Five common mistakes small-cap investors make in managing their portfolios

Experts

Experts

Sharesight is a leading aggregation platform in the Australian market that provides investors with a one-stop shop to manage their investments across different asset classes, exchanges and jurisdictions.

Through its simple online platform, Sharesight allows investors to save time and money, track their dividends, assess the true performance of their portfolio and quickly compile trading data for tax purposes.

The platform provides up-to-date information, tracking more than 40 of the world’s major stock exchanges and more than 240,000 stocks, ETFs and funds to give investors an effective ‘single picture’ of their investment performance.

In this article, the company highlights five common mistakes equity investors make, based on data insights obtained from their platform.

With improvements in technology, retail investors now have broader access to invest in major global exchanges such as the LSE or the Nasdaq.

In that context, when taking advantage of those opportunities it’s important to seek diversification across sectors.

For example, if you’re investing in the ASX small caps space, there’s a good chance you’re getting over-indexed into mining stocks. It’s a simple numbers game — resources stocks make up the bulk of Australia’s small cap sector.

But these days there are plenty of investment thematics in global markets that can help you diversify risk.

One thing we see on our platform is that where people are investing in domestic markets, the bulk of their portfolios are often skewed to mining stocks and financial (banking) stocks.

So we try to encourage a broader investment exposure, and that’s exactly what our platform is set up to assist with.

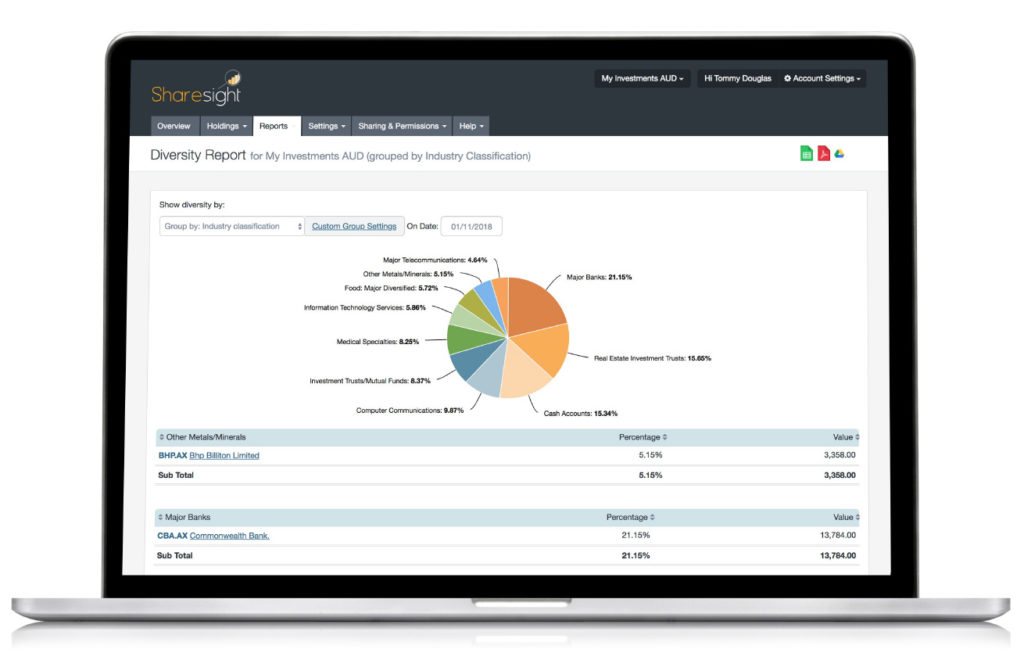

For example, the Diversity Report quickly calculates a breakdown of holdings by sector, market and country in order to provide a simple snapshot of your entire portfolio.

Most small caps don’t pay dividends, but there’s a strong argument for maintaining a balanced portfolio across dividend-paying stocks and high growth stocks with capital gains upside.

For example, only 29 ASX small caps paid dividends in the 2020 financial year, so you’re only seeing half of that return picture and you’re missing half of your potential performance.

As an investor, Sharesight also makes it easier to keep track of your overall performance picture.

Say your small cap portfolio returns an aggregate capital gain of 20%, but you’re also holding some blue-chip stocks that are paying a 5% dividend yield, your actual overall return is higher.

So if you’re only looking at the capital gain numbers that brokerage firms are giving you, you’re missing out on that dividend return which is a key part of your actual investment performance.

As equity investors, it’s easy to fall into the trap of just looking at the bottom line and asking ‘how much have I made on that trade?’

But having a platform where you can quickly assess the performance of your whole portfolio is also really useful for tax purposes.

A good example is capital gains tax (CGT). Using Sharesight, you can quickly calculate the CGT payable on winning trades during the year. If one of your trades is still ‘live’ and is in the red, you might then choose to close out that trade in order to recognise a capital loss. You can then use that loss to offset your gain in the financial year and reduce your tax bill.

Another important habit to build is looking at time frames. Having simple access to your portfolio means you can quickly check the length of time in trades.

If you’ve been holding an ASX stock for 11 months, it might pay to wait another four weeks until the 12-month threshold so you can recognise the CGT discount on disposal. Monitoring those details can end up having a material positive impact on your full-year returns.

If you’re trading small caps stocks on international markets such as the Russell 2000 index in the US, when you sell those companies you’ll typically have to repatriate the funds into Australian dollars for tax purposes.

So it adds another layer to your investment, and you need to be mindful of whether currency changes are impacting your returns.

For example, back in February this year the Australian dollar was buying around US80c – now it’s buying closer to US70c. If the AUD falls from the level it was when you bought US stocks, that adds a currency gain to your overall returns

These days, a lot of people just leave US dollars in their US brokerage accounts and wait for an opportunity to invest. But you’ve still got to pay taxes on them when the gains are made, so it helps to manage your investments with a platform that easily allows you to monitor those currency fluctuations.

At Sharesight, one thing we see a lot of is investors opening up a brokerage account with different brokers – particularly when there’s a discount deal on.

For example, one broker will offer free trades on an ETF while another introduces discounted brokerage rates on ASX trades. So people are opening different brokerage accounts to take advantage of new deals.

It’s becoming increasingly common with more brokerages in the market offering discounted rates. People are less committed these days to sticking with a broker that they may have been with for the last 5-10 years.

But what ends up happening is you’ve got shares held with all these different brokers because you don’t necessarily move them all across to your new broker.

And the result is that you don’t have a single view of your performance. Often that means spending time to pull data into a spreadsheet – and that’s one of the exact problems Sharesight solves.

It doesn’t matter who you’re trading with because the data’s all there, compiled on one platform to maintain an accurate investment picture – whether you invest in a handful of ASX small caps or manage a global investment portfolio across multiple indexes.