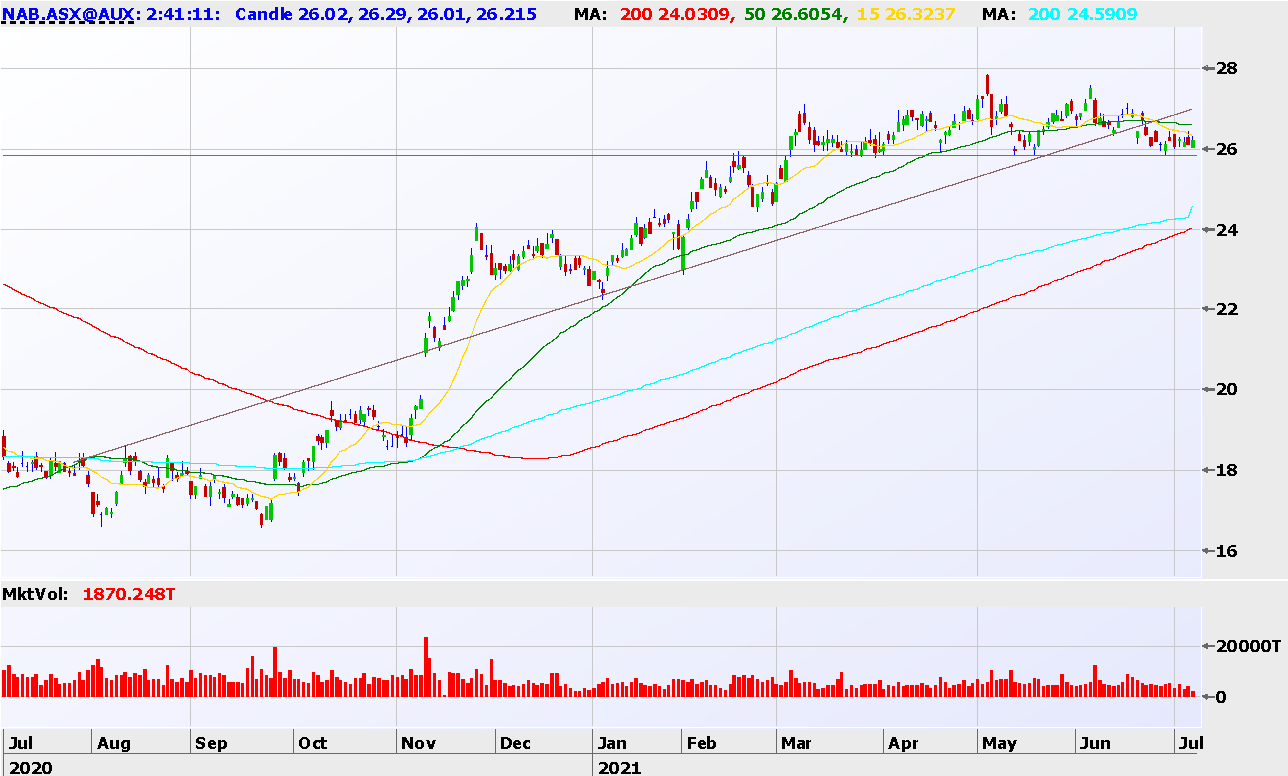

Chart of the Day: Free fall beckons for NAB if $26 support is broken

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

OK I get it.

You didn’t come to Stockhead to read about National Australia Bank (ASX:NAB) per se.

But look, we’re doing technicals here, and NAB is one hell of a technical stock.

Of course, it’s similar to the other big banks in price action, and macro drivers rule the day when it comes to these guys.

Notwithstanding, we are currently short NAB, and here is why.

On a break of $26, there is a lot of clean air below. It hasn’t done it yet, granted, but it’s trying.

In reality, the stock has now been caught in a $1.50 range for the better part of six months now.

That after an enormous COVID inspired / bond yields getting off the mat rally, that took it from $17 in September 2020, to $27 in the last couple of months.

If we’re short, there’s no need to hold this short above $28, and that is being generous.

The medium term uptrend looks to have broken (longer upward sloping line in black) out of inaction more than anything else.

The horizontal supports just below $26 are clear as day.

Should they break, there are lots of downside targets, including gap fills dating back to Feb around $24, and dare I say it, an enormous one all the way back to November 2020 at $19.87.

It’s precisely because it seems so implausible that you should be wary.

It’s precisely because there’s currently so much dogma in the market about where things are going that we are prepared to entertain it.

Steve Collette of Collette Capital Pty Ltd (ABN 56645766507) is a Corporate Authorised Representative (No. 1284431) of Sanlam Private Wealth (AFS License No. 337927), which only provides general advice.

Collette Capital only makes services available to professional and sophisticated investors as defined by the Corporations Act, Section (s)708(8)C and 761G(7)C.

The Collette Capital Wholesale IMA Strategy has returned +24.57% p.a. net of all fees as at the end of February 2021 since inception in January 2015 (using the Time Weighted Return method of calculating returns).

Learn more at www.collette.capital

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.