Experts: Bottom picking and ASX stock tips from Opal Capital’s Omkar Joshi

Picture: Getty Images

- Saxo’s Head of Equity is concerned investors are not ready for may happen next

- We look at asset categories that are winning and losing

- Stockhead reaches out to Opal Capital’s Omkar Joshi for some stock tips in this downturn

The past six months have been one of the toughest start to the year in recent memory, catapulting the financial markets to a state few investors have ever experienced.

To make things worse, the mentality of today’s investors has been shaped by the relentless bull market of the past 10 years, and especially the last five.

Peter Garnry, head of Equity Strategy at Saxo, is concerned that investors may not be prepared for what might come next.

“Only few investors are really prepared for what might happen as we deal with the consequences of the physical limit that the world has arguably hit,” Garnry said.

“Central banks and businesses were used to a flexible and ever-expanding supply function.

“However, the supply function of the world economy has for good reasons become inelastic, which means that any demand push goes straight into inflation,” he argued.

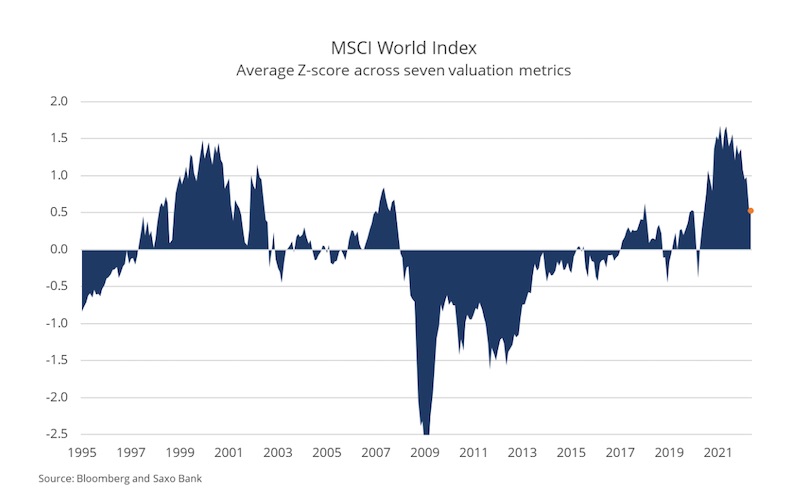

But despite a galloping energy and food crisis, runaway inflation, and higher interest rates globally, the MSCI World Index is still valued above its historical average.

Garnry reckons that given the current outlook and interest rates level, the MSCI World should already be trading below average.

“Earnings for global companies are already down 10 per cent from their peak in Q2 2021, and the outlook is not looking rosy.

“Investors are simply slow at updating their views, and we observe no material change in behaviour among retail investors, which is also why this equity market has more room to fall,” Garnry said.

“A relentless bull market over 12 years, only punctuated once in a while by short-term V-shaped recoveries, has reinforced a buy-the-dip mentality and more risk taking,” he added.

Are we at the bottom yet?

The S&P 500 Total Return Index is down over 20% this year, which means that US equities are officially in a bear market.

The big question is: Where and when is the bottom in the current drawdown?

According to Garnry, based on the information picture we have today, his best guess is that the S&P 500 will correct around 35% from its peak.

“This could take somewhere between 12 and 18 months to hit the trough, which means sometime later this year or in the first half of 2023,” he said.

Sequoia Capital, in its 52-page presentation in May, went even further by saying that:

“The V-shape recovery will not happen this time, and the bear market will likely not exhaust itself until the new generation of investors that went all-in on speculative growth stocks – Ark Invest funds, Tesla and cryptocurrencies – have fully capitulated.”

Which categories are winning?

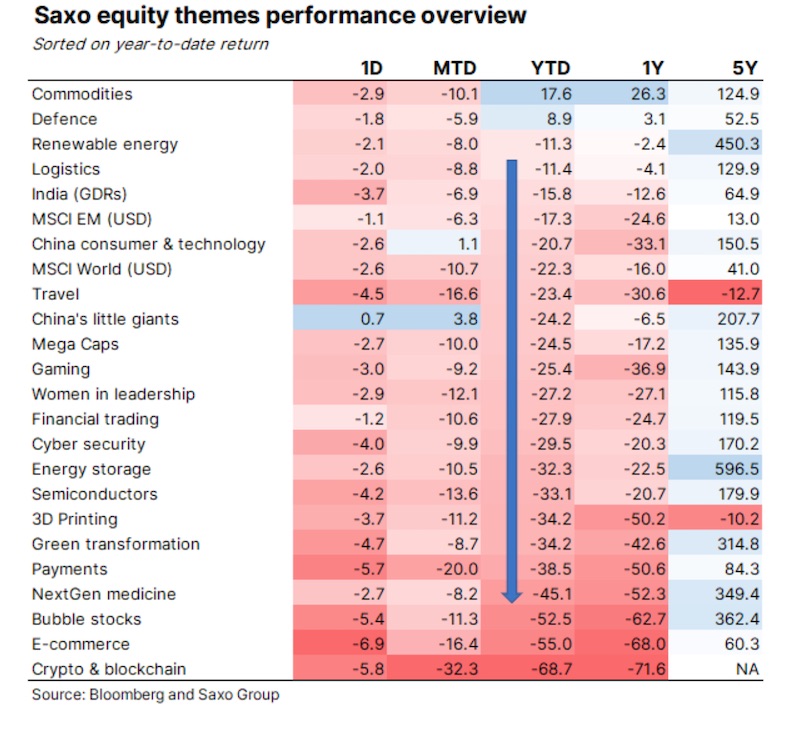

Garnry said that looking at his themes of baskets, it’s clear that two categories stand out – commodities, the principal driver of the current supply side inflation, and defence stocks, being at the receiving end of Europe’s increase in military spending.

Meanwhile, the two best theme baskets among all the losing baskets are logistics and renewable energy.

“We expect these themes to continue doing well until equities hit bottom in the current drawdown,” Garnry said.

The worst-performing themes this year have been crypto and blockchain, e-commerce, bubble stocks, nextgen medicine and payments.

“The red thread is that tangible assets are generally outperforming intangible assets, but the only exception to tangible assets winning is real estate,” he said.

In developed markets, excessive valuation levels on residential homes coupled with historically low interest rates mean that the real estate sector is vulnerable to a downturn in the economy, said Garnry.

“It’s difficult to be positive on real estate, despite it being a tangible asset,” he added.

Fed Reserve holds the cards

Back on domestic shores, Opal Capital’s portfolio manager, Omkar Joshi, says that markets are moving so quickly that it’s hard to have a conviction on one asset class at the moment.

He also concedes there is more downside to come, with de-ratings starting to come through in some of the the higher multiple high-growth names.

“We haven’t really seen earnings downgrades come through, and we also haven’t seen analysts really starting to bring down their estimates.

“That’s why I believe there’s more to come in terms of downside,” Joshi told Stockhead.

Joshi also thinks the selloff will be accentuated by sharp rallies caused by dip buying, as what usually happens in a bear market.

“But the one caveat to all this is really the Federal Reserve. If they change their rhetoric and move more towards a dovish stance and start cutting rates again, then we could see a turnaround in the financial markets,” he said.

ASX stock tips

Joshi says that it’s more important than ever to pick stocks that are resilient in a tougher economic backdrop.

“A name that does pop up from that is companies like Tabcorp Holdings (ASX:TAH), which is more recession proof,” Joshi said.

Another name that Joshi likes at the moment is ResMed (ASX:RMD).

ResMed has been struggling with semiconductor chip shortages, but there are signs they are about to ease.

“Yes ResMed is an expensive stock but at the same time, there’s some improvements going on in the supply chain, and they’re in a good spot with the Philips recall,” explained Joshi.

Tassal Group (ASX:TGR), a salmon farming company, is another stock that Joshi likes.

Tassal is the largest producer of Tasmanian grown Atlantic salmon, supplying them to both domestic and international markets.

“Salmon prices are improving, and Tassal’s underlying business is in good shape,” says Joshi.

Ampol (ASX:ALD) also offers a good opportunity for investors according to Joshi, especially as its refinery business has improved significantly in the last six months.

The resources and energy sector meanwhile has been a good spot in the past, but Joshi says that some resource names are now starting to have production and cost inflation issues.

“We’re now seeing more recessionary fears actually starting to flow through into commodity prices, rather than just the inflationary uptick,” he said.

Joshi is also less optimistic about tech stocks in the current recessionary environment.

“You probably don’t want to be allocated too heavily in growth and tech at the moment, or anything that’s a bit more longer duration, which comes under pressure as rates go up,” he said.

Share prices today:

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.