FREE WHELAN: Alec and Jimmy make a (contrarian investing) poddo

Via Getty

In this legendary Stockhead series, investment manager James Whelan from VFS Group offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a damn fine professional money manager.

Absolutely cracking episode of the BIP Show podcast recorded on Friday with the head of the Orbis Global Balanced Fund.

Being contrarian investors they need markets like the one we’ve seen for the last year to show their worth. And since there’s no sign of this market changing any time soon it’s important to hear the views of these types of long term contrarian investors.

Listen here for the views of Alec Cutler.

There’s an interesting point about energy stocks in there somewhere which I agree on. They are cheap and deserve a look in whether you are chasing a trade or longer term investment.

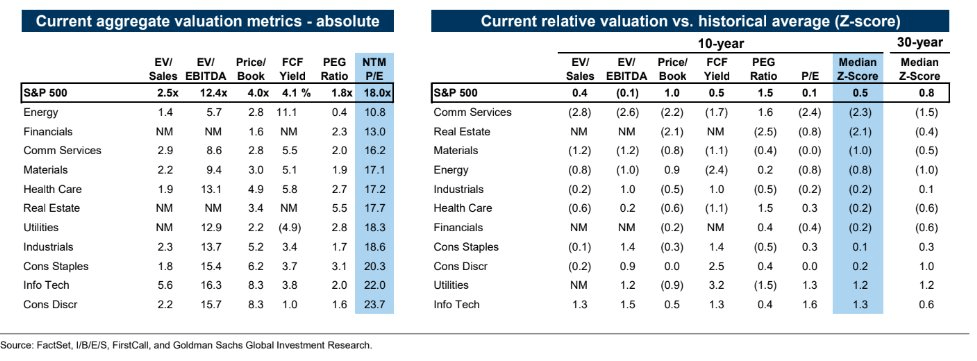

Funnily enough there was some things put in front of me about this very thing over the weekend. Let’s start with a sector by sector relative analysis in the US.

The blue column on the left hand chart is Next Twelve Months’ Price to Earnings Ratio which shows the market as a whole trading at 18x. Above it’s 10 year average of 17.2x (which partially explains this pullback we’re now in the midst of.

Look at the top of the blue column there.

Energy. Cheap.

Now look at the bottom.

Consumer Discretionary. Expensive.

A price to earnings growth ratio below 1 as well. Dig out the old Peter Lynch book and it’ll tell you that in a fairly valued market (and I’m paraphrasing here so take it easy on me) a company’s Price to Earnings and expected growth should be a match. So a PEG ratio of bang on 1 shows that everything is in its right place.

Trading below and you get value.

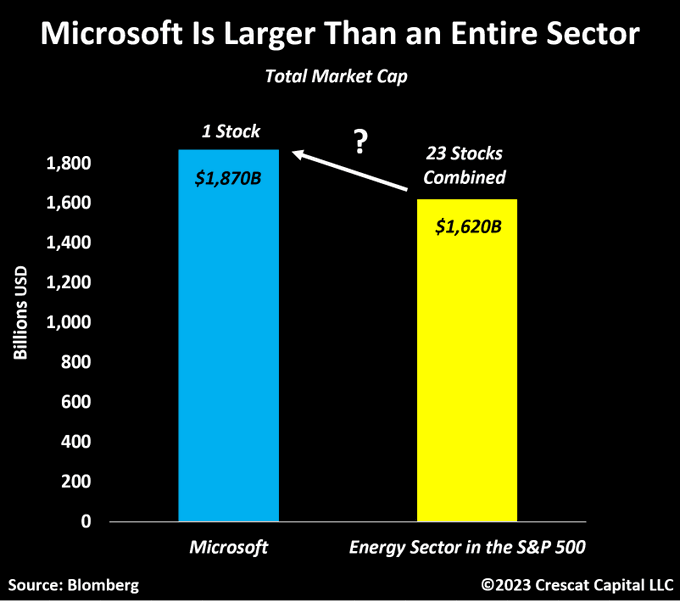

Here’s some more comparison done by Otavio Costa of Crescat Capital… and yes I know it’s apples and oranges but this is something to behold.

“Microsoft still has a higher market cap than the entire Energy sector in the S&P 500 today. Keep in mind: Exxon *alone* produces just as much annual free cash flow as $MSFT today. And no, this is not just a specific case with $XOM. All the energy companies in the S&P 500 are profitable on a free-cash-flow basis today. Either tech companies are still too expensive, or energy stocks remain a bargain… or both.”

The main difference in why price has been restrained has been global ESG mandates keeping a leash on money flow. If you think there’s a more prolonged battle in Ukraine ahead and a market that will continue 2022’s attitude of squashing complacency then you have the foundations of an unwind theory of the ESG run.

It will continue, they say.

Also Russia is cutting output which we cover in the podcast so I won’t rewrite that.

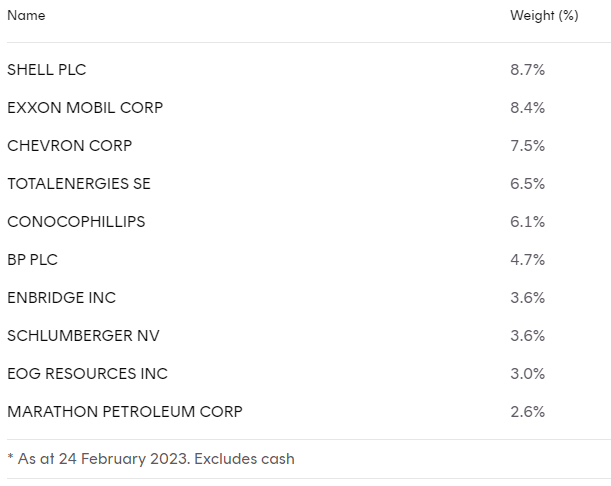

Best way to access this is via the Betashares FUEL ETF which I have mentioned before. I hold it and plan to add if more of this market bearishness continues. Which I believe it will for a while ahead.

These names…wow.

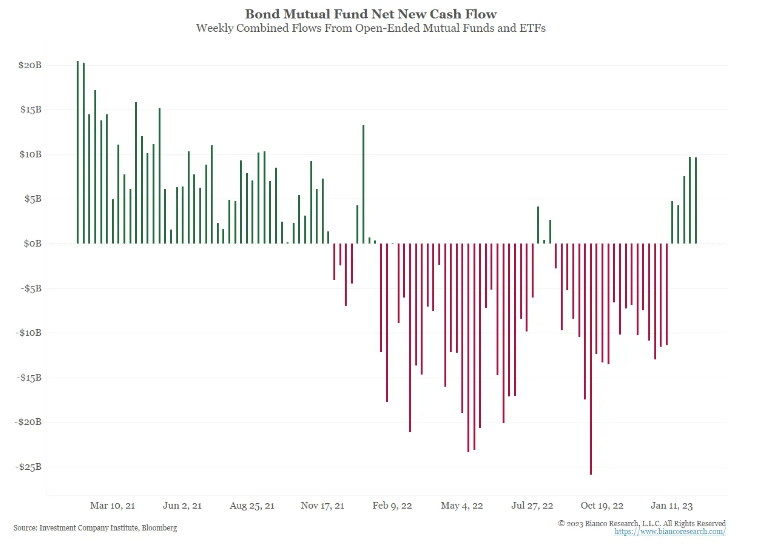

The same theme continues where we travel up and down in sentiment to reach more or less the same point we started the year.

The great bond rally has stalled as the US continues to show stubborn resilience but flows remain strong.

Bonds “cheaper” and flows stronger. You know what you need to do in that case and it’s buy a few.

Park the bonds next to the energy stocks and the Quality stocks and you have a pretty tidy looking global portfolio to take into the second quarter.

But as always don’t be too aggressive with this market. It’s frustrating but patience and prudence pays off this year.

All the best and stay safe,

James

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.