FREE WHELAN: Bullish USA

Via Getty

In this Stockhead series, investment manager James Whelan offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Another week rolls on and we saw that we accurately predicted the RBA decision (ouch) but that I still haven’t picked a Cup winner since Delta Blues. I know which one I’d rather be better at predicting.

While the expression “let’s circle back to this in the new year” becomes more prevalent from this week onwards we remind you that the market remains open and for now, bullish.

As for Moody’s, not so much with regards to the USA.

Dropped on Friday afternoon and made some headlines. The US economy is an unstoppable powerhouse and should be treated as such.

This I found interesting and backs up the colossal bond purchases we saw through October. They’ve seen their highest weekly inflows since June. Happy to follow along there.

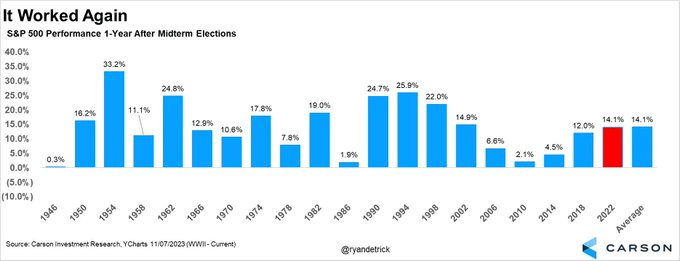

Now for the stats that matter. The S&P 500 has never been lower a year after the midterm elections. Which were a year ago. Since 1946 the average return on the market over a 12-month period following the midterms is 14.1%. How much was it up this time? 14.1%.

Remarkable. Stay the course.

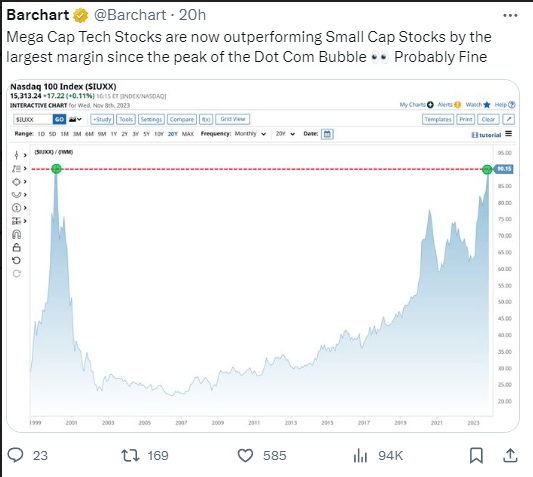

If you see anything like this then please don’t be too alarmed either. There’s always a set number of charts that various commentators will say “this looks ominously like 1987 or 2008” or something like that.

This is no different and you need to take this with a big grain of salt.

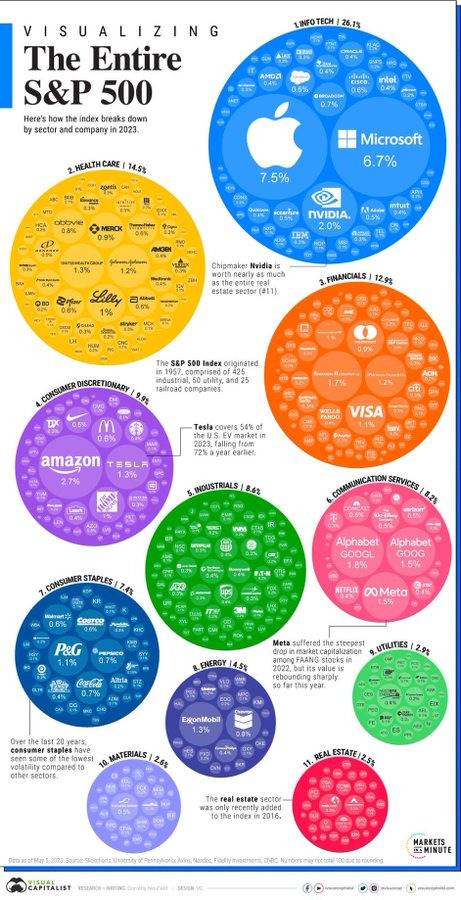

Remember that the paradigm of the “Magnificent 7” is different now (he says) based on the astronomical cash flows generated by those companies and the strength of their stock prices negates much of the traditional ways of valuing those companies.

Hence, in theory, the separation will become more pronounced. Here’s a visual map of just how big they are.

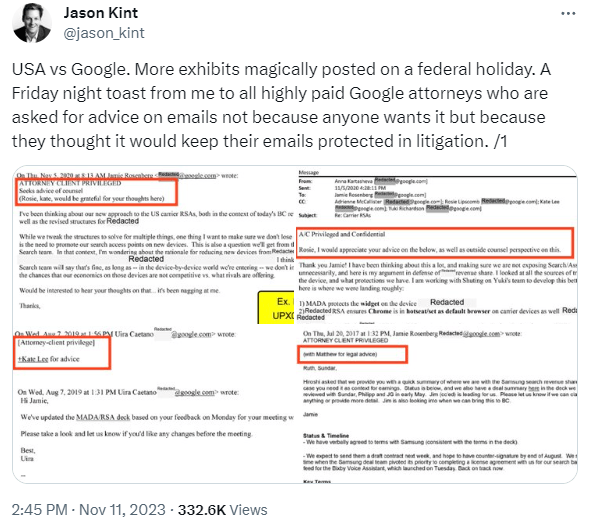

That being said, Google is going to be going through some things for the foreseeable future with the USA vs Google antitrust trial. As usual the best follow for this is Jason Kint on Twitter. He’s picking through every court document and finds some interesting things.

There will be a point to be back in Google but I think it may be more prudent to be light on it, particularly when Microsoft is right there which already went through its own antitrust back in the day.

That’s all for today with an unenviable schedule for me ahead. I’ll leave you with a link to the latest podcast which as always explains things better than I can.

All the best and stay safe,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.