Two legends, 37 large caps, earnings season insight and outlook because that’s how we make our breakfast bacon

Image via Getty

Ladies and Gentlemen.

Max Cappetta, CEO and Senior Portfolio Manager at Redpoint IM, Toby Bellingham PM at Redpoint’s Australian and Global Equities, FX and Futures

2022 Revaluation and Calendar Year Outlook

Phase One of the revaluation is nearing an end:

- Inflation has cleared the tower.

- Central Banks will now reel it back in and rates will rise a bit more

- PE multiples have de-rated in line with a higher discount rate (ie: higher interest rates)

- So far in 2022:

-

- IT (including concept names in Healthcare, Discretionary & Mining) have performed worst on a year-to-date basis

- YTD – I’d like you to meet Tyro payments (ASX:TYR) -75%, Megaport (ASX:MP1) -54.4%. And it didn’t happen for Appen (ASX:APN) -48.8%.

- Energy, Utilities, Industrials, Staples & Large Cap Health have outperformed

- YTD – Let me present New Hope Coal (ASX:NHC )+100%, Woodside Energy (ASX:WDS) +43.1%, Coles (ASX:COL) +4.9%

- IT (including concept names in Healthcare, Discretionary & Mining) have performed worst on a year-to-date basis

August earnings will determine what Phase Two looks like:

- In the ASX300, 265 companies are reporting results and 219 of them are reporting results for the full year

- Confession season has been relatively quiet in terms of upgrades/downgrades

- FY22 and FY23 earnings expectations remain remarkably robust: (so far!)

- Energy stocks are still benefiting from tailwind of higher oil/gas/coal prices

- Banks enjoying improving net interest margins and modest bad debts with strong employment

With ASX forward PE at ~14x, the question for investors: Is it time to buy?

History says: not yet (sorry)

- We’re yet to see an earnings contraction (from a slowing economy) and we’re certainly not at a peak in terms of interest rates and monetary settings

- The low forward PE is due to resources trading at ~8x while Industrials trade at ~19x.

- In the absence of further issues we expect a reduction in earning expectations across most sectors and more so if a recession is needed to curtail rampant inflation

- This means defensive, quality and a diversified portfolio positioning

Redpoint flags following earnings potential / risk in FY22 reporting season:

Resources Sector

Energy stocks have the near term earnings momentum (in this space we prefer WDS, NHC, WHC, VEA).

Larger diversified miners (such as BHP, RIO, S32) present better valuation but weaker near term sentiment (in this space we prefer ILU, IGO, PLS)

There are massive dividend yields on offer once again this reporting season (for instance 7-10% gross for the larger miners).

Oi! Don’t get too entranced by these payments as they are backward looking: EPS (and thus DPS) are set to contract 10% in FY23 and a further 10-20% in FY24 with lower commodities pricing (iron ore trading below $100, base metals retracing, copper -25% in Q2, nickel -30%, aluminium -30%)

A cocktail of cost pressures/labour availability/Covid prevalence is continuing to have an effect on Australian based mining operations – resulting in cost blowouts and investment delays.

If the economic landscape materially weakens then mining contractors such as Worley (ASX:WOR) can provide a more defensive exposure vs pure commodity based miners.

Consumer Discretionary Sector

- “at home” remains an important thematic supporting discretionary spending for the home but there will be less major works due to inflation in building materials

- A softening in building points to headwinds for the likes of BLD, Brickworks, CSR, and James Hardie

- Homewares and electronics remain supported (eg, the likes of Harvey Norman, JB Hifi, Nick Scali)

Consumer Staples Sector

- We like supermarkets (prefer WOW and MTS vs COL)

- Rural exposure such as Graincorp (ASX:GNC) and Elders (ASX:ELD) are also favoured but…

- We are avoiding Inghams (ASX:ING) & Bega (ASX:BGA) because of rising cost pressures eating away at profit margins

Property Sector

- We will focus less on office property and back to retail, especially where there is a supermarket anchor and/or strong homewares exposure

- We prefer Charter Hall (CHC), Vicinity (VCX) and Home Consortium (HMC) and are avoiding Mirvac (MGR) and Lend Lease (LLC)

Banking Sector

- Bank reporting will be focused on the Commonwealth Bank and Suncorp

- NAB and ANZ still look the most attractive on valuation alone: ANZ now depends on how it can benefit from its purchase of Suncorp Bank; CBA still a solid yielder and market leader and preferred to WBC

- Recent bank commentary from quarterlies suggest NIM is improving. ANZ is seeing NIM expansion with exposure to early rate hikers in NZ and US

- NAB and CBA have commented that they see their mortgage customers as being well placed at present

- The rise in mortgage rates will likely bite as we approach Christmas rather than having an impact on results to 30 June 2022.

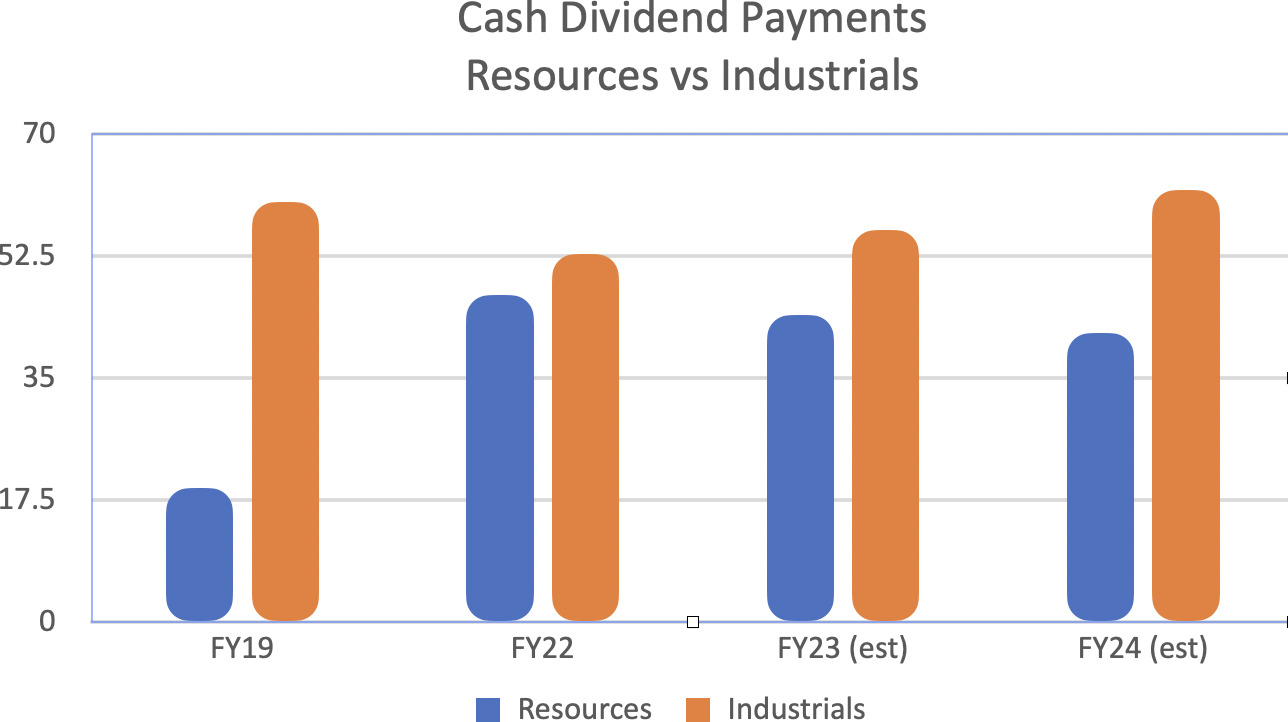

A little forward guidance and a nice chart:

A deteriorating global growth outlook is likely to impact the metals and mining sector with expectations already pointing to a fall from the recent record earnings and dividend payments, especially from iron ore miners. While there is evidence that this contraction is already reflected in current share prices, investors should avoid being excessively focused on the high current dividend yields.

The chart below shows the actual cash dividends paid from the ASX200 split by resource companies and the rest (ie: Industrials).

Industrials are expected to take until 2024 to return to the same aggregate dividend payment made in the 2019 financial year.

While the resources sector may well have already peaked in terms of dividend payments the expected FY24 aggregate cash dividend payment of ~$40b will still be double the $20b this sector paid in 2019.

This raises the prospect of a return to favour for the broader Industrials sector.

Transport and Logistics firms such as Transurban, Cleanaway and Qube are all forecast to continue to grow their profits and dividend payments over the next two years while Qantas is expected to return to profitability and dividend payments in 2024.

The impact of higher interest rates and inflation in food and energy costs are expected to bite in the latter part of 2022.

A close watch on consumer spending in the lead up to Christmas will be important since many discretionary retailers have already had their share prices de-rate and will likely surprise on the upside in this August reporting season. More defensive sectors such as supermarkets and healthcare are expected to hold up better should discretionary spending weaken in the months ahead.

The healthcare sector is also attractive thanks to a significant exposure to US dollars which can provide a cushion to profits should the Australian dollar weaken.

Banks may also provide a more defensive exposure assuming that employment remains robust and bad debt levels remain modest.

A few favoured Small Caps – July 2022 – from Toby:

Sims Ltd (ASX:SGM)

Sims is a favoured small cap exposure at present for us. It’s a very well run company, exposed to the increasingly popular thematic of the circular economy.

Sims is among the world’s leading metal and electronics recyclers, an Aussie belter which has been leading the way to a more sustainable future. A theme that’s resonating, and only will more.

Sims has built its strategy to take advantage of several structural tailwinds that will play out in the decades to come. The demand for steel is set to increase, driven by an increase in infrastructure, buildings, machinery and green energy projects.

In addition, copper, aluminium and nickel are key inputs into technologies that will contribute to the energy transition, such as renewables, electric vehicles and battery storage.

Sims also recycles electronics, a growing industry that benefits from exponential growth of technology and data and the need for society to commit to carbon reduction, waste reduction and other ESG goals.

The company scores well on fundamental metrics with a sound balance sheet and low debt, attractive returns on capital and a valuation that is undemanding compared to international peers.

Nufarm (ASX:NUF)

Nufarm is another small cap exposure that we rate highly.

Nufarm is a crop protection and seeds technology business. Another great Aussie innovator manufacturing a range of ag-chemicals which protect crops from weeds, pests, and disease.

As the world’s demand for food increases over the coming decades, we view Nufarm as well placed to benefit from this long term thematic. And we believe the world will benefit from Nufarm.

From a fundamental perspective Nufarm scores well on growth with a strong crop protection pipeline and several new seed technologies including a canola seed that provides a plant-based source of Omega 3 for the use in several industries such as aquaculture, food and pharmaceuticals. The existing business is very well diversified geographically, with operations US, Europe and Asia.

Great leadership too.

Nufarm trades at a discount to global peers and is attractive considering the growth prospects of its seed division.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.