LGT Crestone: Inflation isn’t getting worse. It’s simply not getting better as fast as we would like

Hurry up and cost less. Via Getty

This is pretty good. It’s the very latest thinking out of the best brains inside UBS and LGT Crestone, delivered by the latter’s Chief Investment Officer Scott Haslem.

It’s not all good news, but it’s a wonderful assessment of where we are right now and how to panic the least.

Kidding. It’s full of level headed answers to many investor questions and holds much counsel we thought we’d share.

Are we crashing into a recession? Where should we allocate? Are we here yet on inflation?

Take it away, Scott…

“WE continue to believe a broad-based global recession can be avoided, although the past month has made any ‘soft-ish’ landing harder to see.

“But let’s be clear, in the US (the origin of significant policy uncertainty and concern), inflation isn’t getting worse. It’s simply not getting better as fast as we would like it to. Inflation also appears to be on the cusp of a peak in Europe and the UK in September.”

And while it is taking its own sweet time to emerge in the reported data, Crestone appears convinced via a few ‘upstream’ indicators – like commodity prices, port queues, delivery times – that “inflation is on the cusp of trending lower.”

“We remain convinced inflation will fall noticeably in the US by year-end and will be much lower during the first half of next year in the UK, Europe, and Australia.”

Higher than expected September US inflation data was a timely reminder there are days of heightened uncertainty.

Haslem says, “greater evidence is needed that ‘demand destruction’ is sufficient” to ensure future inflation stays on that path.

“This will be required soon (in a matter of months, not quarters) to avoid a policy error and slipping into a scenario where recession in 2023 is unavoidable.”

Active portfolio management remains key, even in uncertain times

“Taking a longer-term view, the brutality of markets this year has unwound significant amounts of valuation risk built up over many years,” Haslem says.

“That’s not to say that some further adjustment may not lie ahead – it’s just that a significant amount of the journey should now be behind us.

“For investors holding cash out of the market (putting aside the unfortunate fact that it buys 7% less than it did a year ago), it’s likely time to consider putting some (but maybe not all) of that to work.”

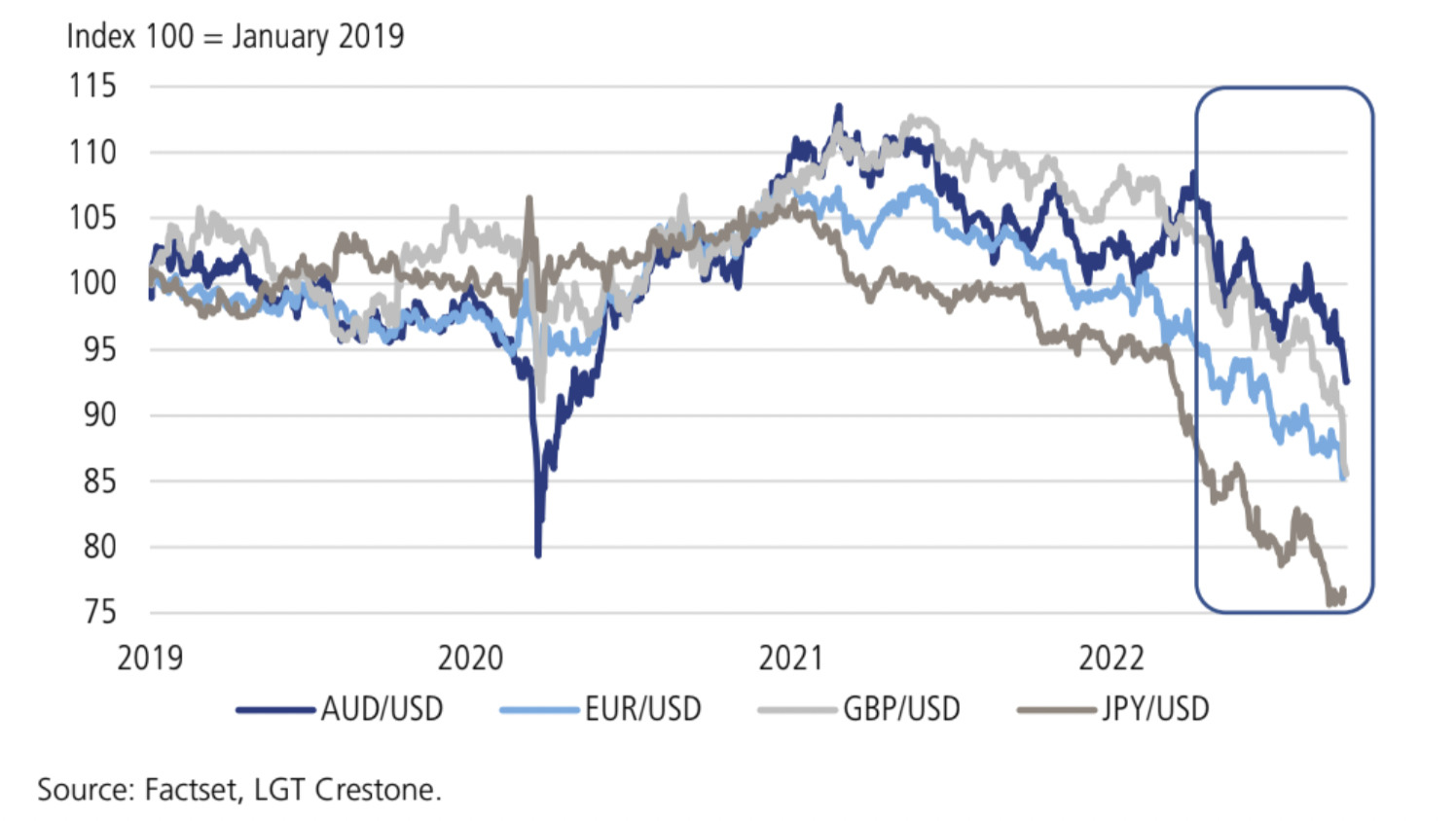

And LGT Crestone warns you, Australia: Do not forget the recent crazy currency volatility (ie: USD strength):

“Valuation excesses now appear less problematic”

But that doesn’t mean there’ no work to do, according to LGT Crestone:

“Slower growth, higher inflation, higher interest rates, and persistent volatility, even if the exact quantum of that remains uncertain, leaves a laundry list of opportunities to explore.”

So now might be the time to go check asset allocations and make sure they’ve not gone with the tide, and “drifted too far from their long-term targets:”

“Uncertainty and volatility should also be catch phrases for focusing on quality and resilience in portfolios,” Haslem says. “Diversifying across multiple themes (such as ageing, urbanisation, infrastructure, or decarbonisation) can help minimise future drawdown risk.”

So, talking equities, should we be battening down the hatches for a more defensive posture?

“This question is key, given slower growth may impact discretionary consumer sectors and housing more materially than healthcare or quality technology that offer attractive free cash flow yields. There should be a focus on ensuring limited style bias or stock concentration risk across equity managers.”

Scott says some equity markets are more fairly priced than others, such as Australia, which looks relatively defensive given a weak Aussie dollar, less inflation risk, and a relatively more protected growth outlook.

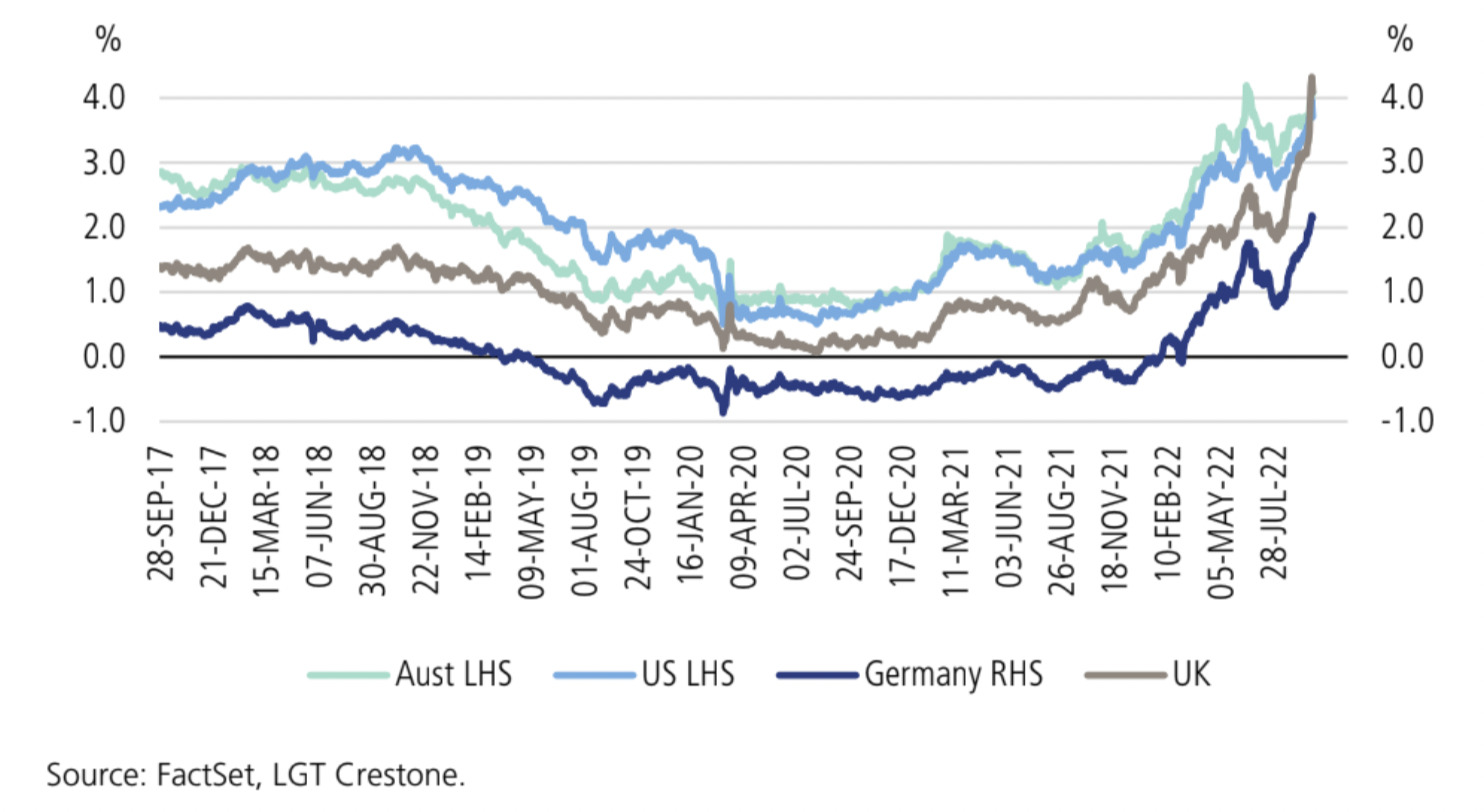

So you’ve got to ask yourself a question: Is it time to consider the higher yields now on offer, potentially adding modest additional duration to portfolios?”

Global bond yields are up and up

Just remember, Australia:

“Active portfolio management remains just as key through periods of heightened near-term uncertainty, as at times when we perceive risks to be more ‘normal.’”

Australia. Stop spending what you saved

“We need some ‘demand destruction’ (especially in services) relatively urgently,” Haslem says.

“We mostly need consumers to choose not to spend their generous excess savings.”

And LGT Crestone reckons it’d be great of the jobs markets unwound a bit:

“A rise in unemployment would be an important signal for central banks, helping them to avoid over-tightening and making a 2023 recession unavoidable.”

Global growth outlook keeps shrinking… but it’s no COVID-19 or GFC

There’s also a gaggle of incoming obstacles and mysteries

“Sure, the outlook is always uncertain.”

This is true, Haslem says, and why, a well-designed, globally-diversified portfolio – traditional fixed income and equity assets and unlisted alternatives – remains the best way to preserve long-term capital through the cycle.

Still, much more than usual, Crestone says investors face serious near-term challenges, like:

- Sticky inflation due to rising services prices — Price inflation – a la rent, travel, education is easing noticeably, although pent-up post-pandemic demand for services is still rising, which could slow the pace of improvement.

- Fears of a wage-price spiral — No one wants to work post-COVID while demand for labour post-stimulus is still high, giving current workers rare wages leverage.

- European energy woes could spread— With Russia now culling some 40% of supply to the EU, price impacts will spread to all markets. Heavy industries will shut down as electricity prices soar.

- Intensification of Russia/Ukraine war — Yep. Won’t help.

- China’s property market still on a precipice — New property starts are 50% lower and sales 30% down during the July quarter from two years ago. The policy response has been modest so far. On the glass half full side, UBS does not expect this to evolve into a debt crisis; the half empty from BCA Research, an imminent rebound in home sales is unlikely. COVID-zero policies, Xi Jinping’s October coronation, disrupted activity and supply chains… little wonder China’s uncertain outlook is weighing on investor confidence.

- Potentially ‘unhelpful’ fiscal support— England borrowing to pay for tax cuts, etc. Others could follow suit.

They can feel it coming in the air tonight

“In addition to these cyclical uncertainties, the investment environment is also confronting a number of likely structural changes, including the fading impacts of 30 years of hyper-globalisation (as the world rethinks who it wants to engage with), as well as the end of 80 years of relative geo-political calm (with multiple potential geo-political hotspots in play).

“Together, these uncertainties have led to greater volatility over the past month, particularly in global currency markets. The US dollar has moved to historic highs, and a number of currencies, including the yen, euro and British pound, are at multi-decade (or record) lows against the US dollar, and have moved there in a relatively disorderly manner.”

Haslem says with such an uncertain outlook in this kind of global environment, it’s no time for heroics:

“…(it’s) difficult to have very high convictions with respect to any asset class and we, therefore, remain close to neutral in our tactical asset allocations (with a preference for tactical positioning within asset classes).

“…we recently increased our overweight to domestic equities relative to global equities (reflected by a greater underweight to Europe). We also took the opportunity to extend our recently more favourable view toward government bonds by moving modestly overweight. We remain overweight cash, funded by our underweight to credit, with the view to deploying to risk assets should conditions permit.”

— Comments from Scott Haslem, LGT Crestone CIO in Volatility continues: The path to a ‘non-hard’ landing narrows.

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.