Confessions of a Day Trader: ASX tantrums are for Monday. Then it’s ALL fighting ’till Friday

Fight 'till Friday. Getty

Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday 9th Jan

Here we go. Another start to the week, but this time it should be for a whole five days. Yipee.

Fortescue (ASX:FMG) came out pre market with CFO resigning after 13 years, so they were marked down. In fact, they were the only ones showing a fall early on. So just had to have a go. All bad news out.

That worked out ok and then 11.00am go in CBA (ASX:CBA), which also came in good.

Thinking that was it, for some reason FMG had another crash and had to go twice before they settled back up.

3.30pm for CBA into the close worked out ok. Doubled the size as only 1/2 hour to go, so rolled the dice and they came in with a few mins to spare. The 4.10pm matchup was not too good, so luckily missed that.

Plus $920, thanks mainly to CBA. Good start to the week.

Recap

Bought 2,000 FMG @ 21.69

Sold 2,000 FMG @ 21.76 ($140.00 profit)

Bought 1,000 CBA @ 103.64

Sold 1,000 CBA @ 103.90 ($260.00 profit)

Bought 2,000 FMG @ 21.56

Bought 2,000 FMG @ 21.48

Sold 4,000 FMG @ 21.57 ($220.00 profit)

Bought 2,000 CBA @ 103.37

Sold 2,000 CBA @ 103.52 ($300.00 profit)

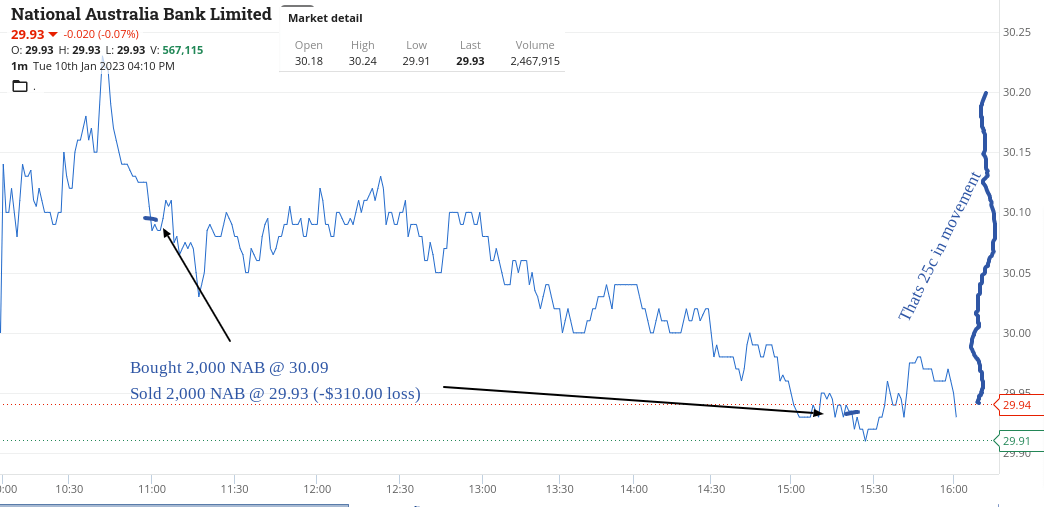

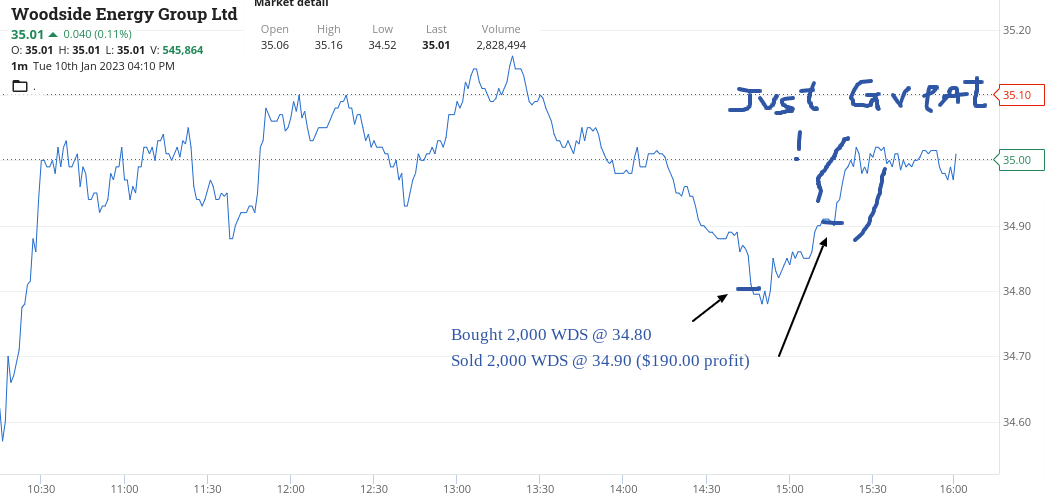

Tuesday 10th Jan

Today was a frustrating and very long lasting day. Didn’t enjoy it today.

Things like CBA had very low volumes and when I did have a go in NAB (ASX:NAB), it was like death by 1000 cuts or in my case death by 1c falls.

I finally got the shits and cut my first two trades for a loss and then as 3.30pm approached I went for the jugular in CBA.

Came out up $100 before brokerage. Hope tomorrow is better but fear the great Australian beach holiday is affecting volumes and taking away interest.

Recap

Bought 2,000 NAB @ 30.09

Bought 2,000 WDS @ 34.80

Sold 2,000 NAB @ 29.93 (-$310.00 loss)

Sold 2,000 WDS @ 34.90 ($190.00 profit)

Bought 2,000 CBA @ 103.01

Sold 2,000 CBA @ 103.12 ($220.00 profit)

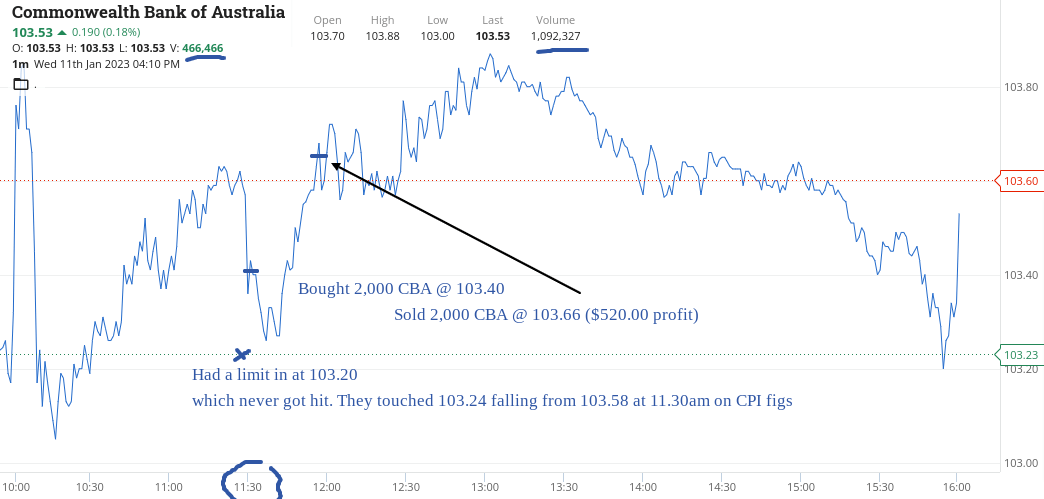

Wednesday 11th Jan

Had to wait till 11.30am CPI figures to come out before getting some action. CBA fell from $103.58 to $103.24 at 11.30 and I had a limit in, right there and then at $103.20 and then they bounced and I chased them up to $103.40 before they started to fall back again.

It took them 1/2 an hour to recover and now hit my sell limit. Don’t get me wrong, I was expecting to get hit at $103.20 and then be forced to double down at $103.00 but it never happened.

For once it went my way, as I figured whatever the CPI figure was, it will be OK for the banks. Expect them lower tomorrow though.

Up $520.

Recap

Bought 2,000 CBA @ 103.40

Sold 2,000 CBA @ 103.66 ($520.00 profit)

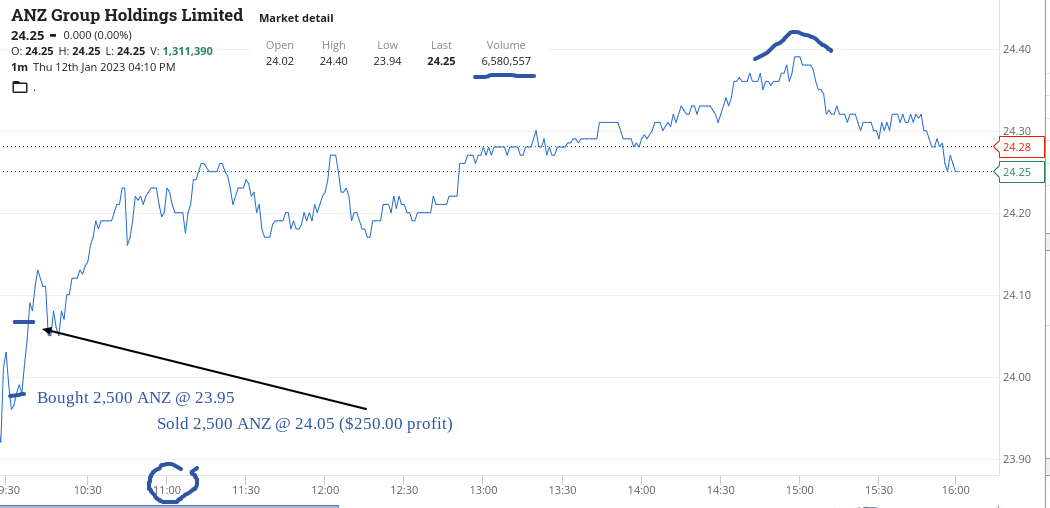

Thursday 12th Jan

Well I got my call on CBA wrong today as they never really looked back. For some reason ANZ were down and below $24.00, so picked some up and put them in to sell 10c higher, which got taken out and that was that for me.

Today, everything was in the blue on the watchlist, so my style of trading and bottom picking, just wasn’t happening.

CBA, for example, opened at $104.30 and closed at $105.18 on double yesterday’s volume and tomorrow is Friday 13th. May the trading Gods be kind to me tomorrow. Up $250.

Recap

Bought 2,500 ANZ @ 23.95

Sold 2,500 ANZ @ 24.05 ($250.00 profit)

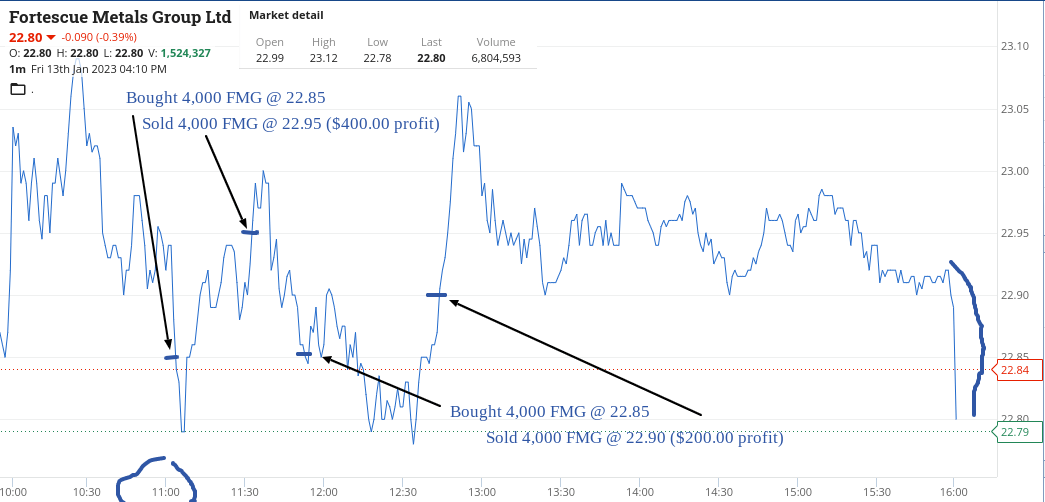

Friday 13th!

Everything up overnight again and only one stock on my watchlist which was struggling to hold its gains was FMG.

Got two go’s in them at $22.85 at 4000 a time and made a 10c and a 5c turn and ended up $600 in total which was a bit of a surprise to me.

Why they got sold down, I’ll never know but I thank the sellers for giving me some profits. Maybe Mike Cannon-Brookes was shorting them. Who knows.

So, end the week up $2390 gross or $1964 net, which just happens to be the year I was born!

CBA opened at $105.65, had a high of $107.06 and closed at $106.50 and it was only this week that I was having an arm wrestle with them at $103.00. Amazing!

Recap

Bought 4,000 FMG @ 22.85

Sold 4,000 FMG @ 22.95 ($400.00 profit)

Bought 4,000 FMG @ 22.85

Sold 4,000 FMG @ 22.90 ($200.00 profit)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.