FREE WHELAN: Crony Capitalism continues. Stay the course on oil.

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Wow what a weekend that last one was. For a while there the banks in the US collapsed and it was GFC v2 awaiting us on Monday morning. I was getting flashbacks of those days with the 24-hour news flow bringing the worst updates imaginable.

Everyone in finance remembers where they were when the news hit and, I’ve told this story before, but it was a fascinating time… so I’ll go around again.

It was back in 2008…

I was on well earned 2008 leave with my beautiful wife and stopped at Dubai on the way home from Europe. I was a simple trade support lackey at the Investment Bank division of UBS but with ambitions to move to the front office eventually.

I fell in love with Dubai immediately.

Right time zone to capture the bridge between Aussie and European clients, favourable taxation, favourable business startup, lots of expats earning money and holidaying there.

Perfect place to set up a little office of the Wealth Management arm and help people invest globally. As long as you stayed inside you were fine.

I was even drafting a proposal in my head for how to make the switch.

We were about to head down to the pool when something flashed up on the TV (I had Bloomberg on because there were a few things going on in 2008 financial markets).

“Something, something Lehman something loss, something. Something US$3.9 billion dollars.”

I texted the boss to see what the mood was in Sydney particularly since it was known how badly UBS were attached to some of these things.

From memory his response went: “Bank is stuffed but we’re ok. Hurry home.”

I went home, booked out 10% of the market every day in 14-16 hour days, watched the world burn and never went to Dubai again.

Dream over.

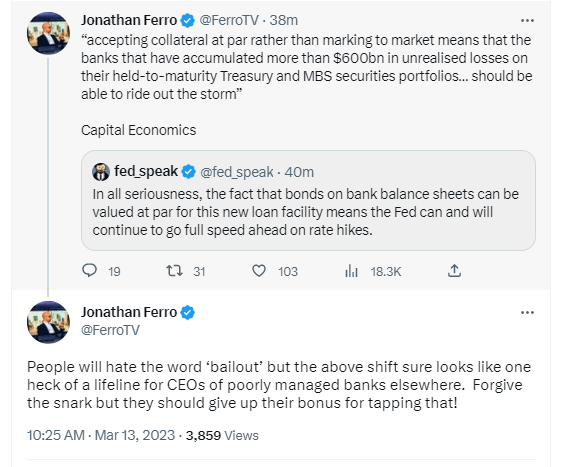

The previous few days’ events weren’t the same but is sort of a Clayton’s bailout in the way the Fed will be valuing banks’ bond holders at par. I won’t go into the details because there are other things going on, everyone else is writing about it and it’s also a moving feast.

Jonathan Ferro of Bloomberg TV has summarised it best:

It’s sort of a bailout.

I won’t be changed on this view.

Crony Capitalism continues. They bailed out the banks in the GFC when their risk wasn’t managed, then used the same formula to solve a health crisis (bizarrely) and it looks like they’re still going the same way. Risks were taken and banks are getting excused. I’m tired of arguing about it.

The only difference is that this won’t change the rate trajectory in the US. Higher for longer for sure. Just a little slower than before.

Here? I’m a coin flip that the RBA raise in April. That’s some relief for mortgage holders.

Now for an idea…

This week I’m all about Artificial Intelligence.

Sometimes you set aside a weekend to really dig into a subject like the requirement for vast arrays of digital infrastructure but then you’re staring down the barrel of a global financial crisis and your attention gets diverted.

Truth be told I was absolutely gunning for an opportunity to buy the US banks at generational lows but it looks like Janet Yellen has gone ahead and taken that opportunity away from me.

Once again and as usual all the panic for not much activity and things, on the whole, are fine.

You know it’s fine because this guy is doing this.

More updates later in the week but for now please listen to the podcast from Friday in which I interview Head of Commodities at the ANZ Daniel Hynes.

He’s bullish oil, and I am too.

Stay the course on energy.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.