Currency Trends: Will the year of the Rat give us a nasty bite?

Pic: d3sign / Moment via Getty Images

Hedge fund Hunter Burton Capital CEO Tony Bradley gives his views how he sees 2020 unfolding.

The Year of the Rat, the first of the Zodiac animals is known as a cunning, smart animal, and seen by the Chinese as a symbol of wealth and surplus. And while the Rat has historically seen strong equity and economic growth this year I’m seeing some worrying signs.

The S&P 500 bucked the trend of the last four decades (1989, 99, 09, 19) by being flattish on January 20 after averaging +24 per cent in the year prior, but the cracks are appearing in the Forex landscape.

The Aussie dollar dropped 3c and sits precariously just above its post-GFC low of 0.6670.

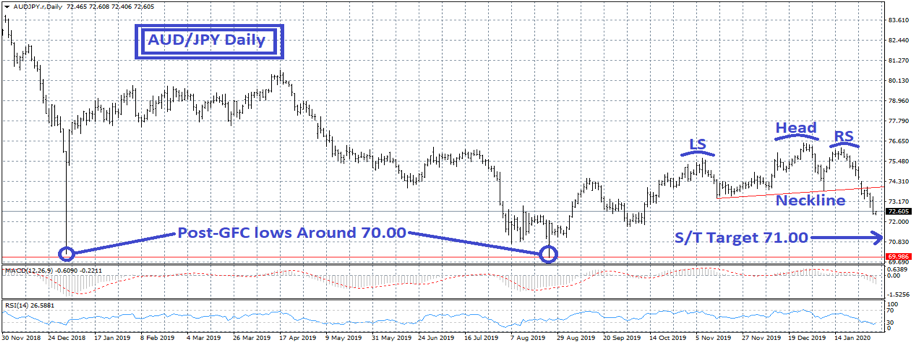

The ultimate guide for optimism in global markets, the AUD/JPY rate, sits nervously above its post-GFC lows around 70.00 and I am expecting a stern test of that level in February.

Key commodities such as oil and copper are down noticeably since the New Year.

Furthermore, we have coronavirus threatening travel to and from China and obviously impacting global GDP in the process.

Bushfire devastation in Australia is having an impact on the tourism dollar and household debt remains a major concern for the RBA and the major Australian banks.

Ten-year bond yields perked up in December but have backed off sharply to around 1 per cent and are still 54 basis points below their US counterpart.

The Aussie vs Yen, pivot point

If you look at the charts for the AUD/JPY, 70.00 is the worry-time pivot point.

Price action is very bearish, breaking a Head-and-Shoulders top and setting a short-term target of 71.00.

A test of post-GFC lows around 70.00 is expected in February and if we break that level sustainably we can expect wide-reaching consequences for confidence in global markets.

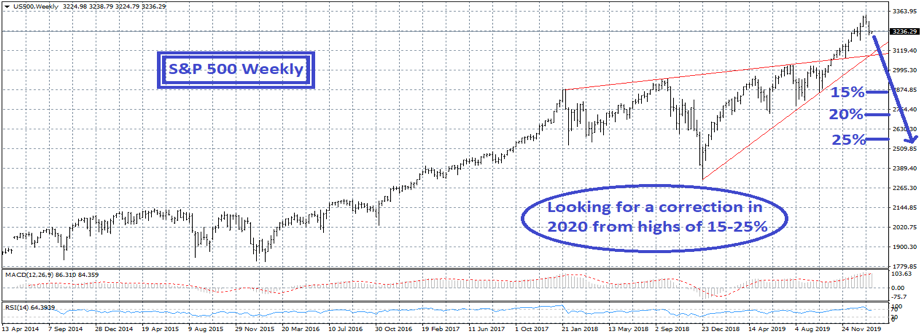

The S&P 500, due for a correction?

Despite new highs, the S&P still looks very scary to me! It’s not often you look at a chart perched at all-time highs and get the heebie-jeebies!

An atomic rising wedge presents itself and I would expect to see a 15-25 per cent correction from current highs in 2020.

The longer the tenure of the chart that you inspect, the more exponential and dangerous it appears. I recommend choosing stocks wisely and diversifying into other alternative assets this year.

In my opinion, there aren’t too many cards to fall from the deck before a recession of some description grips Australia. For all of these reasons, I have concerns for stock markets and the Aussie dollar for 2020.

Brexit officially occurred on January 31, but it will take several months to sort out, and is becoming backburner news.

I expect the EUR/GBP to remain in the 0.8300-0.9300 post-referendum range, so around 0.8400 I see limited downside.

I am calling for a 15-25 per cent correction in the S&P 500 in 2020, so I recommend choosing your stocks carefully rather than just a general index play.

I expect to see an Aussie dollar closer to 60c than 70c, and as much as I am talking my book here, I really believe that diversification of your investment portfolio is a smart move for the Year of the Rat.

Starting his career in 1987 Tony Bradley is a seasoned foreign exchange trader with a 30+ year career working in Australia , New York, Tokyo and Singapore for some of the world’s largest investment banks including Societe Generale, UBS and Credit Suisse. In 2011 he launched Hunter Burton Capital, a global macro discretionary hedge fund trading in major currency markets.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.