For Die Hard Investors: Luke’s trio of high-risk small caps Most Likely to Survive Nakatomi Plaza in 2024

Via Getty

Stockhead: Okay, Luke Winchester, CIO Merewether Capital … yada yada… let’s start with the single most important question today in finance: is Die Hard a Christmas movie?

Luke: Yes of course it is, what a stupid question.

Stockhead: Correct. The second most important question: Will 2024 be the year of micro and small caps?

Luke: Are we starting?

Stockhead: Yes. We started.

Luke: Well …after a cracking November and December to date, the party has started, the bodies are being ejected from Nakatomi Tower and the champagne flutes are clinking.

Stockhead: Nice.

Luke: I’m not finished.

Stockhead: Sorry. Please, continue.

Luke Winchester: Die Hard Small Cap Opportunist

“In all seriousness, I am always wary of a crowded trade and every man and his dog is talking up the recovery of small and micro caps after underperforming for two years, but at the risk of being a barber telling someone they need a haircut, I also think small and micro caps are the place to be in 2024 on the ASX.

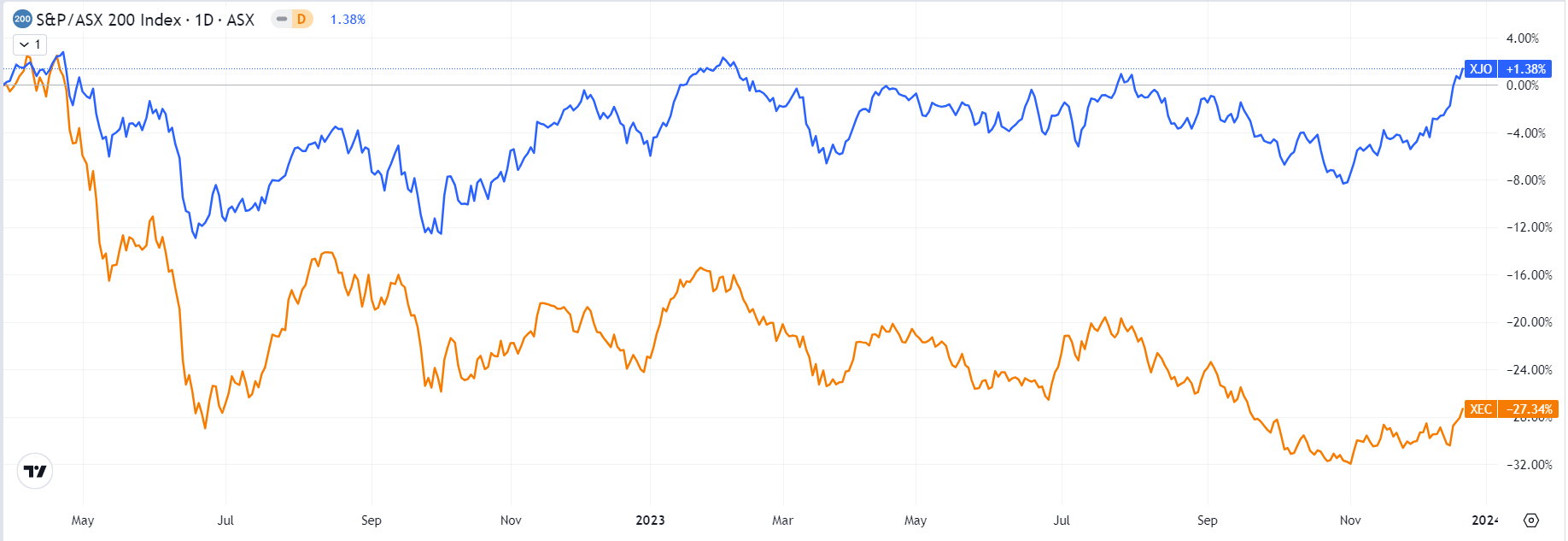

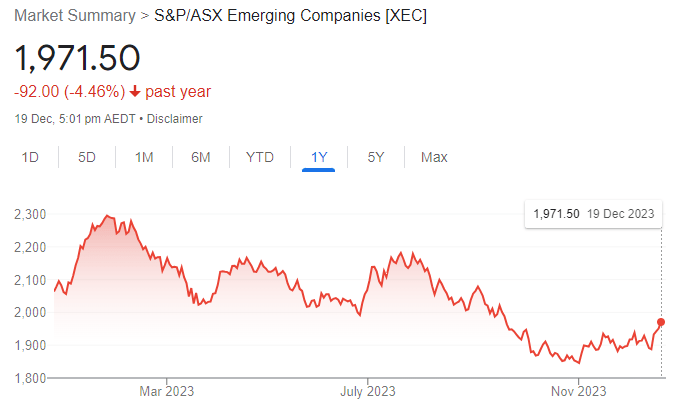

“You can’t sugarcoat it, it has been bloody tough being a small and micro cap investor over the last couple of years. Look at this chart below – from early 2022 until today comparing the ASX 200 index to the ASX Emerging Companies index with a nearly -30% relative underperformance.”

“I mean really, the dedicated small and/or micro cap investors have pretty much felt like Hans Gruber in his last minutes on Earth for two years…”

“But there are reasons for optimism.

“It is, after all Christmas, even in Nakatomi Tower.”

America is not sneezing

“There is a saying that when the US sneezes the world catches a cold. As the biggest economy and developed capital market in the world it tends to lead the way for the rest of us.”

But right now though the US isn’t sneezing; it’s a picture of rude and unkempt, possibly illicit performance-enhanced health.

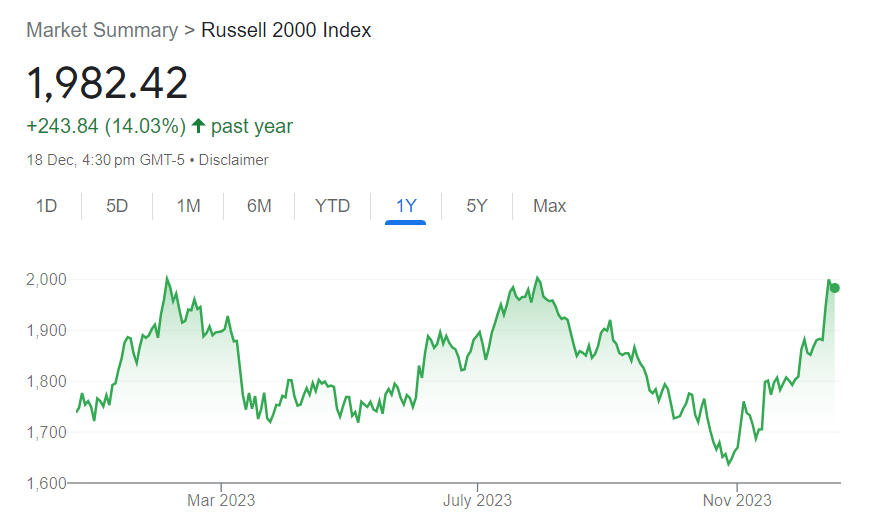

“For better or worse, the economy is powering ahead and with inflation tamed and the Fed providing the path forward to rates normalising to a lower rate (where they need to be in this high debt world), and small caps in the US have exploded out of their bear market, like a bunch of C4 wrapped around an ergonomic chair rolled down an elevator shaft…”

“What you’re looking at is a more than +20% move higher in just a few weeks, back to a yearly high… Almost impossible to conceive of only a month or two ago… Meanwhile, here at the sleepy ASX – investors haven’t quite caught up…”

“Though there may be valid reasons for that,” Winchester adds.

“Our economy isn’t as strong as the US with weaker GDP numbers (especially per capita when you remove the massive stimulatory effect of elevated immigration) and inflation still a bit too stubborn. While most pundits think the RBA are likely done, their path to rate cuts are not as clear and Australia could be a victim of the ‘higher for longer’ that has permeated the macroeconomic analysis throughout 2023.

“But as I said earlier, the mood has certainly improved around micro and small caps. It has almost become universally acknowledged how much they have underperformed larger peers, and as valuations get stretched at the top end of town and confidence does return to equity markets more generally, the expectation is that institutions will slowly trickle back down into small and micro caps, accepting the higher risk of those companies because of the discount valuations and returns on offer.”

“And it’s not hard to see the value because a lot of it is being realised upfront with a booming M&A market among micro and small caps.”

M and ASX

In just the last few months, the following tickers have all received a bid in some form: Pacific Smiles (ASX:PSQ), Volpara Health Technologies (ASX:VHT), Adore Beauty (ASX:ABY), Whispir (ASX:WSP), Damstra Holdings (ASX:DTC), Cirrus Networks (ASX:CNW), Healthia (ASX:HLA), Southern Cross Media Group (ASX:SXL), Symbio Holdings (ASX:SYM), Energy One (ASX:EOL) …

“It’s not a surprise to see elevated M&A activity with beaten down share prices and larger peers and private equity having more confidence in the outlook for capital markets.”

Stockhead: Anyway, let’s cut to the chase. Yeah ok Winchester you think micro and small caps will do well next year, great. What stock do you actually like though!?!

Luke: “Calm down needy and anonymous Stockhead reader, I’m here to give you an idea from one of the stocks in the Merewether Capital Inception Fund I think are positioned to do well.”

Compumedics (ASX:CMP)

“So, this manufacturer of brain imaging and sleep diagnostic medical equipment has been a quiet achiever over many decades, generating $800m in cumulative revenue, 85% of which is exported to global markets.

“Unfortunately for shareholders the share price has been disappointing over the long term as the company has historically struggled to escape its small niches into larger addressable markets, but there are great signs that may be changing.

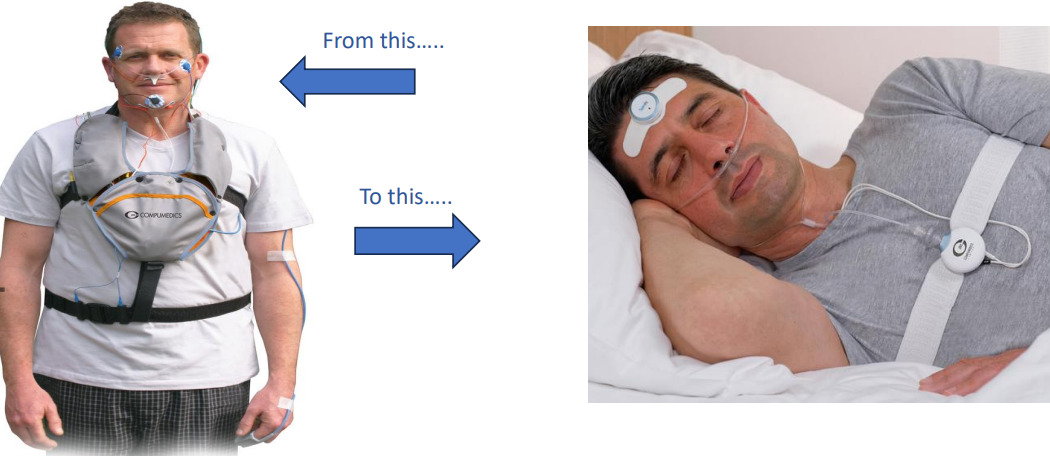

“The company is currently commercialising Somfit, their next generation sleep monitoring product which is a potential step change for the industry drastically reducing the size and complexity of testing systems, reducing user error and allowing for better home sleep testing. Somfit recently received FDA approval, with CMP already building out a salesforce and inventory to hit the ground running in the world’s biggest home sleep testing market.”

“On top of that, CMP are also bringing a new product to market in the magnetoencephalography (MEG) space, a form of brain scanning that tracks direct brain activity. It can be used in the diagnosing and tracking of brain diseases such as epilepsy, Alzheimer’s, Parkinson’s, autism and schizophrenia.

“For CMP’s top line, the development in this space is extremely lucrative, with each machine generating $4-5m in revenue, with two sales recently announced through their Chinese distributor for $9.3m.”

“After some issues in FY23 the business looks set to have a bumper FY24 with 1Q24 revenue up 115% compared to last year. There is a MEG sale this year which boosts that number, but even excluding that revenue was up 40%.

“With Somfit FDA approval and two more MEG sales announced, the outlook for CMP looks rosy with the company guiding towards $5m EBITDA in FY24, about 10x the current $48m market capitalisation, a very reasonable price for a global medical equipment business with two emerging growth markets gaining serious traction.”

“I’d also be remiss not to mention the last stock I’ve added to the M Fund.”

Kip McGrath Education Centres (ASX:KME)

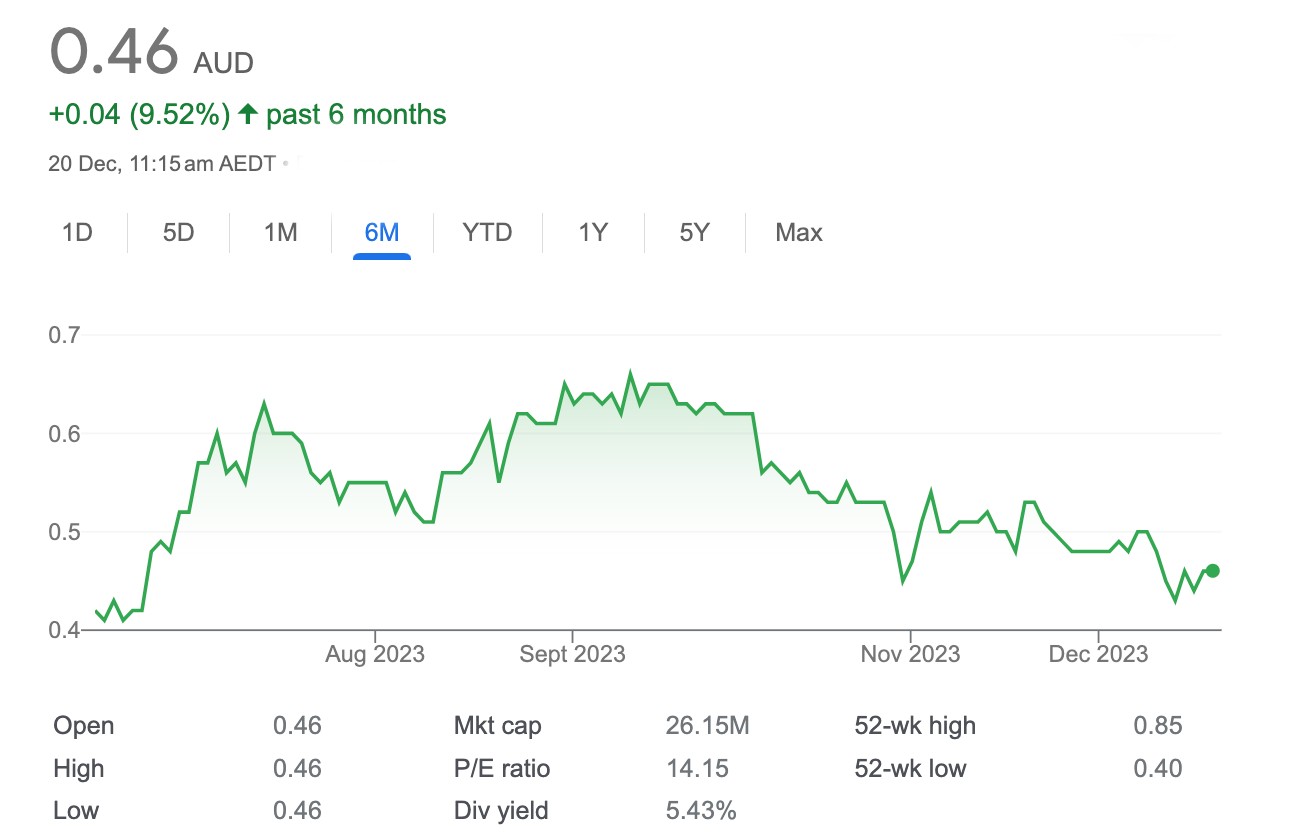

“…I just couldn’t help myself and bought a bit more Kip McGrath Education Centres (KME) last week when it slid below 45c. It’s been a long way down for the remedial tutoring business as profit growth has stalled over the last few years. But at the current market capitalisation of $26m, 13x net profit is too cheap in my opinion for the growth potential on offer.

“The business is expanding into the US and the market is naturally skeptical. The graveyard of ASX companies trying to crack the lucrative US market has more dead bodies than Nakatomi Plaza after John McClane celebrates a traditional Christmas.

“That said, the US is committing significant dollars over the next few years to eliminate the ‘learning loss’ experienced through Covid restrictions, with $28bn allocated to high impact tutoring. Through their Tutorfly brand, KME is positioning themselves to work under this funding, currently contracted with 14 school districts, up from three last year and over $3m in contracted revenue for this year.”

“The update at the AGM showed 20% revenue growth through the first quarter, with a similar run-rate guided to the full year. What disappointed the market however was the commentary that some higher costs from buying out some franchisees into corporate centres would impact the first half.

“I get why the market would take a wait and see approach, but the strong revenue growth and the low valuation provide enough margin of safety for me.”

Atlas Pearls (ASX:ATP)

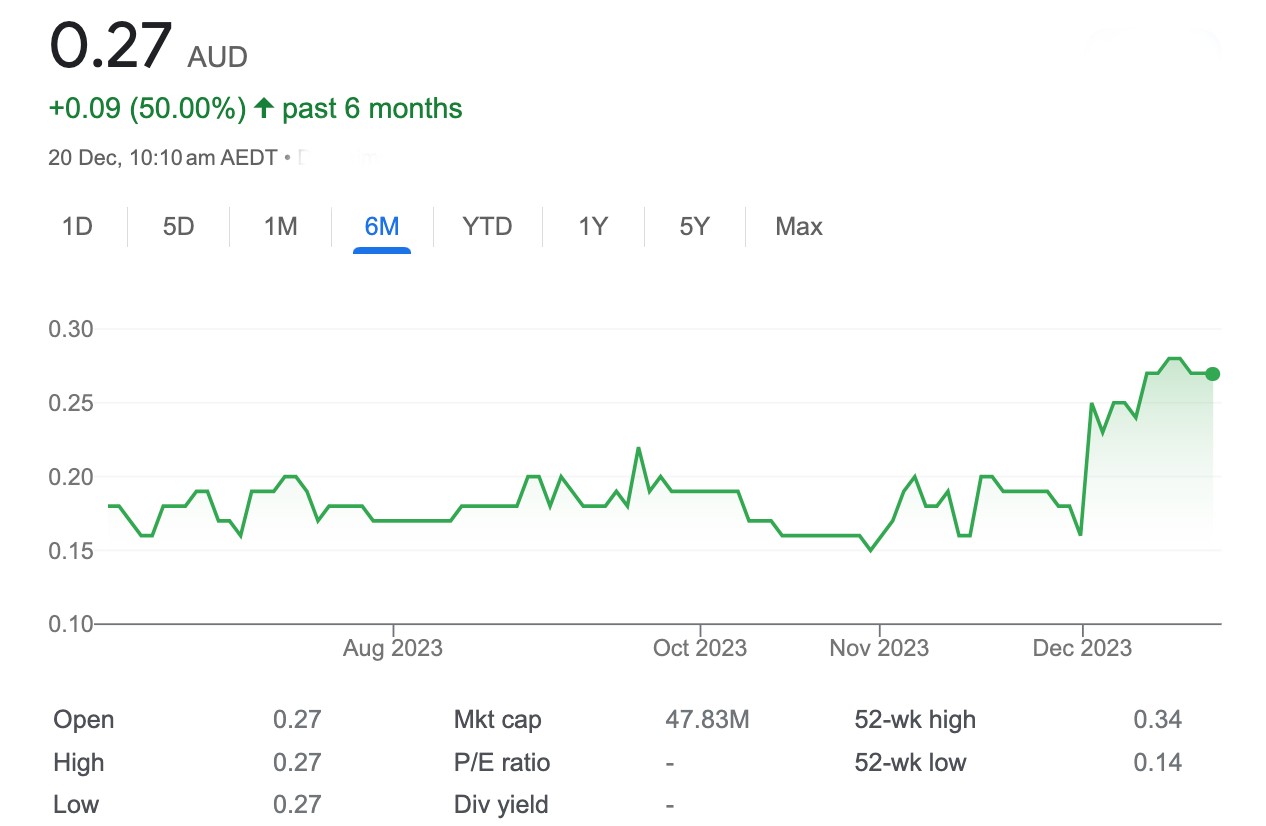

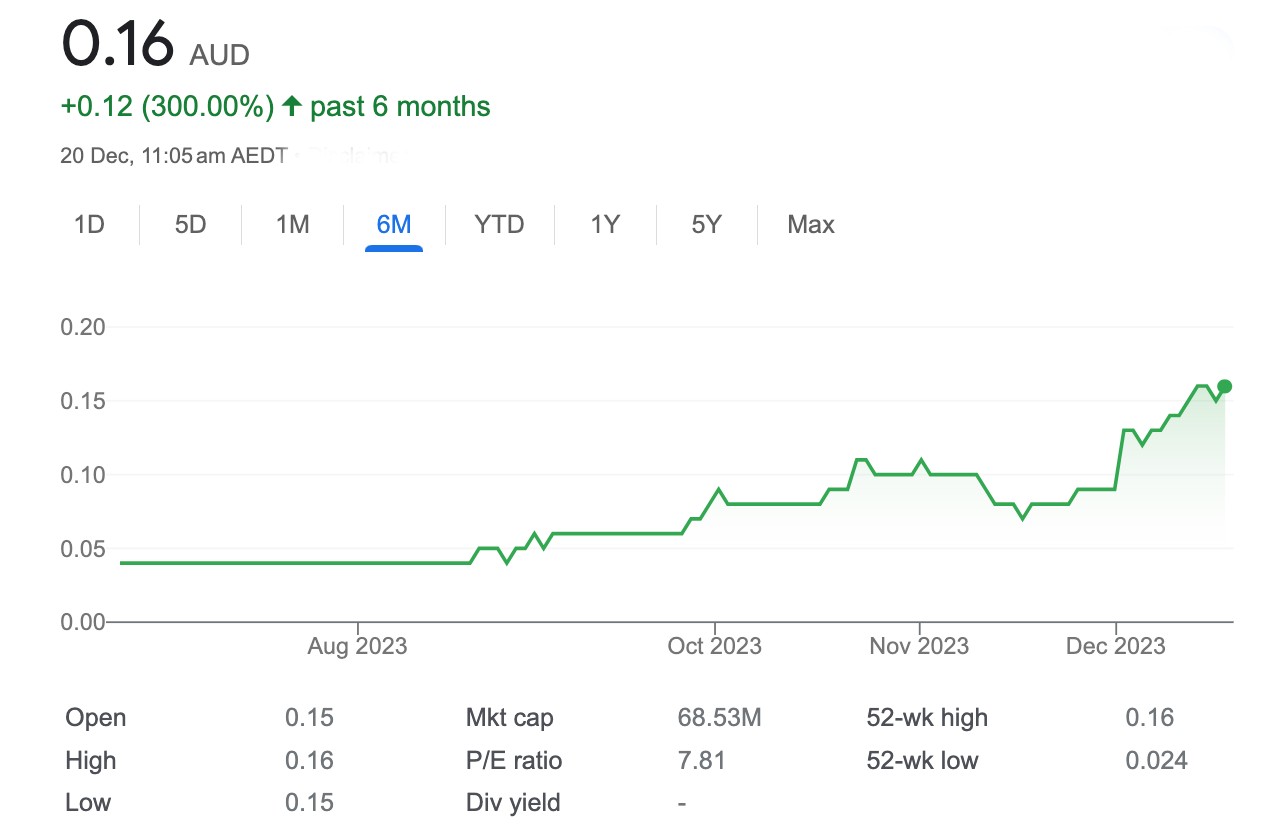

“Speaking of cheap, the other stock I cheerfully bought recently was Atlas Pearls.”

“What a run this is had, but it is still screamingly cheap. Don’t get me wrong, this isn’t for the faint hearted, but for the more adventurous Stockhead readers it is worth a look.

“A Western Aussie-based company, the South Sea pearl production is in Indonesia, and while they don’t get the attention of other luxury products, the pearl market is booming on the back of increased demand from Japan and China, as well as supply issues primarily from a disease affecting Japanese pearls.

“That means ATP is in the right place at the right time. Their production is remaining steady around 600k pearls a year, but they are seeing a near tripling of their sale price from $37 at the start of last to year to over $100 now.

“This means for the first five months of this year they have already cleared last years total revenue, which was a year they did $9m in profit.

“If conditions persist (which all signs point to in the short term), the business should clear $20m net profit this year, leaving them trading on around 3x earnings on the current $64m market cap.

“Now, Stockheaders – tread carefully – as I said this is one for the adventurous.”

“There is geopolitical risks with production, it is a luxury commodity that can see pricing swing on the changes of supply and demand. But given the valuation and the likelihood of big capital returns (a special dividend this year seems locked in) I think there is plenty more in it.

“I haven’t even mentioned that Kim Kardashian wore a pearl dress to the Met Gala this year, what more proof do you want that pearls are in fashion?”

“My wife has been a bit wary of how much research I have done into this stock, but uhh…you get it, we fundies have to do the work, right?

“Well, there you have it.”

Stockhead: Thanks Luke…

Luke: Shush, you! … As I was saying, not much more I can add, other than wishing all a Merewether Christmas and suggesting my fellow micro and small cap investors go and buy themselves a new jumper for 2024:

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.