FREE WHELAN: Bullish action in the US, but I’ll be Biden time till there’s a sign of quality Chinese marching power

Via Getty

In this Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

A note of housekeeping with the National Day of Mourning announced for the 22nd September. The ASX will be closed that day. God save the King.

Beginning with the “should you wish to feel old” of the day please note that the babies born on September 11, 2001 just turned old enough to buy beer in the United States.

The fact they were old enough to join the military three years ago tells you everything you need to know about that country too.

Note that the assistance they’ve given Ukraine has clearly helped, with continued reports coming in of Russian positions being abandoned through eastern regions of Ukraine following a Ukrainian counter-offensive to retake strategic positions which begun in August.

The Euro immediately jumped on the Monday morning open, but I’d be hesitant to chase that too hard. Expect Russia to respond proportionally to their level of desperation.

Also, remember, the war could end tomorrow and Europe doesn’t immediately go back to buying Russian gas, even if the taps are turned back on.

It DOES mean continued moves into alternative energy. Stay bullish nuclear.

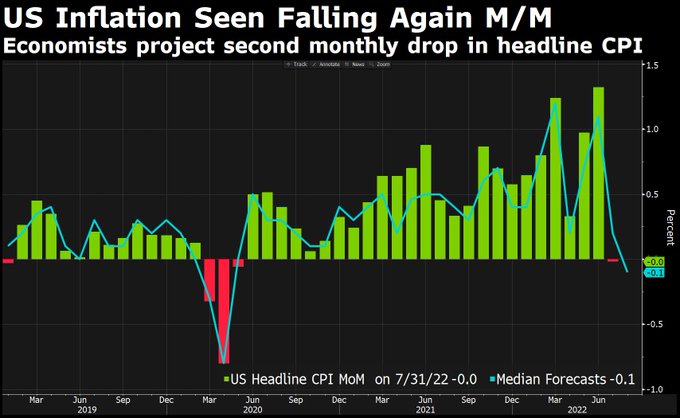

Coming up this week we have inflation numbers out of the US which will drop on Tuesday night and will again cause controversy for watchers of “is there inflation or not” in the States.

Month on month consumer price inflation is expected to be a little lower, mostly thanks to lower petrol prices. Year on year the expectation is still for an increase of ~8%.

So things are as expensive as they were 30 days ago but 8% more expensive than 365 days ago. When that second number gets closer to 2% the Fed will slow it all down on rate hikes.

Until then, 75bps of increase is a certainty next week.

Chinese marching power

The market absolutely seems to have taken this in stride with bullish action but I’m biding time on reallocation of funds until we have certainty out of Chinese direction.

They’re the fuel for the market fire into year end and I will not miss that.

Note that the 20th National People’s Congress of the Chinese Communist Party commences 16 October 2022 and is expected to see Xi re-elected as Gen. Sec. of the CCP or be newly elected as Chairman of the CCP, which hasn’t been a thing since 1982.

It’s a whole new level.

Re: Inflation

I’m happy to make a wild call that once the tide turns on inflation it will be a quick snap back to reasonableness.

Eg. 4 readings will show us 8%, 5%, 3%, 2%. Year on year. Mortgage rates are biting and big company hiring freezes will assist spending to decline.

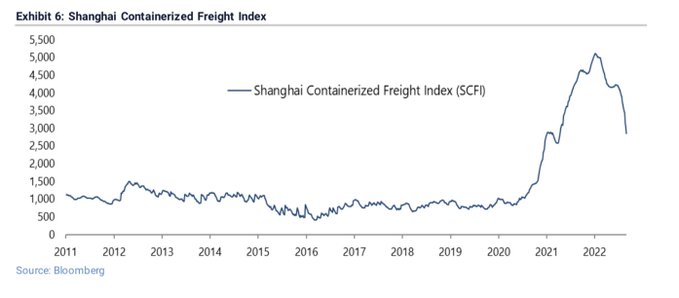

Shipping rates are already way down which was a big input cost.

For more on predictions and tech hiring freezes, have a listen to the podcast, recorded late last week.

Flows

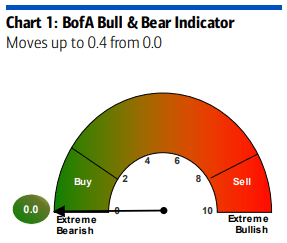

Two bits of research hit the inbox over the weekend. One from Bank of America and another from Jefferies and both on fund flows so far in September.

BofA showing that full bearishness has resumed with this:

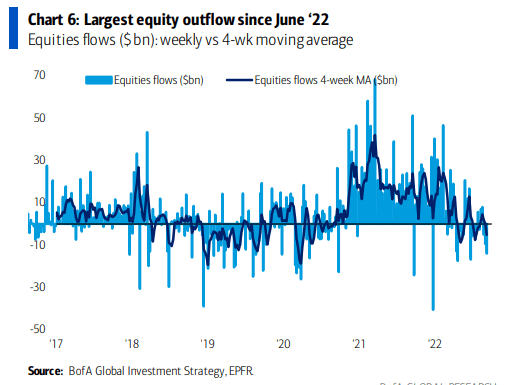

And the evidence on outflows continuing to trend downwards:

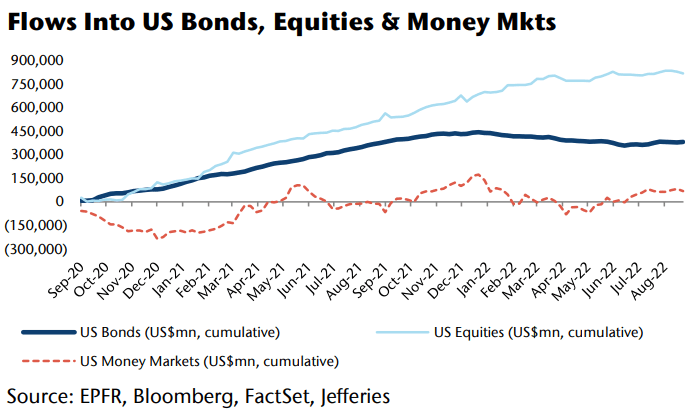

And we can see that over a long time frame equities flows have been coming off whilst the bond market is steadily receiving decent flows:

This does encourage my viewpoint to bring balanced accounts to the old favourite “60/40” portfolio (60% equities/40% bonds) by the end of the year before the first rate cuts start coming down.

After having its worst year since the 1930s so far, I believe the classic portfolio should perform admirably from next year onwards.

We bought and added to VAF (Vanguard Australian Fixed Interest ETF) last week and will probably add to it every month until the end of the year.

All the best and stay safe,

James

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.