Forget ‘growth’ or ‘value’, ASX fund managers want quality — and here’s how one fundie judges it

Forget the growth v value stock debate. This fund manager says quality stocks are more important

While investors debate about whether growth or value stocks are better, one ASX fund manager says quality is more important when it comes to small caps.

“What we’re looking for are quality small companies that deliver reasonable value when we put them into our portfolio – and to us that’s the thing that drives superior long-term performance,” Longwave Capital’s David Wanis said at the Pinnacle Investment summit earlier this week.

“The simple reason [quality matters more] is because small companies are more likely to fail than large companies and reducing or removing the drag from that small cap failure is a significant part of delivering better long-term returns.

“Although value and growth outperform and underperform the index at various points in time, it’s quality that delivers those superior returns in small caps,” he said.

What do quality stocks look like?

Few investors would disagree that quality is key when judging ASX stocks.

But how do you judge quality stocks on the ASX, or any exchange for that matter.

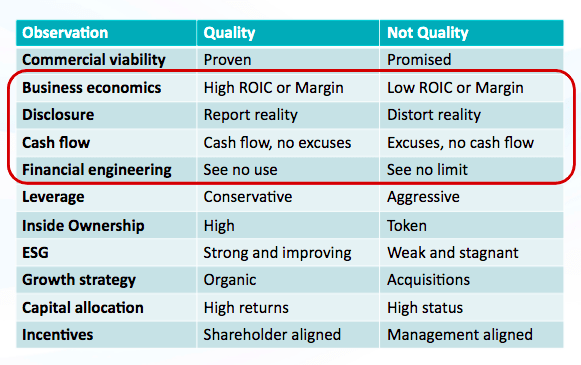

Wanis provided this chart of indicators for investors to look for. In particular, he said four (circled in red) were important in the modern investing world.

“Quality works everywhere, it works through time, across countries, across sectors,” he said

“And quality between different business models whether you’re tangibles based business or intangible based business quality still makes a difference.”

Tougher to judge quality stocks

But as important as it is to judge quality stocks, Wanis noted it has become harder in recent decades as companies’ shares of market value shifted from tangible to intangible assets.

In the USA, intangibles now accounted for 90% of a typical company’s market value.

“When we looked at different companies, we had a clear understanding they were using the same standards and auditors were assessing them on the same basis,” he said.

“As we move from a tangible world to an intangible world all those foundational assumptions suddenly come into question.”

“The big question is — do they still apply? And if they do, how do we create that same sense of comparability across all companies in this intangible world?”

“Intangibles are built from people’s time, ideas, software, brands – they’re things that come from human endeavours and it’s been a way of unlocking a huge amount value.”

“The amount of leverage of people’s ideas into intangibles has been incredible for shareholder returns.”

“But a lot of standards we used to apply now suddenly don’t apply, when we talk about people’s time we’re talking about payroll and wages and how much of that is expenses and how much of that time is going to create intangible assets which will be used in the future.”

Margins could identify quality stocks on the ASX

However, one concept that could still be used is margins.

“In this world you don’t need huge amounts of capital to create a wonderful business,” Wanis said.

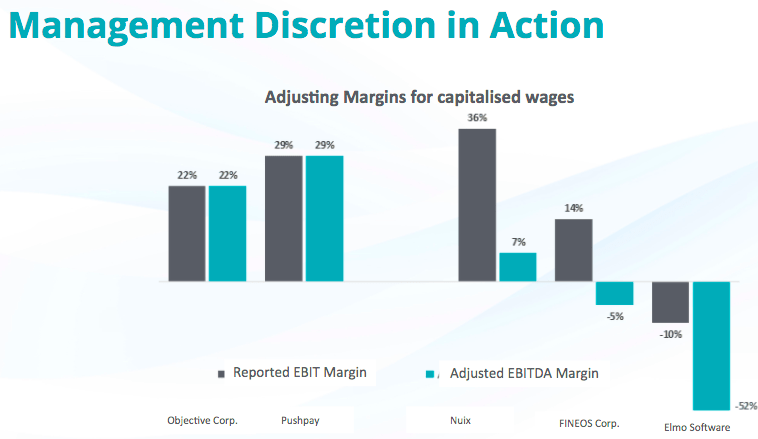

“And so margin has become the lens through which we grade the quality of businesses, and so we see five businesses as they report their margins as management are allowed to apply their discretion about what they capitalise and expense in the current year.”

“One data point doesn’t tell you the business, but it is important nonetheless.”

Longwave conducted research on five ASX software stocks, adjusting the margins for a consistent treatment of expenses.

Some companies expense everything in the year they spend it such as Objective (ASX:OCL) and Pushpay (ASX:PPH) but the others – Nuix (ASX:NXL), Fineos (ASX:FCL) and Elmo Software (ASX:ELO) – capitalise their expenditure instead, something that Longwave pointed out makes a difference.

There is no suggestion this is illegal or misleading conduct on any of these companies’ part.

“There’s value in understanding what the reality looks like and trying to differentiate between the quality of these businesses,” Wanis said.

Successful business models “durable and sustainable”

Also speaking at the Pinnacle Investment Summit was Marcus Burns from Spheria Asset Management and he also observed there was irrationality in the share prices of some of those companies.

“There’s a very high retail participation in the market right now, which is causing lots of irrationality and volatility in share prices,” he said.

“Fundamentals aren’t even secondary, they’re deemed irrelevant.”

“Our view is successful growing companies eventually make money and have business models that are durable and sustainable through market cycles. We are working in a probability game, not an improbability game.”

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.