Confessions of a Day Trader: It’s just nice to start the year with a plus

Pic: oatawa, iStock / Getty Images Plus

Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

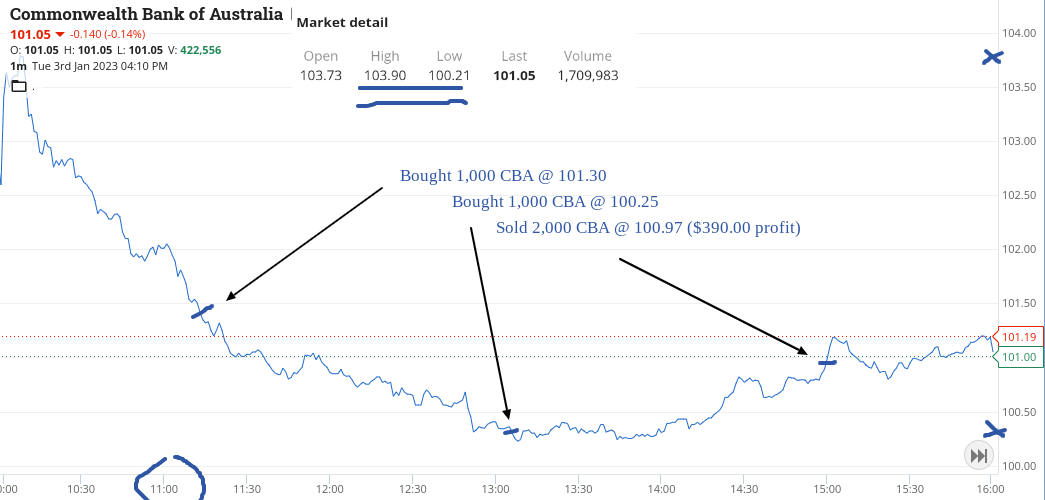

Tuesday 3rd Jan

The day to the new year starts off with my watchlist redder than Santa’s hat. What a start to the year.

I manage to be staring at over a $1,000 loss at one stage in CBA (ASX:CBA) before they stage a recovery from being oversold.

They had opened up at $103.73 and touched a high of $103.90, so picking some up at $101.30 was a bargain, or so I thought.

Wrong!

Had to double down at a $1 or so lower, just to get my average down. I was thinking this is a good start to the trading year, with CBA showing a swing of almost $4 and me caught in the rip of it.

Then hallelujah, they rise from the dead and I lock in a profit at just below $101 and walk away a bit dazed.

Anyway, up $390 after a wild ride.

Recap

Bought 1,000 CBA @ 101.30

Bought 1,000 CBA @ 100.25

Sold 2,000 CBA @ 100.97 ($390.00 profit)

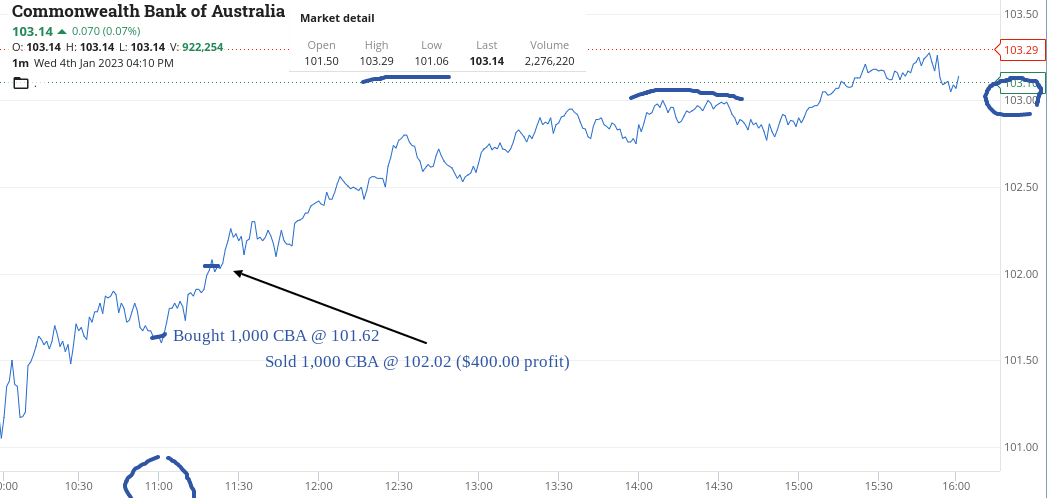

Wednesday 4th Jan

Up $560 though it could have been a bit more, after CBA did a complete bipolar on me from yesterday.

They opened at $101.50, had a high of $103.29 and their last trade was $103.14.

I got in at $101.62 and out at $$102.02 and then they promptly put on another dollar. I had my eye on buying some more if they dropped, but they never really did.

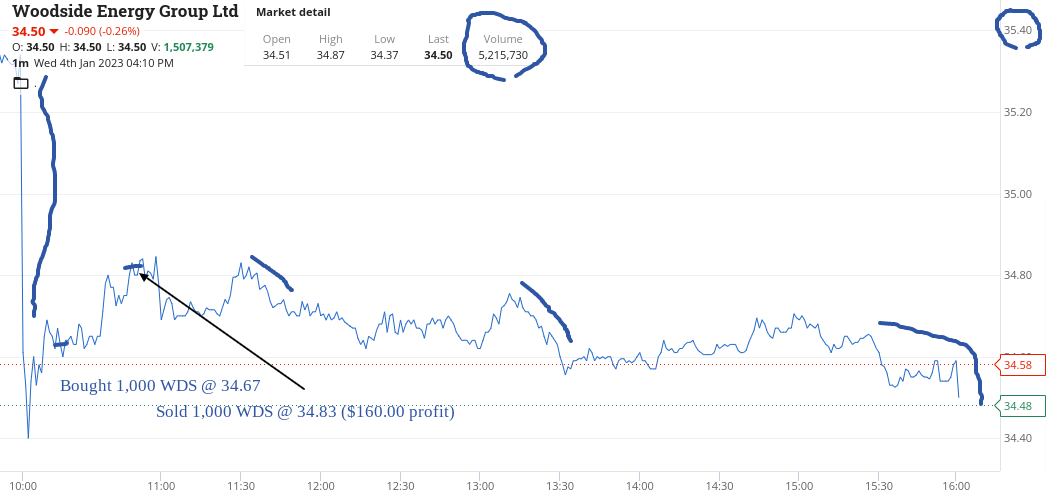

On Woodside (ASX:WDS) I just had to wait for a rally, which didn’t last very long and a 16c was probably the best you could squeeze out of them , as they later fizzled out again.

Recap

Bought 1,000 WDS @ 34.67

Bought 1,000 CBA @ 101.62

Sold 1,000 CBA @ 102.02 ($400.00 profit)

Sold 1,000 WDS @ 34.83 ($160.00 profit)

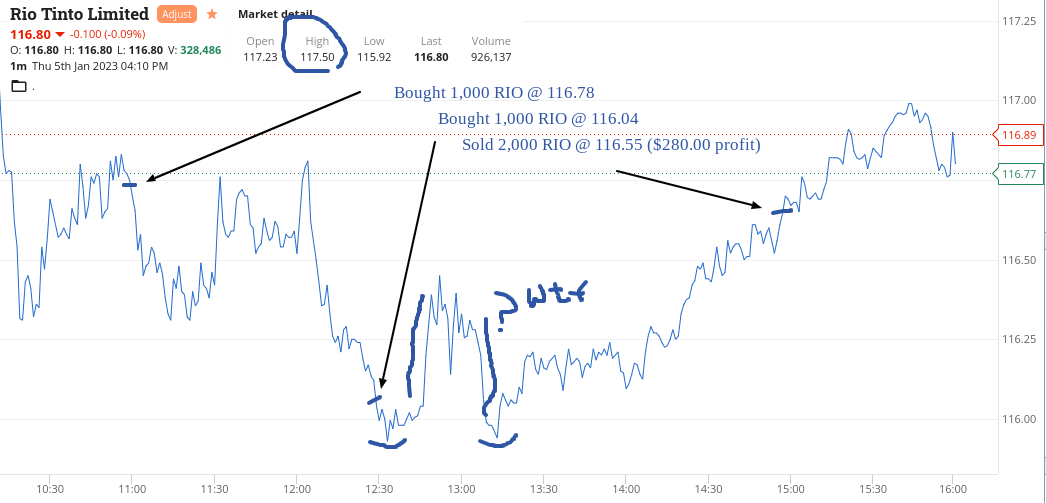

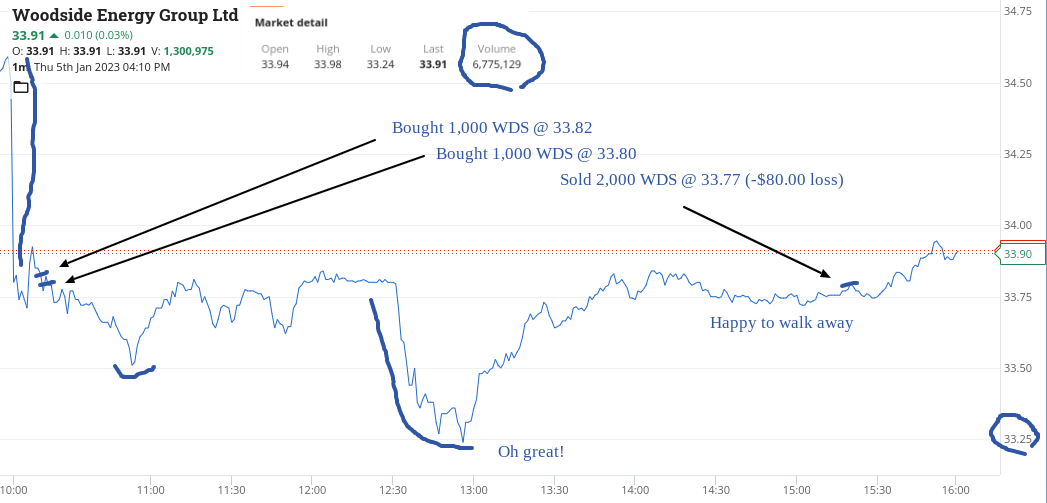

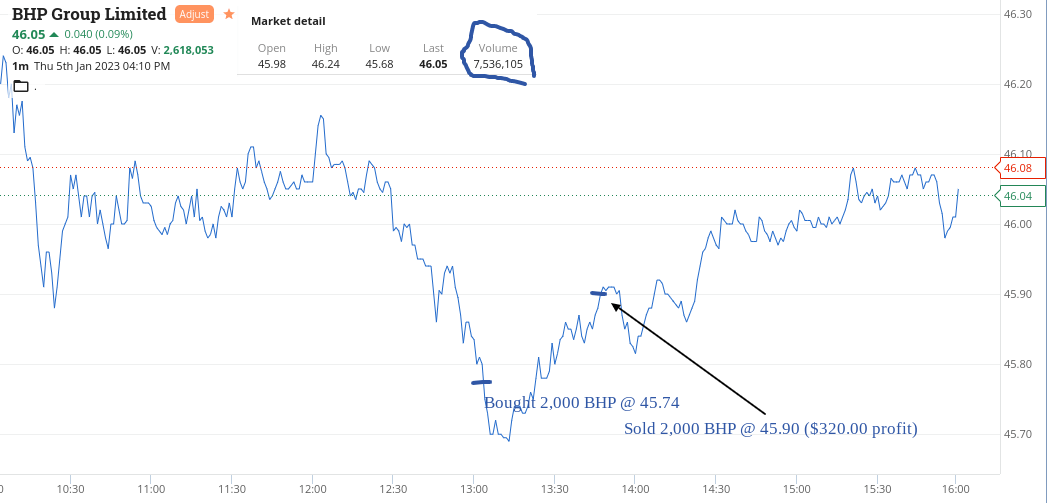

Thursday 5th Jan

Not really like this starting of the new trading year.

CBA touched $104.70 in the morning, which was up from an opening of $103.56, so nothing I could do there.

Went once and then twice in Woodside as they were the only one on my watchlist who were down.

Everything else was like at a 45 degree angle going upwards. They gave me some pain.

BHP (ASX:BHP) was a good spot as they were looking over-sold and they gave me my first profit.

RIO (ASX:RIO) finally came good but had to cut Woodside and of course they closed just below their days high.

Up $520 but not really enjoying the journey at the moment!

Recap

Bought 1,000 WDS @ 33.82

Bought 1,000 WDS @ 33.80

Bought 1,000 RIO @ 116.78

Bought 1,000 RIO @ 116.04

Bought 2,000 BHP @ 45.74

Sold 2,000 BHP @ 45.90 ($320.00 profit)

Sold 2,000 RIO @ 116.55 ($280.00 profit)

Sold 2,000 WDS @ 33.77 (-$80.00 loss)

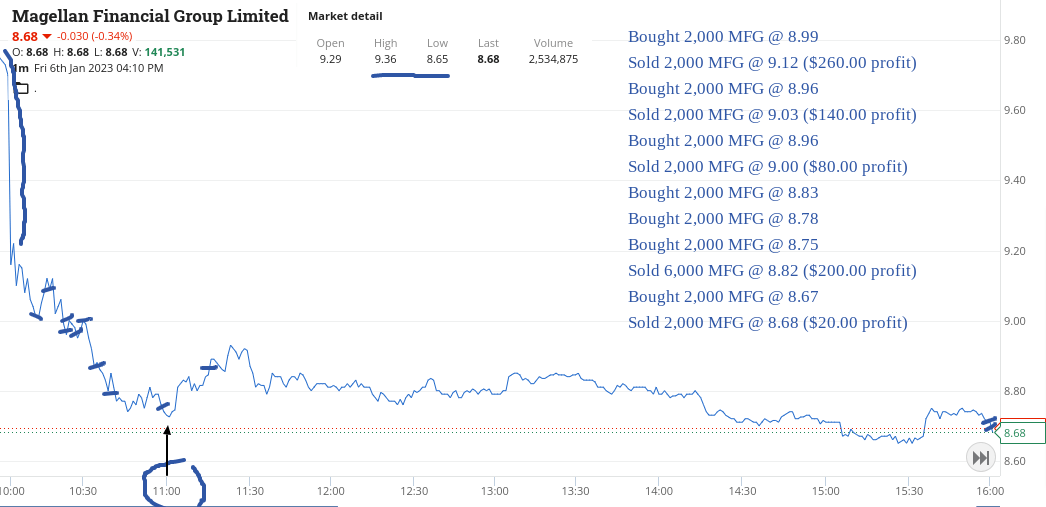

Friday 6th Jan

Only have eyes for Magellan (ASX:MFG) today in and out 3 times before building up a bigger position pre 11.00am, as I was punting on a margin call type bounce, which kicked in a little bit after. Then had one more go towards the end of the day which gave me a small loss.

Up $660 today and $2050 in a shortened week or $1704 net. Nice to start the year with a plus!

Recap

Bought 2,000 MFG @ 8.99

Sold 2,000 MFG @ 9.12 ($260.00 profit)

Bought 2,000 MFG @ 8.96

Sold 2,000 MFG @ 9.03 ($140.00 profit)

Bought 2,000 MFG @ 8.96

Sold 2,000 MFG @ 9.00 ($80.00 profit)

Bought 2,000 MFG @ 8.83

Bought 2,000 MFG @ 8.78

Bought 2,000 MFG @ 8.75

Sold 6,000 MFG @ 8.82 ($200.00 profit)

Bought 2,000 MFG @ 8.67

Sold 2,000 MFG @ 8.68 ($20.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.