Can Uber make back the $US60bn it lost in the pandemic?

Uber could use a lift. Via Getty

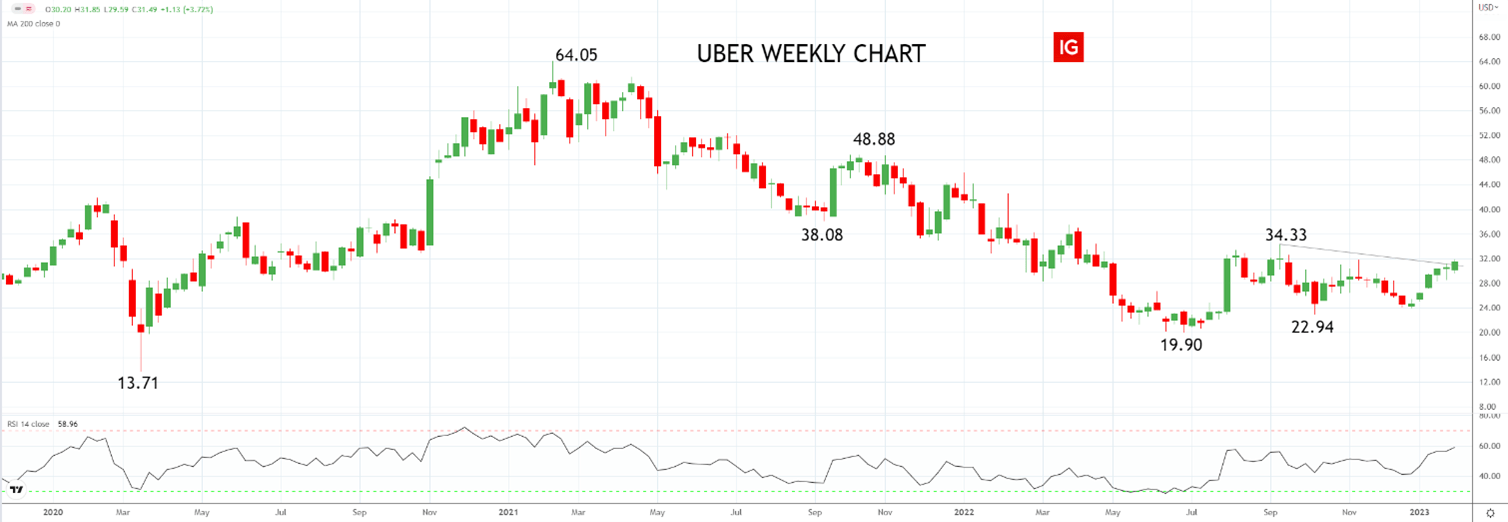

According to Tony Sycamore at IG Markets, the value of Uber’s stock crashed somewhere in the vicinity of 70% between the February 2021 and halfway through last year. It was a long, slow descent.

“That’s the equivalent of US$60 billion in shareholder capital being wiped out.”

Ah, happy days. And worth remembering.

Because, (and fast forward six months) this week, Uber is scheduled to report its fourth quarter (Q4) earnings… sometime after the market closes on Wednesday in the States. That’s the 8th of February, BTW, but it’ll be the 9th by the time you all wake up and smell the delivery man.

So, after a horrible pandemic, the street is pretty upbeat about the ride-hailing giant’s Q4 prospects. Uber’s delivery business is thought to have done pretty well in the last three months of 2022.

Online order volumes for example are expected to have surged.

The US investment firm Zacks has pegged the consensus estimate for revenues from Uber’s delivery segment currently at $US2.83 billion, up some 2%.

While, with economies reopening and more people on the go, Uber services are expected to have seen buoyant demand, benefiting Uber’s growing mobility business.

Zacks says consensus estimate for mobility revenues is circa US$3.97 billion, a handy uptick of 4.5%.

Preview: Uber Q4 2022 earnings

We asked Tony Sycamore, IG markets analyst what traders should be on the lookout for?

“In Q3 of 2022, Uber recorded a net loss of $US1.2 billion, $US512 million of which was attributed to revaluations of Uber’s equity investments.

“The company beat analysts’ estimate for revenue, which grew by 72% year over year to $US8.3 billion, and reported adjusted EBITA of $US516 million, exceeding its guidance of $US440 – $US470 million,” Tony says.

The Uber CEO Dara Khosrowshahi says behind the strong performance, several useful tailwinds are helping,

For Khosrowshahi, Uber’s improvement is in step with the global economic thaw and the favourable winds are all activity related.

“Cities reopening, travel booming, and, more broadly, a continued shift of consumer spending from retail to services,” he said.

With those trends expected to continue, Khosrowshahi provided upbeat guidance for Q4, expecting gross bookings to grow by between 23% and 27% year over year (YoY) and an adjusted EBITA of $US600 million to $US630 million.

How does Uber measure its performance?

According to IG, Uber has three main operating segments under which the company then measures its performance via the following metrics. They’ll be Gross Bookings, Revenues and Adjusted EBITDA, all of which will be scrutinised for growth when the company reports.

“The Mobility segment is Uber’s flagship ride-hailing business which connects consumers with drivers. In Q3, Revenues grew by 73% to $US3.8 billion YoY for an Adjusted EBITA of $US898 million.

“The Delivery segment provides a platform for consumers to search for food and either pick up the meal at the restaurant or have it delivered,” Tony adds

In Q3, Tony also says revenues from this segment grew 24% YoY to $US2.8 billion for an Adjusted EBITA of $US181 million.

The Freight segment is of growing importance too.

“It connects carriers with shippers on the Uber platform and provides upfront and transparent pricing. In Q3, Revenues grew 336% YoY for an Adjusted EBITA of $US1 million.”

Drilling down further, Tony says the market will also be looking closely for:

- An increase in the number of monthly active platform users (which grew by 14% YoY to 124 million in Q3)

- An increase in the number of trips (which increased by 19% YoY to 1.95 billion trips in Q3)

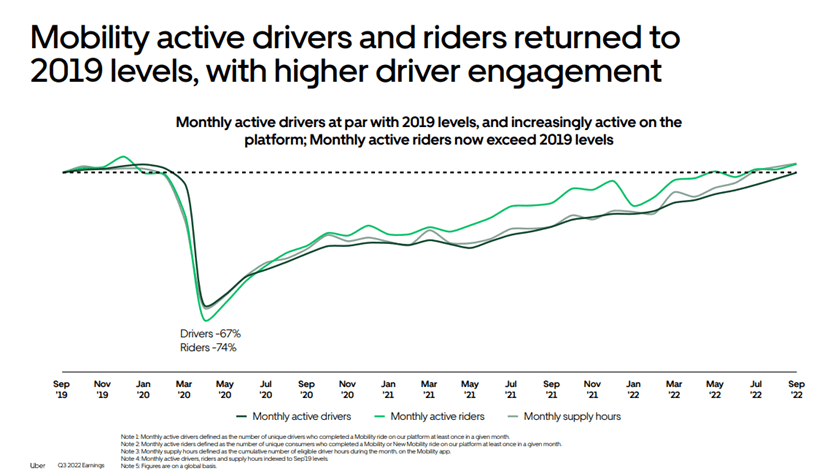

- The trend of drivers returning to drive for Uber continues. An estimated 80% of the drivers who left the service during the pandemic have returned

- And Uber One subscription adoption levels.

Uber Q4 earnings (USD) – what Tony expects:

- Revenue: $8.47 billion vs $8.34 (Q3 2022)

- EPS: -$0.18c vs $-0.61c (Q3 2022)

- EBITDA: – $614m vs $516m (Q3 2022)

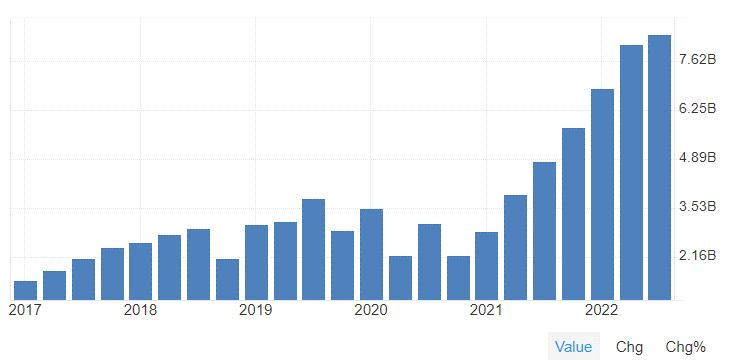

Uber sales revenue (5 years, USD):

Source:Uber, Via Trading Economics

Tony goes technical:

The share price of Uber fell almost 70% from the $US64.05 high it traded to in February 2021 to a low of $US19.90 in June 2022, the equivalent of US$60 billion in shareholder capital being wiped.

Uber weekly chart (USD):

Source: TradingView

“Uber has experienced better fortunes in 2023, as the share price surged by almost 27% above the downtrend from September’s $US34.33 high. A performance that left the Nasdaq’s 10.62% in its wake,” Tony says.

“Presuming Uber breaks higher above the downtrend can be sustained in the coming sessions, it allows for a test of the September $34.33 high before the $37.45 high of March 2022.

“Mindful that a sustained break above a band of resistance at $37.45/$38.10 is needed to suggest that the rally from the June 2022 low of $19.90 is impulsive rather than a bear market rally.

“Should Uber’s share price fall back below the 200-day moving average, currently at $27.05, it would be an initial indication that the corrective rally is complete and that the downtrend has resumed.”

Uber daily chart (USD):

Source: TradingView

The final word from Tony?

“The market will be keen to see evidence of volume expansion in the metrics noted above, as well as guidance that the company can continue to grow despite the presence of higher interest rates and slower growth and a more competitive market place.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.