Free Whelan: Boeing, Boeing… gone?

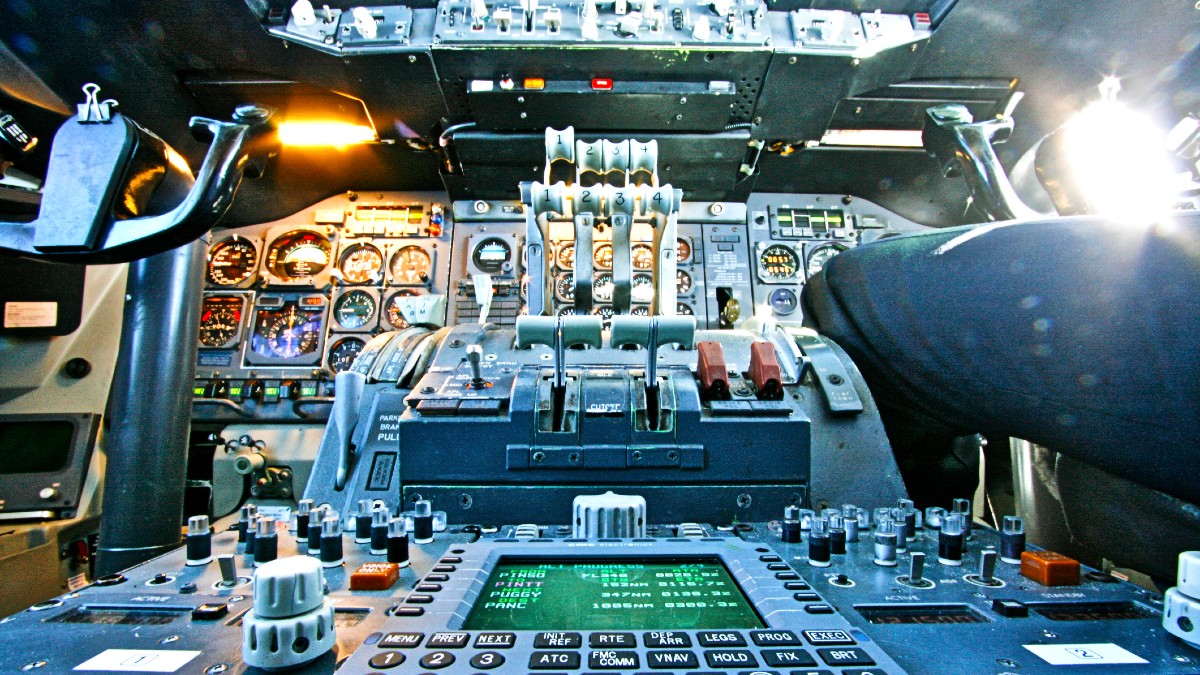

Via Getty

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Good morning and it’s so good to be back in the country I love.

Raspy and a little rounder, I can safely say that the US is nowhere near a recession, the NRL was a complete success, friendships were made and some new business to be done.

Vegas did its best to knock us down but us Aussies are made of stronger stuff. Also managed to spend a day in the Mojave and I’ll release my report on that at a later date.

A note that our NRL tipping comp is in full swing and as usual round 1 showed why I’m going to be keeping my day job. Isn’t it a great time of year, though?

Days getting a little shorter, that chill starting to come in on the evenings, footy on the TV in the afternoon. You can’t not love it. Join up here, still lots of chances to win.

Speaking of bravery…

The method in which I made it to Las Vegas from California was in the same type of plane and same carrier as the one who lost a door panel mid-air.

But Boeing… being Boeing… they can’t find the records for the door panel investigation.

On top of that a wheel fell off a 777 last week while taking off from San Fran (where we departed last week as well).

Remember in 2014 when Al Jazeera released hidden camera footage of the B-787 factory floor where workers were asked if they’d fly the planes they were building.

None agreed. Watch here from about the 24 minute mark.

Boeing does more than fly

If given two choices I’d have to say that there’s a better chance that BA heads south before heading north in a chart like this…

But keep in mind that around a third of its revenue comes from defence, space and security.

Also remember that we’ve already declared Trump the next elected President of the USA, and he’s saying things like this…

So go ahead and play that trade as you see fit. BA on the way down, long on election night.

China on the mend

Running out of room so I will say that an eye on the Chinese growth story is worth a look and it’s discussed on the podcast I recorded on Friday.

The recent People’s National Congress have reiterated a 5% GDP growth target and 7.2% increase in defence spending, which is in line with past targets.

I’m happy to be a very, very hesitant buyer of China here, noting that a Trump election win does keep tariffs on the table with more volatility.

Second last thing, Wellnex Life (ASX:WNX) is finally seeing the fruit of their labour in the acquisition of Pain Away. It’s now a profitable company. Couldn’t be happier.

Could be the value buy of the year here.

Finally, there’s a really good conspiracy going around regarding Princess Kate’s whereabouts.

She arrived back from hospital and Kensington Palace released the first photo of her which was immediately killed by the AP due to being manipulated.

This has captured my attention, not going to lie.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.