FREE WHELAN: As margins go sideways you don’t need to be a hero

Via Getty

G’day,

Special shoutout to Josh Chiat of Stockhead for joining myself, David Scutt of Ausbiz and Global X ETF’s Blair Hannon for joining me to run through our themes and thesis for the year ahead. Great commentary all round. If you get a chance to watch please do so. Link Here so see the replay.

If you’re trying to make sense of the world at the moment and wonder why every few days there’s a switch in narrative from “rates are coming off because inflation is coming off so the market is fine” which suddenly handbrakes into “inflation is still actually quite high and various Fed messaging shows they’re not slowing down things are NOT FINE” then you can join me in this wonder as well.

It’s exactly the type of thing we thought might happen this year as we see the economic and personal data pulling itself apart. The story and the markets they propel will continue to change from red to green and back to red again.

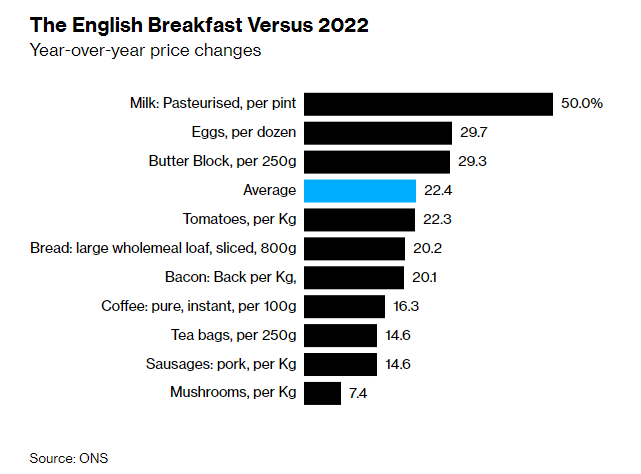

Decent example here in the UK, where inflation is still up year on year but is in fact slightly less up than on previous months. It’s running at about 10% increase.

While it’s slowly coming back into line, try telling that to a UK family putting together the Sunday fry up.

Year on year the average cost of ingredients is up 22%. Bloomberg put together an article about it and I don’t need to link to it because it’s telling you exactly what you already know: actual things are actually more expensive and it’s difficult to see the blue sky above the clouds.

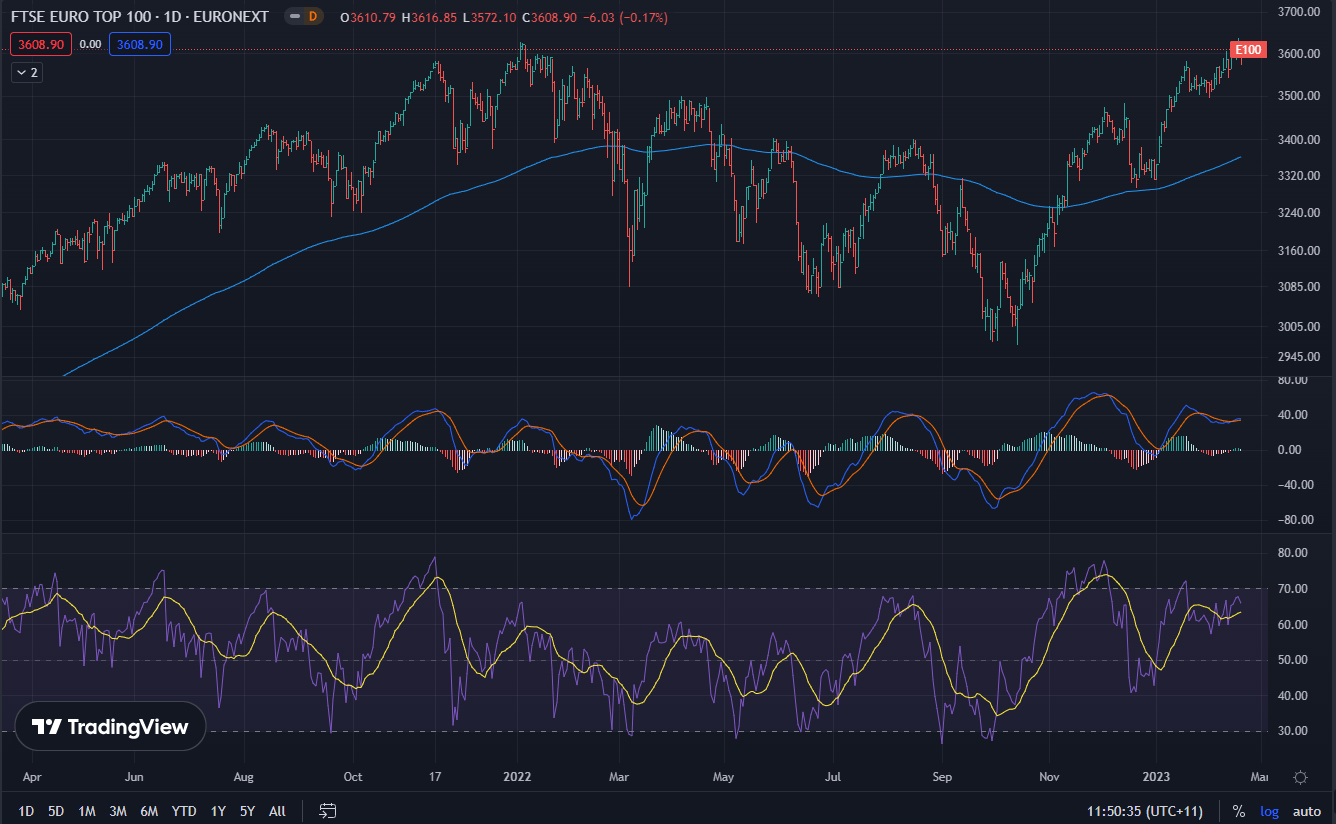

Funnily enough, and whilst there is no real connection between the market and the economy, especially the FTSE which is all about European companies listed in the UK so barely reflective of UK growth, we see new highs being made.

Note that we are proudly long F100 (the Betashares FTSE 100 ETF) and will be looking to thin out some exposure on a little more strength. Keep an eye on that Relative Strength indicator at the lower end of the graphic above.

The Wall St Journal seem to be on the ball with solutions that matter.

Oh my goodness.

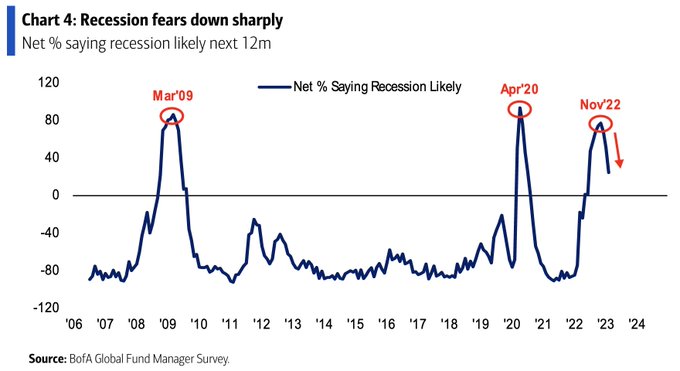

Carrying on with the changes in narrative that just as the market (at least in the US) turns bearish because the Fed will have to carry on we also have the BofA Fund Manager Survey showing a sharp decrease in recession fears.

Along with this is the fact 2/3 participants think that what we’ve seen in the US has only been a bear market rally and not the start of a new bull market. I’m still hesitant to go overweight the US and want to wait until the full extent of the earnings recession there has been brought to the fore.

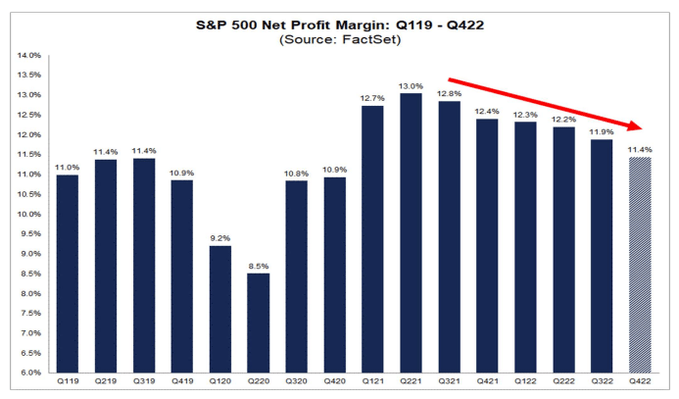

I’ve mentioned this before but margins are ultra-important now more than ever. That’s not a ground breaking statement. Quarterly reporting has shown that Earnings Per Shares is down ~5% due to 1.00% of margin compression. That’s a big deal.

Here’s a chart…

I’ll say this clearly: margins are getting squeezed.

This led to a revelation of a tweet by an anonymous financial account that hit the nail on the head wonderfully:

“Going to be sickly funny when corporate caution on staffing levels in order to protect margins is what causes the economy to turn down rather than a rates-led demand hit that isn’t coming”

Well said.

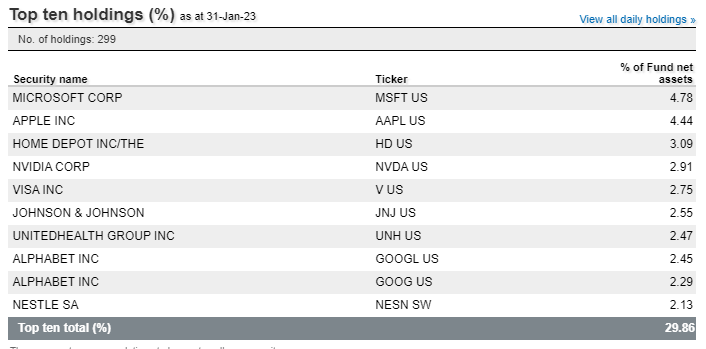

In a world where margins are tight and rates are going up and you need to be invested in something then I’m strongly looking at Quality.

Why quality? Short answer: Why not?

Long answer: lower leverage, better ability to withstand hard landing and most likely to receive flow in soft landing.

Tech layoffs done ruthlessly and market appreciated it. Ability to defend margins relatively well. High return on equity (net income over avg shareholders equity) so put REALLY BLUNTLY:

Since ROE is simply earnings over equity, if you increase the profit margin, you increase earnings. Increasing earnings without increasing equity has a domino-like effect on ROE, increasing that as well.

Buying on the backfoot QHAL. A hedged global quality ETF containing some of the most consistent earners in the planet.

However there’s no rush on this. The market is in a bearish stance at the moment so no need to be a hero.

All the best,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.