Confessions of a Day Trader: Take the long way home?

Picture: Getty Images

Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 28

Start the day off in Queensland with BOQ after their CEO resigned and the stock was down 9% with news built in, so picked up 2000 at $7.05. Their range today was $7.35 to $7.02 on 10m, last at $7.14.

So off to a good start for the week. Then FMG hover around the $19.00 level, having opened up at $18.80.

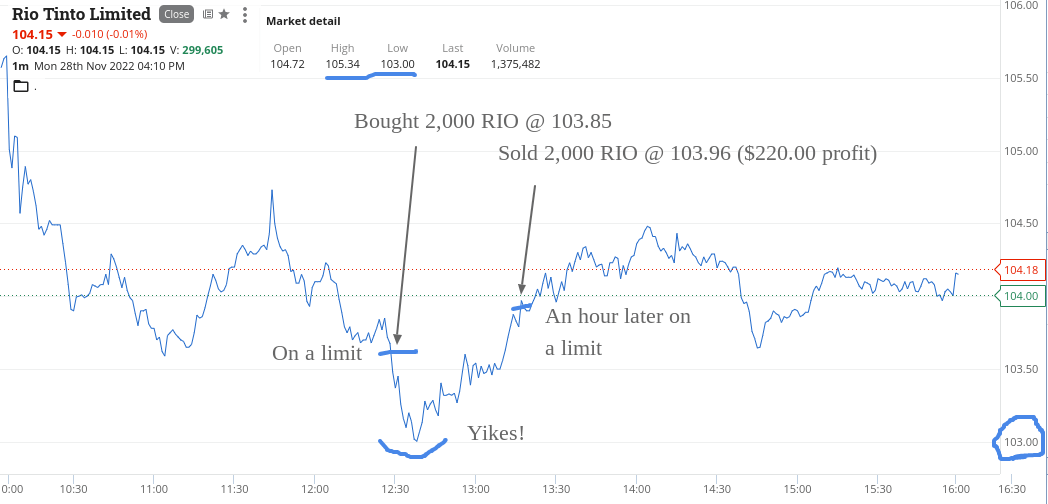

Have to double down on them, as got the timing a bit wrong on them and also RIOs.

Both have dramatic falls after I am set and RIOs fall to $103.00 exactly, which has me staring at a loss of $1,700 and then an hour later out they go on a limit for a $220 gross profit. FMG also mirror RIO’s hour-long fall and recovery.

Why the market does this I never know, but just go with the flow (feel a T-shirt logo coming on!).

Up $780 with heart rate matching an inverse view of RIO’s chart.

Recap

Bought 2,000 BOQ @ 7.05

Sold 2,000 BOQ @ 7.11 ($120 profit)

Bought 2,000 FMG @ 19.00

Bought 5,000 NHC @ 5.68

Bought 2,000 FMG @ 18.92

Bought 2,000 RIO @ 103.85

Sold 5,000 NHC @ 5.72 ($200 profit)

Sold 4,000 FMG @ 19.02 ($240 profit)

Sold 2,000 RIO @ 103.96 ($220 profit)

Tuesday November 29

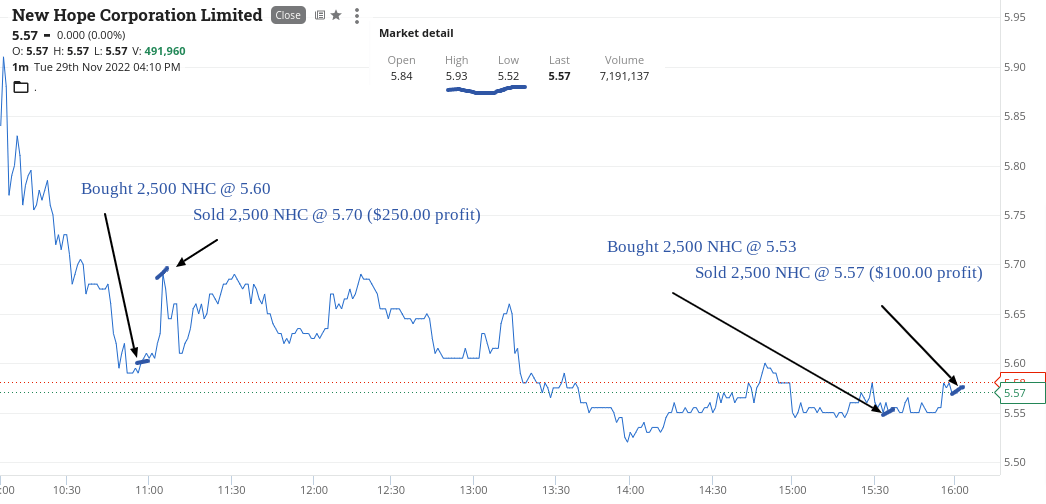

Went slightly against my trading trending rules today and bought some NHC on the way they were trending up and not down.

Worked out OK though and the second day trade was back to normal trading rules.

Their range today was $5.92 to $5.52 on 7m shares and buyback still on so around the $5.50 level seems safe.

FMG were again around the $19.00 so had an each way bet in 2000 and didn’t have to double down. Their range today was $19.89 to $18.90 on 10m shares.

Up $770.

Recap

Bought 2,500 NHC @ 5.60

Bought 2,000 FMG @ 19.00

Sold 2,000 FMG @ 19.21 ($420 profit)

Sold 2,500 NHC @ 5.70 ($250 profit)

Bought 2,500 NHC @ 5.53

Sold 2,500 NHC @ 5.57 ($100 profit)

Wednesday November 30

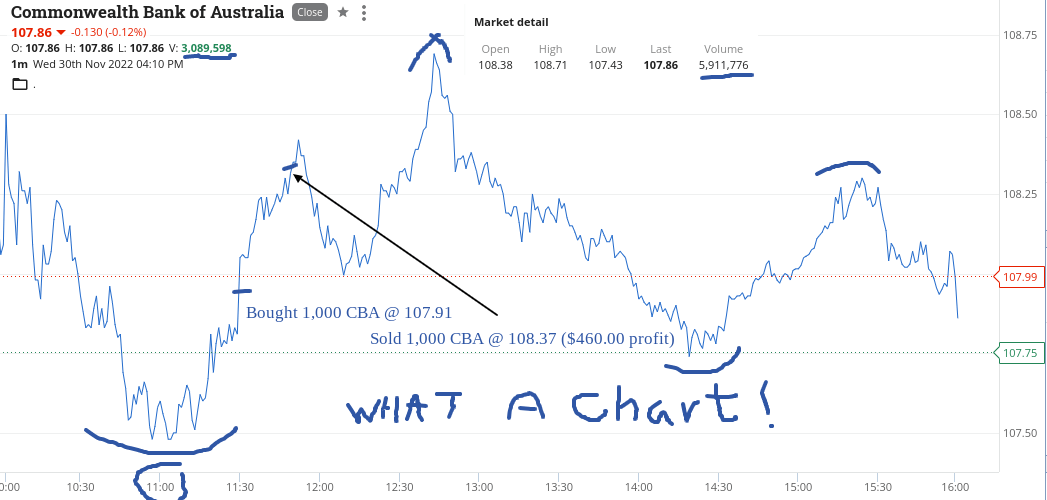

Today was an amazing day, as better than expected CPI figs put a fire under some of the short short players.

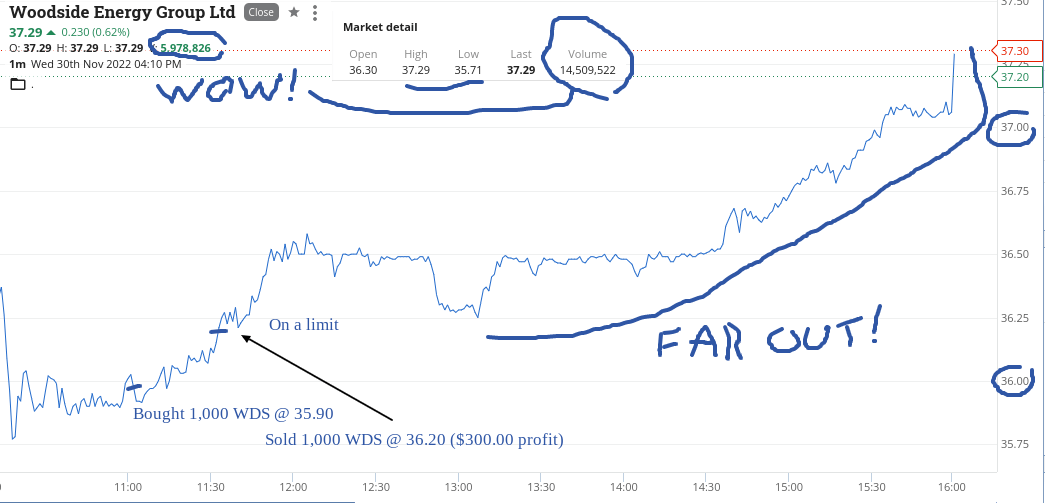

Woodside has been acting like it’s had COVID over the last few days and now given all-clear.

Volume was 14m today and I am a proud 2,000 of that, though I did not only leave something on the table, I left the whole friggin’ house. That volume and range ($35.71 to $37.29) tells me that the shorts well and truly got a wedgie today.

Then we had RIOs screaming past CBA to reach a day’s high of $110.49 before closing at $109.62. At their day’s low of $107.40 they missed CBA’s low of $107.43 by 3c.

What an amazing day and something like I haven’t seen for a long time. It was a ‘Australia had won the World Cup and Albo has given us all a day off to celebrate’ kind of market.

Up $10 less than yesterday at $760 and I hope you all had a good day trading!

Recap

Bought 1,000 WDS @ 35.90

Sold 1,000 WDS @ 36.20 ($300 profit)

Bought 1,000 CBA @ 107.91

Sold 1,000 CBA @ 108.37 ($460 profit)

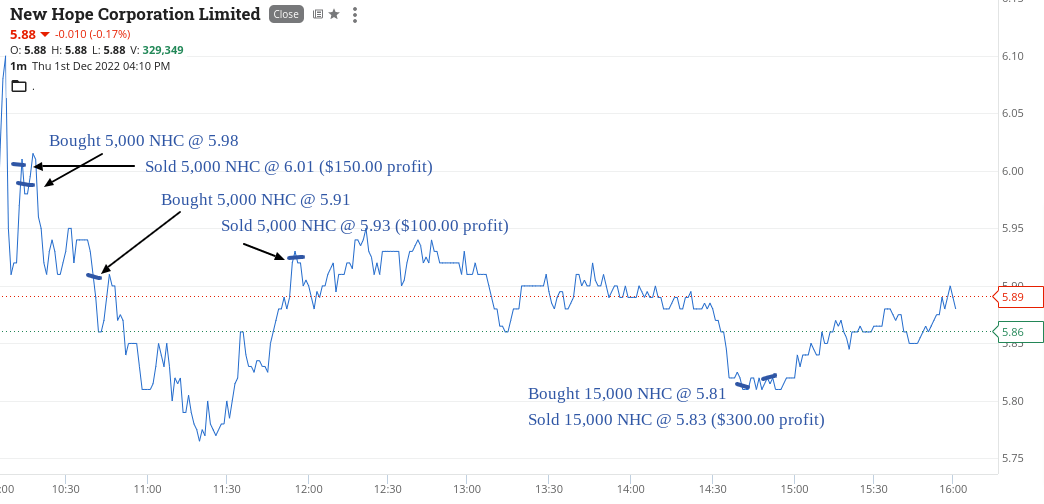

Thursday December 1

Come in with NHC opening above $6.00 and reaching $6.12. Go once when they go below $6.00 and then again when they fall to $5.90 and then finally at $5.81, heading towards the close.

CBA levelled out around $108.50 so had an each way bet but didn’t need to double down as they had a nice spike and had them on a limit sell.

Had another go and was not looking very good, until a late day spike and flurry, so happy to cut them, as had a profit locked in on NHC.

Up $630, thanks to NHC and RIOs were on fire again. Range $$110.26 to $113.87 and closed at $113.23 and that compares to CBA’s last trade of $108.42.

Recap

Bought 5,000 NHC @ 5.98

Sold 5,000 NHC @ 6.01 ($150 profit)

Bought 5,000 NHC @ 5.91

Sold 5,000 NHC @ 5.93 ($100 profit)

Bought 1,000 CBA @ 108.50

Sold 1,000 CBA @ 108.69 ($190 profit)

Bought 1,000 CBA @ 108.35

Bought 15,000 NHC @ 5.81

Sold 15,000 NHC @ 5.83 ($300 profit)

Sold 1,000 CBA @ 108.34 ($10 loss)

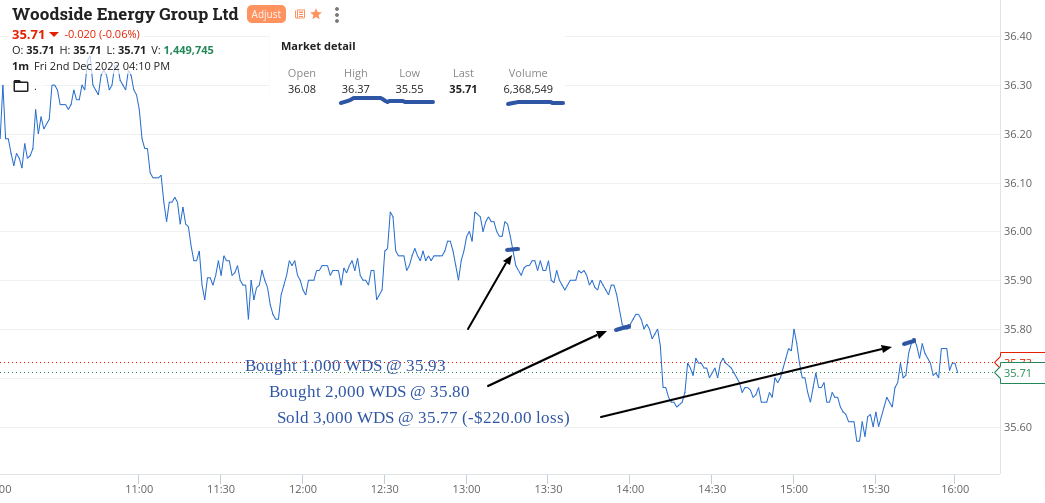

Friday December 2

Started the day out early with some NHC and then some CBA, which at the time my gut said wait but my head said go for it, will be a quick one.

So, in a moment of weakness, I had to double down which eventually went OK and then later I just got lazy and went for the full monty, which didn’t start out very well.

Basically my later punt in CBA and then WDS came out square but cost a bit of commission.

Ended Friday up $620 even after losing $220 in WDS and it was a fair bit of work involved in just spinning the wheels on this one. Could have done better today but was not fully concentrating and paid the price.

For the week up $3560 gross or $2957 net so used up a fair amount of commission getting there. Let’s hope not too tired Monday morning from watching the soccer late on Sunday!

PS – Every stock on my watch list ended the day in the red.

Recap

Bought 2,500 NHC @ 5.76

Bought 1,000 CBA @ 107.27

Bought 1,000 CBA @ 106.85

Bought 2,500 NHC @ 5.79

Sold 5,000 NHC @ 5.80 ($125 profit)

Sold 2,000 CBA @ 107.18 ($240 profit)

Bought 1,000 RIO @ 111.82

Bought 1,000 WDS @ 35.93

Bought 2,000 CBA @ 106.87

Bought 1,000 RIO @ 110.93

Sold 2,000 RIO @ 111.50 ($255 profit)

Bought 2,000 WDS @ 35.80

Sold 2,000 CBA @ 106.98 ($220 profit)

Sold 3,000 WDS @ 35.77 ($220 loss)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.