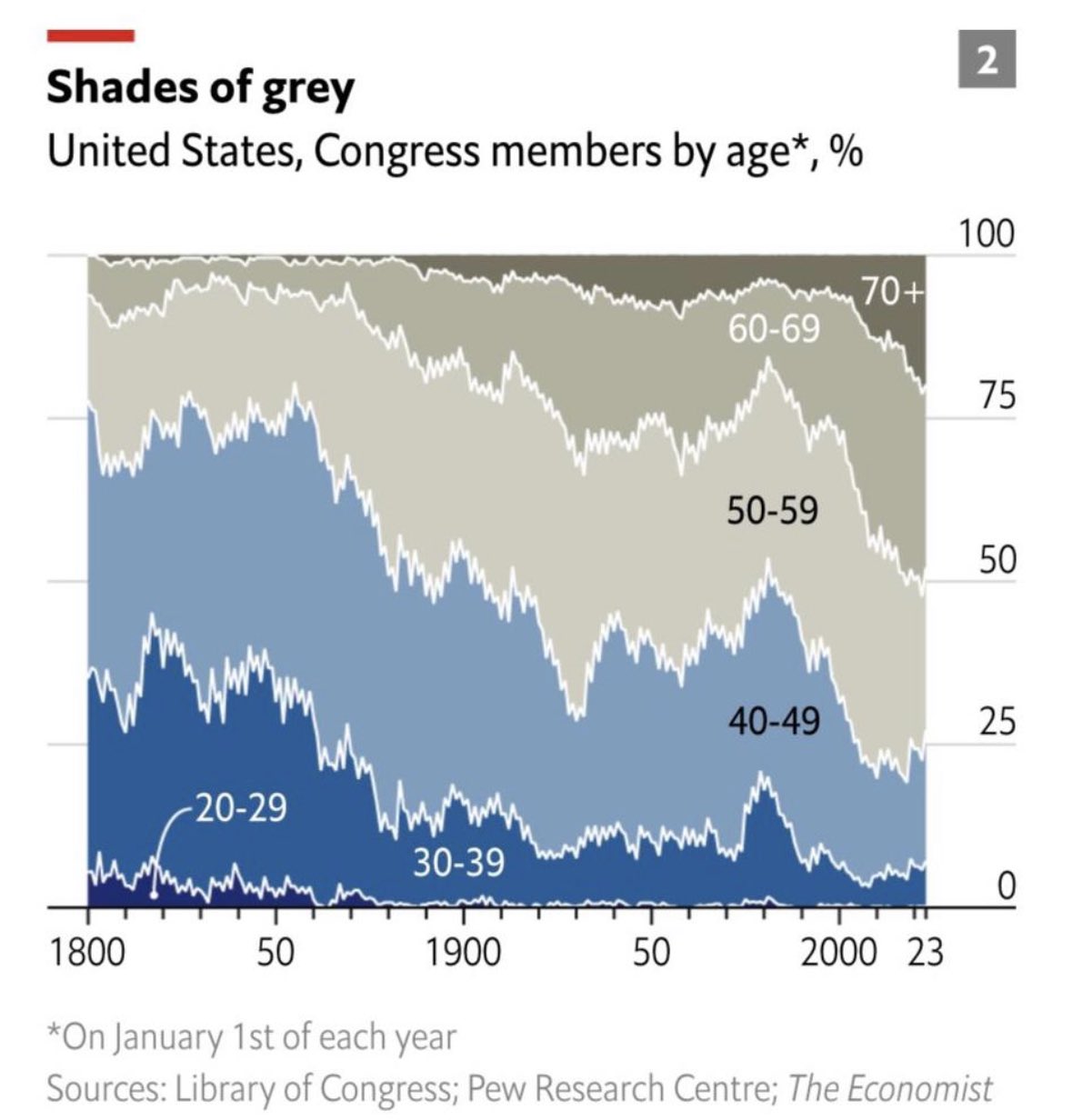

This is amazing to see… (below) showing the age of Congress members in the US.

No comment. Short note because it’s a full week ahead.

All the best,

James

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.